📊 Overview

Solana (SOL) is currently at 210.44 USDT, with many technical signals and recent capital flows indicating a trend supporting long-term investment, but there are also some risks to consider. The question of whether SOL is the best choice for long-term investment will depend on the growth momentum of the ecosystem, market signals, and capital allocation strategy compared to other popular coins like BTC and ETH.

🔍 Detailed analysis

1. Fundamentals & Ecosystem

Expansion cooperation: Recent news shows that the Solana Foundation and HSDT are collaborating to enhance on-chain profits, expanding the DeFi service ecosystem. This helps SOL strengthen its competitive position in the long run.

Single chain concentration risk: While strategic cooperation increases potential, the single-chain blockchain structure still has risks if SOL encounters technical issues or network congestion.

Relation to BTC/ETH: While BTC focuses on value storage and ETH leads the smart contract space, SOL is expanding rapidly, creating an advantage in the DeFi and NFT markets. A diversified allocation can help reduce systemic risk.

2. Technical data

Price trend: The weekly frame shows the KDJ indicator at a high level, with MACD strongly positive, indicating that the long-term upward trend remains positive.

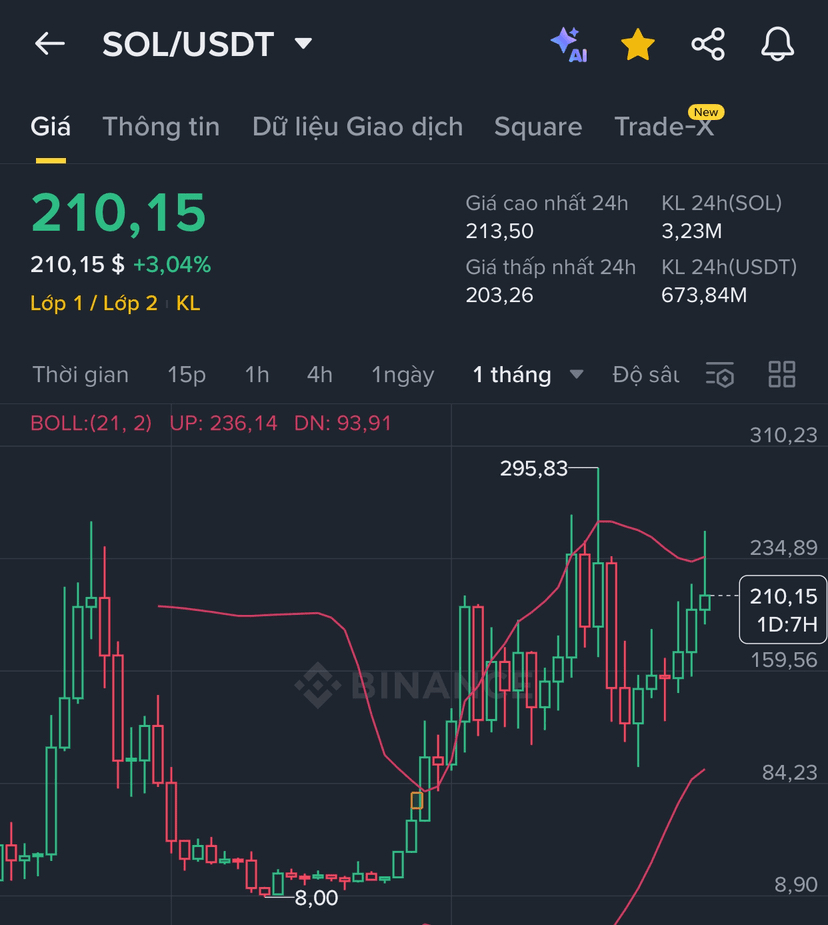

Support and resistance: The daily BOLL sets the mid-region around 226 USDT, but the price is currently below this area, with potential for a rebound if it exceeds 210–213 USDT in the short term.

Market momentum: The Long/Short ratio of around 4.3–4.55 indicates that the buyers are clearly in the lead, similar to the trends of BTC and ETH as the market expects an upward trend.

3. Capital flow & Investor sentiment

Net inflow: In the last 2 days, there has been a significant influx of funds (27/9: +40.5M USDT), which then slightly decreased, reflecting short-term profit-taking sentiment but still maintaining buying pressure.

Contract trading: The funding rate at -0.000074 indicates that those opening Short positions are paying fees, reflecting not strong downward pressure, consistent with bullish expectations.

Relation to BTC/ETH: As the market with inflows into BTC and ETH remains positive, SOL benefits from the overall sentiment and is ready to receive additional funds when there is a technical breakout.

🎯 Conclusion

SOL has a good fundamental foundation, expanding cooperation, and technical momentum supporting the long-term upward trend. However, attention should be paid to risks from the single-chain structure and short-term capital flow volatility. With the current price at 210.44 USDT, SOL may be a top choice for a long-term portfolio, especially when reasonably allocated with BTC and ETH to optimize profits and minimize systemic risk.

In conclusion: If the goal is long-term capital growth, SOL is in a strong position to become a pillar in the strategy, especially when combined with other leading market coins to balance potential and safety.