Robert Kiyosaki’s long game from 'Rich Dad Poor Dad' to Bitcoin (3:28)

Markets have turned increasingly unstable in early 2026.

Bitcoin has struggled to reclaim the $70,000 level. At the same time, precious metals have pulled back sharply from recent highs.

Gold hit a record above $5,500 in late January 2026 before sliding back below $5,000 in February. Silver also surged past $120 in late January before dropping into the mid-$70K range during February’s sell-off.

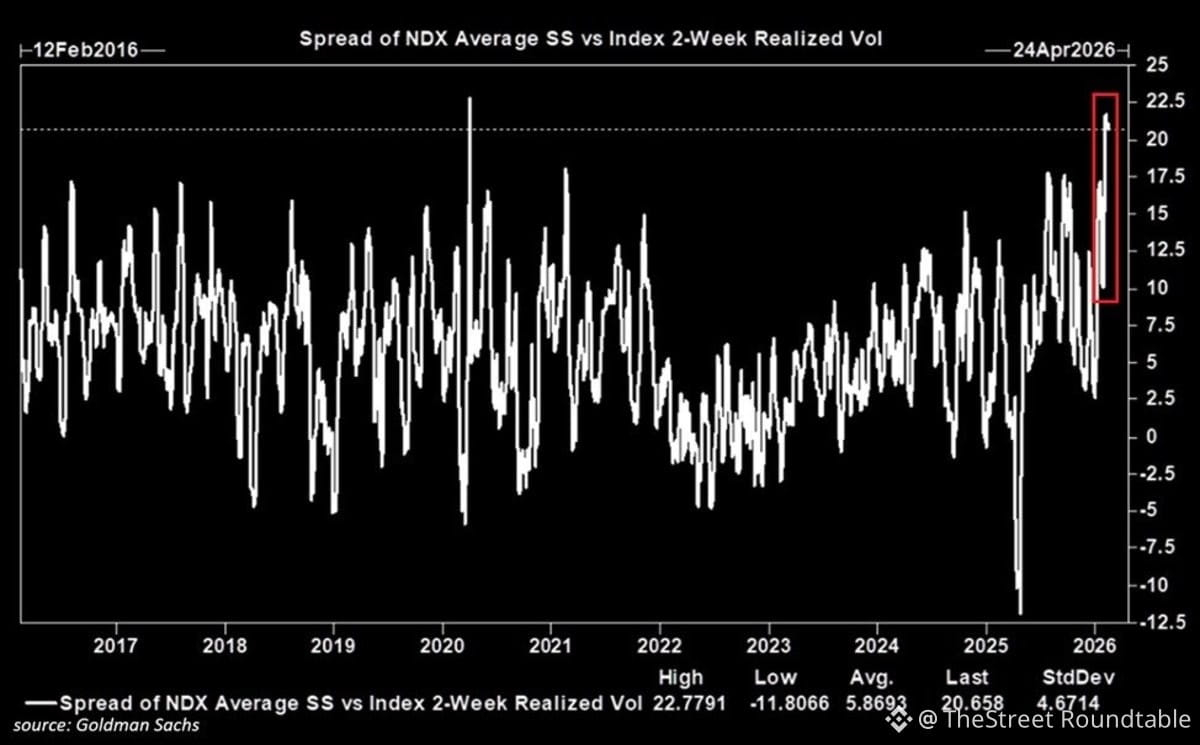

On Feb. 16, financial commentary outlet The Kobeissi Letter flagged rising volatility beneath the surface of the stock market. It said the gap between two-week volatility in individual stocks and the Nasdaq 100 had climbed to 20.7 points, the highest level since 2020.

Spread of Nasdaq-100 (NDX) single-stock volatility vs index volatility.

Spread of Nasdaq-100 (NDX) single-stock volatility vs index volatility.

The measure has doubled over the past month and now sits three times above its four-year average, showing that even if major indexes look calm, many individual stocks are experiencing extreme moves.

In response to current market conditions, Rich Dad Poor Dad author Robert Kiyosaki says he is not afraid of a crash.

Related: Gold and silver crash puts crypto back in focus

Market crash as buying opportunity

In a Feb. 17 post, Kiyosaki reiterated his long-held warning that a historic market crash was coming, saying the “giant crash is now imminent.”

Kiyosaki’s broader strategy centers on accumulating hard assets during periods of panic. He said he holds gold, silver, Ethereum and Bitcoin, and plans to increase his exposure if prices continue to fall, positioning himself as a buyer when others are selling.

“Market crashes are priceless assets going on sale,” he wrote, adding, “Let this crash make you richer.”

Popular on TheStreet Roundtable:

Hedge fund manager predicts Bitcoin to $50M

Another company makes a U.S. comeback

Gold, silver, S&P 500, crypto crash again amid extreme fear

Robert Kiyosaki is betting on scarcity

A core pillar of Kiyosaki’s bullish stance on Bitcoin is its fixed supply. The Bitcoin protocol caps total issuance at 21 million coins, a hard limit embedded in its code.

"I am so bullish on Bitcoin I am buying more and more as Bitcoin’s price goes down. Why? There will only ever be 21 million Bitcoin and there are nearly 21 million Bitcoin already in circulation."

According to blockchain data from Blockchair, Bitcoin’s circulating supply currently stands at 19,990,871 BTC, meaning just over 1 million coins remain before the 21 million cap is reached. New coins are released at a decreasing rate through a process known as bitcoin mining, with periodic “halving” events cutting issuance in half roughly every four years.

Kiyosaki points to this built-in scarcity as a key reason he continues to accumulate during downturns.

With supply capped and demand fluctuating based on market cycles, he argues that panic-driven sell-offs present long-term buyers with discounted entry points into a finite asset.

At the time of writing, Bitcoin was trading at $68,204.18, down 0.94% on the day, while Ethereum stood at $1,993.53, lower by 0.22% over the same period, according to data by CoinGecko.

Related: Markets slide on U.S.-Iran escalation