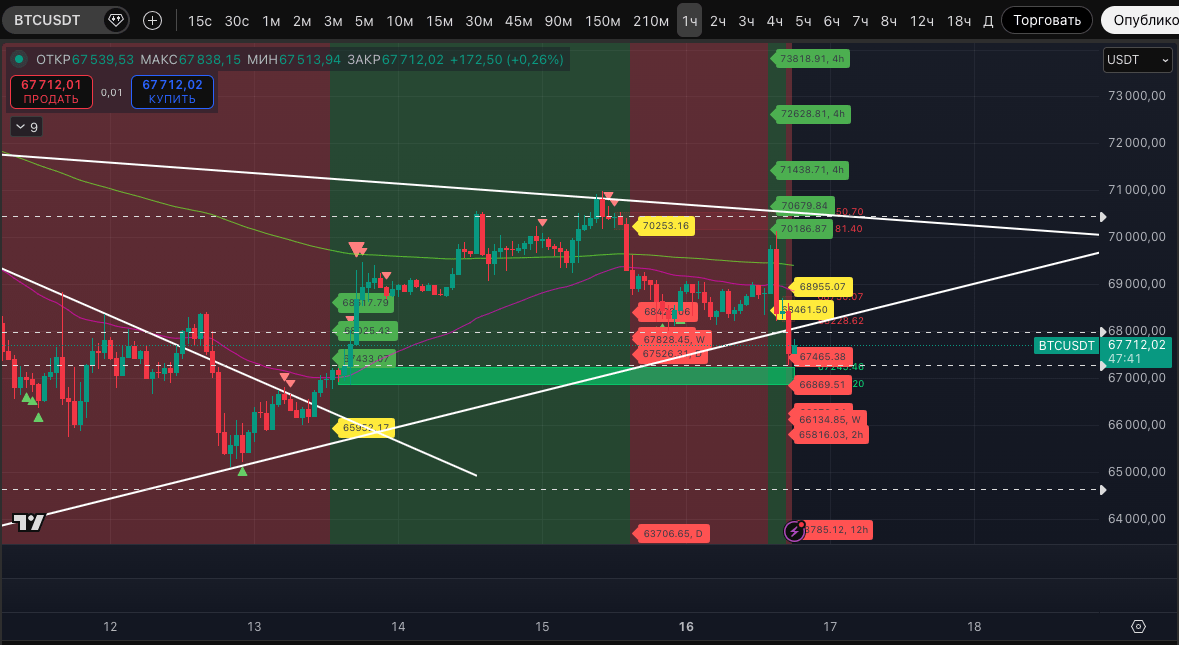

The stable uptrend for BTC on the hourly timeframe has broken, not even reaching the basic target. It turned out to be false, although in the market this uptrend signal was far from the only one (37 assets from the TOP-200).

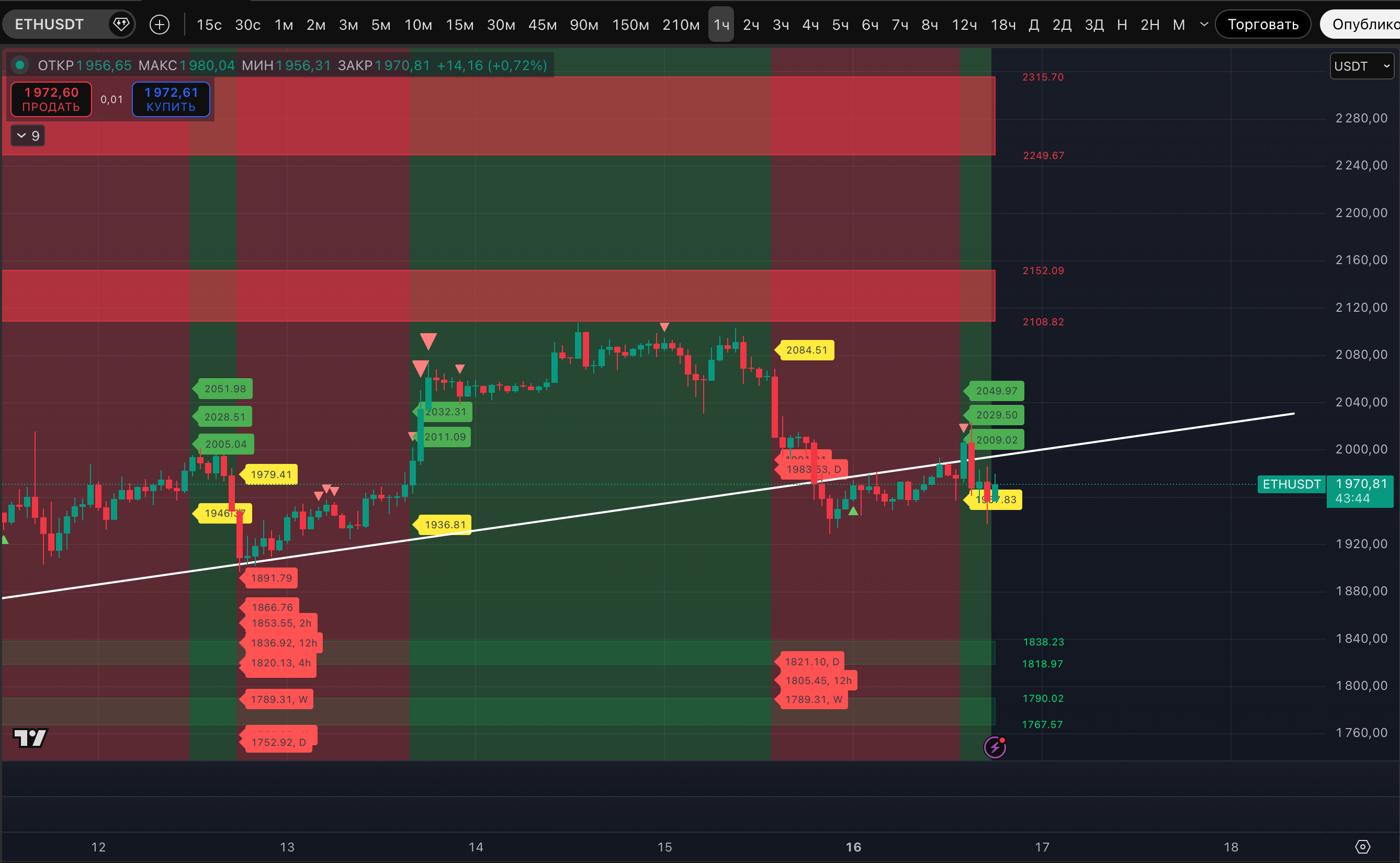

Interestingly, ETH has maintained a stable uptrend on the hourly timeframe.

In this hour, only two assets have shown a return to a stable downtrend on the hourly timeframe - BTC and BAT. So this is currently a pronounced weakness specifically for Bitcoin. But if Bitcoin pulls the price down - then this is a temporary success.

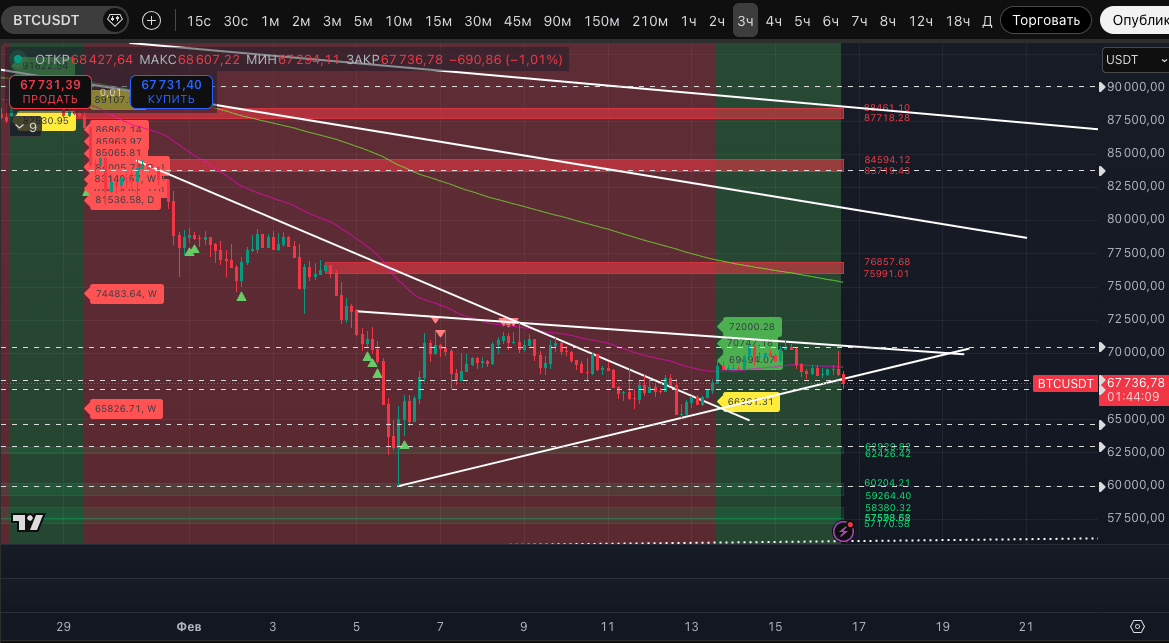

Overall, BTC currently has just under two hours to show a rebound and maintain a stable uptrend on the 3-hour timeframe. After the crash on February 6, the volatility of the asset, although constantly decreasing, continues to have liquidations.

Negative for bulls, as the price has broken the trend support at the lows of February 6 and 12.

In the most negative scenario, we can talk about a "Bearish Pennant" with a full target below $40,000. But we are not looking in that direction for now.

If the trend break occurs on the 3-hour timeframe, it means that only two basic targets will have been achieved in the current uptrend. And the stop in our new strategy, which we are testing, is only moved when the extreme basic target is reached (in this case, $72,000). If the price returns to a stable downtrend on the 3-hour timeframe - this will open the way to liquidity zones $62,426-$62,929, $59,264-$60,204, $57,170-$58,380. Therefore, we will have to continue the series of losing speculative futures trades, accept the loss, and reverse the position.

Although altcoins showed significant strength over the weekend (41 assets from the TOP-200 transitioned into a stable uptrend on the 12-hour timeframe) - it is difficult to argue with the trends of Bitcoin, which are looking downward in the current market.

But the bulls still have a chance; the time to maintain the key uptrend for BTC on the 3-hour timeframe is still there. The decisive hours are now for them.