When the idea of machine-to-machine finance first crossed my mind, it felt distant and theoretical. Then I imagined two AI agents hashing out a service deal in the middle of the night, no humans awake, no approvals needed—and it stopped feeling like a concept. It started feeling like something that could actually happen.

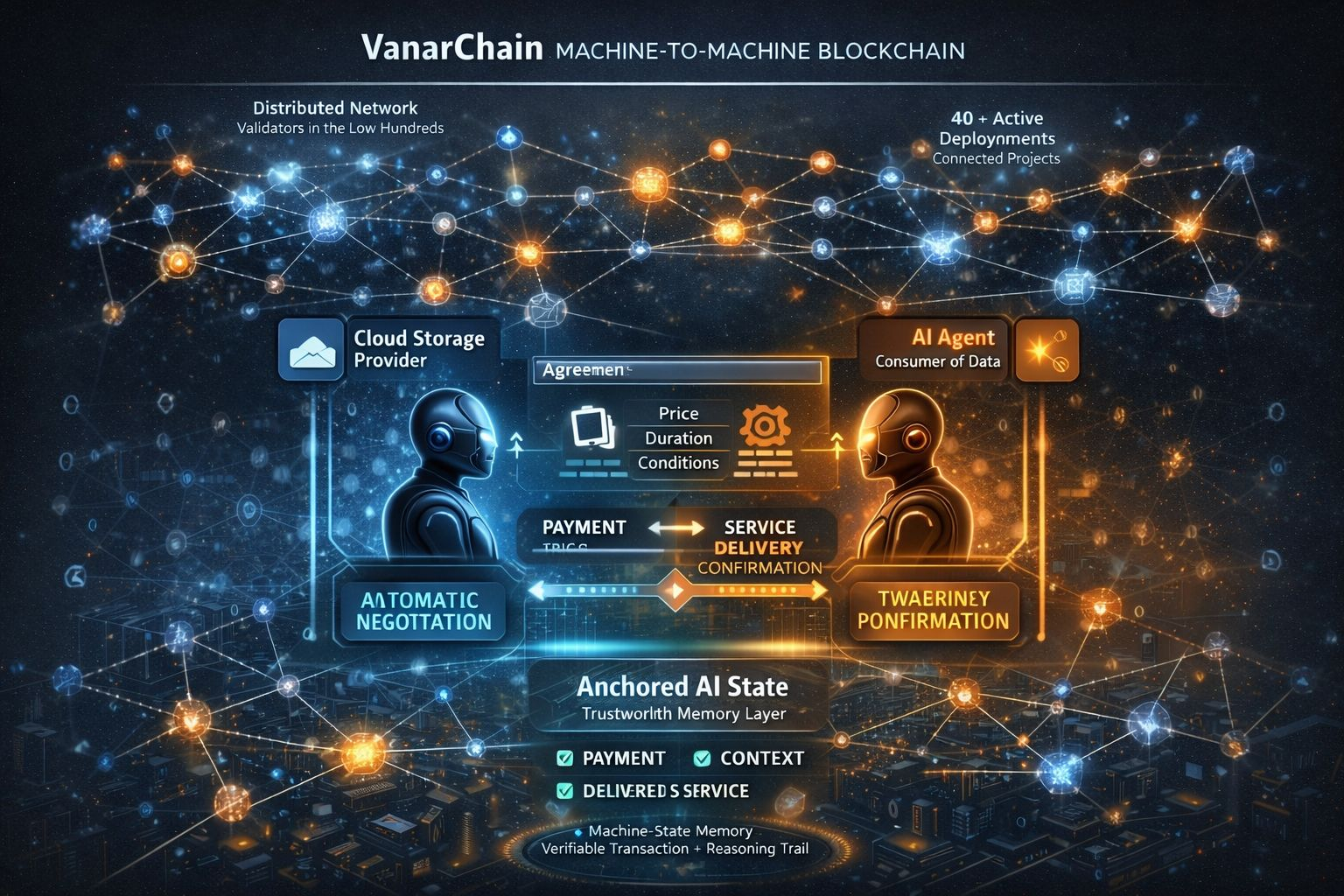

Infrastructure like VanarChain is quietly pointing toward a future where blockchains are built less for human interaction and more for machine coordination. By early 2026, validator participation sits in the low hundreds. That signals a network that is becoming distributed, but not yet fully mature in decentralization. At the same time, more than 40 active deployments exist across the ecosystem. That number doesn’t suggest mass adoption, but it does show that real teams are experimenting with live systems instead of just shipping narratives.

This context matters because autonomous, machine-driven economies require more than fast transactions. They depend on stability, predictable execution, and shared assumptions about how value moves. On the surface, machine-to-machine finance looks straightforward: an AI agent triggers a payment when predefined conditions are met. In reality, that flow depends on persistent context, verifiable execution, and settlement rules that can be audited. If one agent supplies cloud storage and another consumes it, the payment logic needs to function automatically, but the reasoning behind that payment must still be inspectable. This is where anchored AI state becomes meaningful. It introduces a memory layer that machines can reference, rather than treating every transaction as a standalone event.

Market conditions add pressure to this direction. Liquidity across crypto in early 2026 remains thinner than during peak 2024 levels, forcing infrastructure projects to demonstrate real utility. As autonomous agents begin managing high-frequency microtransactions, even small fees can accumulate into meaningful economic flows. That creates new opportunity, but it also amplifies risk. Faulty automation does not fail quietly. Errors scale at the same speed as profits, and poorly designed systems can propagate mistakes across thousands of interactions.

What emerges from this is a shift in who blockchains are for. The next phase may not center on humans approving transactions one by one. It may revolve around machines establishing trust with other machines. In that world, the value of a chain is not only in throughput, but in whether autonomous systems can rely on its state, memory, and execution guarantees.$VANRY @Vanarchain #vanar