Bitcoin analysis 📊: Can it remain steady above $112,000, and is cautious bullishness sustainable?

Recently, the Bitcoin (\u003ct-66/\u003e) market has remained relatively stable, but on-chain data and technical indicators show that investors still need to be cautious 📈. Below, we analyze the current situation of BTC from four perspectives: miner supply and demand, trend lines, on-chain indicators, and the futures market.

Miner balances are stable, supporting a bullish structure ⛏️

The balance of Bitcoin miners currently maintains at 60%, down about 6% from the historical high, indicating that demand is still greater than the issuance, but the gap has narrowed 💡. The stability of miner balances suggests that the market still has enough strength to absorb potential selling pressure, but signs of decline remind investors to pay attention to risks ⚠️.

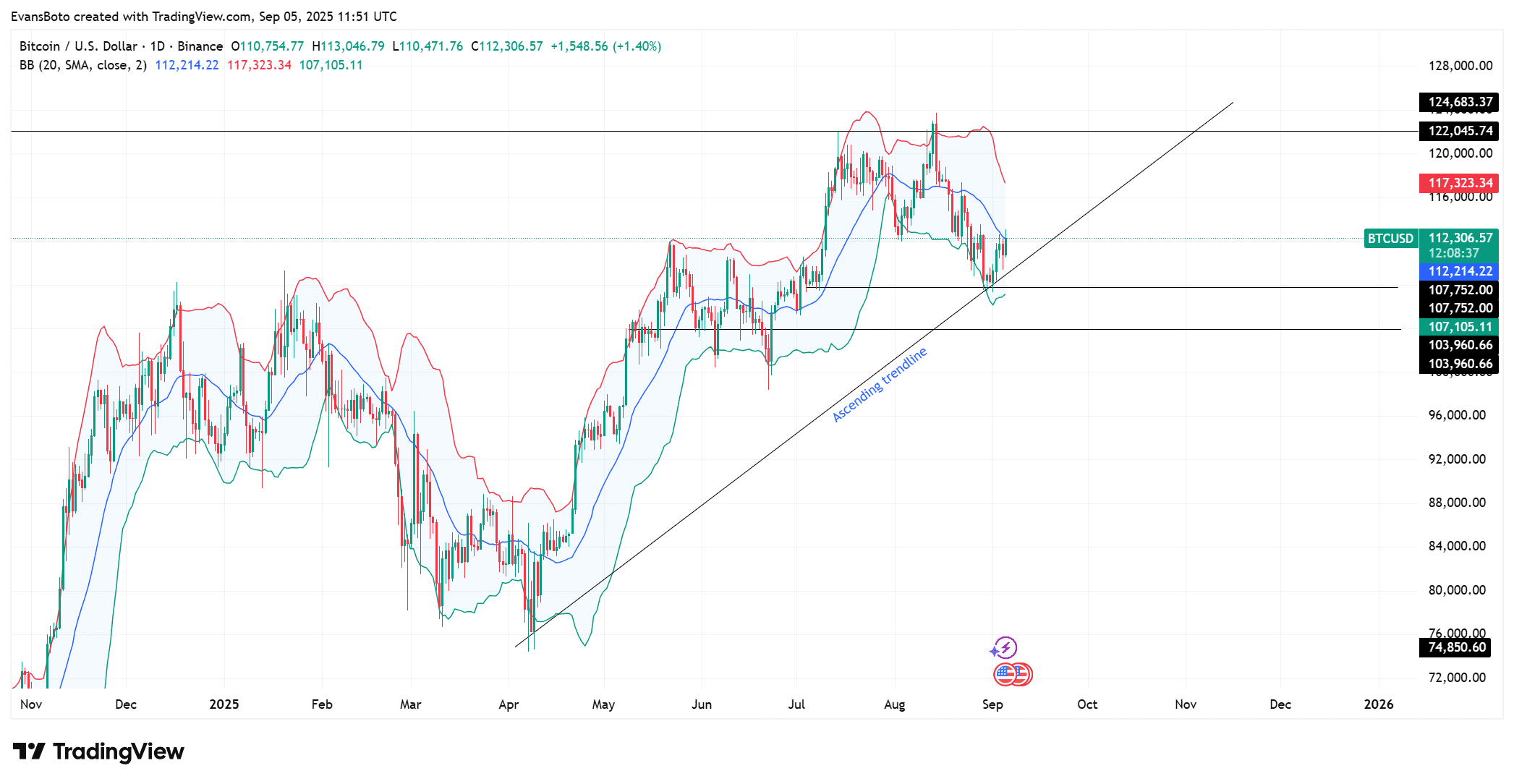

In terms of price, BTC's current trading price is around $112,306, still above the trend line, providing key support for a bullish structure📌. The rebound near $107,000 has validated the defensive capability of this level. In other words, as long as the trend line holds, Bitcoin still has the potential to continue rising.\u003ct-88/\u003e

The trend line support is apparent, and prices are recovering healthily💪

The upward trend line for Bitcoin has consistently supported price movements, with the current price rebounding to $112,000 and remaining within the Bollinger Bands, indicating that BTC is undergoing a healthy recovery📈. Short-term resistance levels are at $117,000, $122,000, and $124,000; if successfully broken, these areas may become targets for the next upward wave🎯.

However, if it falls below the support of $107,000, the price may quickly retreat to $104,000, triggering greater selling pressure. Therefore, the trend line remains key to maintaining a bullish momentum.

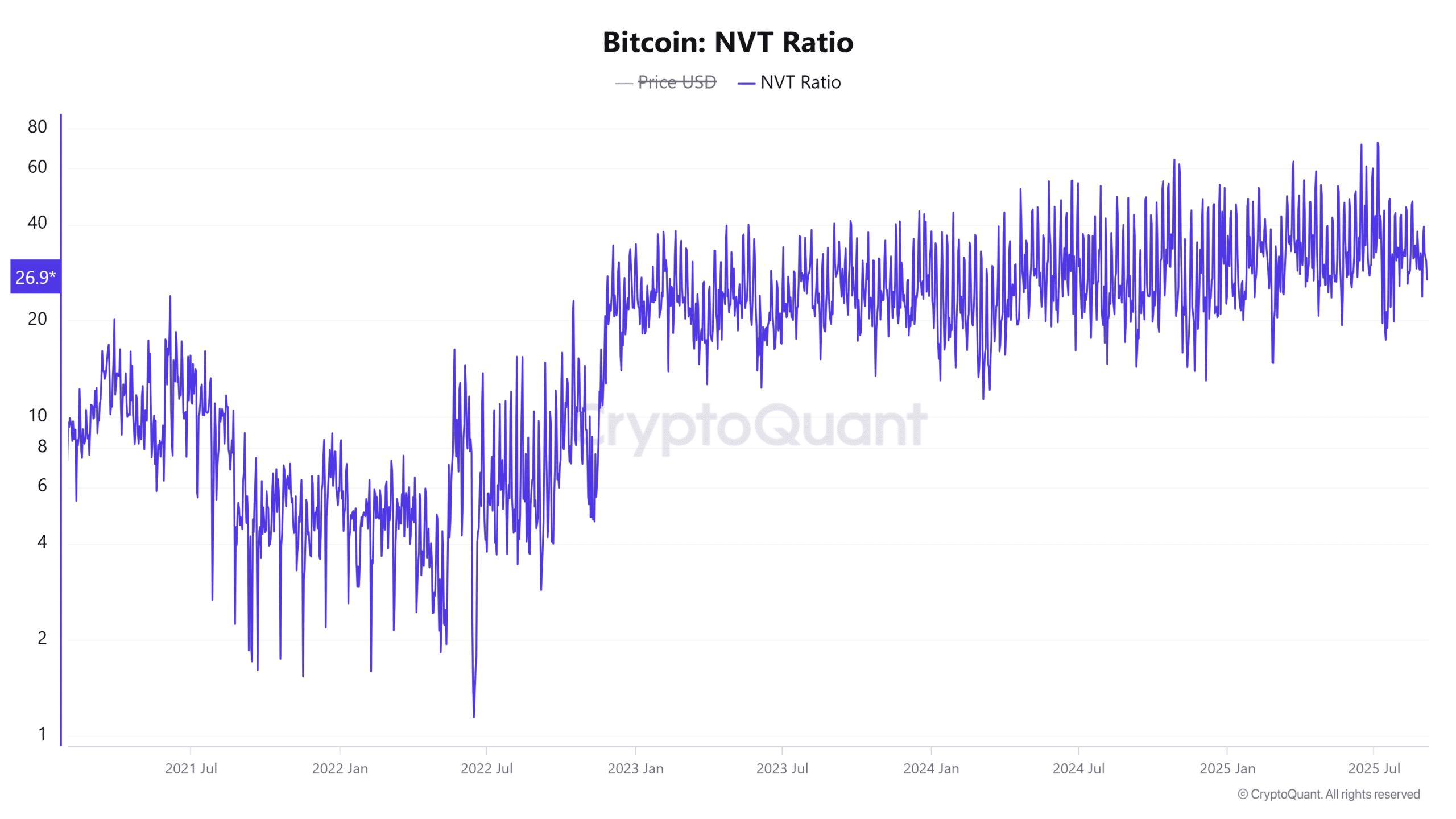

The NVT ratio has declined, and on-chain activity is healthier🌐

The network value to transactions (\u003ct-53/\u003e) ratio has recently decreased by 12.26% to 26.90, indicating that on-chain trading activity is more active relative to market capitalization💥. In other words, the actual utility value of the Bitcoin network is strengthening, and the market's fundamentals are becoming more solid.

The decline in the NVT ratio has also reduced the risk of BTC being overvalued, while providing a more positive signal for future market direction👍. Although miner demand appears slightly weak, the increase in on-chain activity helps balance market sentiment and bolster investor confidence.

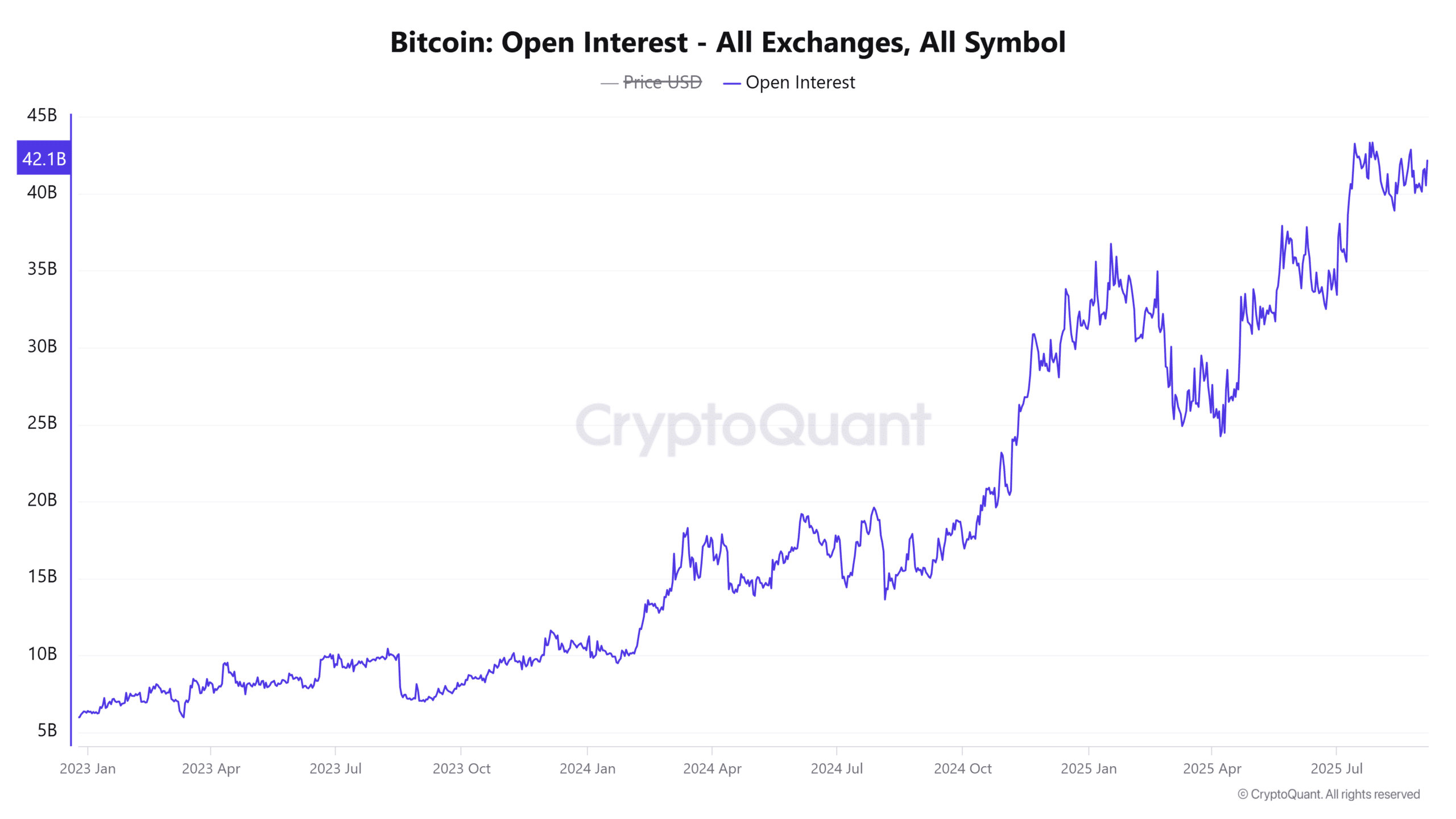

Open interest expansion may exacerbate volatility📊

BTC's open interest has risen to $42.15 billion, up by 2.66%, indicating a recovery in the activity of the derivatives market🦈. High positions mean that the market is interested in both long and short positions, and also suggest that volatility may increase.

If the price breaks through key support or resistance levels, high positions may amplify price volatility📉📈. While this indicates that market participants are confident, a sudden reversal in market sentiment could trigger a chain liquidation risk⚠️. Therefore, short-term stability still relies on trend line support.

BTC Outlook: Cautiously bullish, but risks remain💡

Overall, Bitcoin is still in a cautiously bullish range:

Miner balances are stable at 60%, and supply-demand balance is acceptable;

The trend line provides strong support for prices;

The NVT ratio has declined, and on-chain activity has increased;

Open interest has increased, indicating strong interest in the derivatives market.

These factors indicate that the BTC market has a certain resilience📈, and it may continue to maintain an upward momentum in the short term. However, investors should be aware that if the trend line support is breached or miner demand further weakens, risks still exist⚠️.

💡 Reminder: This article is for informational reference only and does not constitute investment advice. The cryptocurrency market is highly volatile, please invest rationally and pay attention to risk control🦺.