When we discuss VANRY, we are essentially discussing a question:

Is it just a 'public chain telling AI stories,' or does it have the opportunity to find a real position in the Layer-1 race?

In this article, we won't discuss short-term fluctuations, only the structure.

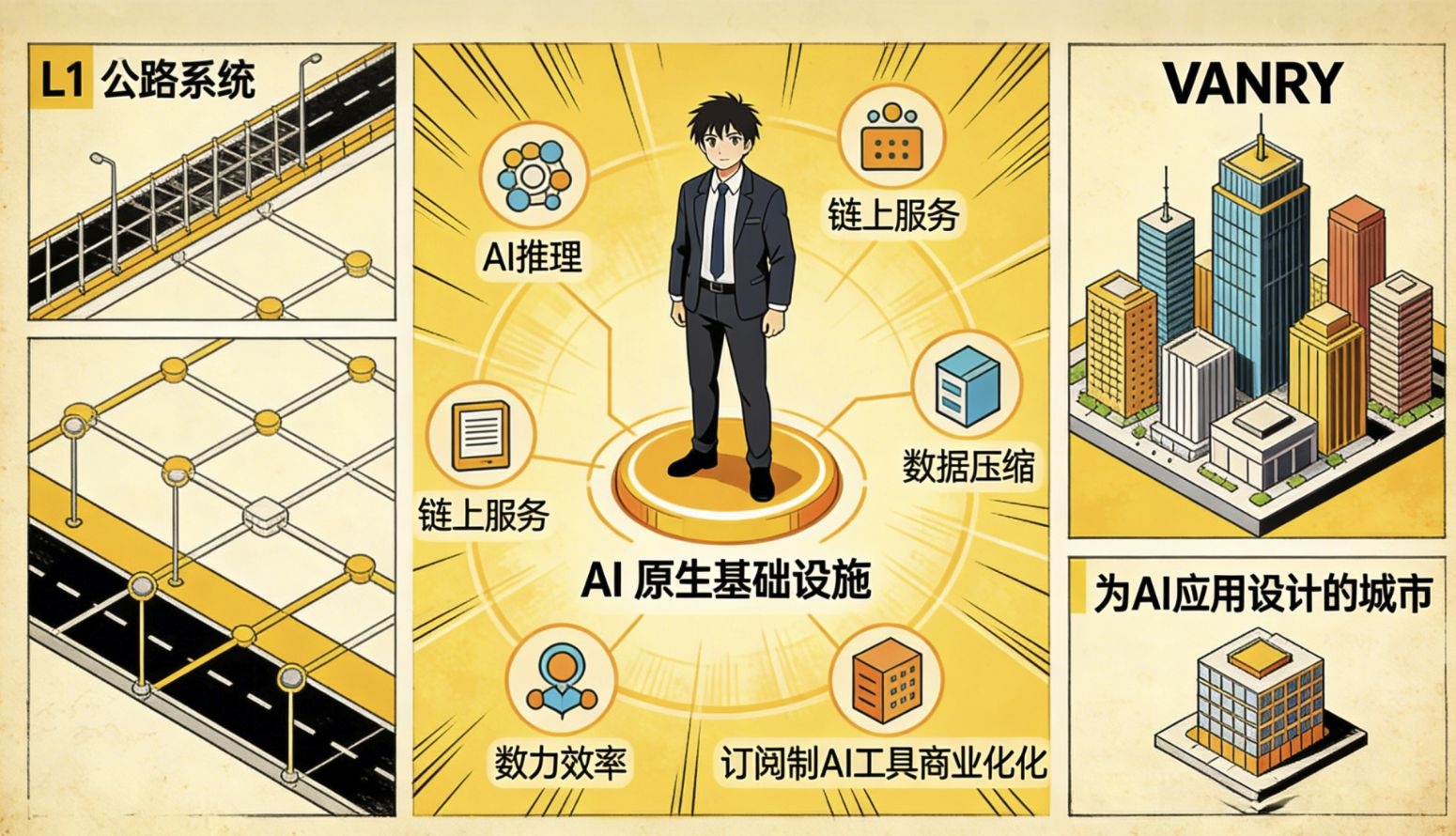

1. The core differences between VANRY and mainstream Layer-1.

First, let's look at the positioning.

Like Ethereum is the standard answer for smart contract infrastructure, its ecological depth is irreplaceable, but the costs and complexities of scaling still exist.

Solana emphasizes high performance and low latency, suitable for high-frequency trading and consumer applications, but it also has its own challenges regarding hardware requirements and network stability.

Avalanche follows a subnet and modular expansion route, emphasizing customizable ecology.

So where is VANRY?

It attempts to position itself as 'AI native infrastructure'.

Not just simply providing execution of smart contracts, but emphasizing:

AI reasoning combined with on-chain services

Data compression and computational efficiency

Commercialization of subscription-based AI tools

In simple terms, other L1s are more like 'road systems',

Whereas VANRY wants to become 'a city designed for AI applications'.

The benefit of this path is clear differentiation.

The risk is that the ecological scale is currently far smaller than leading public chains.

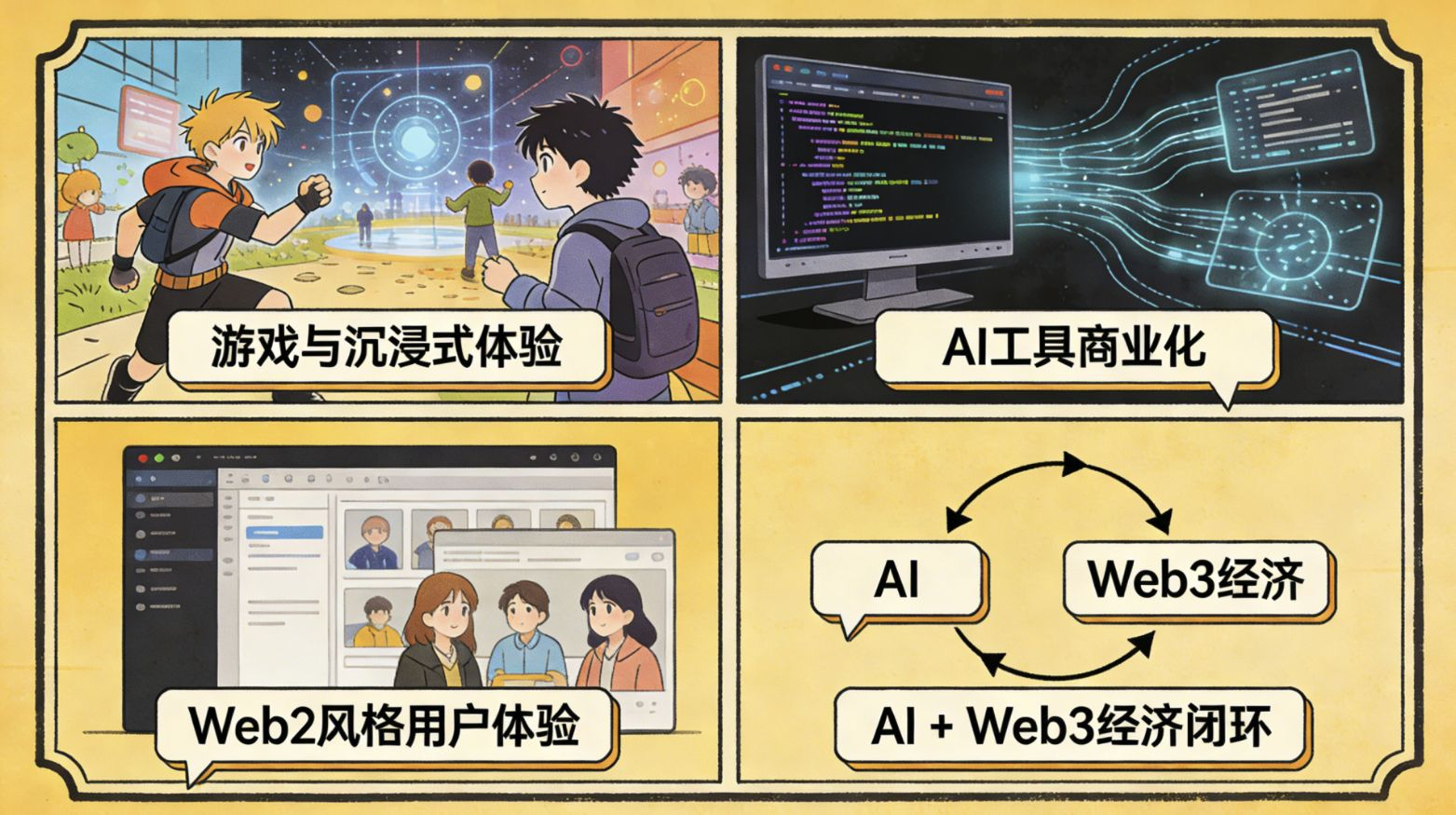

2. Comparison of ecological maturity

The advantages of leading L1s are very direct: the number of developers, the scale of on-chain assets, DeFi TVL, and stablecoin circulation are all much higher than emerging chains.

VANRY's advantage lies in vertical focus:

Games and immersive experiences

Commercialization of AI tools

Web2 style user experience

It has not tried to compete across all tracks, but rather concentrated resources to create an 'AI + Web3 economic closed loop'.

From a strategic perspective, this is clearer than blindly expanding the ecology.

But it also means:

Success or failure highly depends on whether AI applications truly generate continuous demand.

3. Is the token economy sustainable?

This is key.

Whether a Layer-1 token is long-term viable depends on three core things:

Are there real use cases?

Is there a continuous source of demand?

Is there a supply control mechanism?

1️⃣ Use cases

VANRY as Gas, staking, and governance tokens, this is the standard public chain model.

But the difference lies in that it is incorporating AI services with subscription-based tools into the economic system.

If the use of AI tools must consume VANRY,

Then demand will no longer come solely from 'speculation', but from 'service usage'.

This step is a transition from financial attributes to functional attributes.

2️⃣ Demand structure

The demand of leading L1 mainly comes from:

DeFi collateral

NFT trading

Stablecoin transfers

The target demand for VANRY comes from:

AI tool subscription

On-chain data services

Game economy internal circulation

If these scenarios are successful, the demand will be more 'real'.

But if the activity level of ecological applications is insufficient,

Demand may degrade to purely market transactions.

So the premise of sustainability is the continuous improvement of ecological activity.

3️⃣ Supply and inflation structure

The maximum supply of VANRY is about 2.4 billion tokens, and the circulation ratio is already relatively high.

This has two meanings:

Advantages:

The release of selling pressure is relatively transparent, not a high lock-up high unlock-type structure.

Risks:

Prices are more driven by real demand, rather than lock-up stories.

If there are on-chain consumption or destruction mechanisms in the future, and the real use of AI services increases,

Tokens will form a model of 'circulation-consumption-recycling'.

This is the sustainable structure.

4. Risks and reality assessment

We must remain calm.

VANRY's current scale is far smaller than Ethereum or Solana.

The breadth of the ecology cannot be compared either.

Its opportunity does not lie in 'comprehensive confrontation',

And in 'vertical breakthroughs'.

If AI native chains become a trend, it is an early mover.

If AI applications do not form on-chain necessities, it will face the risk of traffic diversion.

So it is not a deterministic asset, but a structural track asset.

5. Summary judgment

Compared to other Layer-1s, VANRY:

Not the strongest performance.

Not the largest ecology

But the most vertical positioning

Whether the token economy is sustainable depends on one core thing:

Whether AI tools really form on-chain consumption habits.

If the answer is 'yes',

Then it will transform from a narrative asset into a functional asset.

If the answer is 'no',

It will remain at the conceptual level of the track.

In today's public chain competition, which has entered the differentiation stage,

A broad net is hard to succeed.

But by going deep vertically, there are still opportunities.

What VANRY is betting on is this path.

Are you willing to leave an observational position for this direction,

It depends on whether you believe:

AI is not just at the application layer, but will move towards the underlying infrastructure.