On the Unchained podcast, journalist Laura Shin conversed with Parker White, the Chief Investment Officer of DeFi Development Corp. His analysis quickly spread because it pointed out a 'culprit' that few noticed: the options market of the BlackRock IBIT ETF.

That day, Bitcoin plummeted from 70,000 to 63,000 USD. But the strange thing is: spot and futures trading remained almost normal. What surged was the IBIT options, where implied volatility shot up. This indicates that the issue did not stem from broad selling pressure, but from a 'blast' in the derivatives market.

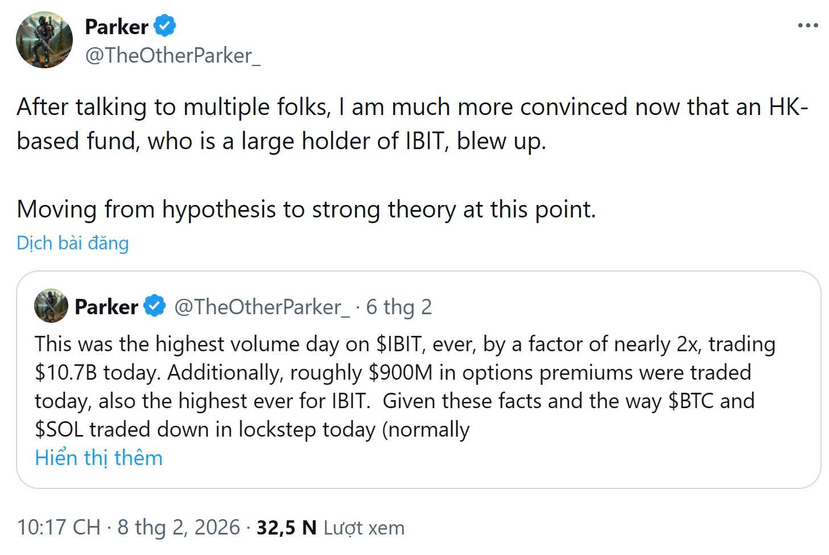

White believes that a hedge fund outside the crypto industry in Hong Kong has been short selling price volatility. As volatility surged, they suffered heavy losses, but instead of cutting their losses, they continued to hold their positions. When they were required to withdraw funds and faced a 90-day payment regulation, they were forced to liquidate en masse — creating a chain shock that pulled Bitcoin's price down.

In short: this could be a failed 'big short', not a panic sell. Sometimes, the market doesn't crash because of a crowd selling off — but because a big player is stuck and forced to exit at all costs.

Not only is there one fund stuck due to short selling volatility — but there may also be a 'predator' behind it.

While many parties are losing due to selling options, Parker White believes that another fund has quietly done the opposite: accumulating cheap put options since mid-year, when Bitcoin's volatility hit historic lows.

The tactic sounds simple but is extremely effective. They pushed the price down over the weekend — the time of thinnest liquidity. By the time the market opened, the options traders of IBIT belonging to BlackRock had to sell to hedge against risks. This technical pressure amplified the decline, like a snowball effect.

White emphasizes: 'Don't get it twisted. The fact is that this week a new billionaire cryptocurrency trader has been mentioned,'

If true, this is not a random crash — but a well-orchestrated short trade.

The key link will reveal itself on the 13F report submission deadline on May 15. If the major shareholders of IBIT in Hong Kong disappear from the holdings list, it is almost a final confirmation.

Currently, it's all just a hypothesis. But the pieces are gradually fitting together — and the market may have just witnessed one of the smartest 'big shorts' in crypto history.