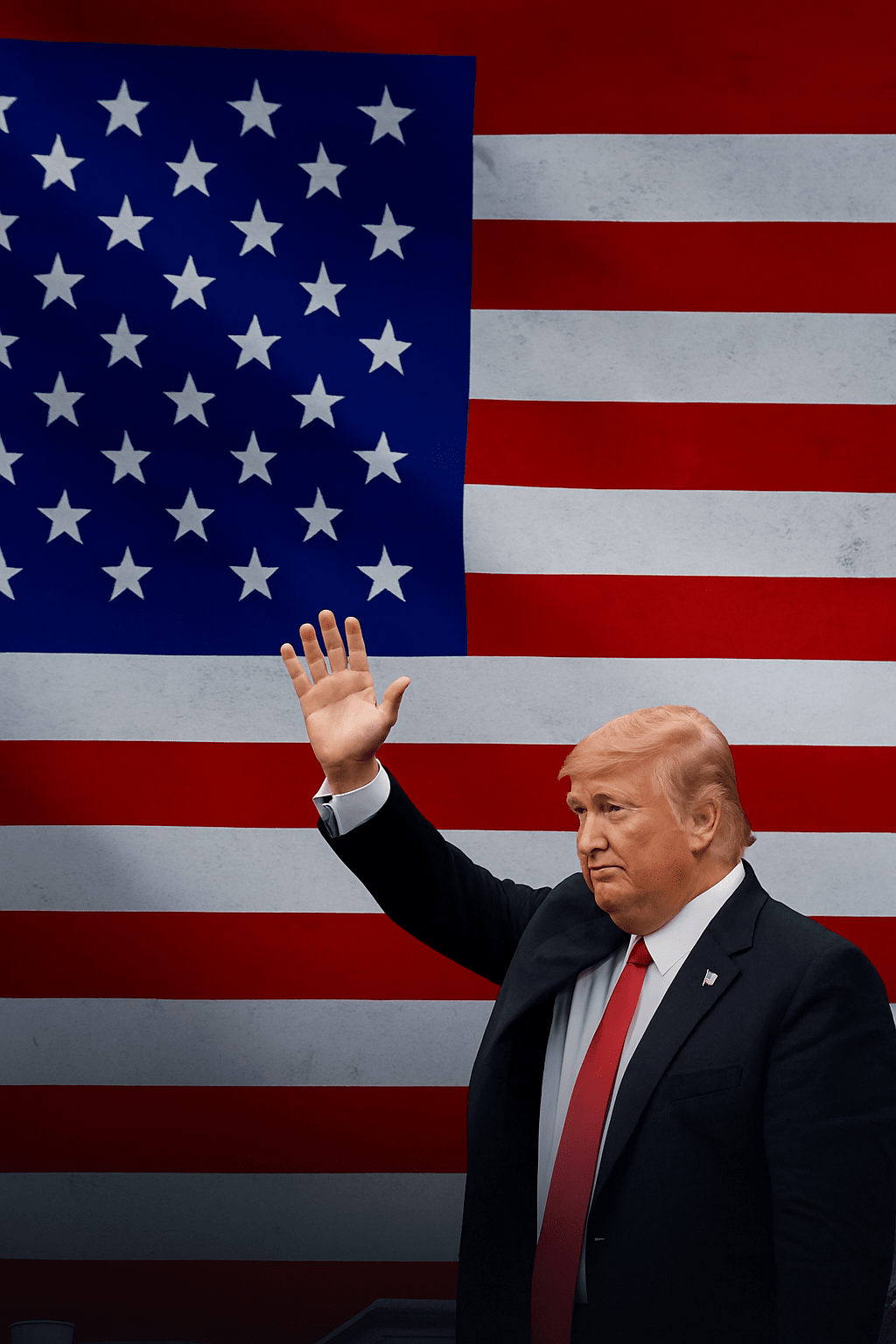

The international economic scenario has just gained a new explosive ingredient: U.S. President Donald Trump has revealed a bold plan to confront the growing American debt — and it involves tariffs on imports. Yes, tariffs are back in the spotlight! 🎭📦

📢 What is being proposed?

Trump wants to use tariffs as a tool for:

- Reduce the U.S. trade deficit

- Stimulate domestic production

- Generate revenue to reduce the national debt

💬 It seems simple, but experts warn: this strategy could provoke global trade tensions, retaliation from partners, and volatility in the markets. And the first signs are already appearing…

📉 The token $TRUMPUSDT dropped -26.98%, reflecting investors' nerves over the possibility of a new trade war. Commodities, USD pairs, and global stocks are feeling the impact — and the market is on high alert. ⚠️📊

🔍 What analysts are observing:

- Direct impact on global inflation

- Reactions from exporting countries like China, Brazil, and Europe

- Possible slowdown in global growth

- Cascading effects on the crypto sector and digital assets

💡 And you, investor, how should you prepare?

👉 Diversify your portfolio intelligently

👉 Follow the most sensitive currency pairs and commodities

👉 Keep an eye on defensive assets and opportunities amid volatility

👉 Assess the impact of fees on the crypto ecosystem — especially on tokens linked to public policies and governance

📣 LIVE session coming soon here on Binance Square and YouTube!

Let's analyze the developments, understand the risks, and outline strategies to navigate this new cycle of uncertainties.

📌 Follow the profile and activate notifications so you don't miss out!

#TrumpTariffs #TradeWar #DebtCrisis #BinanceSquare #CryptoGeopolitics #GlobalVolatility #TRUMPUSDT #FinancialMarket #BinanceBR #CryptoForAll #MarketAnalysis #GlobalInflation #Commodities #SmartInvestment 💬📈🔥 #Binance #PedroNaSquare #PedroCantor