Key metrics: (3Nov 4pm HK -> 10Nov 4pm HK)

BTC/USD -1.0% ($107,200-> $106,200), ETH/USD -1.9% ($3,690 -> $3,620)

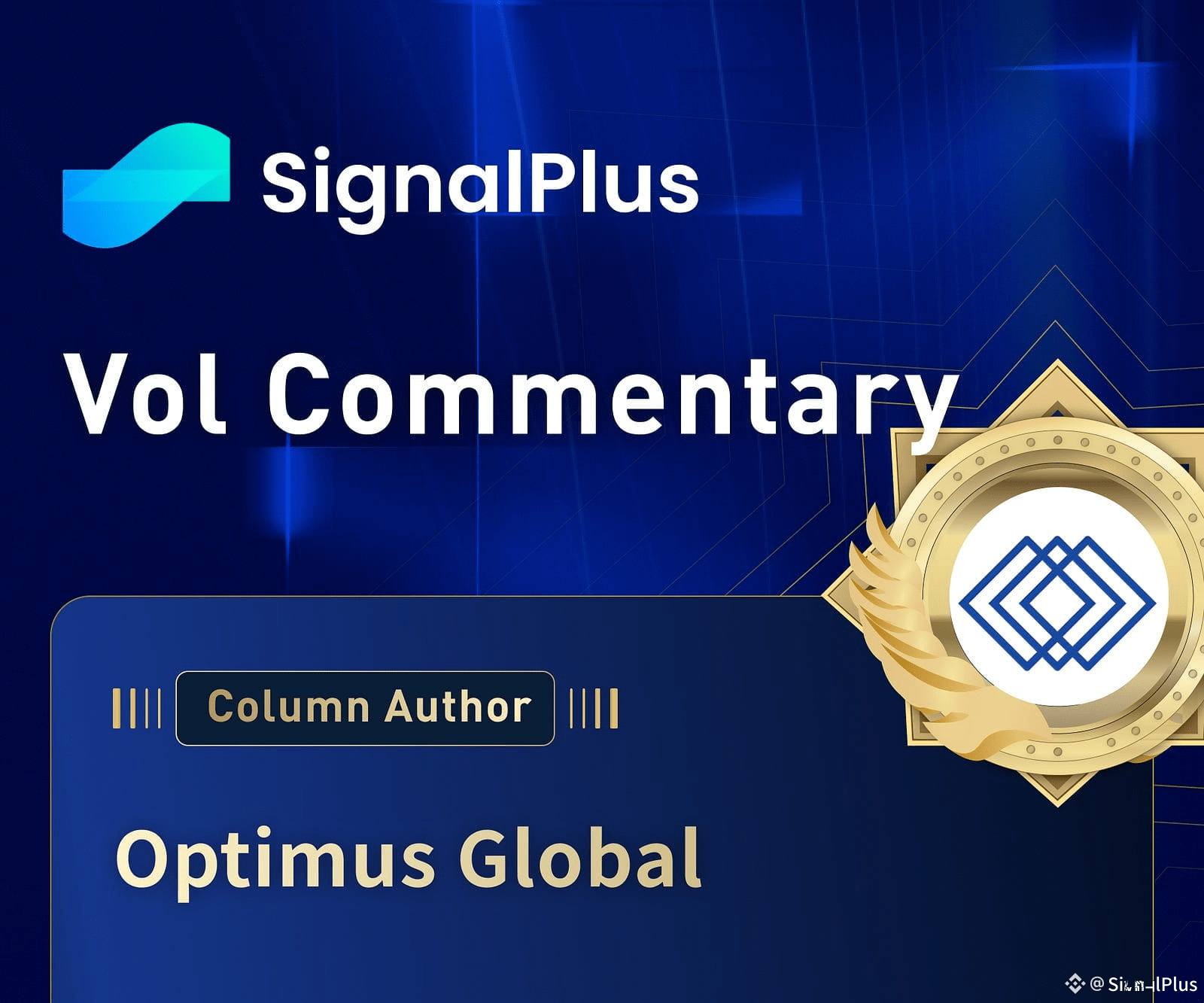

After finally breaching the psychological level of $100k last week, positive news out of Washington over the weekend drove a relief rally to start the week and the market traded up to test the previous support (now resistance) level/region of $104–107k. Through $107–108k we expect the market to see some top side acceleration given the pivotal/choppy zone of $108–114k

A break higher would suggest this part of the correction might be completed and the market could be gearing up for a fast and choppy test of the ATHs. We ultimately think that this would give way to a larger and more sustained correction since we see the larger-cycle as corrective (albeit flat corrective) for the coming months

If we fail to break $107k that would suggest the market wants to retest the $100k support and we have a more “pure” break down target closer to $95k, but given lows have printed on a $98k handle already we have been within a whisker of that level already. We would think that re-tests at or below $100k from here are opportunities to buy delta into, carefully and calmly in a fashion that gives plenty of room in case the downside runs on stops / liquidations before the bigger turn comes in

Market Themes

Wobbly week for risk assets as the US government shutdown extended, with fears of the extended impact on the US economy. On top of this, despite a fairly solid round of US corporate earnings, concerns began to arise around the stretched levels of AI valuations, particularly given the heavy spend and investment being made by some of these companies to continue the development and integration of AI e.g. Meta … what if at the end of all this spending the technology doesn’t produce the revenues priced in? Ultimately so far the investments have been paying dividends, so partly this aspect of the price action felt like narrative chasing on what was probably just a healthy correction given the extended rallies some of these names have had so far this year

Crypto has been underperforming risky assets (and Gold) all year and found itself in a vulnerable position with the broader turn in risk assets. BTC finally plunged through $100k, though selling flows were well absorbed in the $98–100k range, while ETH tested down towards $3k before also finding some support. The end of the Government shutdown and the likelihood of another Fed cut in December (especially given the impact on US economy from the recent shutdown) should ultimately support risk assets from here into year end and this may bring a relief rally, but after a challenging year and high opportunity cost in the space, it still feels like a ‘high risk low reward’ asset in the absence of any crypto-specific catalyst, and therefore may find itself vulnerable should an unexpected turn in risk assets occur once more before year end

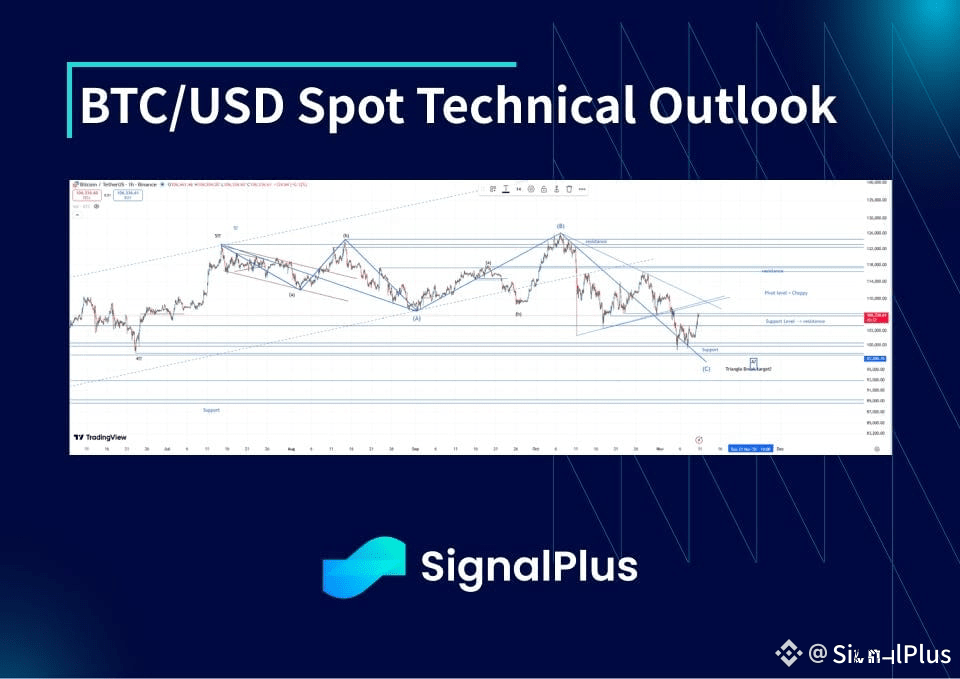

BTC$ ATM implied vols

Implied vols broadly traded sideways this week as realised volatility remained in the low-mid 40s (on a high frequency basis), justifying this newer implied vol base that we have reset to. Implied vols initially dipped early in the week before finding some support as spot broke $100k. However with no follow through below that key level, implies drifted lower into the weekend before finding support again into the new week as spot had a quick rally off the lows

The term structure of implied vols has begun to steepen out as the short-term realised begins to wane with spot establishing itself in a range and no immediate catalysts to trigger a change. Directional players (looking at topside) have shifted positioning to December onwards expiries to allow more time for the market to digest the recent price action

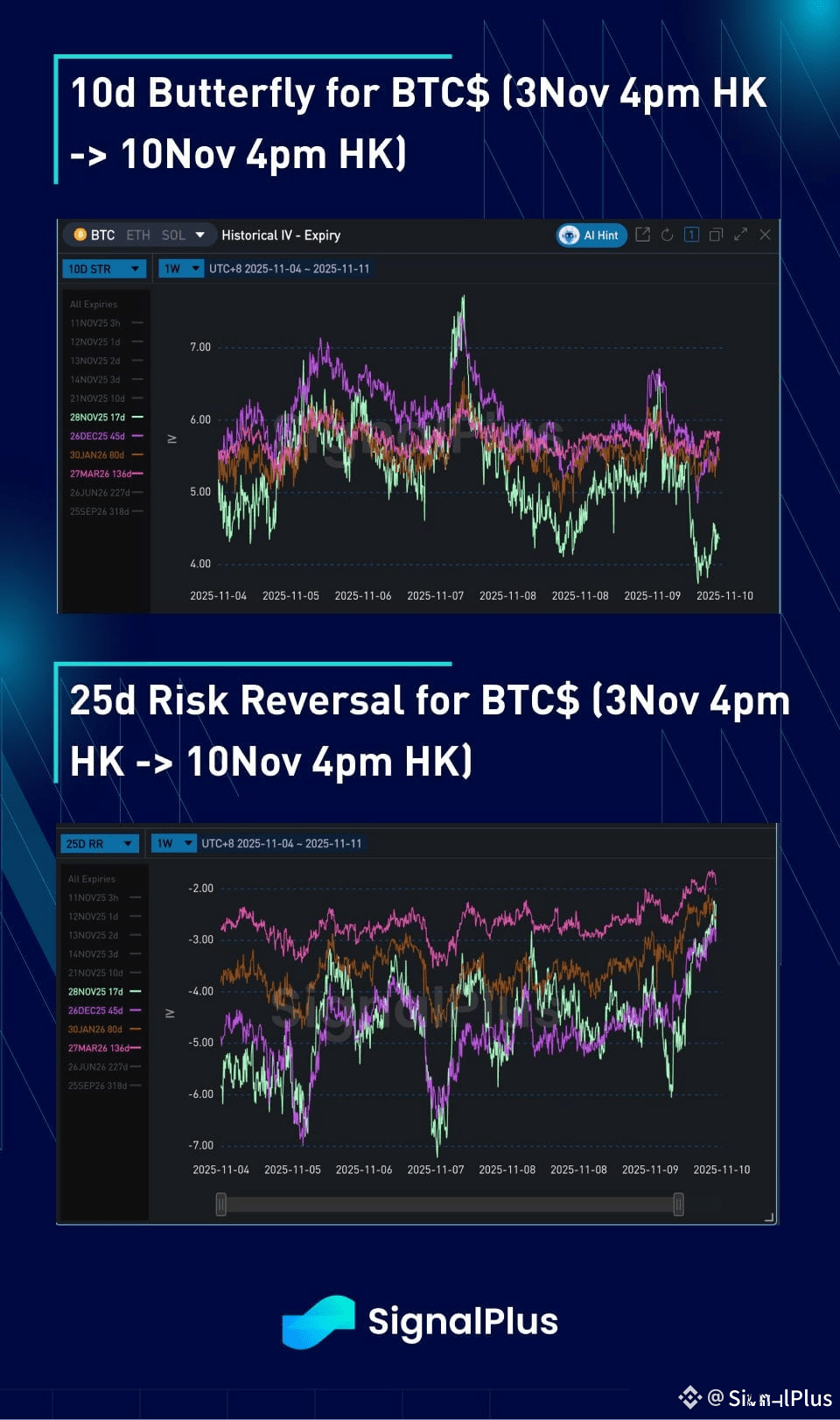

BTC$ Skew/Convexity

Skew prices broadly moved deeper for puts on the break of $100k but having found decent support there and then exhibiting a quick relief rally on the US govt shutdown lifting over the weekend, skew prices began to move less deep for puts as tactical call buyers emerged. Structurally the spot-vol correlation remains clear (higher implied/realised vol on lower spot) as BTC becomes more correlated with traditional equity/risky assets in this behaviour

Convexity prices moved lower as spot retraced into the broad $104–112k range, after a brief visit below $100k. Vol of vol remains high but ultimately the market seems to be finding equilibrium at this newer price range for now having tested and found strong support at $98–100k, any material break of $98–117k broad range will trigger some repricing of risk reversals structurally and bring convexity back into play

Good luck for the week ahead!