Despite weeks of persistent selling pressure, Bitcoin’s longer term holders are quietly doing what they’ve historically done best — absorbing supply.

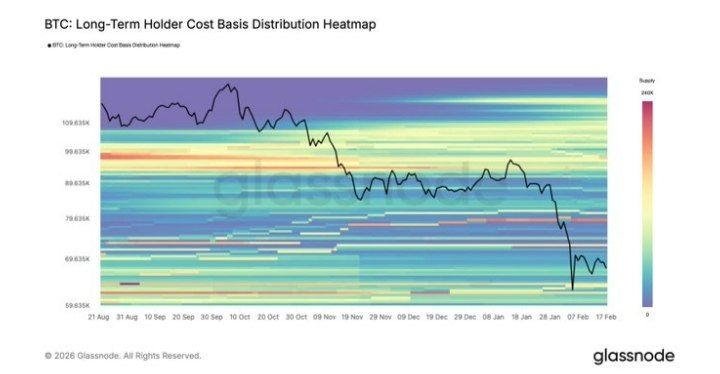

Fresh research from Glassnode suggests the market isn’t breaking down as easily as price action might imply. While BTC continues to stall below the $70,000 level and sits far beneath its late-2025 highs, a strong base of early 2024 buyers appears to be acting as a structural support zone rather than a source of panic selling.

According to the data, the $60,000–$69,000 range has evolved into a dense demand cluster. This is where a large share of investors accumulated during the prolonged consolidation phase in the first half of 2024. More importantly, those coins have barely moved.

That matters.

When markets revisit holders’ cost basis, fear usually kicks in. Break-even levels often trigger capitulation. But this time, that hasn’t happened. Instead of exiting positions, this cohort is holding firm, effectively soaking up supply from newer or weaker hands.

The result isn’t a sharp recovery but it’s also not a collapse.

Rather than cascading lower, price has shifted into sideways compression. The market is transitioning from impulsive declines to range-bound absorption, suggesting underlying demand is still present even if momentum is weak.

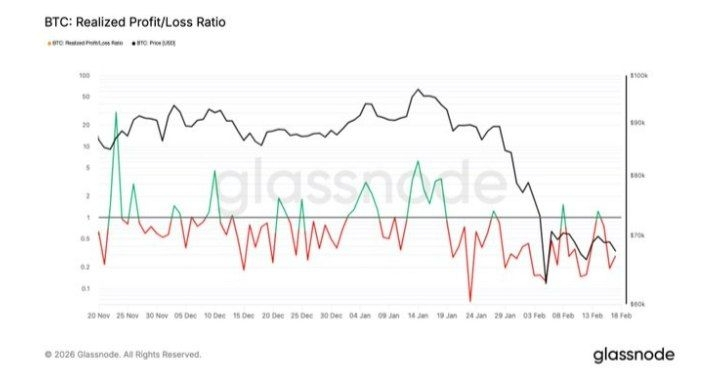

Still, caution dominates the short term outlook.

Many traders expect one more macro flush before any sustainable recovery begins. Sentiment remains fragile, with targets around $50,000–$53,000 widely discussed as a potential final sweep to reset indicators like RSI and MACD and shake out late longs.

In other words, the foundation looks sturdier than the chart suggests, but volatility isn’t over.

Long-term holders are building the floor.

Short-term traders are still betting on one more dip.

Whichever side breaks first will likely define Bitcoin’s next major move.