$ATOM $ASTER The weekend provided a masterclass in market psychology as several altcoins staged erratic "pumps" while the broader market remained under macro pressure. As of February 18, 2026, these moves are increasingly being identified as high-probability short-squeeze events rather than sustainable rallies.

$ATOM $ASTER The weekend provided a masterclass in market psychology as several altcoins staged erratic "pumps" while the broader market remained under macro pressure. As of February 18, 2026, these moves are increasingly being identified as high-probability short-squeeze events rather than sustainable rallies.

With total altcoin market capitalization contracting from 2025 highs, the focus has shifted from "HODLing" to identifying structural failures at proven resistance zones.

The Anatomy of a Failed Breakout

Data across mid-cap assets reveals a recurring pattern of "erratic" weekend volatility followed by an immediate stall.

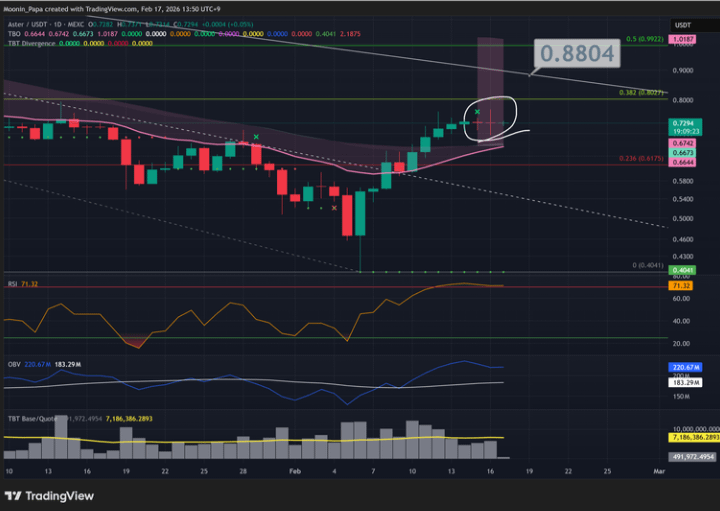

The Cloud Resistance Barrier: Charts such as ASTER and SKY have struggled to penetrate the Ichimoku Cloud on daily timeframes. These rallies often lack the necessary volume to flip resistance into support.

Bearish Divergence: Persistent bearish RSI divergences reinforce the risk of these moves being "bull traps." While prices hit local highs, the underlying momentum is actively fading.

Liquidity Hunting: These weekend spikes are often mechanical, designed to hunt liquidity and liquidate short positions before a deeper correction toward the "2026 Maturity Wall" drain.

Tactical Short Opportunities: The Overbought Watchlist

For disciplined traders, these failed relief rallies offer high-reward-to-risk entries at proven resistance:

Asset Technical Signal Tactical Play

PYTH / PIPPIN Overbought RSI + Liquidity Grab Short entry on reclaim of local resistance

ATOM Mixed TBO signals / Failed Cloud Break Fade the rally if volume continues to decline

ASTER / SKY Stalling at Cloud Resistance Re-short if daily candle closes below the 20-EMA

Risk Management in an "Extreme Fear" Market

The Fear and Greed Index remains stuck at 8/100 (Extreme Fear). In this environment, any altcoin rally that is not supported by increasing volume should be treated with extreme skepticism.

Watch Bitcoin Dominance: As long as $BTC BTC dominance remains near 59%, altcoins will continue to bleed on the "down-legs" while underperforming on the "up-legs".

Capital Preservation: With over $520 million in liquidations recently recorded across the network, preserving capital for the eventual cycle bottom is more productive than chasing weekend volatility.

Conclusion

The 2026 altcoin market is currently a "trader's market," not an "investor's market." Until we see a structural shift in global liquidity, expect more erratic short squeezes that ultimately fail at the first sign of institutional resistance.

Community Engagement:

Are you using these weekend pumps to exit underwater altcoin positions, or are you aggressively shorting the "fake-outs" at cloud resistance? Tell us your target for the next capitulation leg. 📉

#Altcoins #tradingtips #TechnicalAnalysis #BinanceSquare #TradingTips