In trading, demand and supply are the two main forces of the market. These forces determine whether the price of anything (like shares or crypto) will go up or down. The candles visible on the chart tell us the story of these forces.

Demand Zone: This is the area where buyers are very high. When the price reaches this place, people quickly start buying, which drives the price up. Just like when the demand for something increases significantly, its price goes up.

Supply Zone: This is the area where sellers are more prevalent. When the price reaches this area, people quickly start selling, causing the price to drop. Just like when the supply of something increases significantly, its price falls.

First important point: The magic of the demand zone.

Your point: "When a demand or supply is formed, if the price comes back down in the next candle, it still pumps back up."

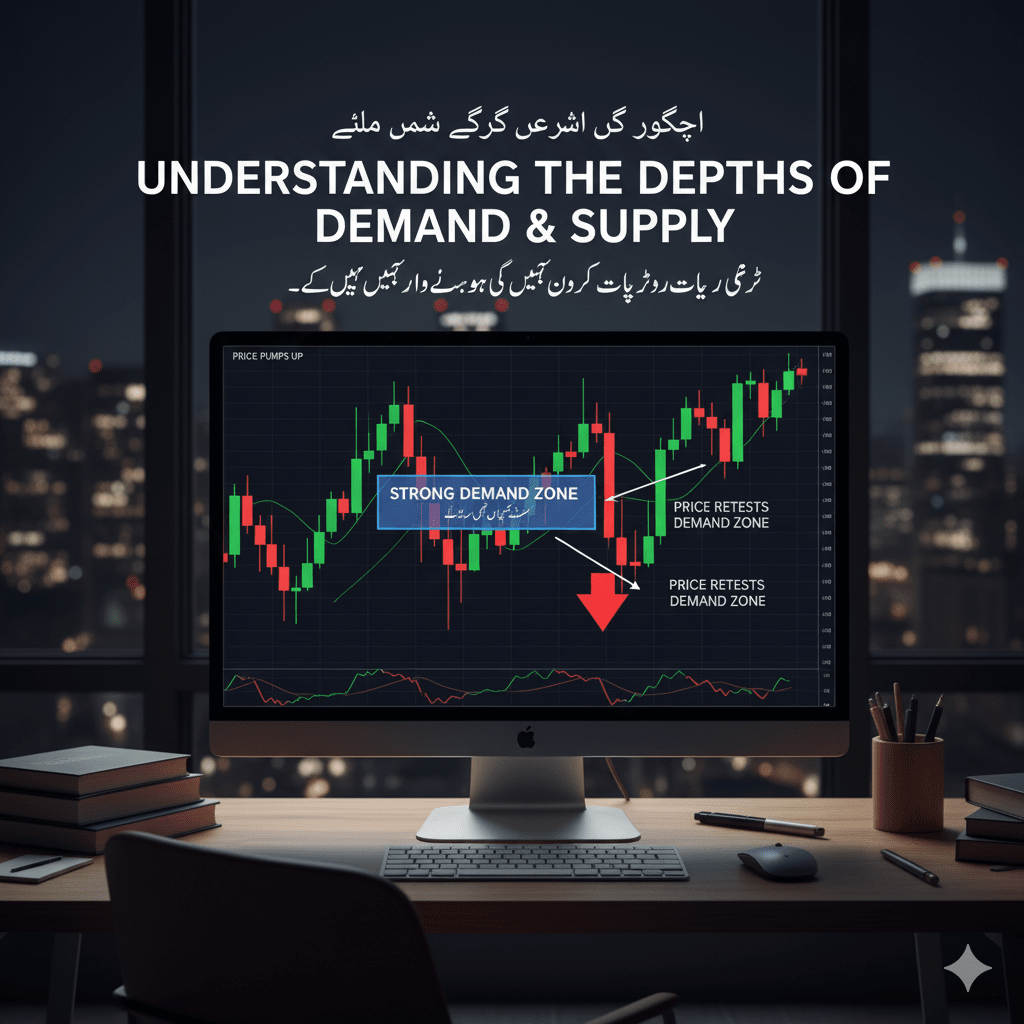

Simple explanation: Suppose that the price rose very quickly at a specific point. It became a strong demand zone (as shown in the picture "Strong Demand Zone"). This means that large buyers had made a lot of buying and selling there.

If, for some reason, the price comes back down in the same demand zone after a while (as shown in "Price Retests Demand Zone"), then large buyers (those who invest more money) become active again. They find this price attractive and start buying again. This causes the price to shoot up strongly again, which is called "Price Pumps Up." They want the price not to fall below this important level.

See the image: