📌 Key factors helping SOL maintain a stable upward trend

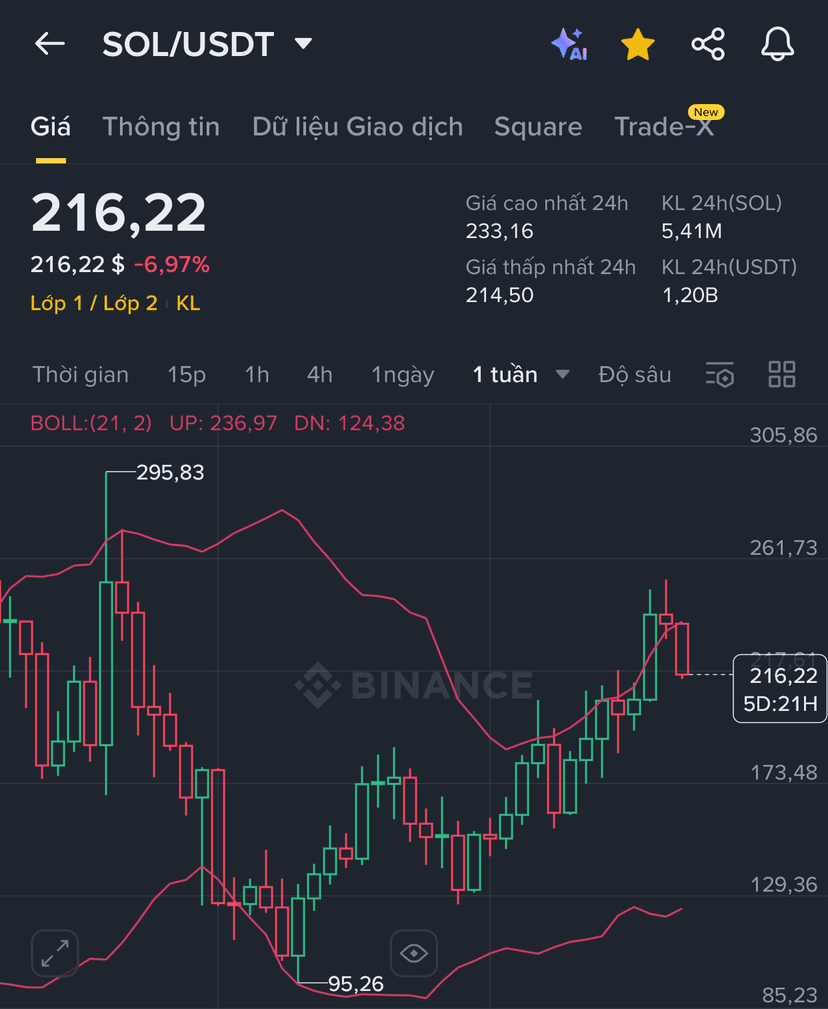

Strong technical support: The current price of SOL is at 216.21 USDT, holding above the important support area around 215 USDT, frequently bouncing back from the MA20 and MA50 lines on the daily and weekly frames.

Stable long-term capital flow: Despite profit-taking pressure, the Long/Short ratio of regular accounts and elite accounts is above 3.8, reflecting confidence in the upward trend.

Industry news and partnerships: Solana is expanding its DeFi ecosystem and participating in the AI network, information from Helius and Korean organizations is boosting demand.

🎯 Opportunity

News (Benefits 📈)

Ecosystem expansion: DeFi on Solana currently offers an annual yield of 8%, combined with AI to enhance applications and attract capital flow.

Institutional signal: Helius is buying SOL at an average price of 231 USDT, reflecting long-term confidence.

International market: Demand from South Korea, combined with the ability to trade FORD stocks on-chain, increases long-term liquidity.

Technical (Benefits 📈)

High Long ratio: Individual and elite players both hold a dominant Long (Long/Short ~ 3.9–4.02), indicating sustainable sentiment.

MACD and KDJ support the upward momentum: The weekly frame maintains positive MACD, KDJ in a high zone but not overbought, creating a foundation for a new increase.

Active buying capital flow: Bid prices have exceeded ask prices in multiple sessions, demonstrating strong demand.

🚨 Risk (Medium 🤔)

Short-term volatility: Large liquidation volume over a short period indicates potential strong fluctuations.

Short-term capital withdrawal: The last 3 days have recorded net capital withdrawal on the SOL chain, which may cause pressure in the short term.

Technical barrier: Resistance around 235 USDT needs to be broken to expand upward potential.

⚡ Action (See increase 📈)

Trading pair and current price

SOL/USDT – 216.21 USDT

Short-term strategy (Buy 📈)

Entry: 214–217 USDT (40% capital)

Stop loss: 210 USDT

Take profit: 228 USDT (50% capital), 235 USDT (50% remaining)

Medium and long-term strategy (Buy 📈)

Entry: 212–216 USDT (60% capital)

Stop loss: 205 USDT

Take profit: 245 USDT (50% capital), 260 USDT (50% remaining)

Strategy combined with other hot coins

Hold SOL as the main asset; can allocate part to BTC and ETH for diversification, add PEPE and SUI for short-term speculative opportunities; XRP, DOGE, and ADA serve as medium-term strategies, especially when the altcoin market attracts new capital.

📚 Conclusion

SOL is supported by a strong technical foundation and long-term trust from institutions, combined with positive market sentiment – if it holds 215 USDT, the possibility of breaking through 235 USDT is clear… This is the time to 'hold the wheel tight' and let the Solana rocket burn out its growth fuel!

\u003ct-159/\u003e