The data is in, and it’s a bloodbath for ETH As we head toward the end of February 2026, the "Queen of Crypto" is looking more like a speculative ghost town than a global computer.

📉 The "Historic" Underperformance

We aren't just looking at a bad week; we are witnessing a complete collapse of momentum.

🔅 6 Red Candles in a Row: $ETH is pacing to close its 6th consecutive monthly red candle.

🔅11 of 14 Months Red: Since early 2025, Ethereum has failed to find a green monthly close in almost 80% of its attempts.

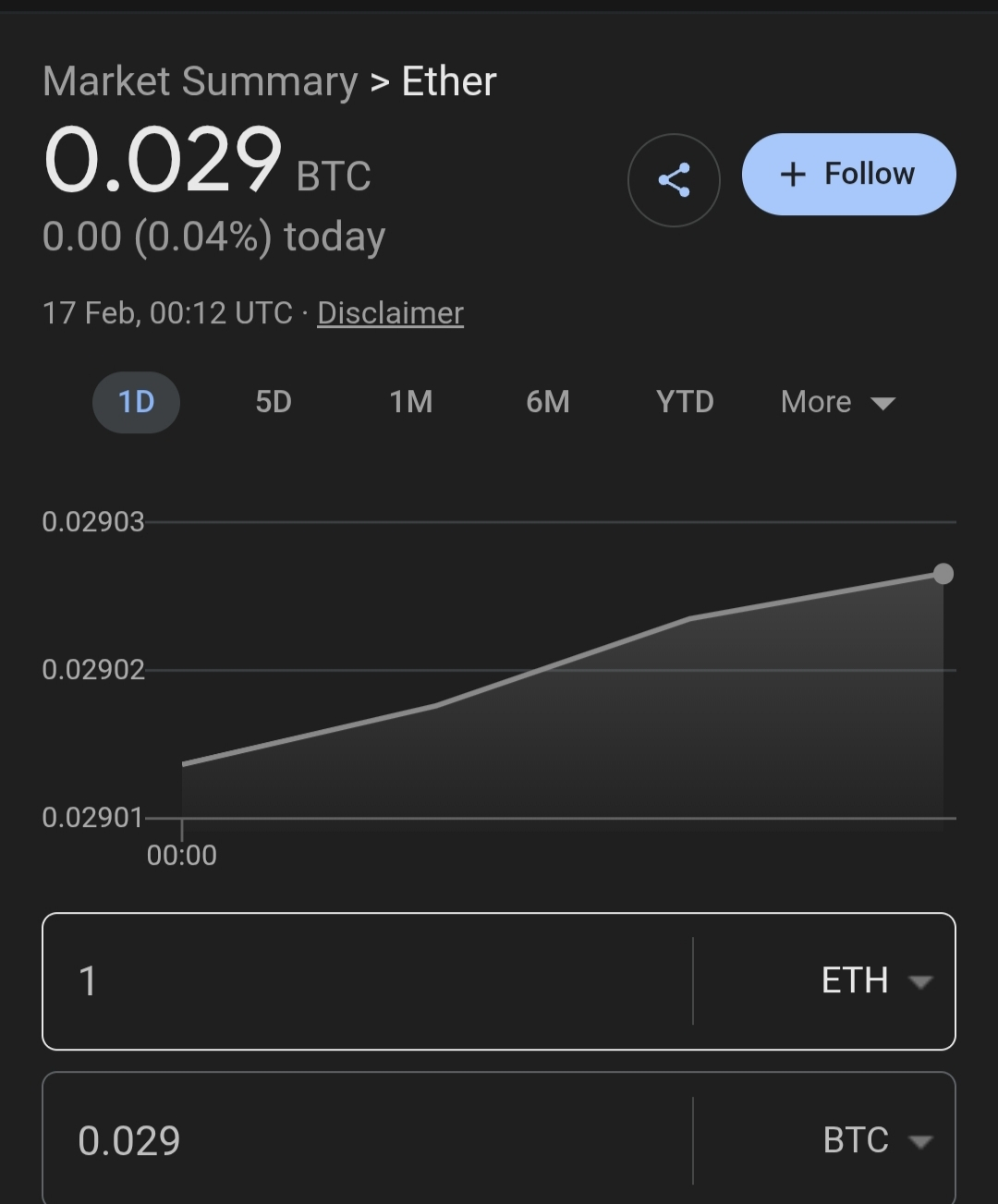

🔅The ETH/BTC Ratio: The ratio has crashed to ~0.029, its lowest level in years. Remember when we thought 0.05 was "the floor"?

🤡 Why the "Memecoin" Label Fits Right Now:

- Utility vs. Price: Ethereum has the "tech" (The Merge, L2 scaling, Danksharding), but the price action is decoupled from reality. When an asset has "fundamentals" but moves like a rug-pull, the market treats it as a meme.

- The L2 Cannibal: Ethereum’s own Layer 2s are winning while the mainnet bleeds. ETH has become a "holding company" for better-performing assets, much like a meme index.

- Vibe-Based Investing: Institutional interest in ETH ETFs has cooled significantly compared to Bitcoin. Investors are no longer buying ETH for yield they’re buying it because they hope it’ll follow $BTC BTC. That’s "hope-ium," the fuel of every memecoin.

📊

🤔 Bottom Line: If it bleeds like a meme, lacks a floor like a meme, and relies on "community vibes" to stay relevant, is it still a "Blue Chip"?

Ethereum is currently the ultimate test of patience. Is this the accumulation of a lifetime, or are we watching the slow transition of a giant into a legacy memecoin?

👇 Drop your thoughts below: Are you buying this dip or is ETH going to 0.02 BTC?