📌 Key Points

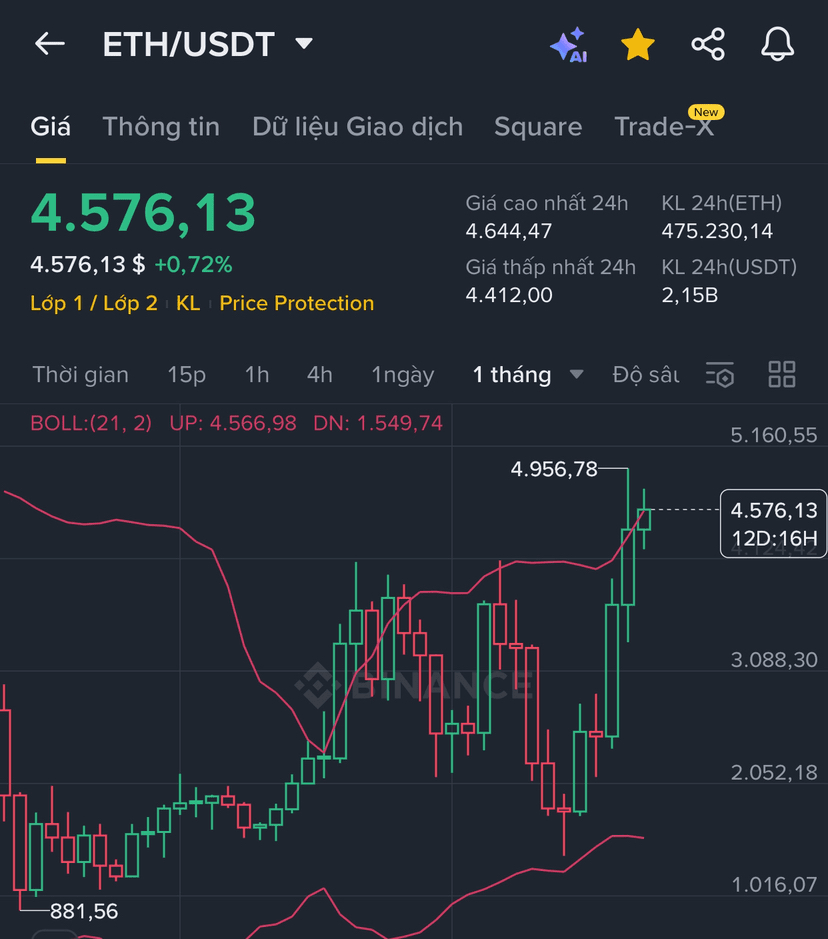

The US stock market recovery is improving global risk sentiment, creating a positive environment for ETH (4577.47 USDT) and digital assets.

The bullish momentum of ETH is supported by inflows from whales and expectations of Fed rate cuts.

BTC continues to lead the overall trend, while SOL, PEPE, SUI, XRP, DOGE, ADA are attracting attention as potential altcoins for portfolio diversification.

🎯 Opportunity

Market information (📈 Positive)

Whale cash flow: Internal transfer of 23,657 ETH ~ 109.7 million USD, plus withdrawal of 15,200 ETH from the exchange, indicating increased long-term holding confidence.

Macro news: Expectations for the Fed to cut interest rates, recovery of US stocks, attracting more capital into risky assets, including ETH and BTC.

Technology application: ETH is developing quantum-resistant technology, increasing long-term value.

Technical (📈 Positive)

Price trend: 4H MACD has just crossed up, KDJ is rising strongly, signaling that the upward momentum may continue.

Market sentiment: The long/short ratio remains high (>3 times leaning towards buyers), positive funding rate, signaling an advantage for longs.

Capital flow: Net inflow of over 14.4 million USD on 17/09 after a series of days of tightened liquidity.

🚨 Risk (🤔 Average)

Volatility due to the Fed's actual interest rate news if different from expectations.

Strong resistance around 4600–4650 USDT may cause profit-taking pressure.

Altcoins like SOL, PEPE, SUI are likely to be more volatile than ETH in fluctuating market conditions.

⚡ Action (📈 Uptrend)

Trading: ETH/USDT – 4577.47 USDT

Short-term strategy (📈 Buy on dips)

Entry: 4530 – 4580 USDT

Stop loss:

4480 USDT (30% volume)

4420 USDT (70% volume)

Take profit:

4650 USDT (30%)

4720 USDT (40%)

4800 USDT (30%)

Medium to long-term strategy (📈 Buy on dips)

Entry: 4450 – 4550 USDT

Stop loss:

4380 USDT (40%)

4250 USDT (60%)

Take profit:

4900 USDT (30%)

5200 USDT (40%)

5500 USDT (30%)

Combined strategy

Hold ETH as the main axis, combine with BTC to stabilize the portfolio.

Take advantage of volatility to trade quickly with SOL and SUI.

Allocate a small portion of capital to PEPE, XRP, DOGE, ADA to seek high yields but accept higher risks.

📚 Summary

The recovery of US stocks is acting as a doping agent for ETH and the crypto market, especially as the Fed may loosen policy — this is the time to "ride the wave" instead of just watching from the shore.