The discussion around AI tokens has exploded over the past 18 months. In 2024–2025, the term became synonymous with huge market speculation and rapid price movements. But as we settle into 2026, the key question facing investors, builders, and technologists is straightforward:

Are AI tokens delivering real utility or are we still in “Narrative 2.0”?

To answer this, we need to look beyond market buzz and focus on actual adoption, infrastructure builds, and fundamental use cases.

The Rise of Narrative 1.0: From Hype to Headlines

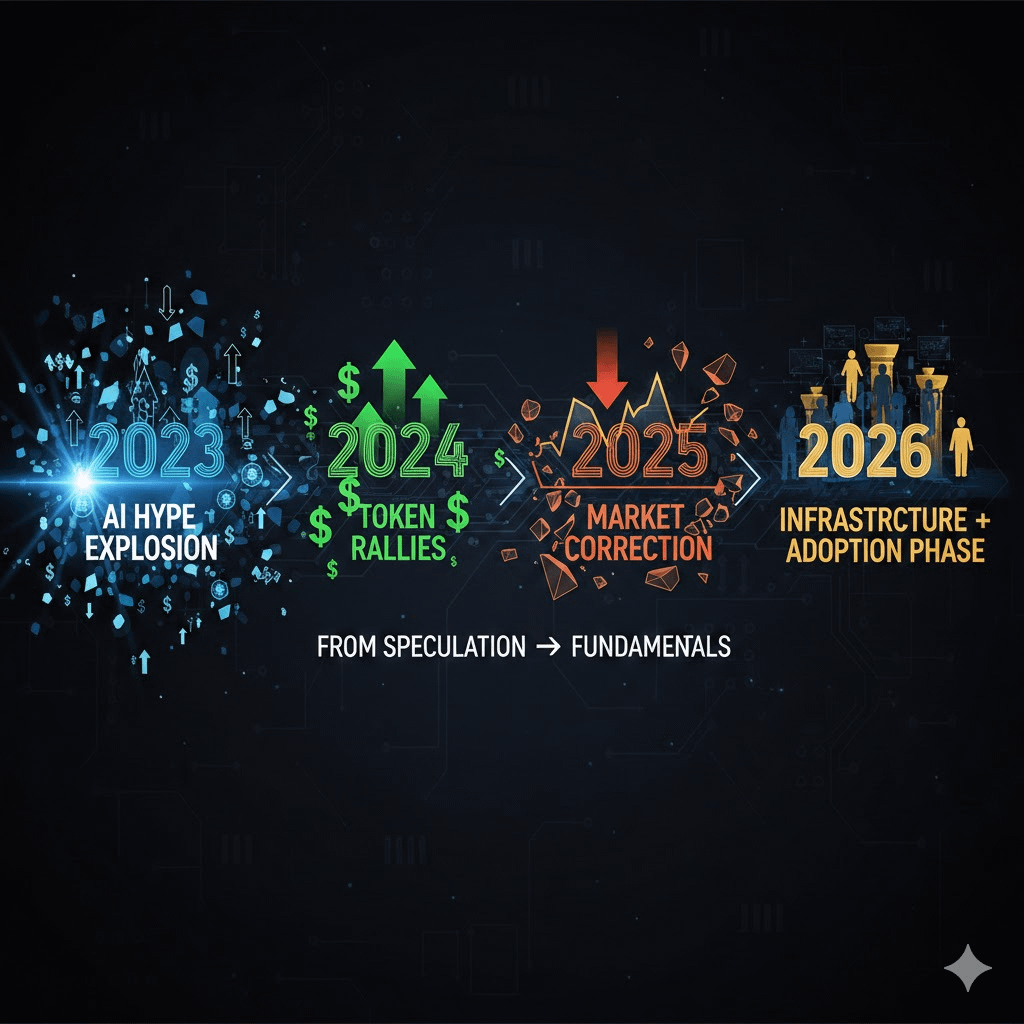

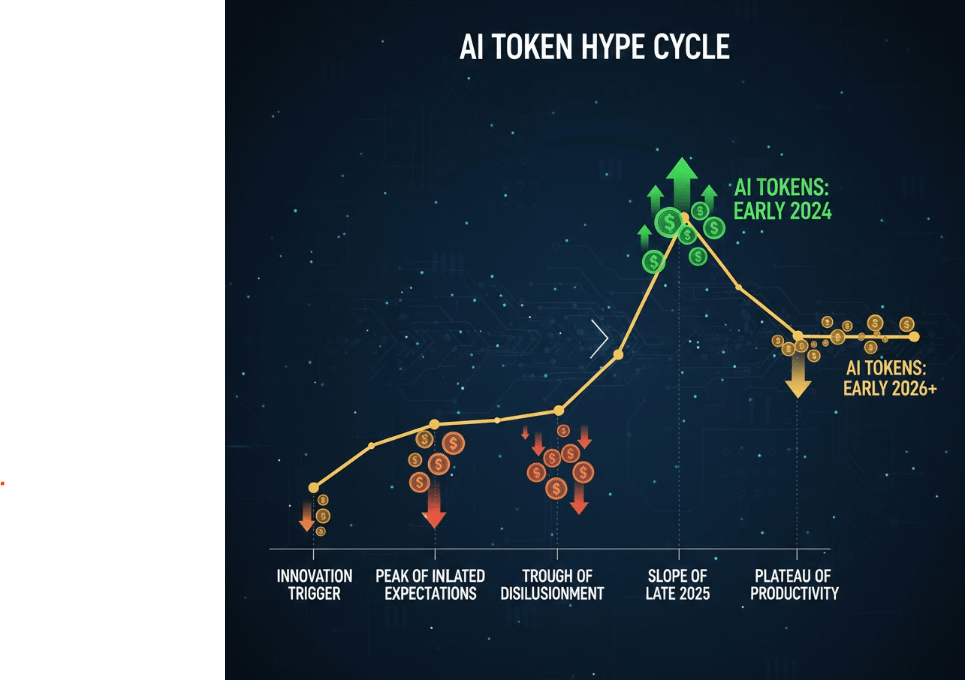

In 2023–2024, the AI token narrative began as a broader extension of two powerful trends:

The mainstreaming of artificial intelligence

Generative models went from research curiosities to everyday tools — chat interfaces, image generation, enterprise deployments, and large language model APIs.

Crypto’s search for a new growth pillar

After years of DeFi and memecoins dominating crypto markets, AI projects offered a fresh narrative that combined AI + blockchain.

The result? A wave of new tokens branded as “AI tokens,” most without real products or users yet, but backed by strong community enthusiasm and social media hype.

Narrative 1.0 strengths:

Created a new thematic rally

Attracted retail and institutional attention

Narrative 1.0 weaknesses:

Many projects lacked clear roadmaps or real adoption

Speculation outpaced fundamentals

This set the stage for where we are today.

Narrative 2.0: Reality Checks & Real Adoption

As of 2026, AI tokens have matured into two distinct camps:

✅ 1. Infrastructure-Driven Projects

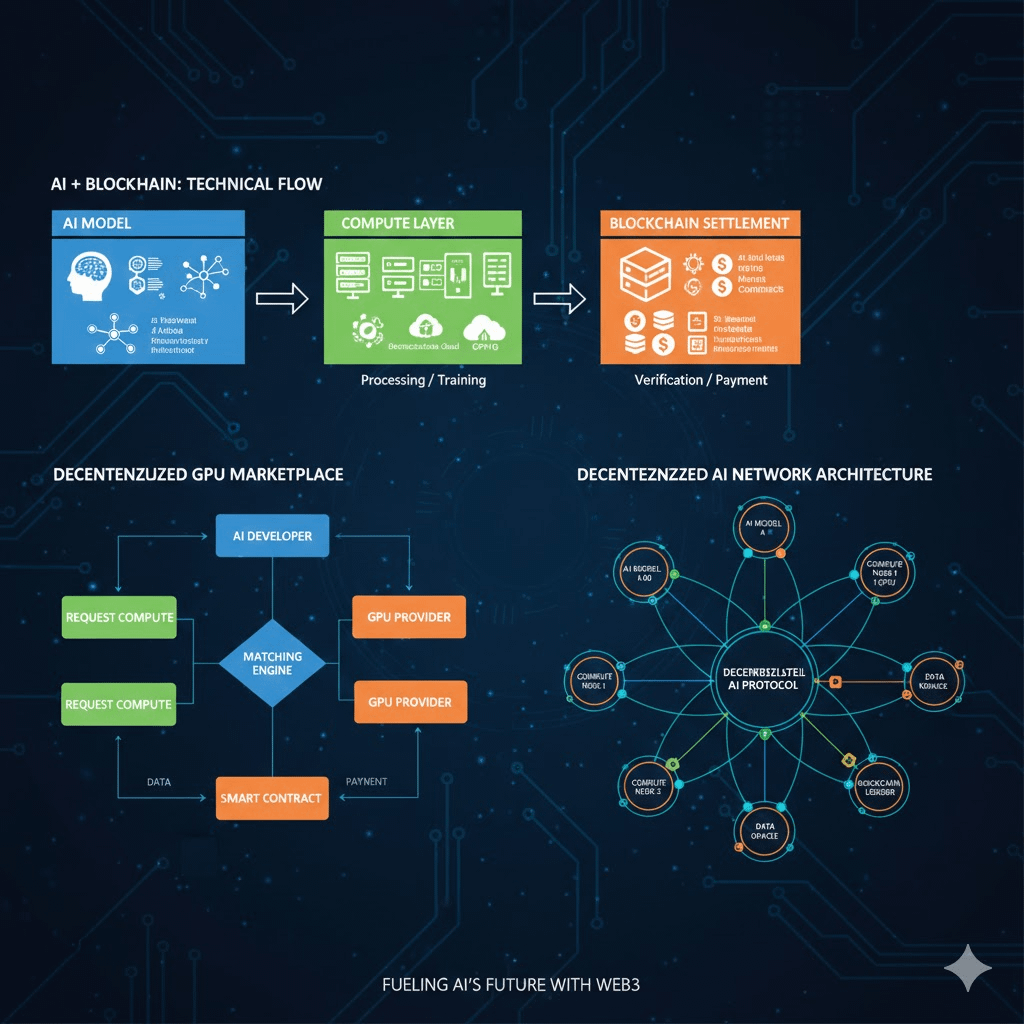

These are the protocols building lasting layers for AI on chain. Instead of selling a vision, they ship infrastructure.

Examples of real utility areas:

Compute marketplaces — decentralized networks where AI workloads can be bought and sold.

Model indexers — on-chain registries tracking AI models, metadata, versions.

Data marketplaces — open networks where high-quality data is tokenized for AI training.

Oracles for AI metadata — ensuring trustable data feeds for model outputs.

AI–smart contract bridges — letting smart contracts trigger AI inference directly.

Projects in this camp are focused on actual use, not just narrative amplification.

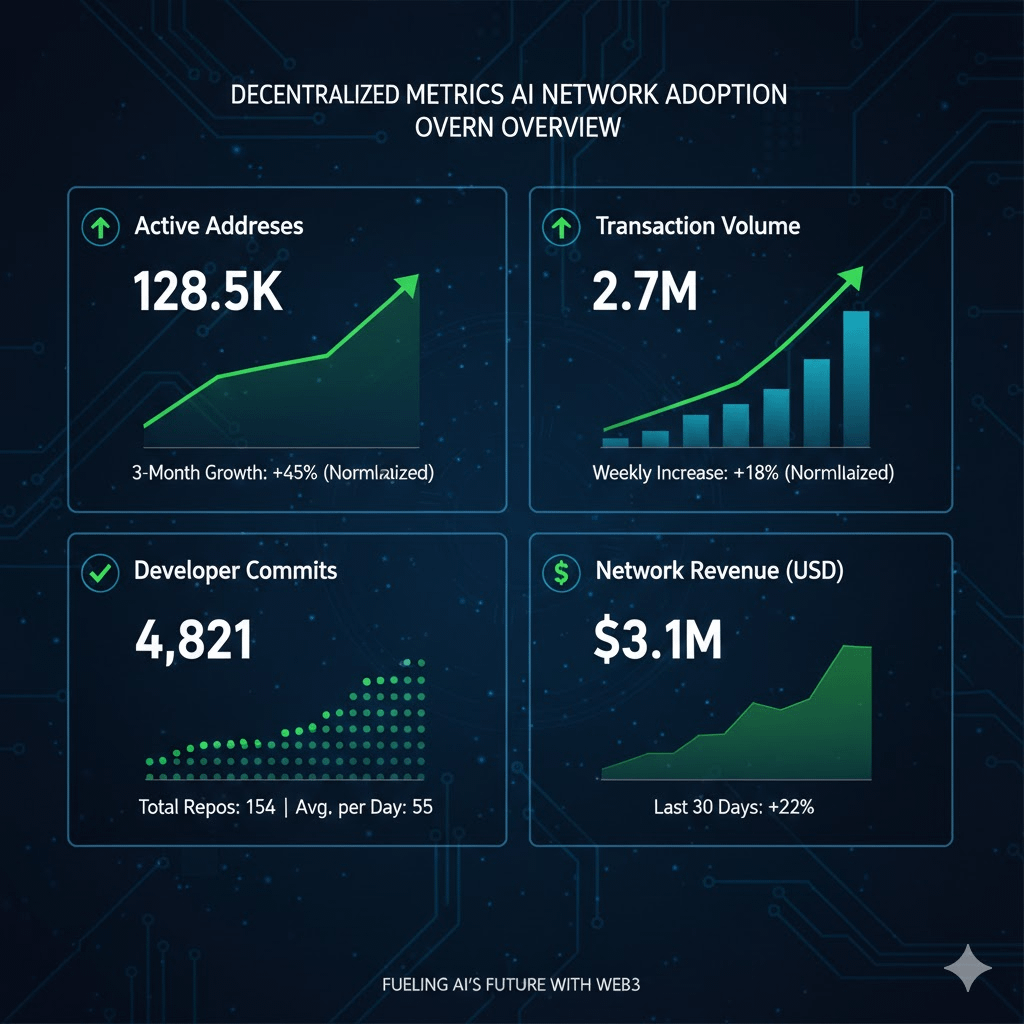

📌 Utility signals we can measure

Active users

Real economic activity (transactions, fees)

Integrations with legacy AI systems

Developer engagement

These are fundamental metrics, not hype proxies.

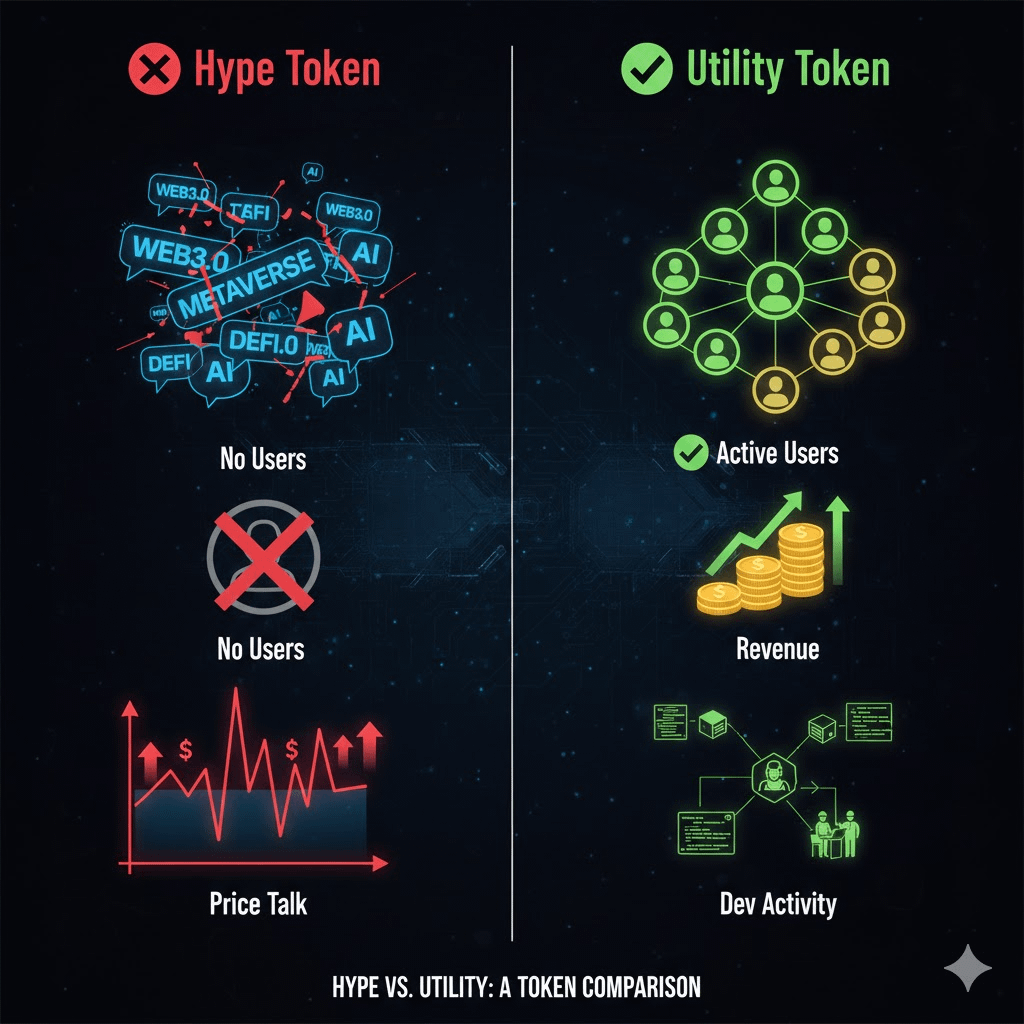

❌ 2. Narrative-Heavy Tokens With Little Adoption

Some projects still lean heavily on AI branding without delivering tangible utility.

Common characteristics:

No mainnet or testnet in production

No paying users

Minimal developer activity

No independent audits or security evaluations

In many cases, these tokens trade based on perception, not product usage.

Adoption vs Hype: What Metrics Actually Matter in 2026

In 2026, separating real AI utility from pure narrative requires looking at measurable fundamentals. Here’s how to tell the difference:

🔥 Signs of a Hype-Driven AI Token

Heavy focus on token price and market cap.

Constant AI buzzwords but unclear product explanation.

No working mainnet or functional testnet.

Little to no developer activity.

No real users or on-chain economic activity.

Zero revenue or unclear token utility.

No third-party audits or security transparency.

Roadmap filled with vague “future integrations.”

⚙️ Signs of a Utility-Driven AI Token

Live product or infrastructure actively being used.

Real economic activity tied to token usage (fees, compute payments, licensing).

Growing developer ecosystem and open-source contributions.

Transparent tokenomics aligned with network usage.

Enterprise or ecosystem integrations.

On-chain metrics showing real transactions and demand.

Independent audits and technical documentation.

Clear problem-solving focus (compute bottlenecks, data access, model licensing, etc.).

Case Studies: What Real Adoption Looks Like

📍 AI Compute Protocols

These platforms allow decentralized providers to bid on providing GPU/TPU cycles for AI workloads.

Real adoption signs:

Live marketplaces with jobs executed

Partnerships with AI dev teams

Token spend tied to compute usage

Why this matters:

Compute is the backbone of AI — and monetizing it efficiently on chain could be a genuine breakthrough.

📍 AI Model Indexing & Licensing Networks

Some projects are building token-linked model registries where IP rights, usage quotas, and access tiers are governed on chain.

Utility here emerges from:

Transparent versioning

Royalties paid to model authors

License enforcement via smart contracts

These are real, mission-critical components for decentralized AI ecosystems.

The Bottom Line: Are AI Tokens Useful in 2026?

Yes, but only for some.

We’ve moved past the early hype where branding was everything. Today’s narrative is more nuanced:

👉 Real utility exists where tokens are embedded in working infrastructure that users pay for and developers build on.

👉 Narrative without product still exists — and those tokens typically lose steam over time.

How to Spot Utility in AI Tokens

Before you invest or hype a project, ask:

🔹 Is there a live product or testnet?

🔹 Are there paying users?

🔹 Is there economic activity in the token tied to product usage?

🔹 Are real developers building on the protocol?

🔹 Does the project solve a measurable bottleneck in AI adoption?

If the answer is yes — you’re looking at fundamentals.

If the answer is no — you’re probably looking at narrative inflation.

Final Thought

In 2026, AI tokens are at a crossroads:

Those grounded in real adoption and infrastructure will define the space.

Those reliant on buzz alone will fade into Narrative 1.0 history.

The age of real utility is here — now we just need to distinguish it from rhetoric.