One of the biggest differences between profitable traders and struggling traders isn’t strategy.

It’s mindset.

Retail traders ask:

“Will this trade work?”

“Is this the right entry?”

“Am I sure about this?”

Professionals ask:

“What’s the probability?”

“Is the risk justified?”

“Does this fit my edge?”

That shift alone changes everything.

Let’s break it down clearly 👇

🔸 1. The Market Doesn’t Offer Certainty

There is no:

guaranteed setup

100% pattern

perfect confirmation

safe entry

Every trade is a probability.

Even the cleanest setup can fail.

The goal is not to eliminate losses.

The goal is to make sure that:

Over many trades, the math works in your favor.

That’s probabilistic thinking.

🔸 2. Retail Thinks in Single Trades

Retail mindset:

This trade must win.

If it loses, something is wrong.

I need to recover immediately.

I need confirmation before entering.

They treat each trade like a verdict on their skill.

But trading is not about one trade.

It’s about a sample size.

🔸 3. Professionals Think in Series of Trades

A professional mindset sounds like this:

“If I execute this setup 100 times, I know the outcome is positive.”

Notice something important:

They don’t need this trade to win.

They only need to:

follow rules

control risk

let the edge play out

That removes emotional pressure.

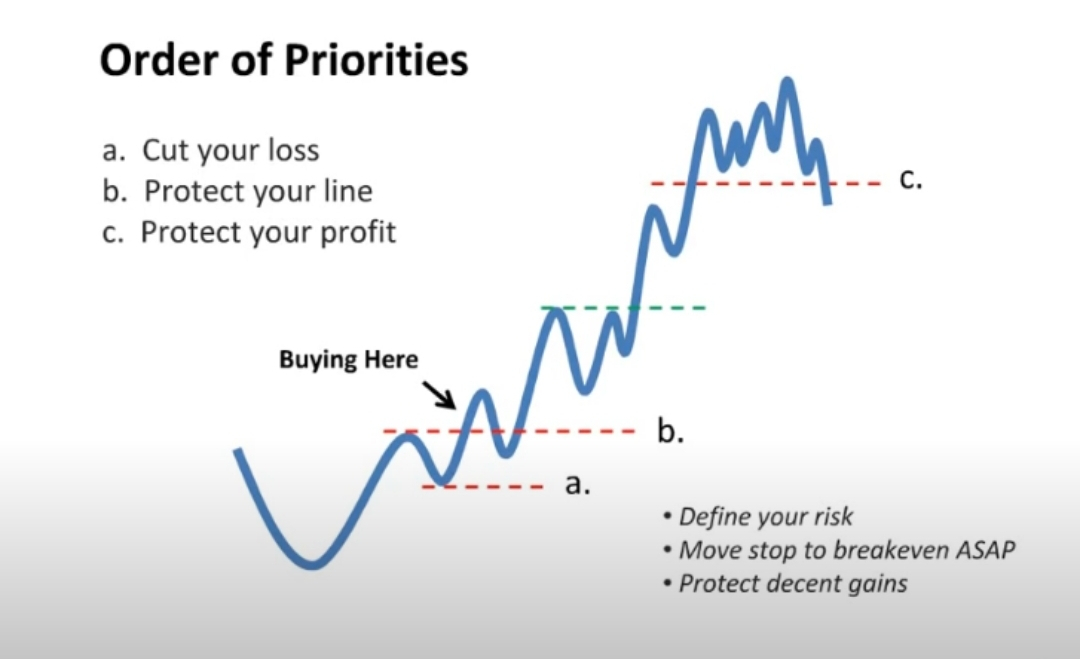

🔸 4. Why Certainty Destroys Accounts

When you seek certainty:

You hesitate on entries

You move stop-losses

You cut winners early

You revenge trade

You oversize when “confident”

Because emotionally, you’re trying to avoid being wrong.

But being wrong is part of trading.

Trying to eliminate losses eliminates discipline.

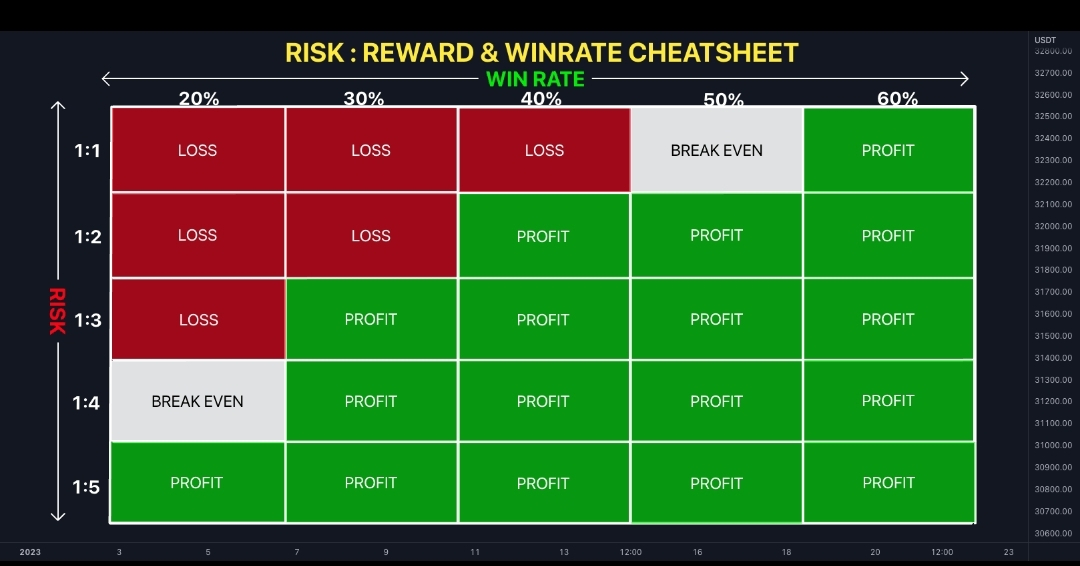

🔸 5. Probability + Risk Management = Edge

Here’s a simple reality:

If you risk 1% per trade

with a 1:2 R:R

and a 45% win rate…

You’re profitable.

Not because you’re accurate.

But because math is working for you.

This is why professionals focus on:

expectancy

consistency

execution quality

Not excitement.

🔸 6. Emotional Traders Obsess Over Being Right

Ego-based trading sounds like:

“I knew it.”

“I was right.”

“The market is wrong.”

“This shouldn’t happen.”

Probability-based trading sounds like:

“That was within variance.”

“Good execution.”

“Next trade.”

Emotion vs structure.

🔸 7. How to Train Probabilistic Thinking

Here’s how you shift:

✔ 1. Track trades in batches of 20–50

Stop judging single outcomes.

✔ 2. Define your edge clearly

If you can’t define it, you can’t trust it.

✔ 3. Accept losing streaks in advance

They’re statistically normal.

✔ 4. Focus on rule-following, not PnL

Process > outcome.

✔ 5. Reduce size until losses don’t hurt emotionally

Emotion blocks probability thinking.

🔸 8. The Freedom of Thinking in Probabilities

When you truly understand probability:

losses don’t shake you

wins don’t excite you

discipline becomes easier

consistency increases

confidence stabilizes

Because you’re no longer reacting to outcomes.

You’re executing a model.

Retail traders trade to be right.

Professional traders trade to let math play out.

The market rewards:

patience

repetition

controlled risk

statistical thinking

Not certainty.

If you shift from:

“Will this win?”

to

“Does this fit my edge?”

Your entire trading career changes.

Educational content. Not financial advice.