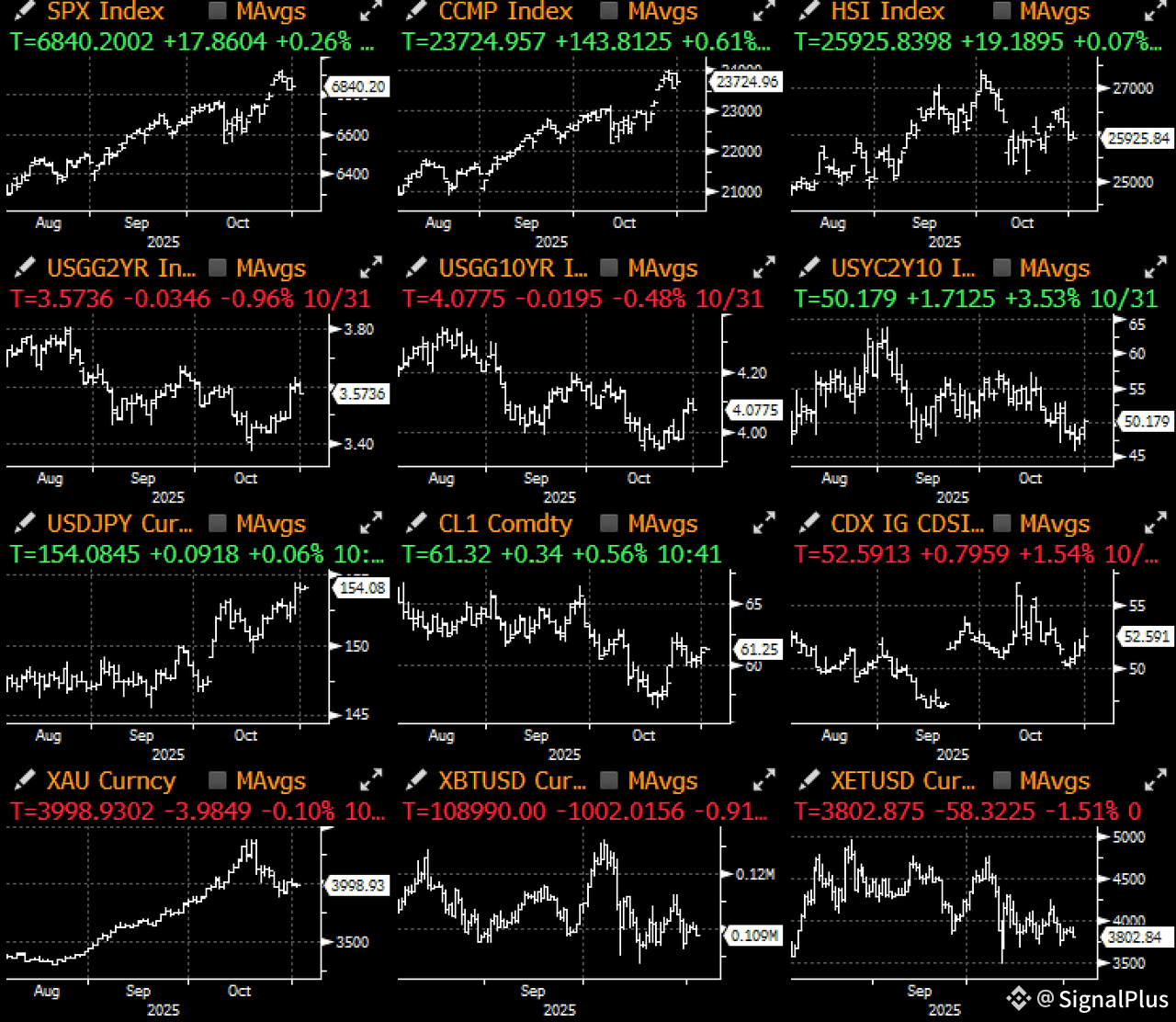

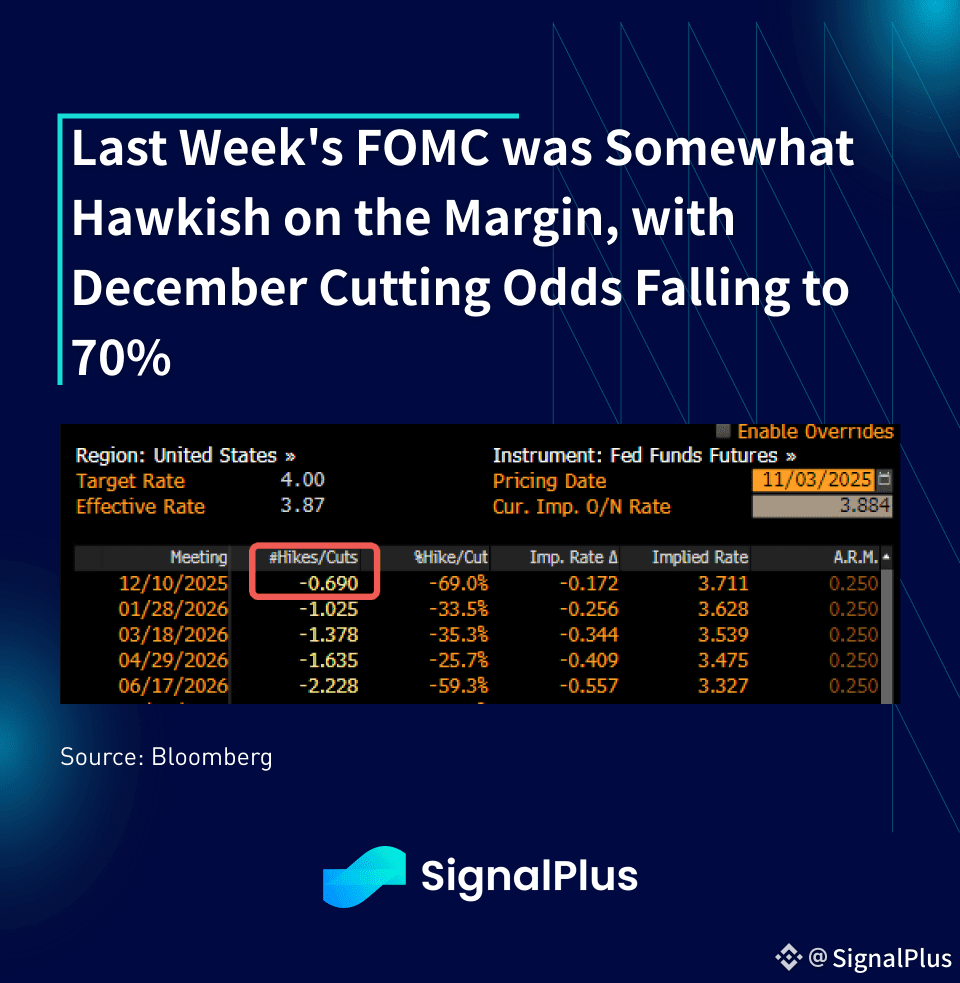

With the US govt still under lockdown, last week’s main event was with the FOMC, where they disappointed market doves as Powell pushed back against the fully priced December cut as being “far from” a “foregone conclusion”. Despite the 25bp rate cut, Powell indicated that there are “strongly differing views” amongst the committee, with roughly half the committee supporting the cumulative 75bp cut in Q4, and the other half dissenting. Furthermore, the govt shutdown made economic forecasting even more difficult than usual, and the Fed went as far as suggesting that they could be “cautious” by waiting out the December meeting to see if a further cut was warranted.

With regards to the economy, Powell views the labour market to have been relatively stable in recent weeks, while inflation is expected to remain close to target despite tariff pressures. The much anticipated end to QT will take place around December 1st, close to market expectations, followed by a pause before expanding again after 1H2026.

In continuing the moderate tone, Chicago Fed President Goolsbee stated on Monday that he has “not decided” about the December rate decision, citing nervousness about the “inflation side of the ledger”, while SF Fed Daly has also stated that she will only “keep an open mind” about a December rate cut.

Given the elevated pricing levels, risk assets were disappointed with the lack of immediate easing, US equities have traded off 1–2% from the ATH since the meeting, December rate cut odds have fallen to just around 70% following a near-certain ~95% probability heading into the meeting.

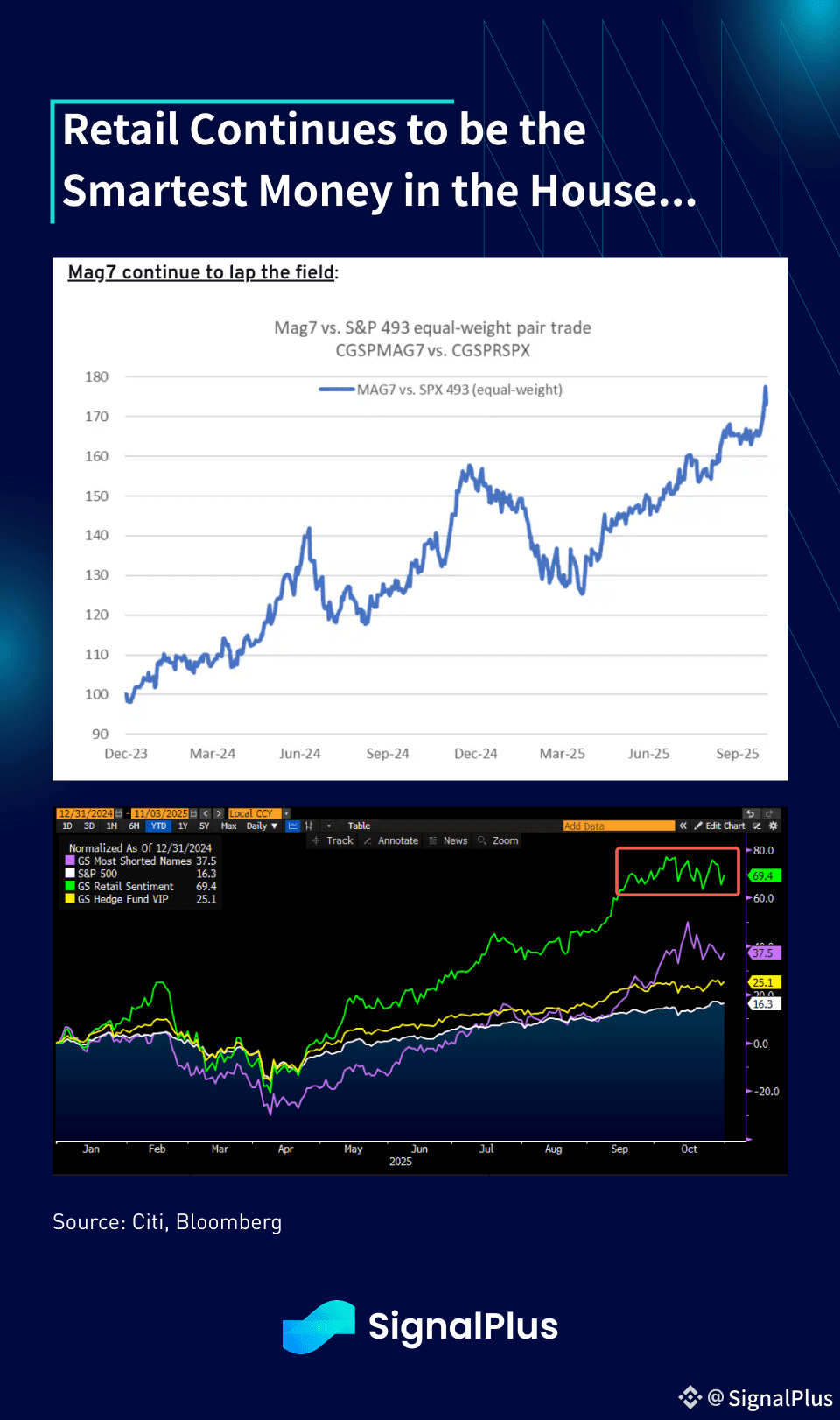

Despite the small setback, overall sentiment remain buoyant heading into earnings with EM stocks in Korea and Japan leading the charge on Nvidia and semiconductor performance. ‘Mag-7’ stocks continue to lead the field with a 70% outperformance versus the benchmark on a 2-yr basis, with the ‘retail-favourite’ basket also outperforming nearly every strategy YTD.

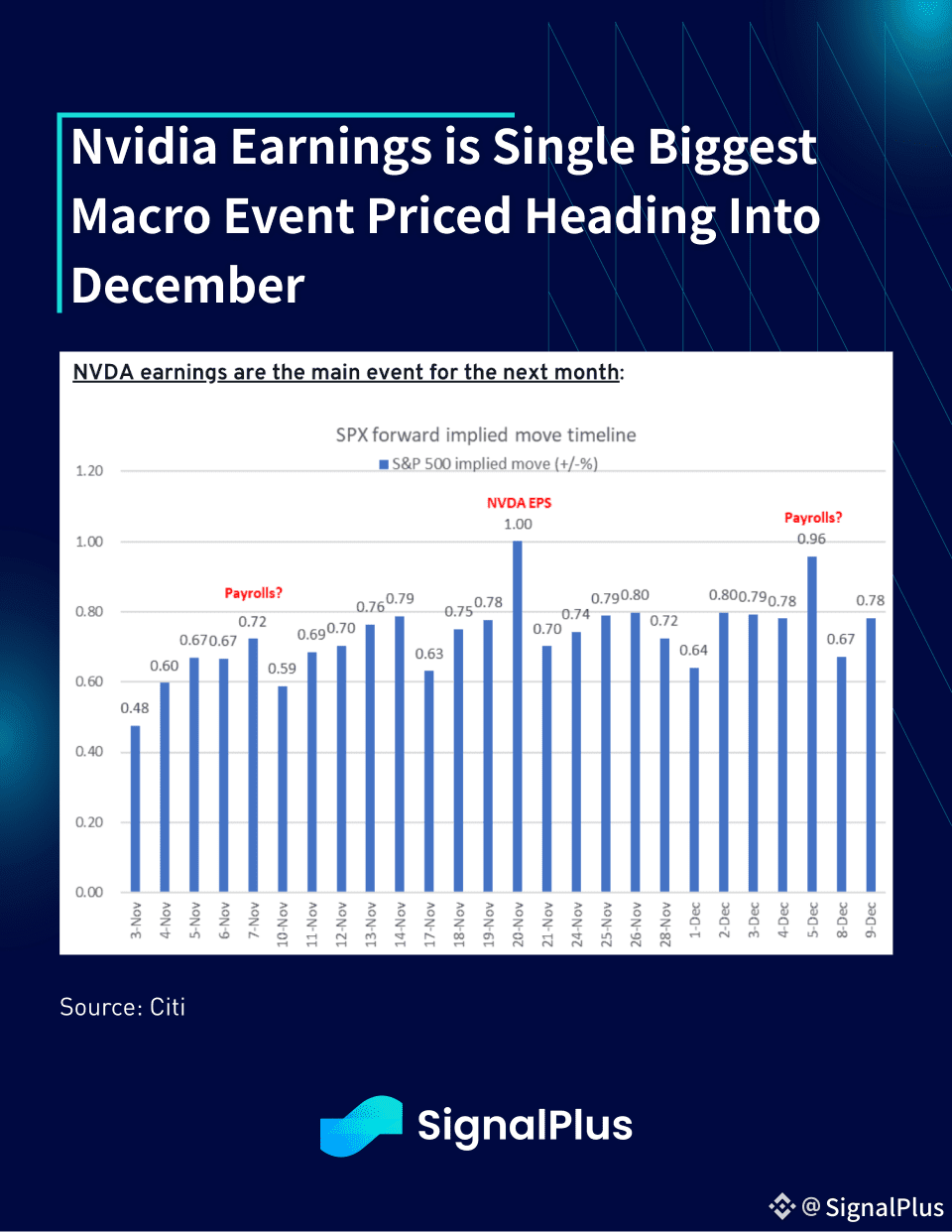

Naturally, Nvidia earnings (Nov 20th) is being priced as the biggest equity market moving event over the upcoming month with a daily SPX breakeven move of +/- 1%, even above the December NFP.

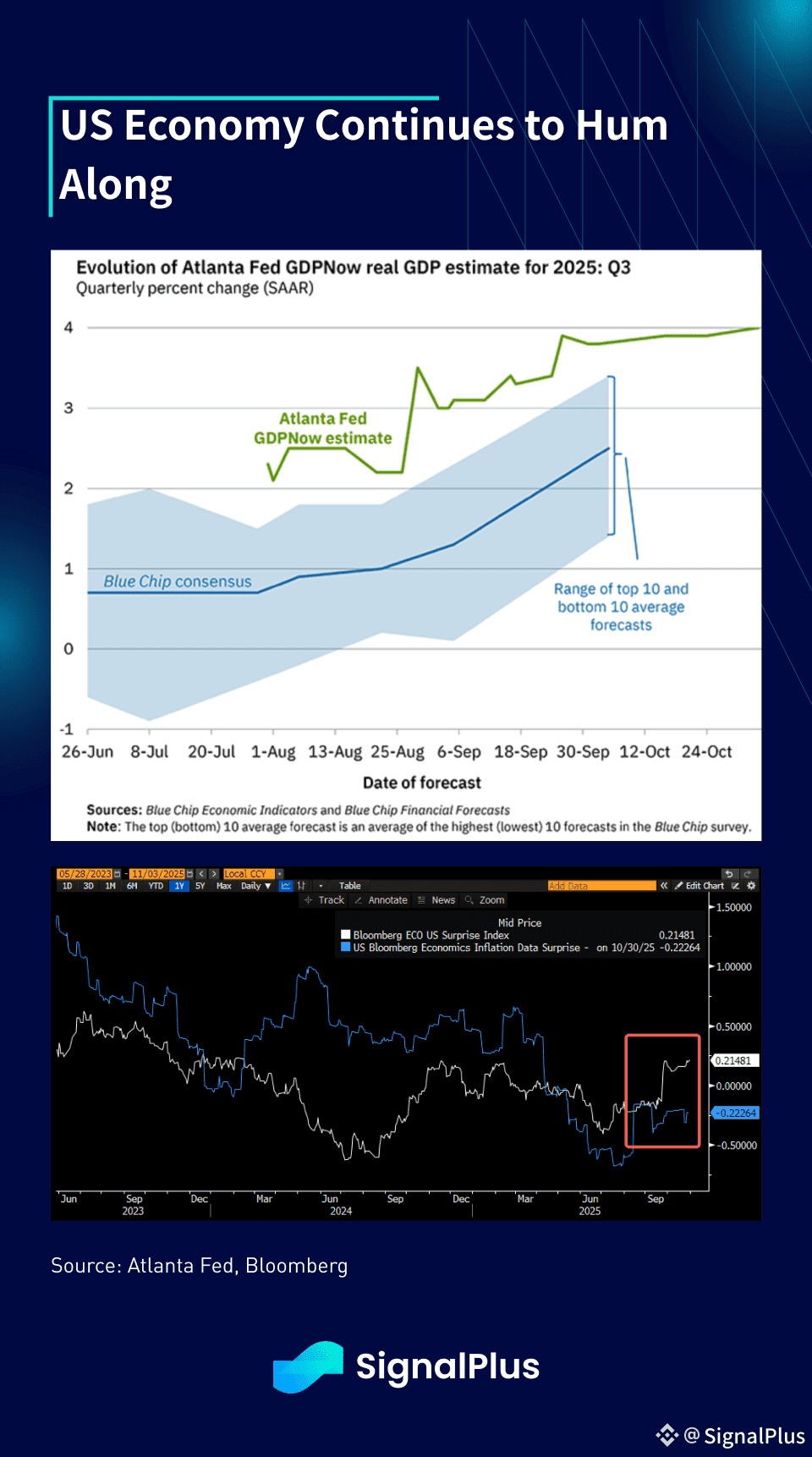

Meanwhile, the economy continues to hum along with Atlanta FedGDP hinting at a 4% growth for Q3, well above any Wall Street estimates, and consistent with the recent pickup in data momentum. Does the Fed really need to cut against this growth backdrop?

Now for the bad news.

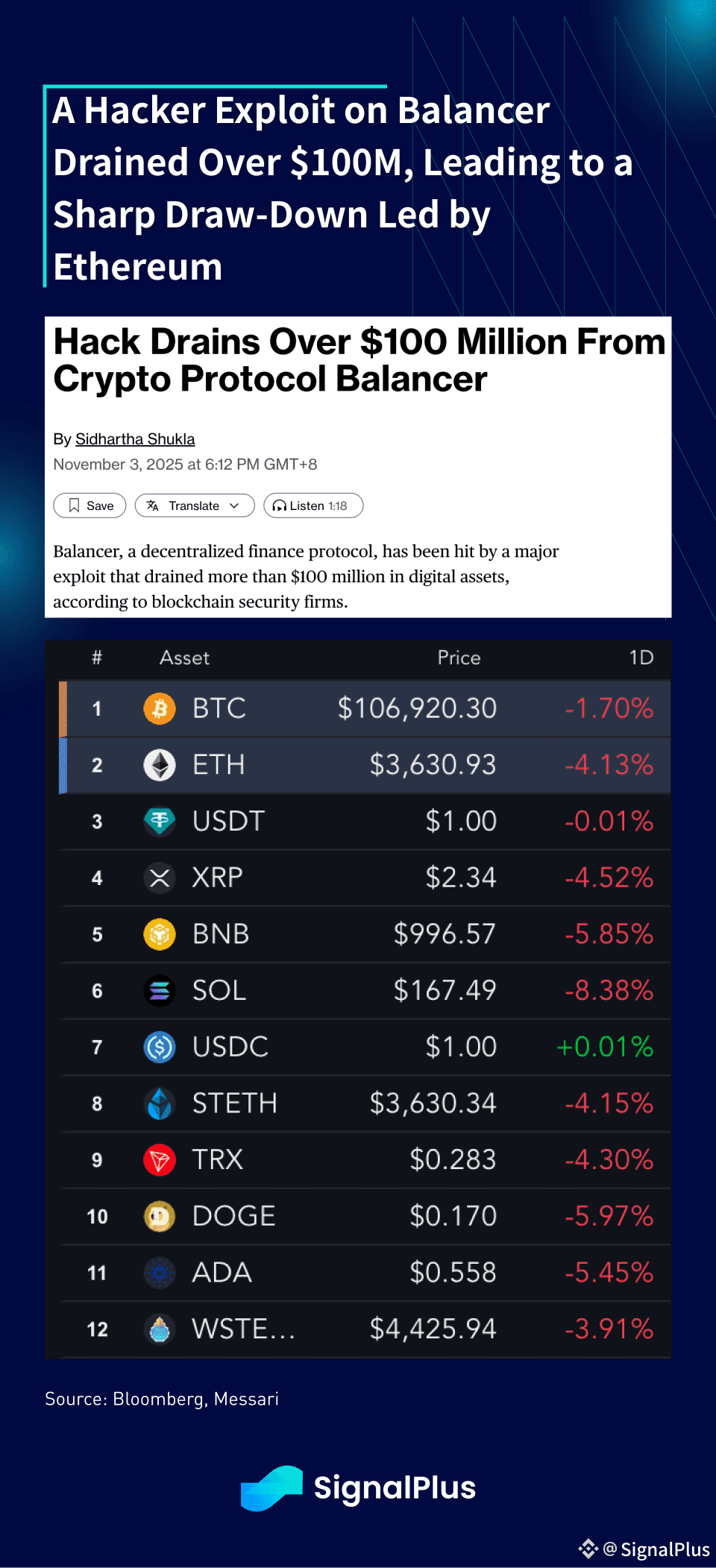

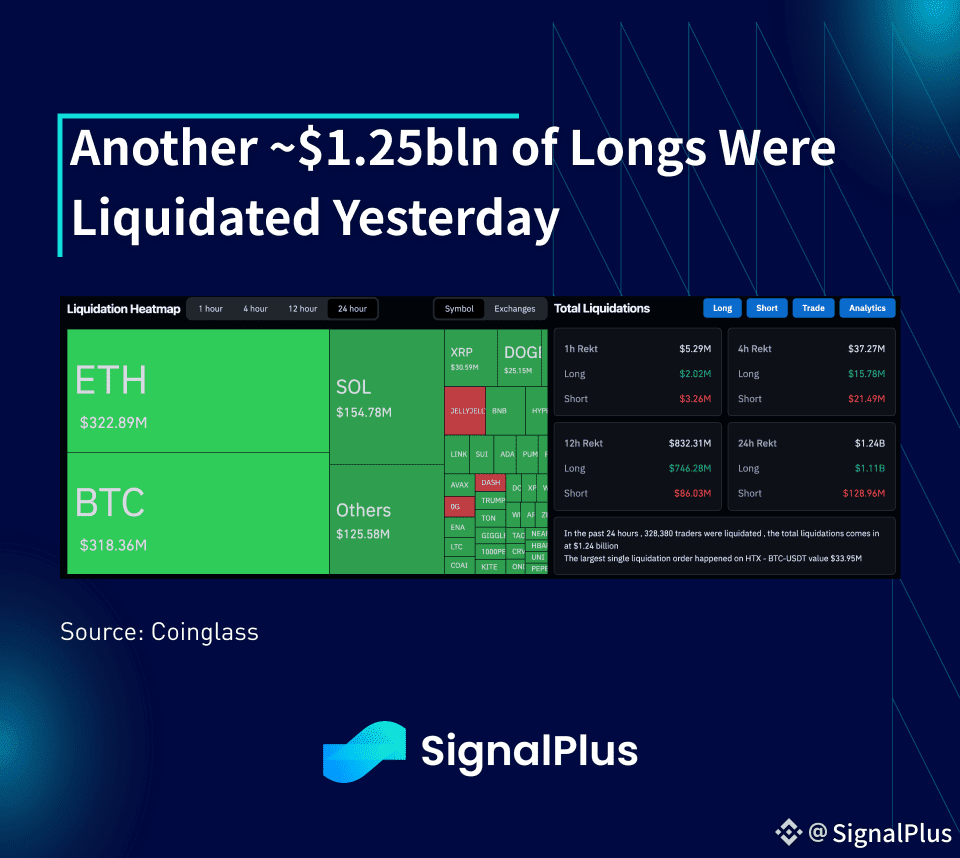

Unlike stocks which have effectively been locked in ‘up-only’ mode, crypto prices have been battered and sentiment has dipped to new lows. Community buying power and optimism has cratered through the recent price drops, with the full repercussions still unclear, and we were ill-prepared for another confidence-zapping move with Balancer hacked for over $130M overnight. Ethereum cratered nearly 10% on the move, with faith in DeFi more shaken than ever given Balancer’s ‘OG’ status as one of the secure protocols in the system. Furthermore, this is happening on the back of swirling rumors that there could be regulatory actions being taken following the ‘Oct-10’ crash between some of the largest players in the market, which has added to the overall woes and taken BTC dangerously close to the $105k area.

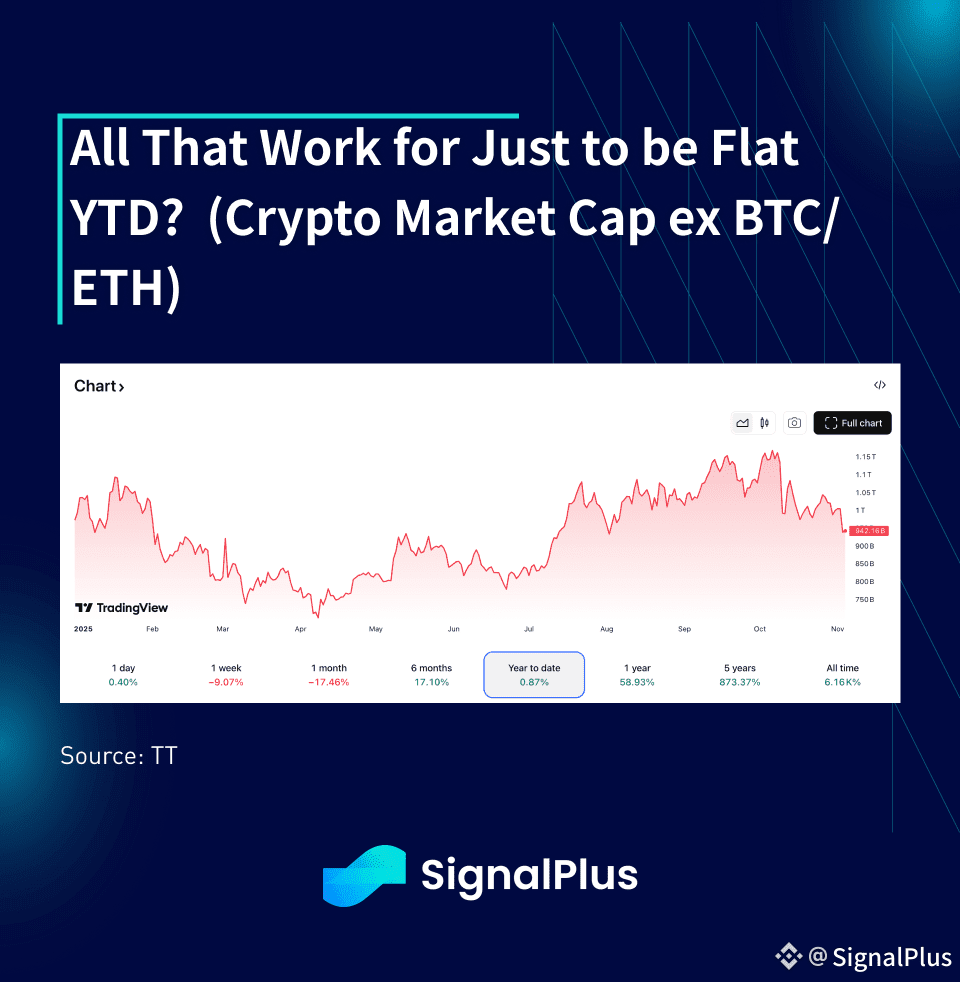

Following the sell-off, TOTAL3 (ex BTC/ETH) market cap is now back to flat YTD despite high double digit gains in other major macro asset classes. Total market cap (with BTC) has also underperformed every major equity index YTD, including China, which is really hurting sentiment across the board with traders who were hoping for an altcoin revival.

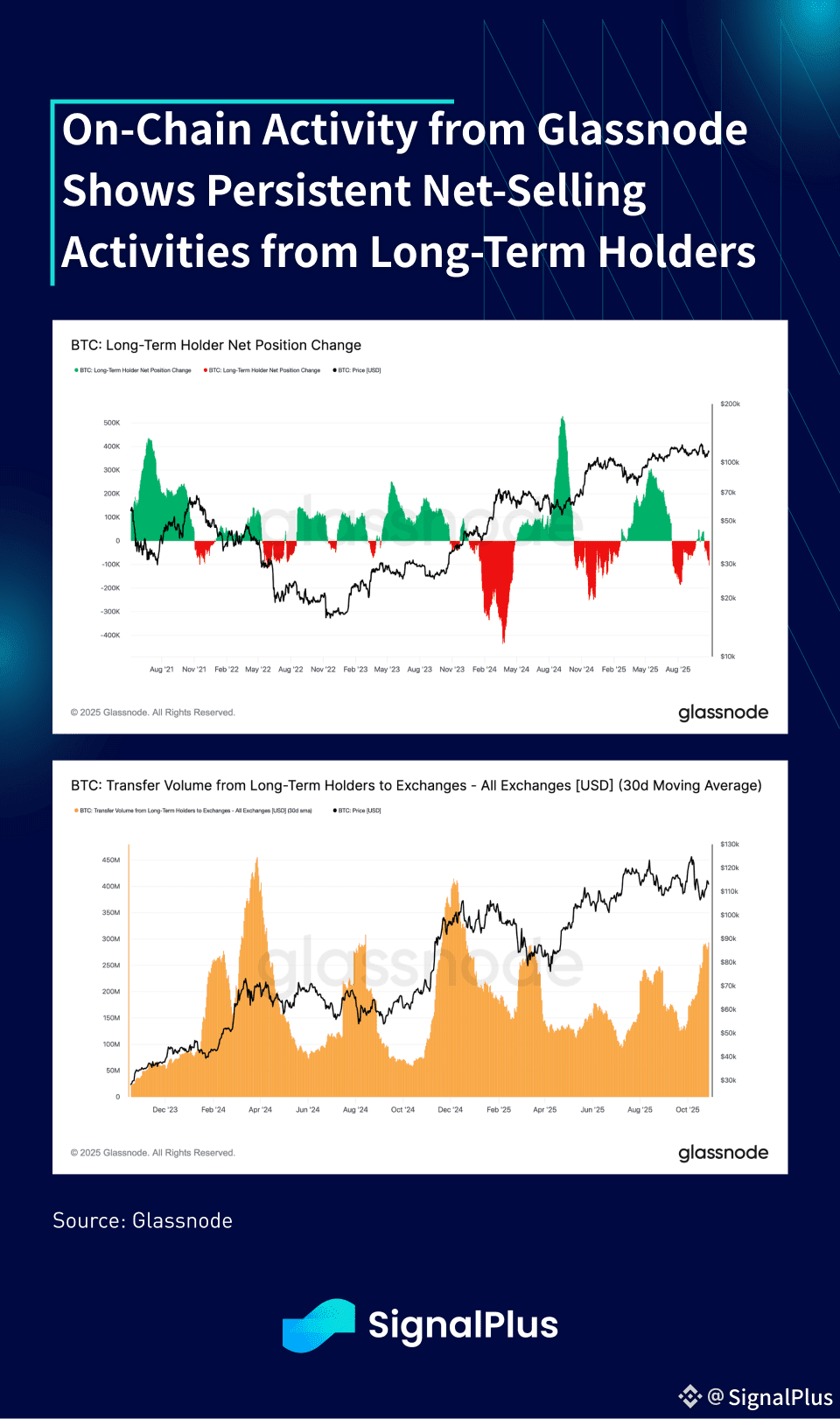

Finally, on-chain activity shows net long-term holders turning net sellers pretty consistently since early summer, which tends to depress price action for the next few months as we have seen currently. Furthermore, based on analysis from Glassnode, high transfer volume from long-term wallets to CEX also suggest preparatory actions preparing for sales, with the recent averages seeing a decent spike and collaborating with more profit-taking activities from long-term holders.

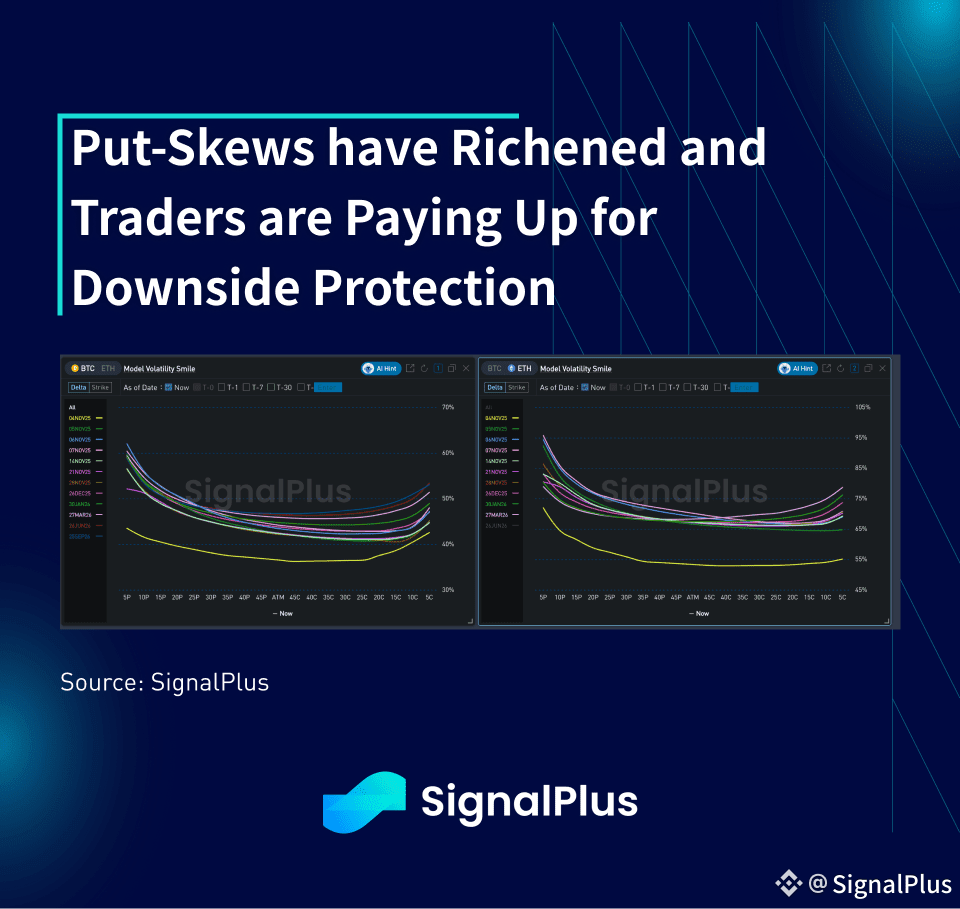

Put-skews have re-richened across BTC & ETH as traders prepare for another leg lower in the near-term. We share the same caution as well and wouldn’t be surprised to see BTC test $100k to the downside again (many tokens have already traded through their Oct-10 lows), driven perhaps by any weakness in US equities or negative headline risks.

Good luck & stay safe. It might be a tricky ride before we can hope for a Santa-rally.