Mike Saylor (Strategy) and Tom Lee (BitMine) continue to buy BTC and ETH respectively.

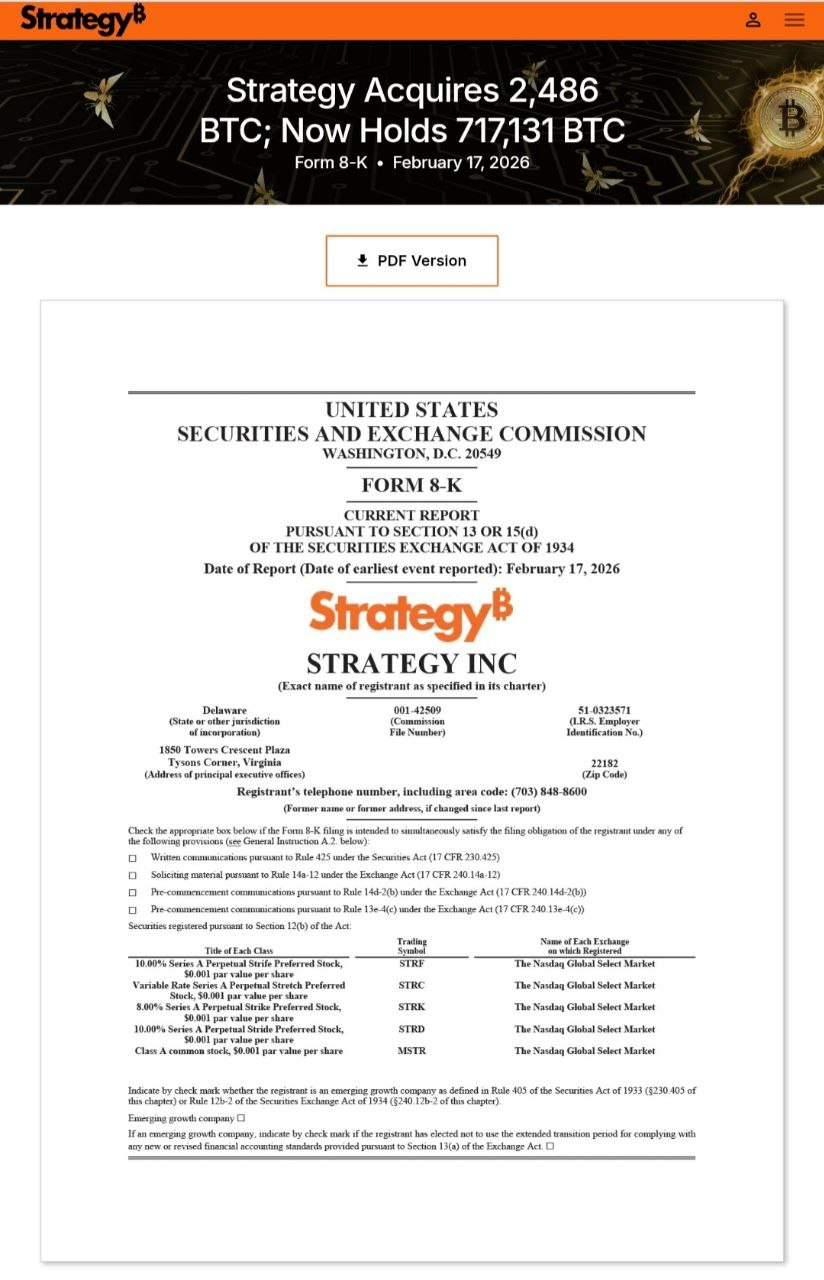

#Strategy bought a significant amount last week - 2,486 #BTC for approximately 168.33-168.4 million $. At a price of about 67,710$ per coin (as indicated by the submitted Form 8-K report).

As of February 16, 2026, #Strategy has a balance of 717,133 BTC, total purchases amounting to approximately 54.546 billion $, average purchase price - about 76,062$ per #BTC.

#Dropstab shows for their portfolio:

- Current balance: 48,594 billion $.

- Drawdown on investment: -10.93% or -5.961 billion $.

- Drawdown from the maximum: -28.56% or -19.428 billion $.

The company BitMine has already purchased 4,371,497 ETH - which is approximately 3.62% of the total supply.

Average purchase price: 3,789$ (very painful). Last week they bought 45,759 ETH (around 91 million $). There are 3,040,483 ETH staked (6.1 billion $). This brings them passive income, but not pleasant enough to sweeten the bitterness of paper loss. Their current paper loss, as shown by Dropstab, is -47.72% or -7.91 billion $.

If/when these companies emerge from their drawdowns without losses and profit from the growth to new heights - they will become legends. However, if ETH can be staked - then how to earn on BTC without selling it - that's a good question. A Bitcoin bank, issuing loans, as an option.

An important point that is not obvious to everyone - news about Saylor's and Lee's purchases are always post-factum news from the past week and they do not bring pump to the markets. Why? Let's imagine that they bought in large quantities, but since last week the market has only fallen further or has not grown at all. This means that even these large purchases did not help the asset show growth. The asset is weak. For market participants, such a picture is more of a reason to sell the asset than to buy more behind these two crypto-maximalists.