The FOGO ecosystem forms its own approach to liquidity development through competitive market-making programs and incentive mechanisms, similar to Fogo Flames. In a highly competitive environment among digital assets, the sustainability of a project is increasingly determined not only by technology but also by market depth. That is why the strategic focus shifts to creating economic conditions in which participants are interested in actively supporting turnover and stability of trading pairs.

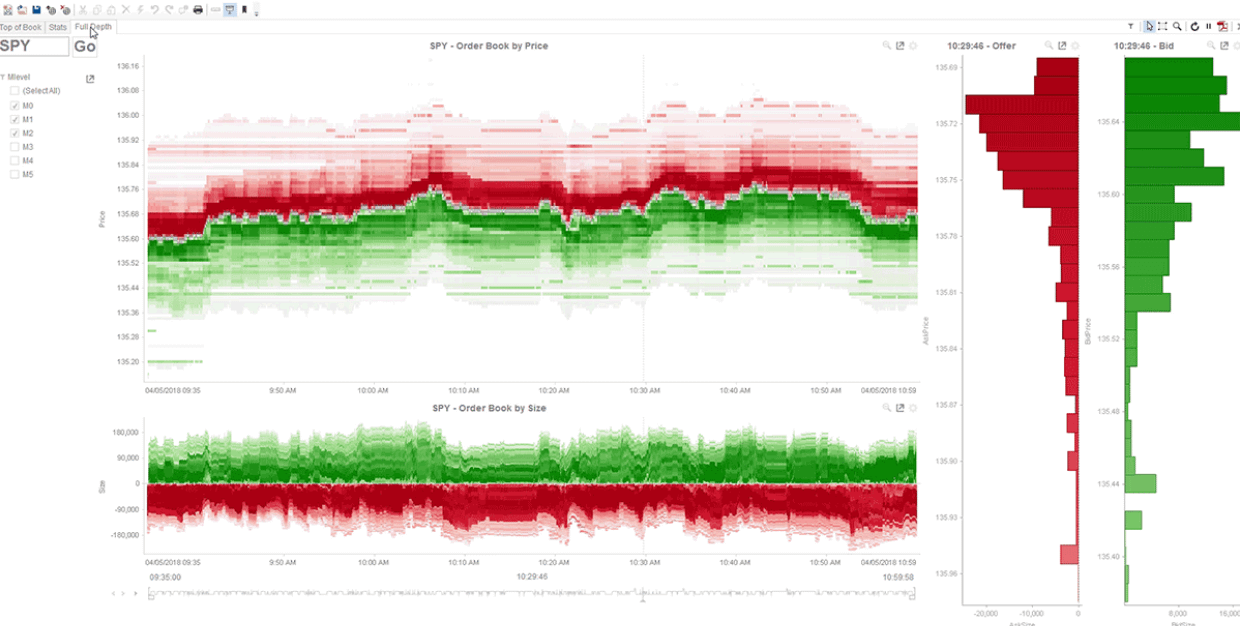

Modern market-making models in the blockchain environment rely on a combination of algorithmic strategies and market incentives. In the classical understanding, a market maker ensures a constant presence of buy and sell orders, reducing the spread and increasing liquidity. However, in decentralized ecosystems, this process is complemented by transparent rules for reward distribution, fixed in the protocol.

The competitive format enhances the effect of such programs. Instead of fixed payments, participants receive rewards based on the quality of their work: the volume of provided liquidity, stability of quotes, market depth, and minimization of price gaps. This creates a dynamic environment where efficiency directly converts into economic results.

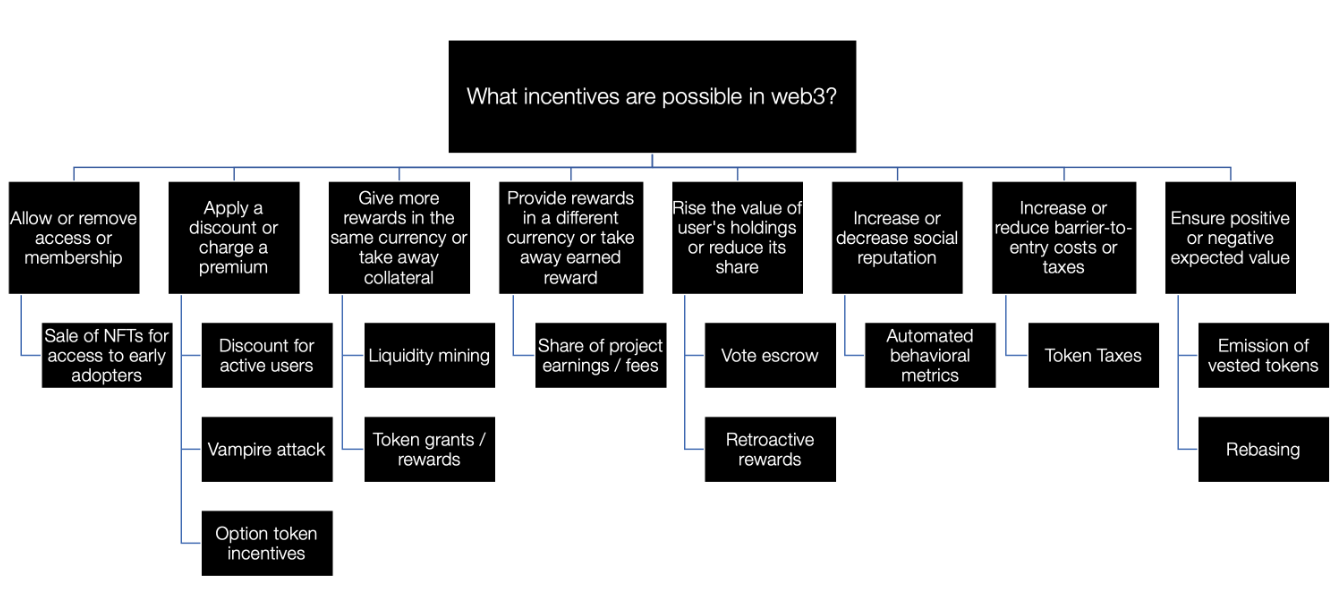

The Fogo Flames mechanism can be viewed as a gamified incentive model. It combines elements of ranking, time-limited campaigns, and bonus coefficients. Participants demonstrating the best performance receive additional advantages, creating a cumulative incentive effect and supporting long-term activity.

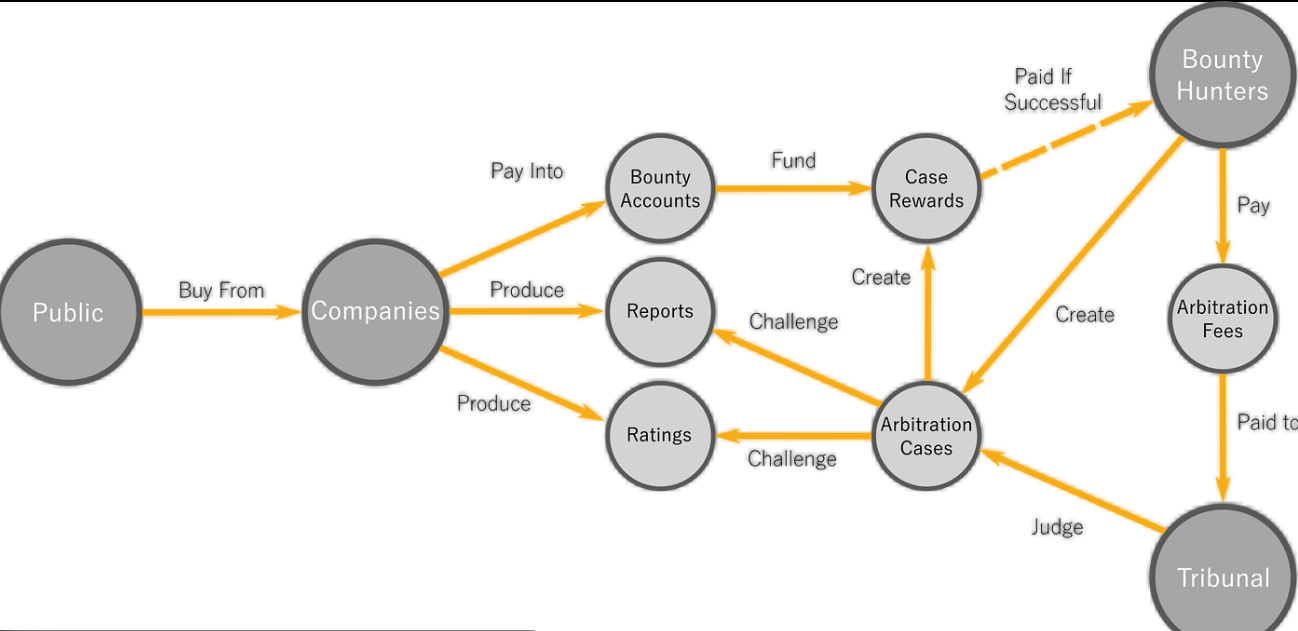

The economic logic of such programs is based on the principle of mutual benefit. The project gains a more stable market and reduced volatility, while market makers get a predictable model of returns. As a result, a balance of interests is formed, where the growth of liquidity enhances trust in the asset.

In the FOGO ecosystem, incentive mechanisms are integrated into the scaling strategy. As the audience expands and the number of trading pairs increases, the program can adapt by changing the parameters of reward distribution. This flexibility allows for maintaining competitiveness without drastic changes to the economic model.

The feature of competitive programs lies in the transparency of metrics. All key indicators are recorded on the blockchain or in an open accounting system, which eliminates subjectivity in assessment. Participants can see their own positions in the ranking and adjust strategies to improve efficiency.

Mechanisms like Fogo Flames also serve a marketing function. They attract attention to the project, create informational reasons, and stimulate discussion within the community. Gamification lowers the entry barrier and makes participation clearer even for those who have not previously engaged in market making.

It is important to note that such programs rely on the experience of other blockchain ecosystems, including Ethereum, where incentivizing liquidity has become a key factor in the growth of decentralized financial instruments. However, FOGO adapts these approaches to its own architecture and economic model.

From a risk management perspective, competitive programs require precise tuning. Excessive rewards can lead to artificial inflation of volumes, while insufficient incentives will not ensure the necessary market depth. Therefore, campaign parameters are calculated taking into account current activity and volatility.

An additional element is the time limitation of certain stages of the program. The seasonal format helps maintain interest and avoid the habituation effect. Each new cycle becomes an opportunity for participants to improve results and increase their share of the rewards.

Incentive mechanisms also contribute to the formation of a professional pool of market makers. Continuous participation in the program develops expertise, improves algorithmic strategies, and enhances market service quality. In the long term, this strengthens the entire ecosystem.

The social aspect is manifested in the formation of a community around the competition. Participants discuss results, share experiences, and analyze strategies. Thus, both financial and intellectual value is created.

The economic effect is enhanced by synergy with other elements of the ecosystem. Increased liquidity facilitates entry for new users, reduces transaction costs, and enhances the attractiveness of the token for long-term holding. Ultimately, incentive programs become part of the overall development strategy.

The Fogo Flames model can include a multi-level reward system, accounting for both individual achievements and contributions to the overall turnover. This approach supports competition while simultaneously encouraging collective results.

In a highly volatile market environment, competitive programs play the role of stabilizers. The active presence of market makers reduces sharp price fluctuations and creates a more predictable trading dynamic. This is particularly important in the early stages of project development.

The technological integration of the program allows for the automation of reward distribution. Smart contracts record results and make payments without intermediaries. This increases trust and reduces administrative costs.

Strategically, such mechanisms enhance the positioning of FOGO as an ecosystem with a well-thought-out economic model. The competitive environment within the program reflects the principles of an open market, where the result is determined by efficiency rather than the status of the participant.

Ultimately, competitive market-making programs and incentive mechanisms like Fogo Flames become an important tool for the development of the FOGO ecosystem. They combine economics, technology, and elements of gamification, forming a sustainable model for liquidity growth and community engagement.