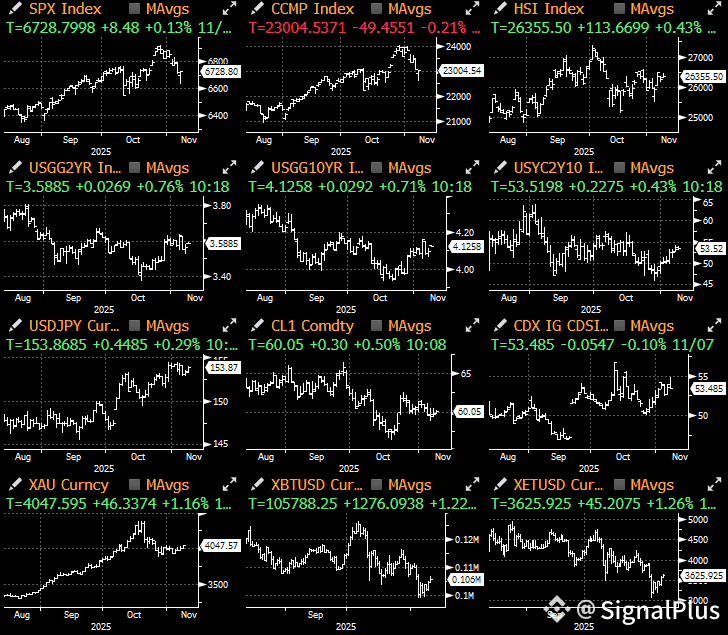

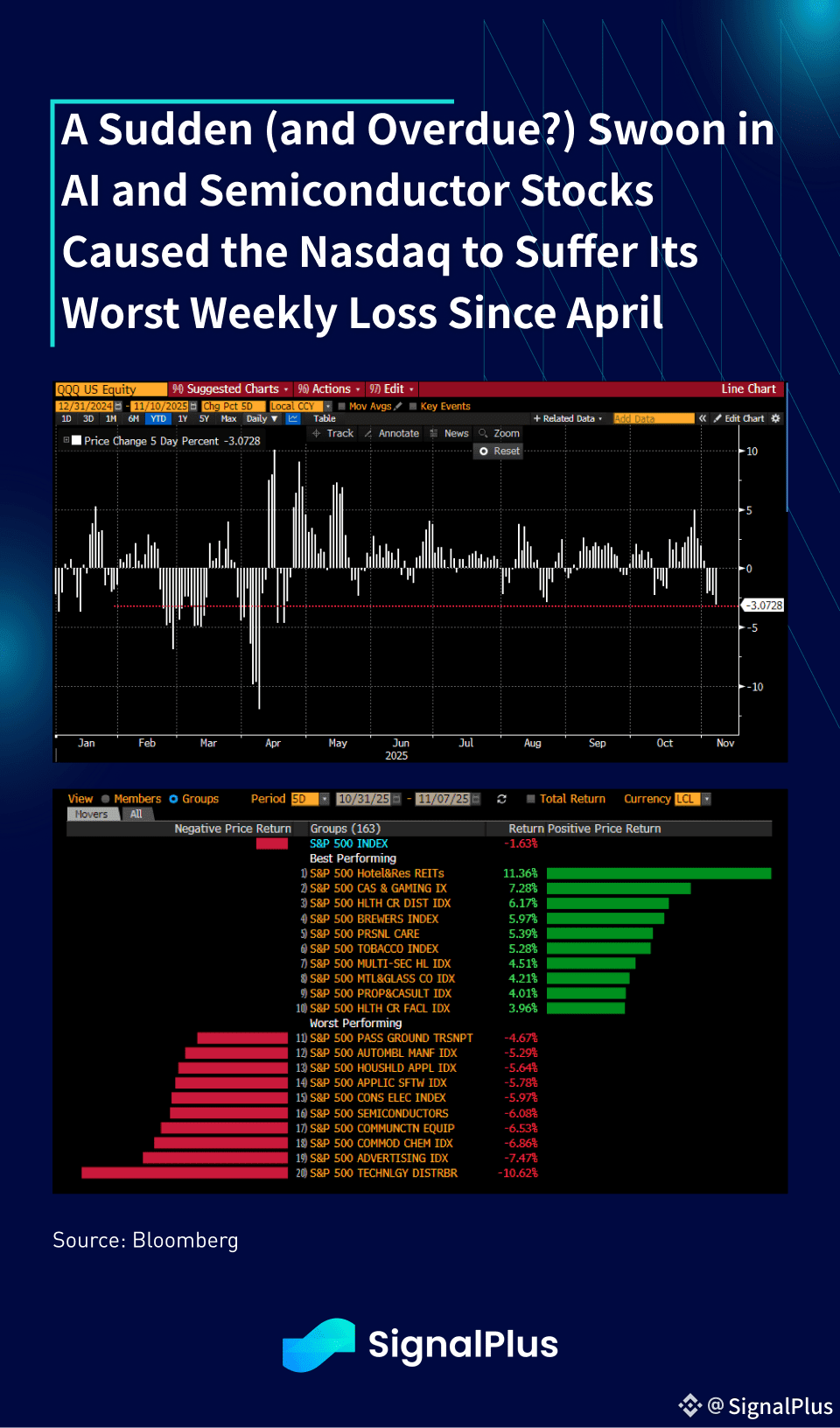

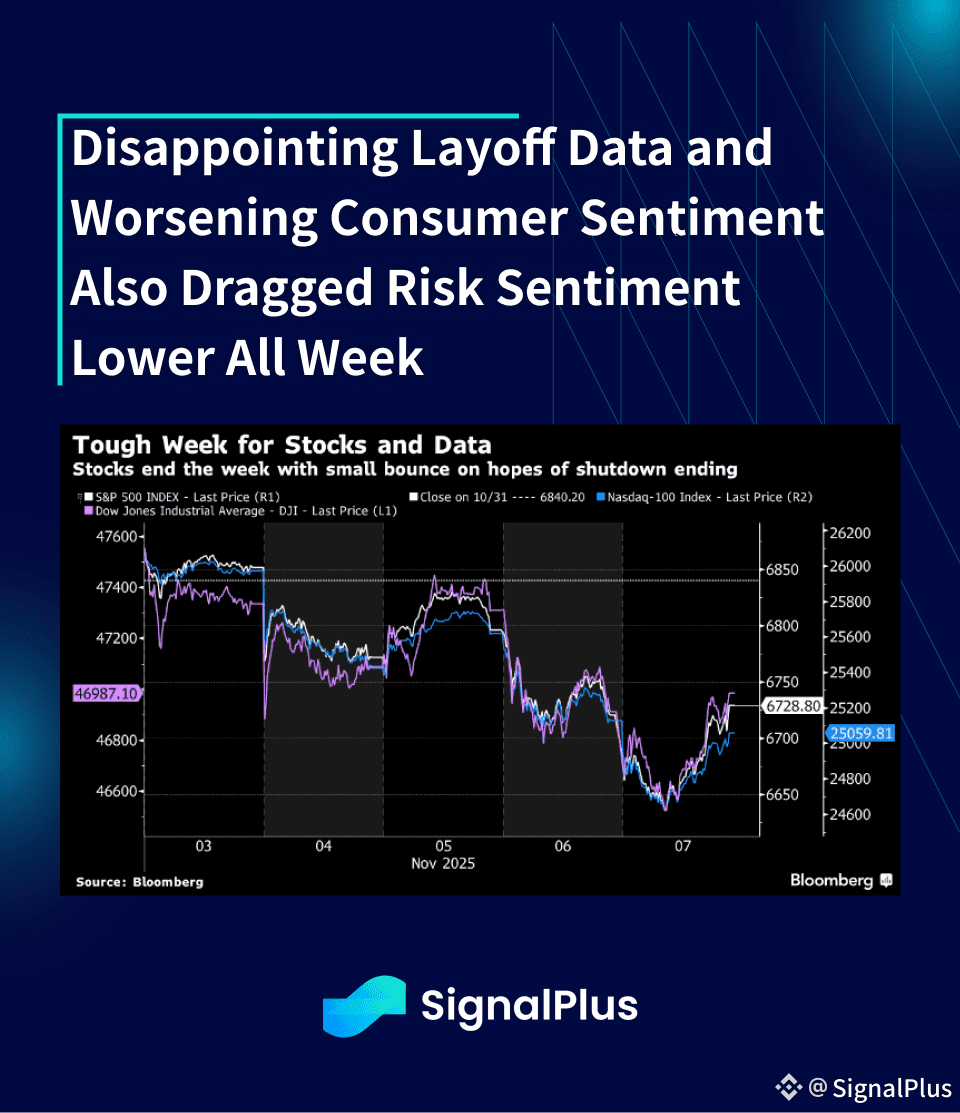

Macro assets had a tough run last week, with Nasdaq suffering its worst weekly loss since Liberation Day in April, dragged down by concerns over a deflating AI bubble and disappointing economic data.

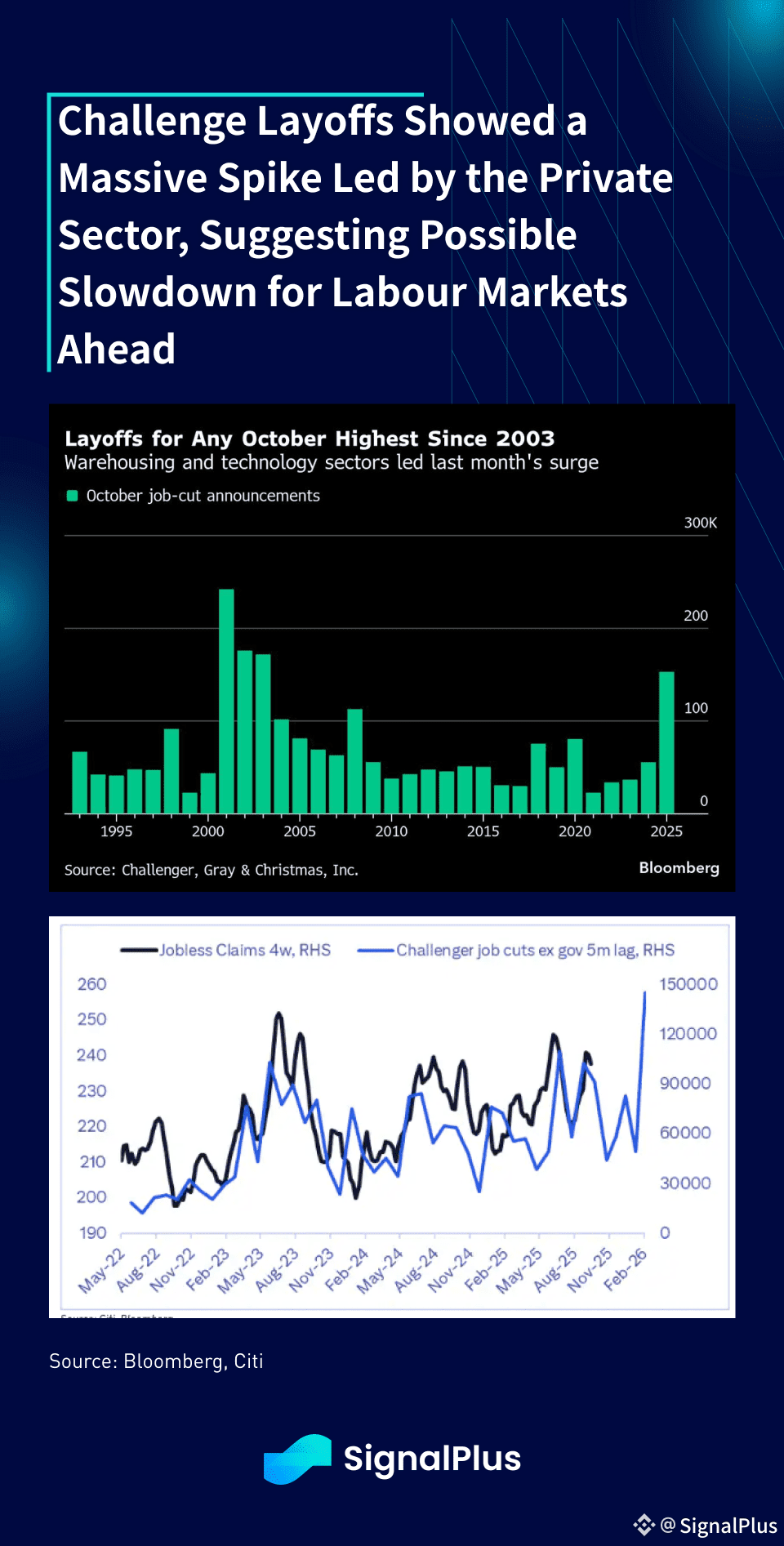

Despite being a ‘2nd-tier’ data release, last Wednesday’s Challenger layoff report shocked market participants with the largest Oct monthly spike since 2003 (+153k, 99k MoM increase), with layoffs driven largely by the private sector. Details showed over 30% of cuts were in warehousing, followed by 22% in tech. While the data can be noisy and not (yet) collaborated by more official payroll figures due to govt shut down, smoothed out averages do show a passing correlation with claims, with markets likely to start assigning more focus on labour data in the coming weeks given the apparent slowdown.

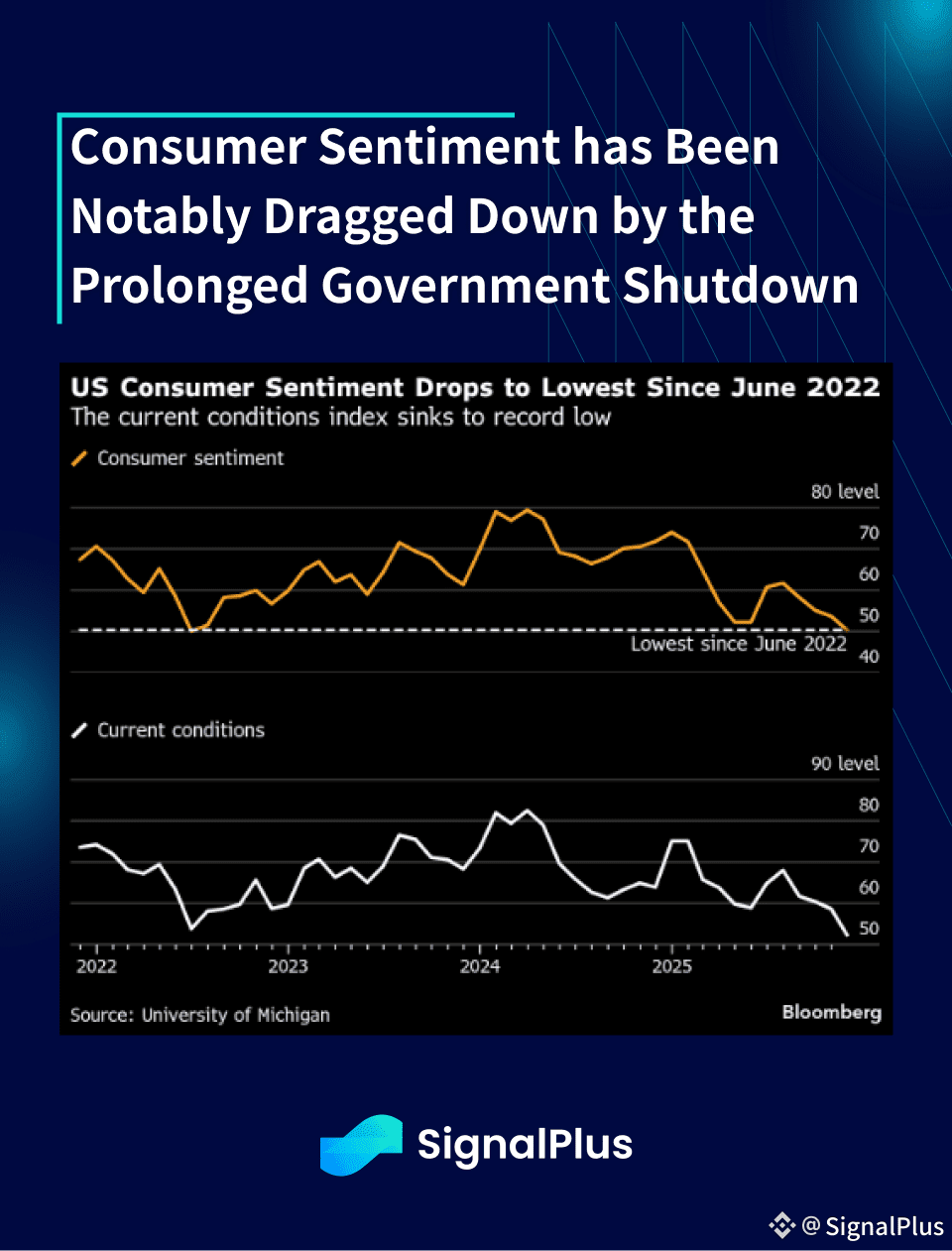

Furthermore, no doubt related to the length of the government shutdown, UMich consumer sentiment fell to the lowest levels since June 2022 (50.3 vs 53 consensus), with short-term inflation expectations sticky at around 3.9%. However, with the shutdown making positive steps to be resolved this week, markets will be hopeful for a sentiment bounce next month to suggest that this was just a temporary lull.

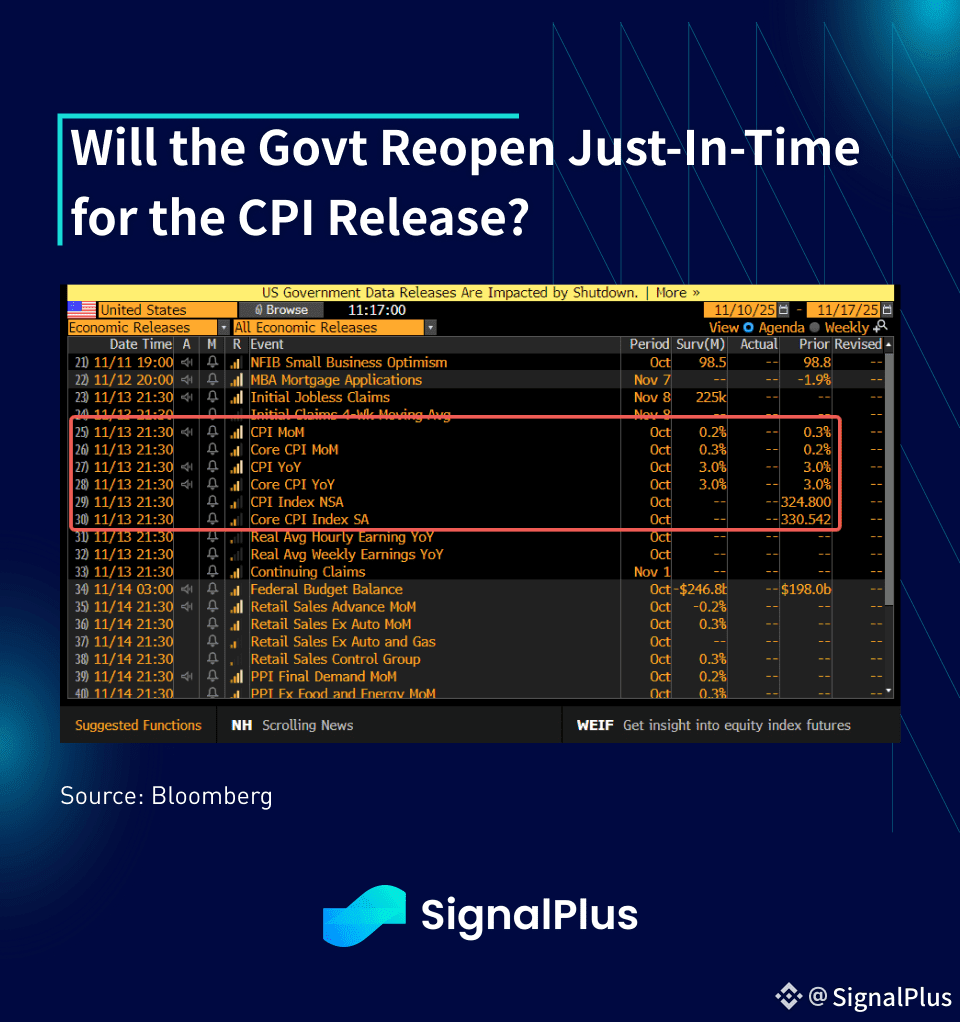

Early headlines this morning suggest that Senate Democrats have voted with Republicans (60–40 count) to overcome the filibuster and move forward with a proposed package that would finally reopen the federal government. The bill still needs to pass the House vote, which could take until Wed or Thursday, which means that might not make the critical CPI release on time.

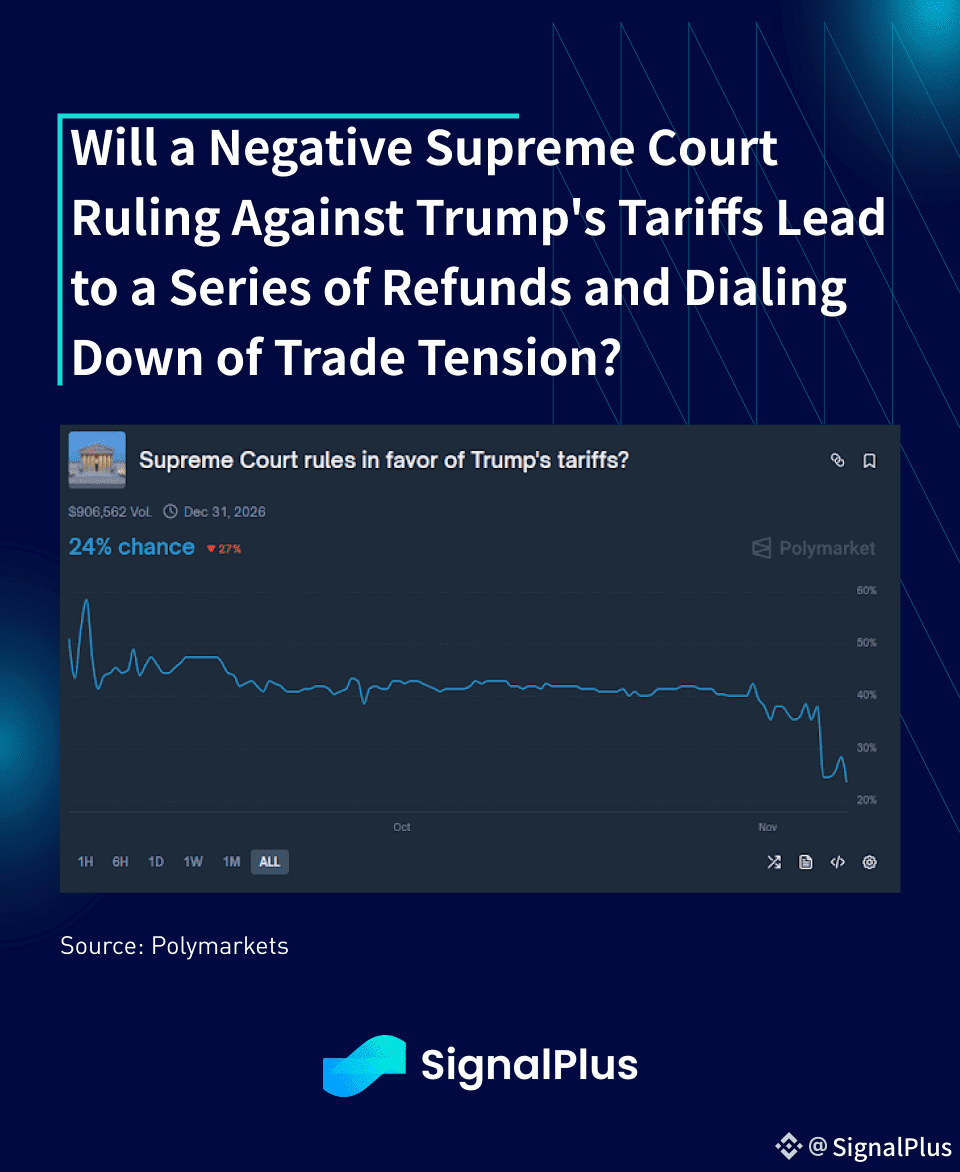

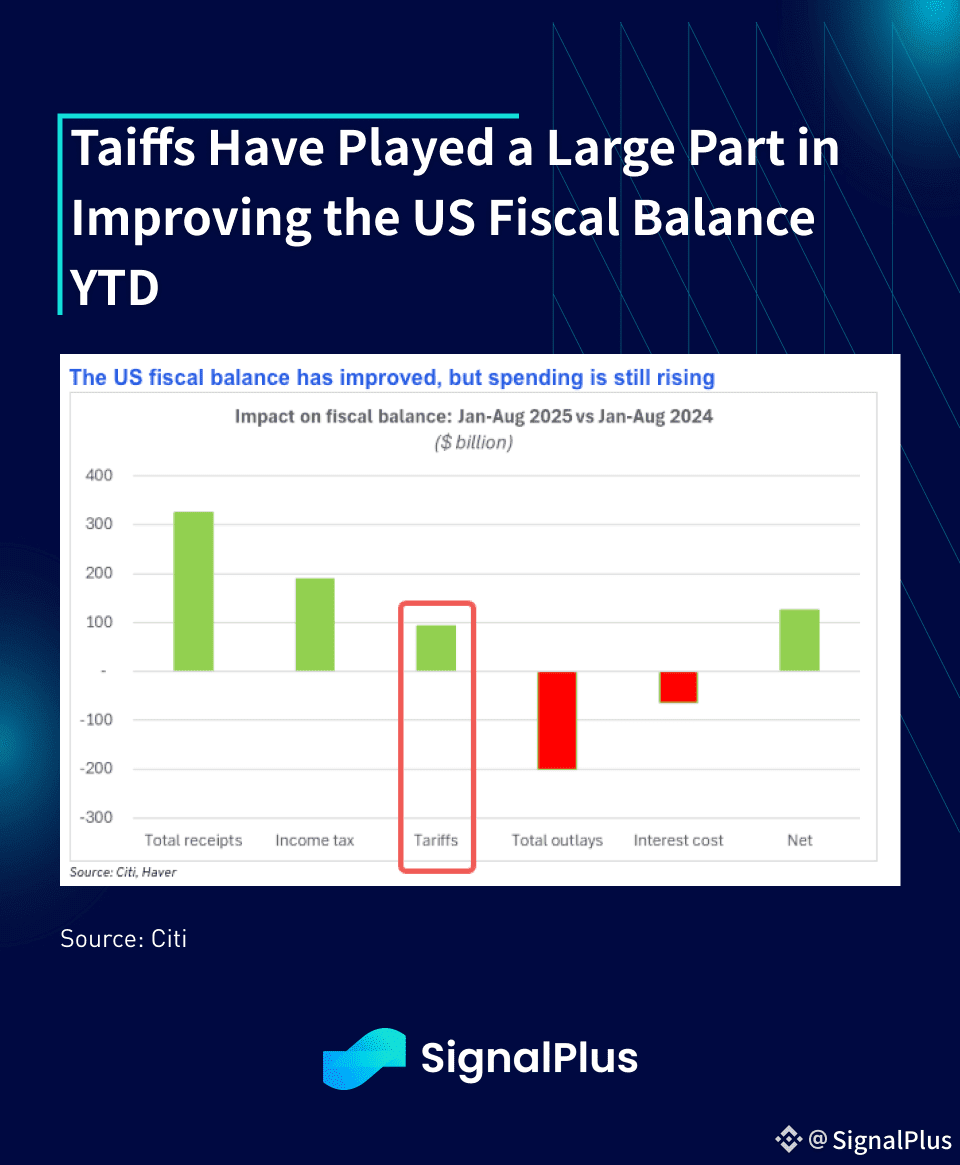

The apparent deal is coming at a time with President Trump and the Republican party has taken a number of recent losses, starting with the ‘blue-sweep’ mid-term elections and the Supreme Court’s rulings against the President’s tariffs as being unconstitutional. Possible refunds of IEEPA tariffs might be necessary in the case of a negative ruling, which would unwind a fair chunk of budget deficit improvements this year, creating renewed uncertainties on the fiscal and debt issuance path from 2026 onwards.

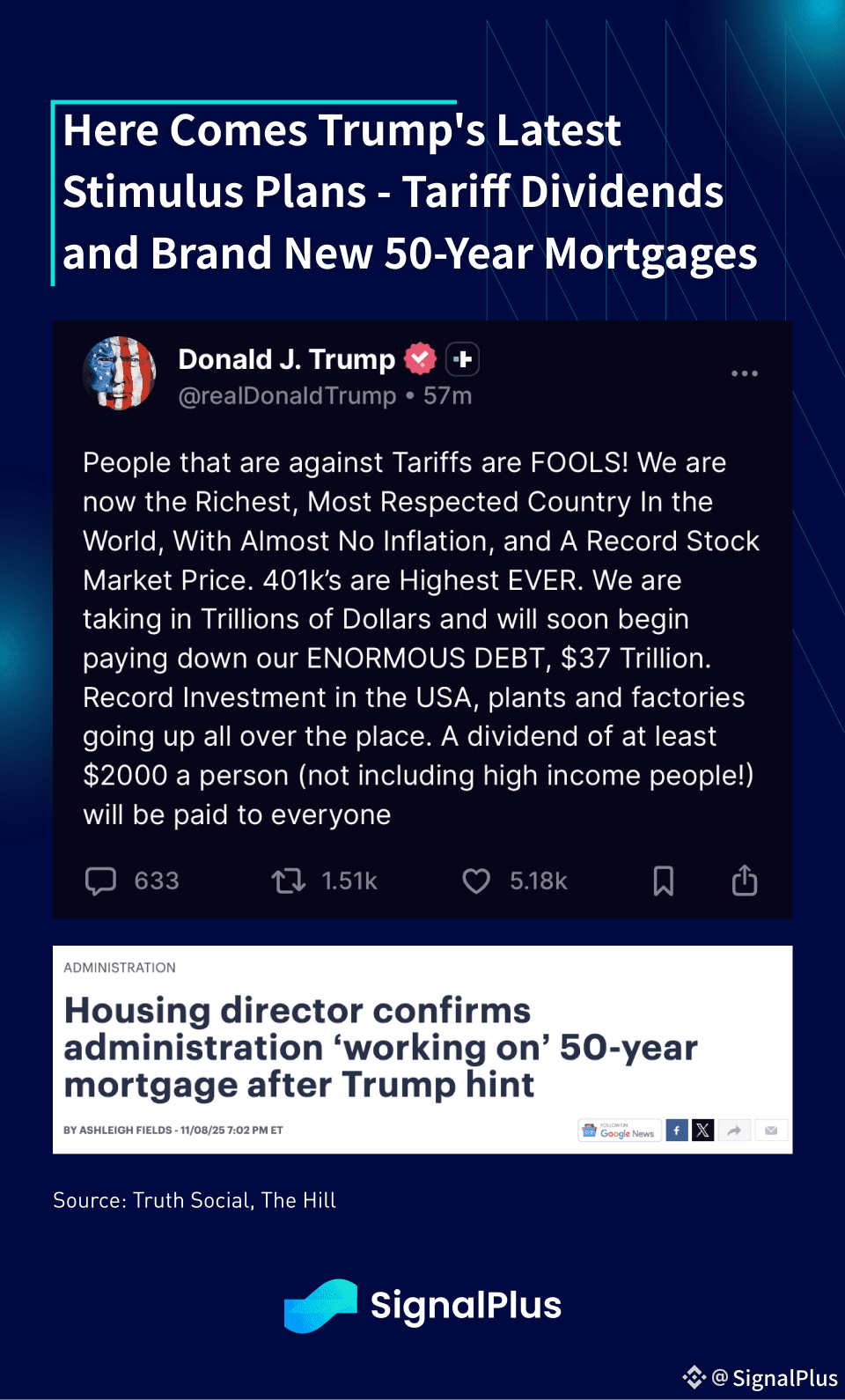

Perhaps in response to these recent losses, President Trump floated a new stimulus check in the form of a $2000 tariff dividend directly to the American populace, in addition to a new 50-year mortgage to improve housing affordability.

The ‘tariff-dividends’ are reminiscent of the covid stimulus checks that were a direct and effective money-printing stimulus, while the ultra-long duration mortgages will provide additional leverage to the system. Both of these should be viewed as new forms of liquidity easing.

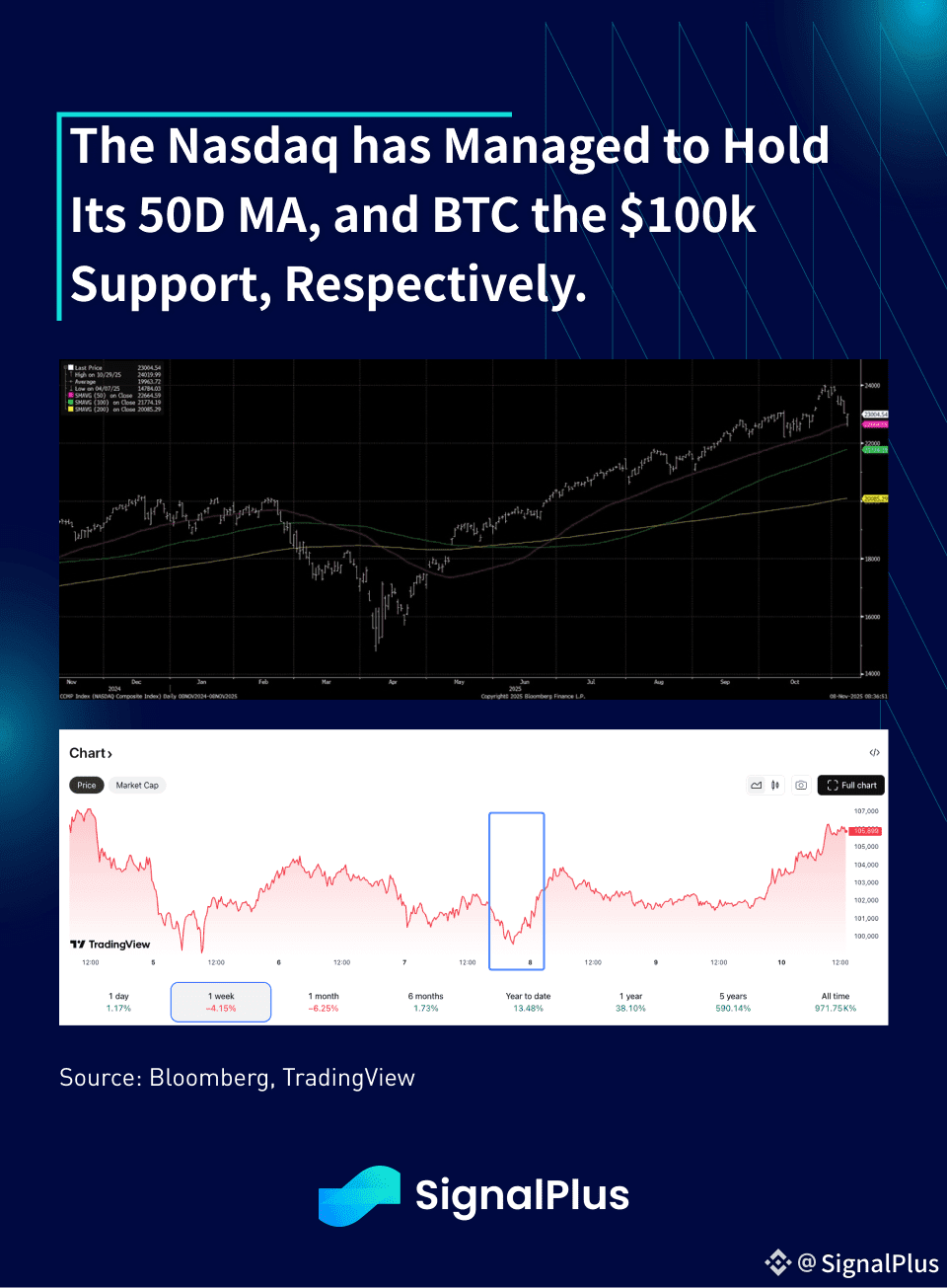

While TradFi assets were closed on the weekend when the news broke, BTC rose roughly 2–3% on this news with the government fully committed to their ‘easy-money’ ways. The Nasdaq also managed to hold its 50d MA last week through the sell-off, just as BTC has managed to hold the $100k support thus far.

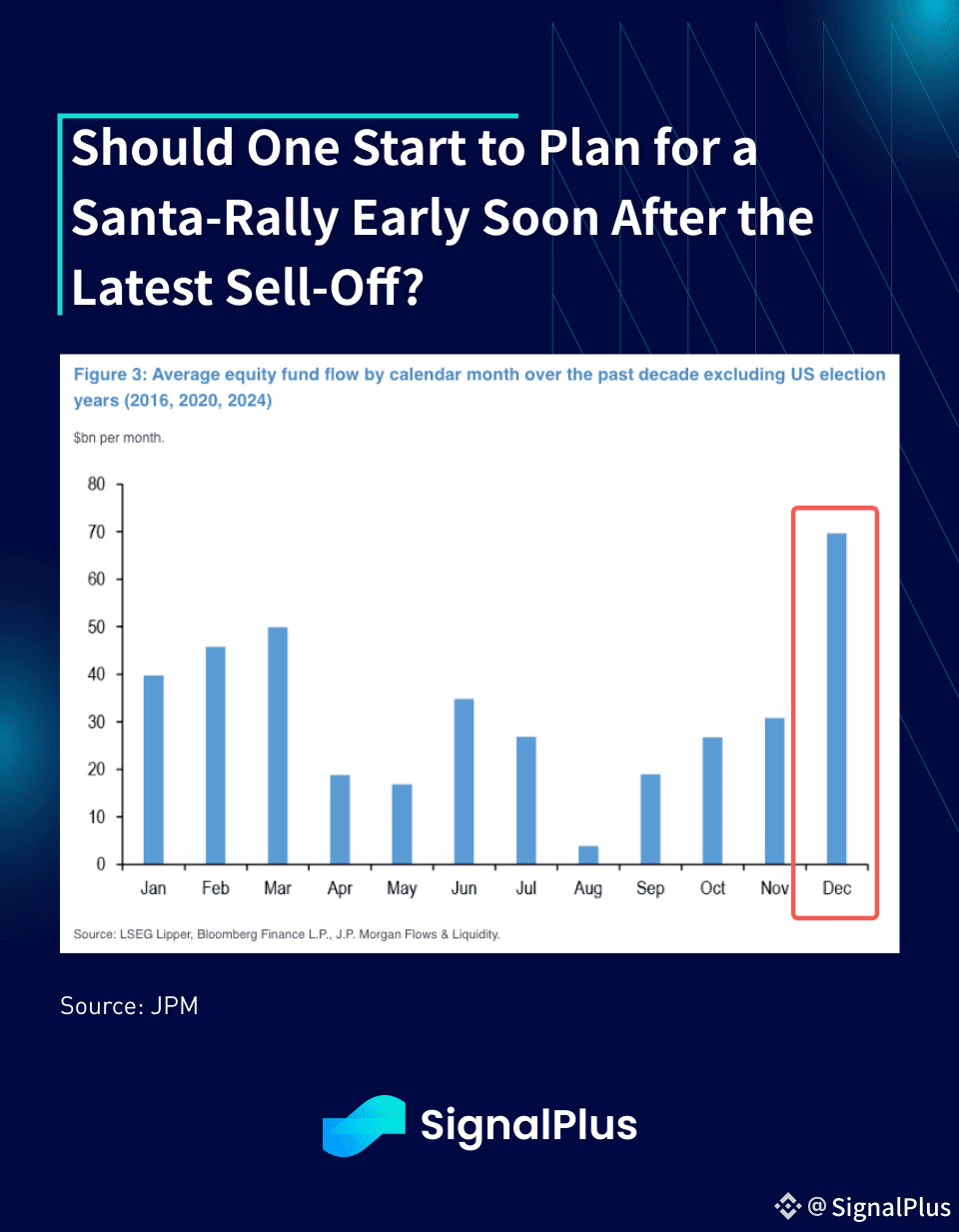

Equity flow seasonals are also entering its most positive month in December, so it might be time to start preparing for a Xmas rally as most of the known risk factors might be behind us for now.

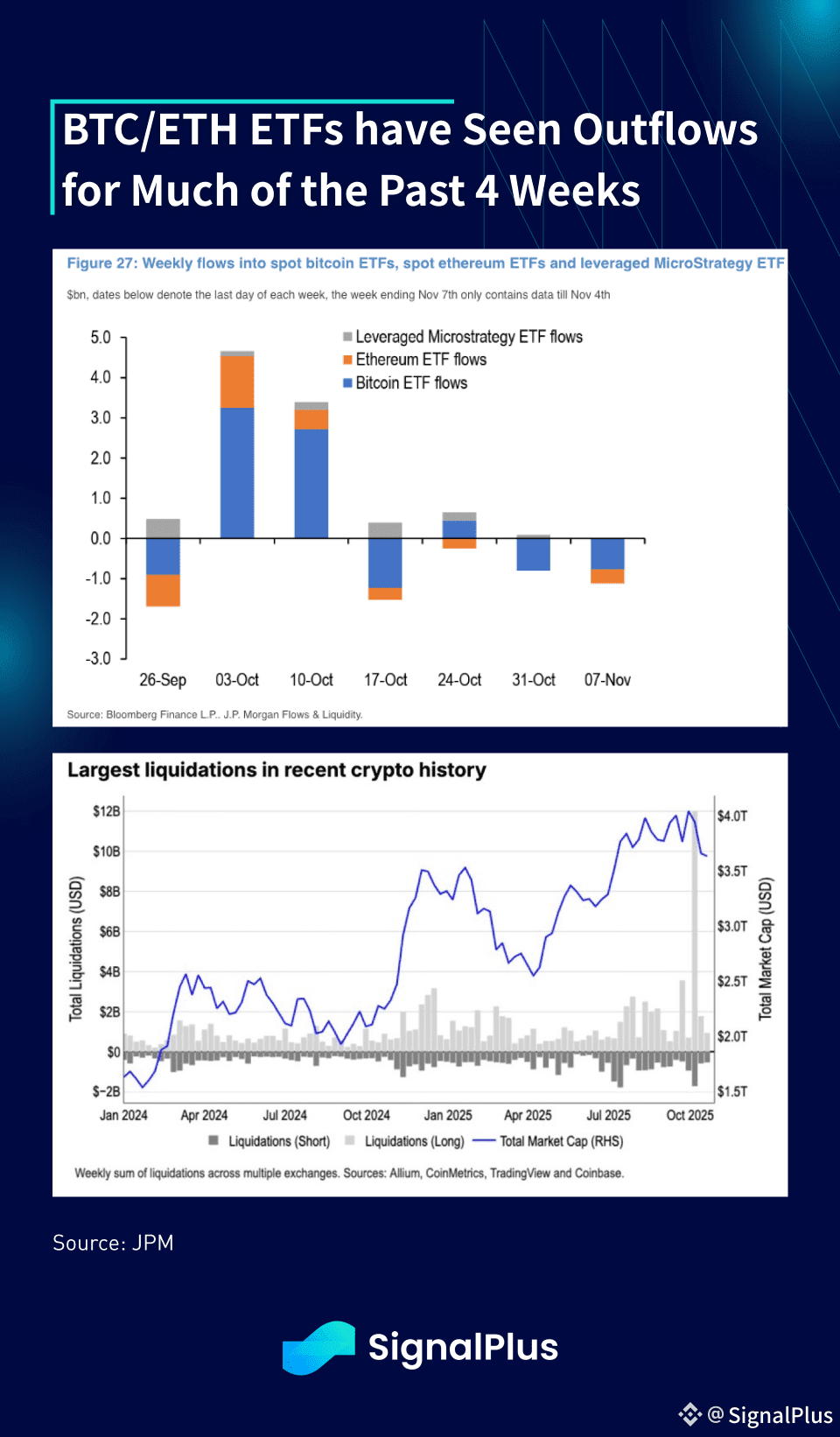

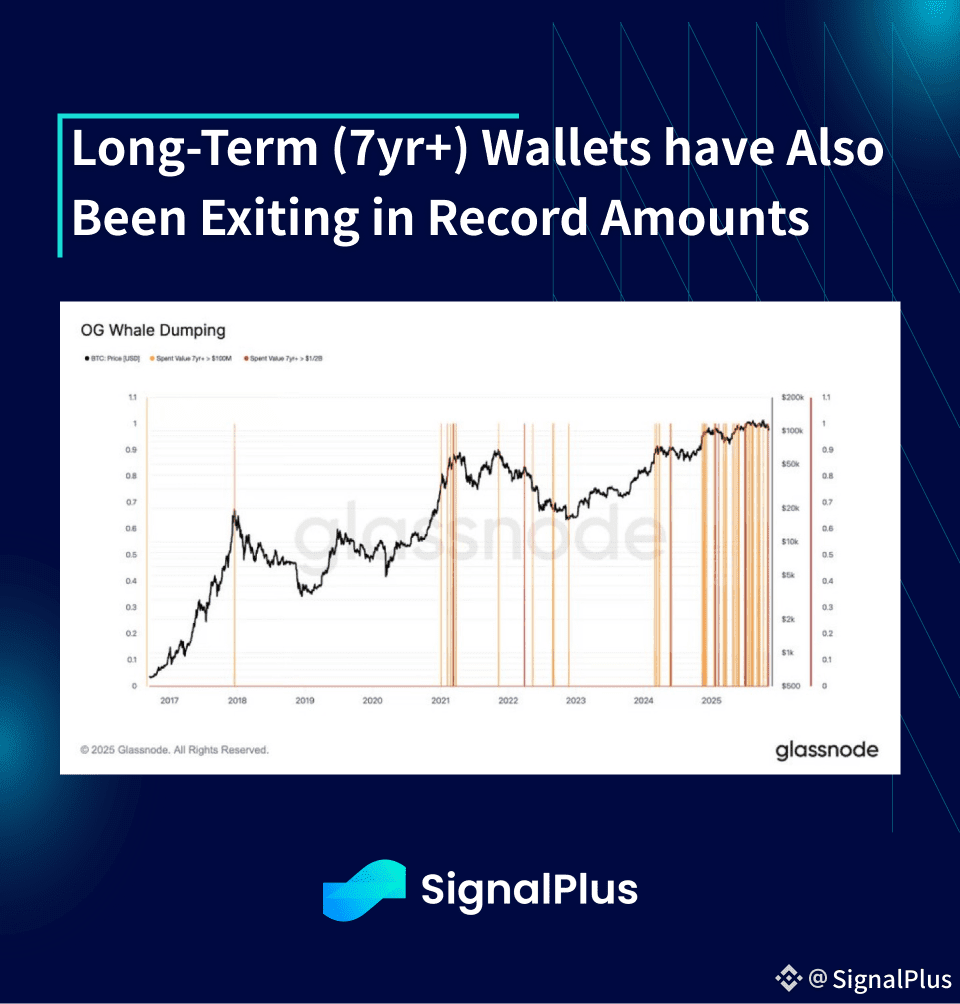

Crypto assets traded on the back-foot for much of the entire week, with BTC holding the $100k battle-line the best it can, following a string of perpetual liquidations, ETF outflows, and OG Whale selling.

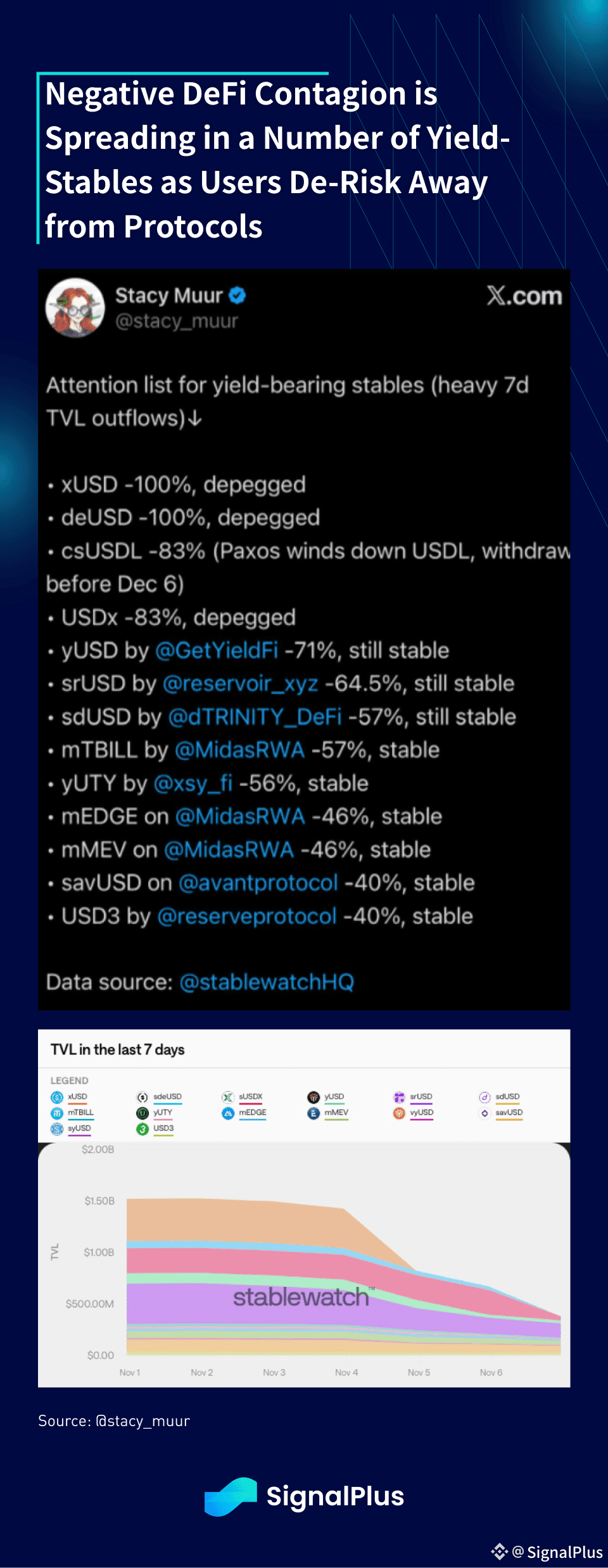

Moreover, as more victims of the 10/10 collapse continue to surface, we are seeing increasing TVL outflows and stables de-peggings across a number of DeFi yield-bearing protocols, following the unfortunate developments in Stream Finance.

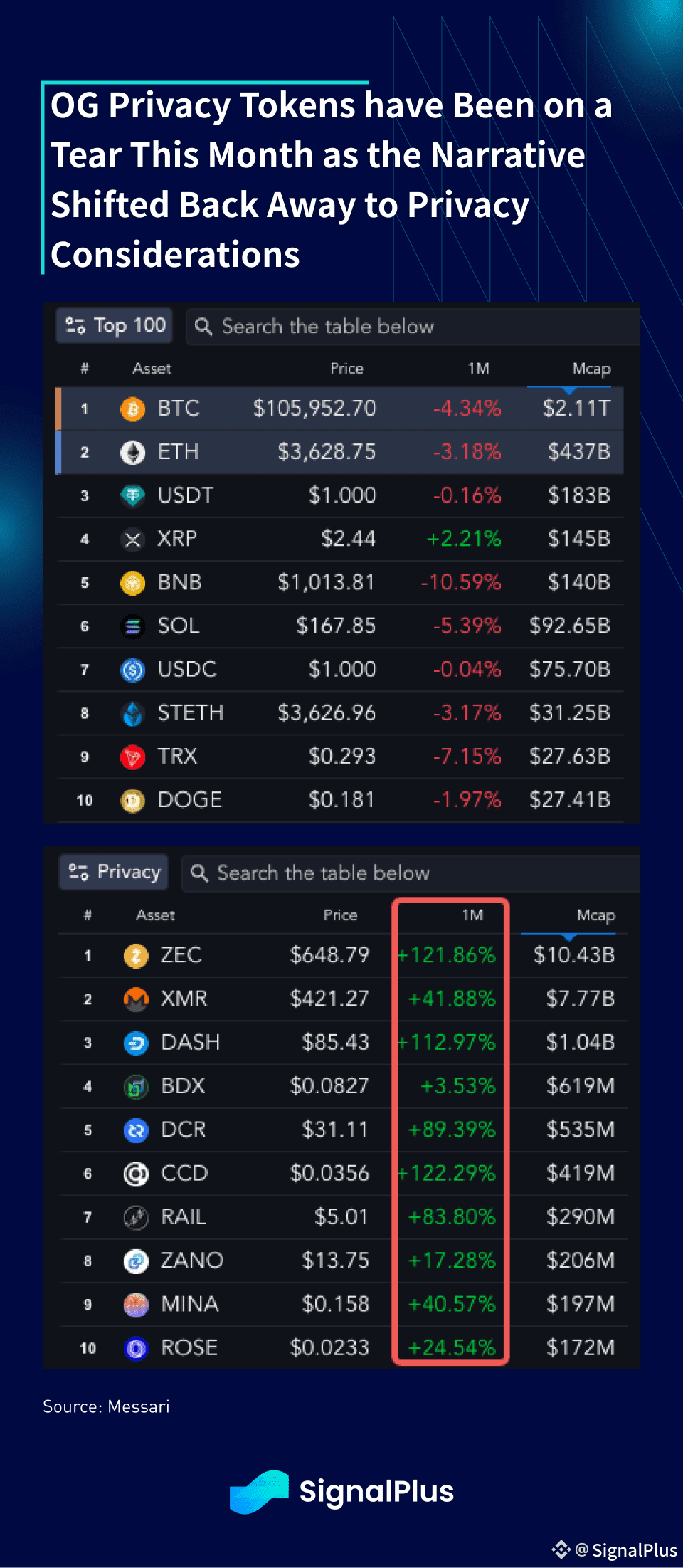

Meanwhile, while the majors and top altcoins are getting punished, old privacy coins (such as Zcash) have been gapping higher with the sector gaining ~100% over the past month. There’s a bit of a resurging narrative of the need for privacy given the increasing heavy entrenchment of TradFi control, though it’s not yet clear to us on whether that’s a sustainable theme, especially given the legislative environment.

Regardless, it’s nice to see at least some sectors doing well in this downturn, and we are feeling cautiously constructive that BTC has held the lows so far. With positions as clean as they have been for a long time, we would lean on the side of optimism as we head into year-end, especially in light of the improving macro catalysts as mentioned above.

Good luck & good trading.