Over the past few years, cross-chain has been one of the most sensitive topics in the blockchain world. Users need to transfer assets between different chains, and developers hope to combine applications across multiple chains. However, in reality, cross-chain bridges frequently become major targets for attacks. Almost all large-scale hacking incidents are related to cross-chain, prompting one to ponder: what kind of trust model should the future of cross-chain be built upon? In this regard, the PROVE token-driven Succinct Network offers a new perspective by using zero-knowledge proofs to replace traditional relayer trust.

Trust Issues

The core issue of cross-chain bridges lies in trust. Most bridges rely on a set of validators or oracle nodes to confirm whether assets have been transferred from the source chain, and then release the corresponding tokens on the target chain. However, if this group of validators is attacked or colludes, the entire bridge becomes insecure. Over the past two years, the amount stolen from cross-chain bridges has exceeded $2 billion, making it the biggest security risk in the DeFi ecosystem. Users do not lack the need for cross-chain, but their trust cost in cross-chain is too high.

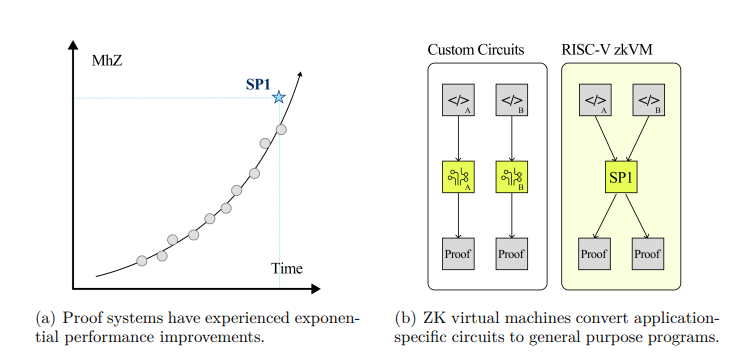

The Role of Zero-Knowledge

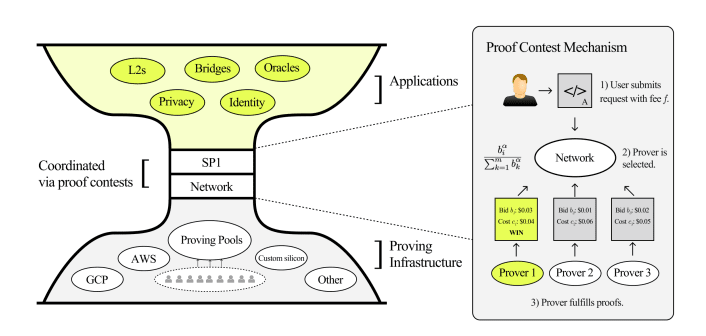

The characteristics of zero-knowledge proofs perfectly align with the pain points of cross-chain. Through ZK, the state of the source chain can be compressed into a small proof, and the target chain only needs to verify this proof to be assured that the operations occurring on the source chain are real. In this way, users no longer rely on specific validators but on mathematics itself. The design of the Succinct Network further markets this process, allowing any prover to generate the proofs required for cross-chain, and then coordinate costs and incentives through the PROVE token.

The Role of PROVE

In this system, the role of PROVE is not just payment. It serves as a coordination tool that ensures that provers are motivated to generate efficient and reliable cross-chain proofs. The cross-chain fees paid by users are settled in PROVE, and provers gain job opportunities through a competitive mechanism, which ensures price discovery and prevents a few nodes from monopolizing the cross-chain market. In other words, cross-chain is no longer reliant on a group of privileged nodes, but rather a decentralized global proof market.

Trading Tool Display 📊

If viewed through the lens of trading tools, it becomes more intuitive. You initiate a cross-chain request from Ethereum to BNB Chain on a DEX interface. The system will display how much PROVE needs to be paid as a cross-chain fee, along with the bidding situation of several provers. You will see an interface like this:

This experience is very similar to the 'choose miner fee' we are familiar with now, but what underpins it is not a simple Gas mechanism, but a decentralized proof competition.

Benefits of Decentralization 🌍

The greatest benefit of this model is decentralization. The biggest risk of traditional cross-chain bridges lies in the collusion of a few validators, but now provers can come from anywhere in the world, even individual GPU nodes. Through PROVE's collateral mechanism and full payment auction, provers cannot cheat arbitrarily, nor can they monopolize the market with low-cost advantages. The result is that the security of cross-chain is greatly enhanced, allowing users to operate with lower trust costs.

Industry Comparison

Compared to existing cross-chain solutions, the differences are very evident. For instance, multi-signature bridges rely on a limited group of signers; light client bridges, while more secure, have extremely high costs and are difficult to scale. The zero-knowledge and PROVE-coordinated model addresses both security and efficiency. Users do not need to worry about who generates the proof; they just need to see that the proof itself is verifiable and that costs are transparent.

Future Trends 🔮

I believe the future landscape of cross-chain bridges will likely be gradually replaced by zero-knowledge driven solutions, similar to how decentralized exchanges emerged when centralized exchanges dominated. Just as DEXs offered new possibilities through automated market-making models during the era of CEX dominance, cross-chain bridges will also experience a paradigm shift. The significance of PROVE here is akin to that of the Uniswap token in the AMM model; it is the cornerstone for market coordination as a whole.

Improvements in User Experience 💡

In addition to security, user experience is also crucial. Cross-chain has always been perceived as 'troublesome, slow, and opaque.' However, if cross-chain proofs are commercialized, fees and delays can be optimized through bidding. Users can choose between 'faster but more expensive' or 'slower but cheaper' options based on their needs. This flexibility is something traditional cross-chain bridges cannot achieve. Imagine being able to adjust a slider in the transaction interface and seeing real-time changes in cross-chain fees and delays, driven by the PROVE-powered proof market.

Risks and Challenges ⚠️

Of course, none of this comes without risks. First, generating zero-knowledge proofs is still a high-cost operation, and if hardware and algorithms are not optimized enough, cross-chain fees may deter users. Second, the number of participants in the early market may be limited, and insufficient liquidity can lead to low bidding efficiency. Finally, the existence of competitors, such as dedicated cross-chain networks or other zero-knowledge solutions, may also affect the adoption of PROVE.

Long-term Value

Even so, I still believe that PROVE has tremendous potential in the cross-chain field. Cross-chain is a rigid demand; users will not completely abandon cross-chain due to security risks, but will seek more reliable solutions. As long as the Succinct Network can gradually reduce proof costs and involve more provers, the scale of this market will be quite substantial. By then, PROVE will not just be a token, but a foundational trust layer in the cross-chain ecosystem.

Personal Observations 📝

One point that I personally pay close attention to is that the demand for cross-chain is often strongly correlated with market cycles. In bull markets, users frequently engage in cross-chain activities and are willing to pay higher fees; in bear markets, cross-chain demand decreases, leading to more intense fee competition. This cyclical fluctuation will also directly reflect on the value of PROVE. Therefore, when observing the long-term trend of PROVE, one cannot merely look at its price fluctuations on charts, but also consider the overall cross-chain activity in the market.

The uniqueness of PROVE lies in the fact that it is not an imagined narrative, but rather directly addresses one of the most challenging trust issues in the blockchain world: cross-chain. Through zero-knowledge and a decentralized proof market, PROVE provides a brand new solution for cross-chain. How far it can go in the future will depend on the speed of technological optimization and ecological expansion, but from an industry logic perspective, this direction is almost irreversible.