October 2025 brought mixed feelings in the cryptocurrency market. While Bitcoin and most altcoins struggle with selling pressure, BNB, the native token of the Binance ecosystem, has stood out positively, recording gains during a period that has historically favored cryptocurrencies. What is behind this result, and can the largest exchange token continue its streak?

Uptober – is it a reality?

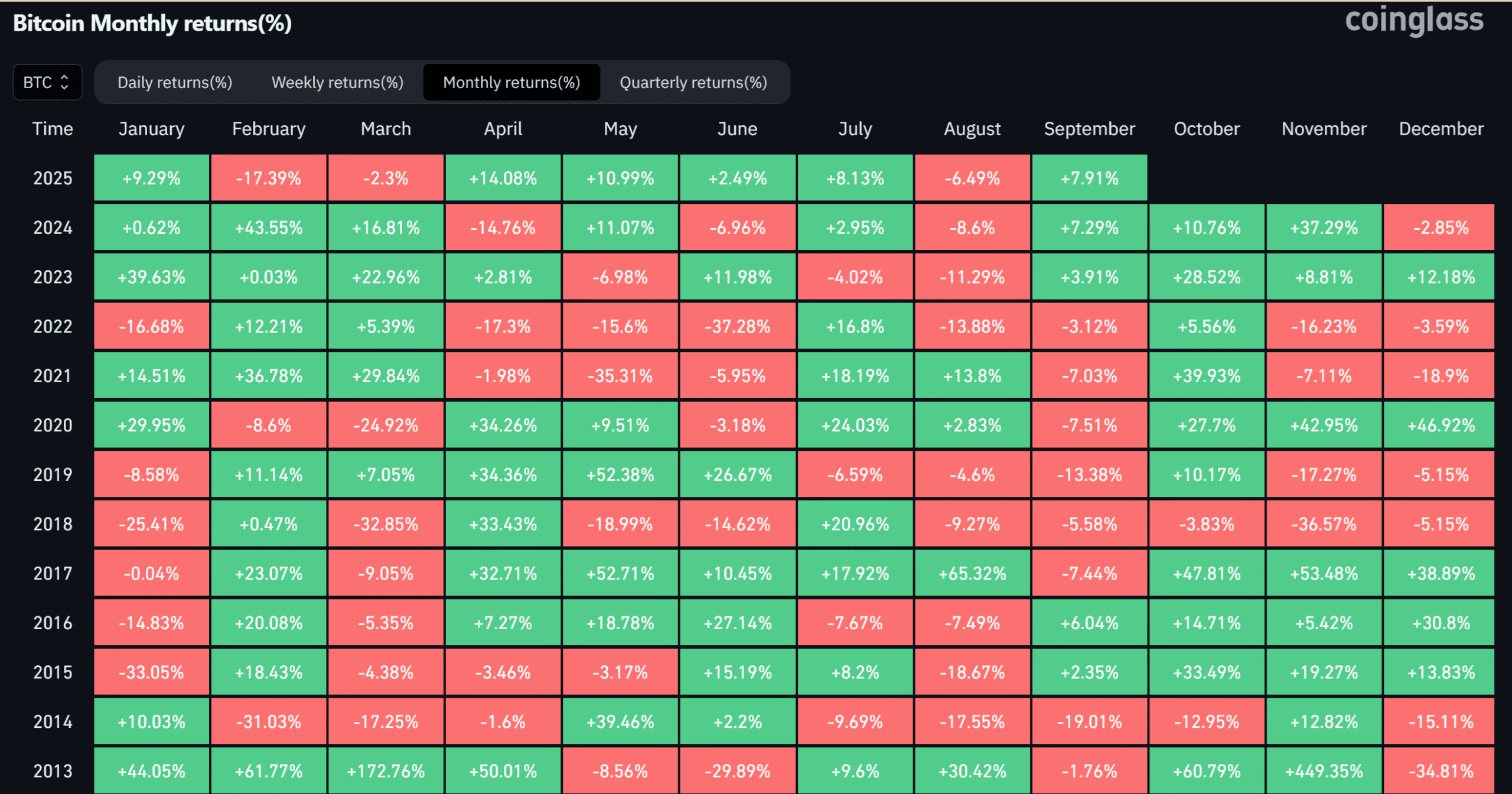

October has unofficially been dubbed 'Uptober' in the cryptocurrency community due to Bitcoin's historical tendency to rise during this month. Analysis of the last decade shows that BTC indeed recorded positive results in most Octobers, except for a few years. Average monthly gains hovered around 20-30 percent during the most successful periods, often driven by increased institutional interest and pre-halving optimism.

In 2024, October brought moderate gains for Bitcoin, supported by speculation about the further development of the ETF market and easing monetary policy by the Fed. The year 2025 was expected to continue this trend, especially in the context of the upcoming effects of the halving in April 2024, which historically materialize with a delay of several months.

October 2025 – different from previous ones

This October has proven to be a challenge for most cryptocurrencies. Bitcoin has lost about 14.5 percent in value so far, while Ethereum has recorded even greater declines. The primary causes were the rising yields of U.S. Treasury bonds, the strengthening dollar, and geopolitical uncertainty related to tensions in the Middle East. Additionally, concerns about weakening global economic growth and signals of a possible slowdown in China have emerged.

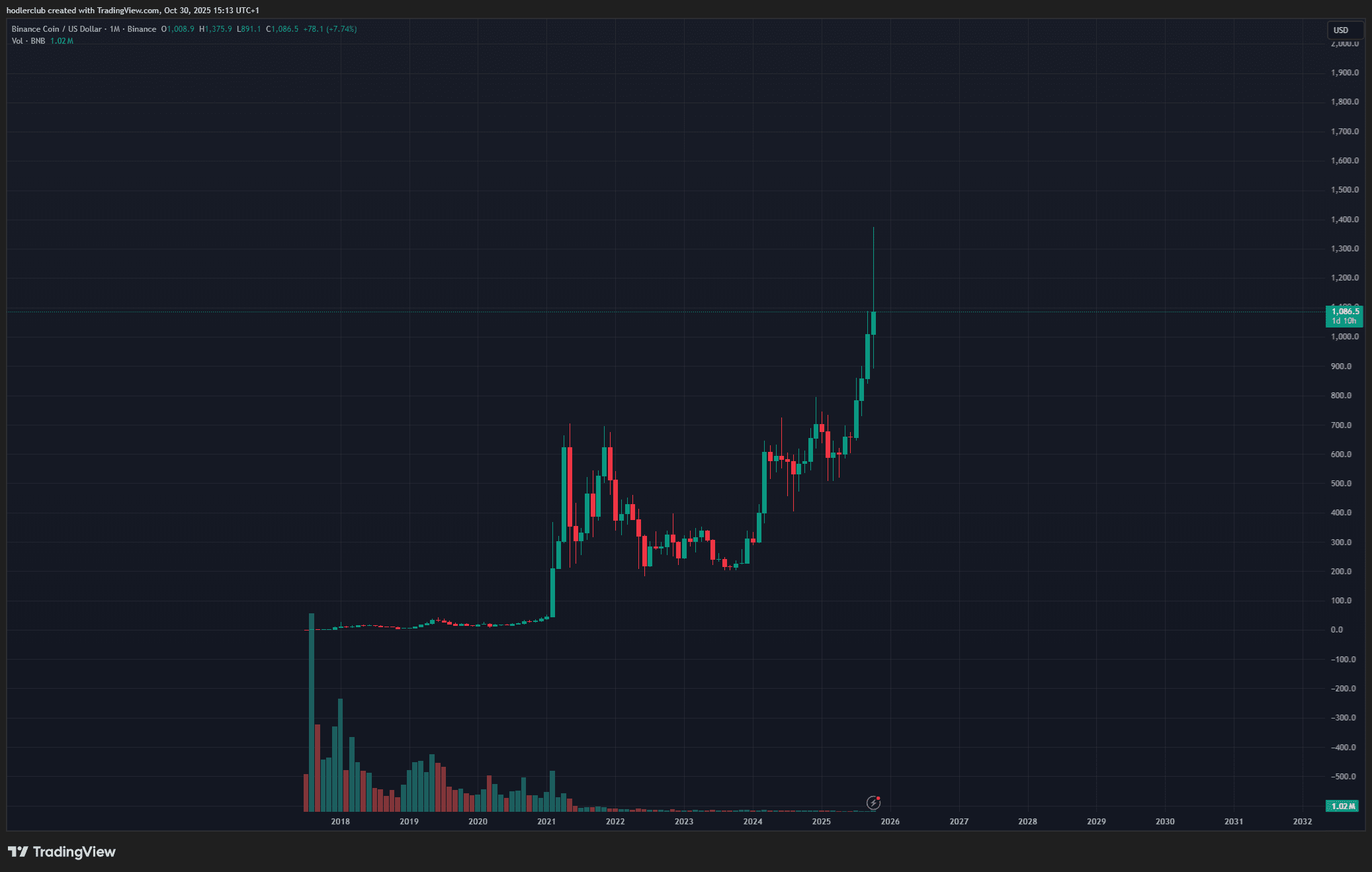

In this context, the behavior of BNB has been surprising. The token Binance Coin gained about 59.88 percent over the entire month (low-high), repeatedly reaching new ATH levels. This resilience against the broader market trend has caught the attention of analysts and investors.

What drives BNB?

Several factors may explain the strength of BNB in a difficult market environment. Firstly, the Binance Smart Chain ecosystem has seen a significant increase in activity in the DeFi and NFT segments. New projects choose BSC due to low transaction costs and high throughput, leading to increasing demand for BNB as network fuel.

Secondly, the token burn mechanism introduced by Binance systematically reduces the supply of BNB. The latest quarterly burn involved over 1.6 million tokens worth more than 380 million USD, making it one of the largest deflationary measures in the history of the project. With the simultaneous increase in the token's utility, the decreasing supply creates favorable price dynamics.

Thirdly, Binance continues its regulatory expansion, obtaining additional licenses in key jurisdictions. Recent approvals in Dubai and Kazakhstan have strengthened the exchange's position as a global player adhering to legal requirements. This builds trust among institutions that are increasingly willing to consider capital allocation in the Binance ecosystem.

Outlook and risks

The question about the further trajectory of BNB remains open. The bullish scenario assumes that the token can continue its independence from the broader market, especially if activity in the BSC ecosystem increases. Some analysts see growth potential up to 1500 USD in the coming months, assuming an improvement in macroeconomic sentiment and further product development by Binance.

The bearish scenario, however, indicates risks. The main threat is a potential deeper correction of Bitcoin, which historically has pulled down the entire altcoin market, regardless of the fundamentals of individual projects. If BTC falls below key support levels, BNB may lose its edge. Additionally, increasing regulatory pressure on centralized exchanges in Europe may negatively affect the perception of exchange tokens as an investment category.

Summary - what next for the cryptocurrency market?

BNB shows that even in a challenging market environment, increases are possible if the project's fundamentals are solid. The growing adoption of BSC, deflationary mechanisms, and regulatory expansion of Binance create favorable conditions for the native token. At the same time, investors should keep in mind the broader market context and possible correction scenarios.

October 2025 may not be a classic "Uptober" for the entire cryptocurrency market, but for BNB, it has proven to be a period of strengthening its position. Whether this marks the beginning of a longer bullish trend or merely a short-term rebound will be shown by the near future and the market's reaction to upcoming macroeconomic events and the development of this blockchain ecosystem.

This article does not constitute investment advice. It was created in collaboration with the cryptocurrency exchange Binance.