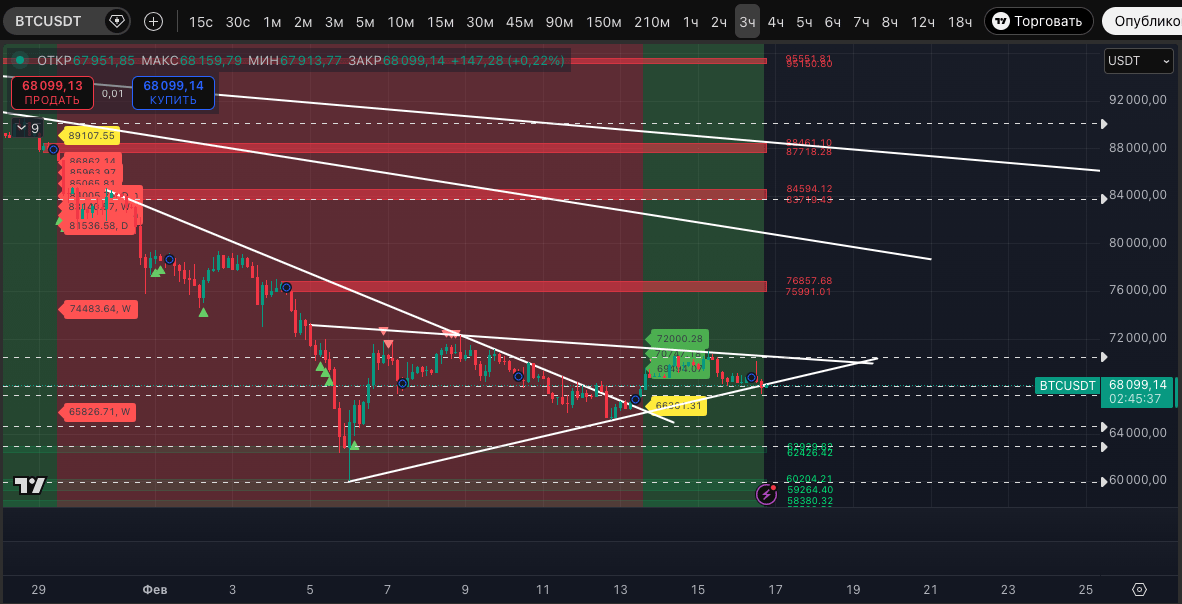

BTC has maintained a sustainable uptrend on the 3-hour timeframe, and therefore we remain in a long position.

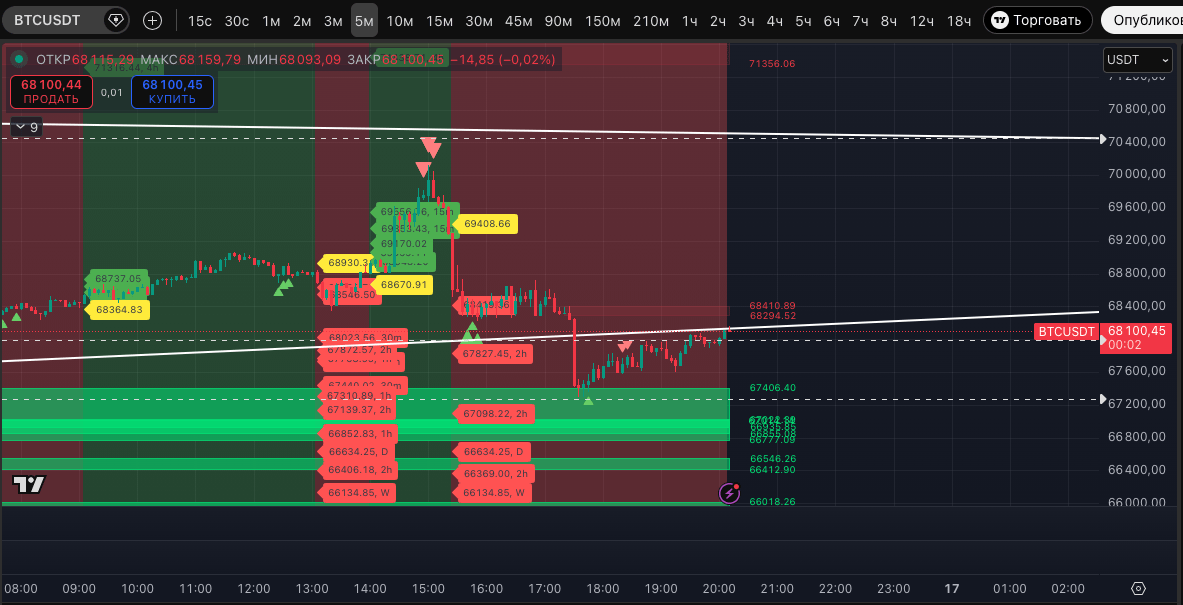

Although the situation for bulls is still holding, forgive me ladies, it's "by a thread". They have not yet returned to an uptrend even on the 5-minute timeframe.

What is interesting - altcoins continue to hold stronger than #BTC at the moment. The new report from P73 CryptoMarket Monitor confirms this. There are no new sustainable downtrends on the hourly timeframe. For example, on the 2-hour timeframe, 5 assets from the TOP-200 have transitioned to a sustainable uptrend, including a player from the TOP-10 like #TRX. Meanwhile, let's remind that #BTC still cannot return to a sustainable uptrend even on the hourly timeframe. But the key point, we emphasize once again - the uptrend on the 3-hour timeframe has held, and we remain in position. Although a finger was already hovering over the "close position" button.

We are set to continue following the strategy we tested last week in Trading View in conjunction with 'Demo account + market simulation,' where we worked through all of autumn and January-February and the results were good. It is difficult to share specific numbers because in market simulation mode, the demo account inaccurately summarizes results for the deposit, which is a downside of Trading View. The results can be evaluated by working through the simulation and opening/closing positions in real-time, keeping the overall picture of the demo account balance in mind. The key result is that throughout the entire test, there were no more than a few exits due to stop-loss in loss consecutively, and overall exits into loss were rare. So the current situation, where there are three stop-losses in a row (we will summarize the results in a table a bit later) is rather an unfortunate coincidence. Historically, the result, we emphasize, is positive. These failures will not force us to abandon the development of the strategy in the live market.

The strategy we are currently testing, in a nutshell, is to trade stable trends on a 3-hour timeframe (instant closing upon trend change) and set a stop-loss to break-even upon reaching the extreme baseline target. Especially if there is such an area as resistance near our liquidity zone indicator. The downside of the strategy is that it results in quite a few stop-losses into positive break-even. Its big advantage is that it allows capturing all the huge market movements, such as what happened from $87,000 to $69,000. With a 30x leverage. This downtrend is visible on the screen. Let us remind you that we did not work it out, all the while waiting for a bounce to enter short.

Right now we are looking for a strategy that will be most appealing to copyists purely from a psychological point of view. From this perspective, a large number of exits into positive break-even and capturing such large movements is the best option. They will always be able to close the position in profit if they want to. Our task will be to catch large movements and in case of failures, maximize the exit to positive break-even.