The price of Dogecoin is forming a bullish flag pattern with a breakout target of $0.41, an increase of 46%.

Whale holdings increased by 700 million DOGE (196 million dollars) in just 24 hours, indicating strong demand.

Both short-term traders and long-term holders have expanded their supply positions, showing conviction in rising prices.

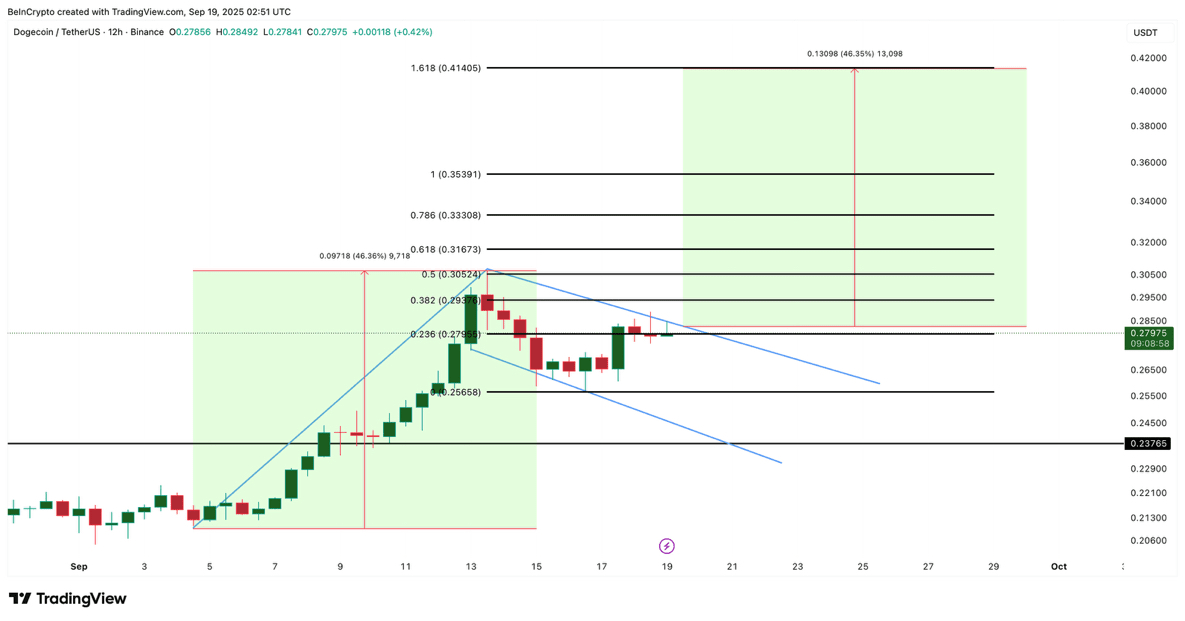

Dogecoin price breakout signals are forming, but the movement has not yet occurred. At the time of publication, Dogecoin is trading steadily above $0.27. On the 12-hour chart, the coin is forming a very bullish breakout pattern that targets up to $0.41, a 46% increase from current levels.

However, the movement takes longer to reach due to weak reactions to market events and calm before the next price rise. Read on to find out why the next rise may just be a delay and not a denial.

Whales and major groups of coin holders are adding to their positions

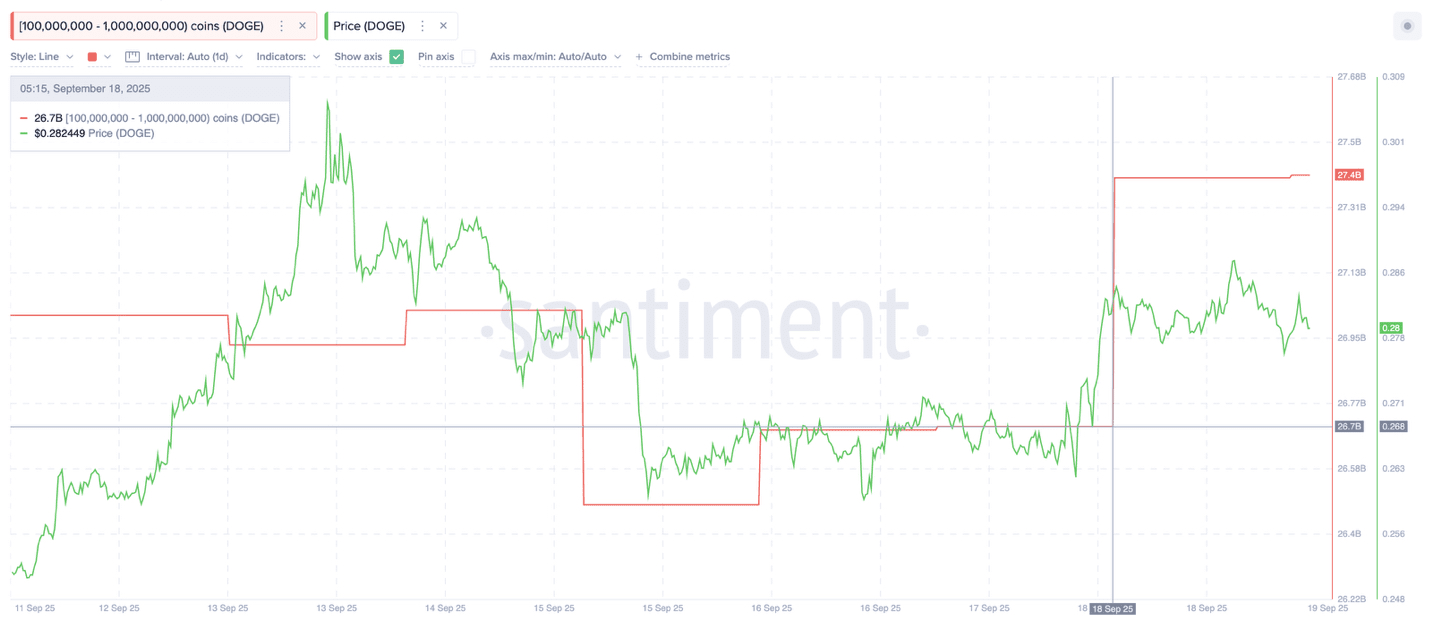

Large holders have increased their activity since the hype around interest rate cuts by the Fed and the Dogecoin ETF launch at CBOE (Chicago Board Options Exchange) has calmed down. The group holding 100 million to 1 billion DOGE increased their balances from 26.7 billion on September 17 to 27.4 billion on September 18.

This is an accumulation of 700 million DOGE (approximately $196 million) over 24 hours.

Accumulation of Dogecoin whales: Santiment

This is a significant increase in just one day, showing that large holders are betting on higher prices.

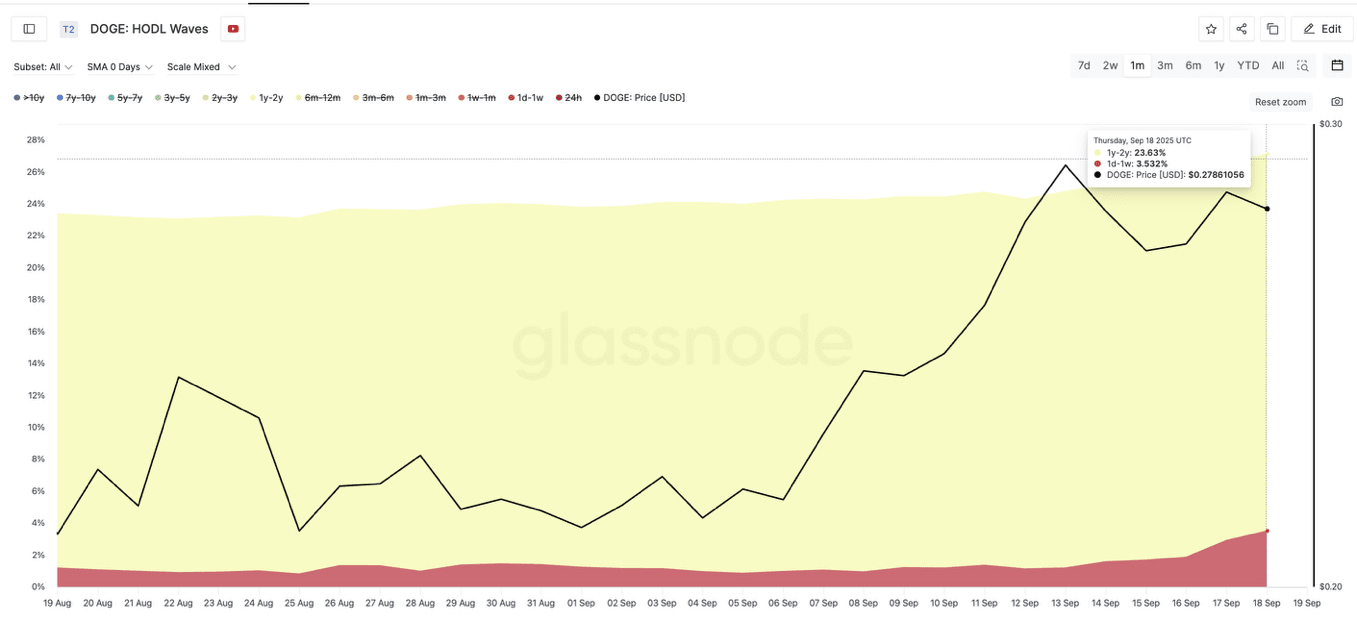

HODL Waves, which track supply by holding time, also reveal conviction from two extreme holding groups. Very short-term holders (1 day to 1 week) increased their share from 0.84% on August 25 to 3.53% by September 18, likely chasing the ETF hype.

At the same time, the 1-2 year group, long-term holders who are already in profit after an annual increase of 166.5%, increased their share from 22.19% in mid-August to 23.63% now.

Contrasting groups in holding work: Glassnode

This unusual overlap shows that both fast traders and long-term holders are adding at the same time, creating a stronger case that sentiment is improving beneath the surface. However, in most cases, whale and holder actions take time to reflect in the price.

This could be one of the reasons adding to the delay in the Dogecoin price breakout.

The Dogecoin price chart illustrates why a 46% rise is approaching.

Even with support from whales and holders, the Dogecoin price could not break through the key resistance at $0.29. This move defines the upper limit of the flag. Until a daily close is above it, the breakout setup remains on hold.

The failure of the ETF listing at CBOE also did not stimulate a new influx of demand immediately. Instead, Dogecoin traded sideways, showing that the hype was pre-calculated. This pause is part of the delay.

However, the bullish flag pattern remains valid. If the Dogecoin price closes above $0.29, the measured move points towards $0.41. Fibonacci levels at $0.31 and $0.33 are intermediate hurdles to overcome along the way.

Dogecoin Price Analysis: TradingView

Support is at $0.25, and a drop below that would negate the bullish structure, at least for now.

In short, the setup is delayed but not rejected. With whales adding billions of DOGE, short-term traders entering, and long-term holders refusing to sell, the breakout scenario remains alive, despite the delay.

If momentum picks up again, the Dogecoin price still has room to rise by 46% towards $0.41.

#DOGE #BinanceSquareFamily #BinanceSquare #Write2Earn #BinanceDoge