If you are still not familiar with $CLANKER , please read the full text

If you have already understood $CLANKER , please jump directly to the 'My view on Clanker' section

What is Clanker?

Clanker is an AI-driven token launch platform on the Base chain, starting in November 2024, enabling one-click token deployment through Farcaster social integration, and shifting to a buyback and burn mechanism after being acquired by Farcaster in October 2025.

Many core asset targets on Base have been created on the Clanker platform, such as BNKR and Noice. BNKR supports Twitter users to deploy tokens with one click, and its underlying technology is also based on Clanker, which means that since the birth of BNKR, Clanker has simultaneously supported one-click token issuance on both Farcaster and Twitter.

Historical changes and core turning points

Clanker was born in November 2024

Early development (end of 2024 to early 2025)

December 2024: The core platform goes live on the Base chain, enabling automatic ERC-20 deployment and creation of Uniswap V3 liquidity pools

Early 2025: Expansion to Arbitrum for multi-chain support, integrating creator reward mechanisms

March 2025: An early developer was exposed for having participated in a scam startup project, and this developer announced their exit from Clanker's subsequent development

April 2025: Gained support from major exchanges (April 23rd for Coinbase spot listing, April 28th for Bybit perpetual contracts)

August 2025: The well-known wallet Rainbow issued a buyout offer for Clanker on Twitter, which was rejected by the developer

Key turning point (October 24, 2025) Farcaster officially acquires Clanker, leading to a qualitative change in Clanker

All protocol fees are directed towards $CLANKER buybacks (67% for direct buybacks, 33% reserved for potential future tax issues)

About 7% of the supply is locked in one-sided liquidity pools

Transitioning from an independent tool to a core function of Farcaster

All non-ETH tokens collected by Clanker historically have been burned in one go, and tokens like Bnkr and Noice have also undergone a one-time deflation.

Now:

November 12, 2025: Binance contract goes live

Fundamental data

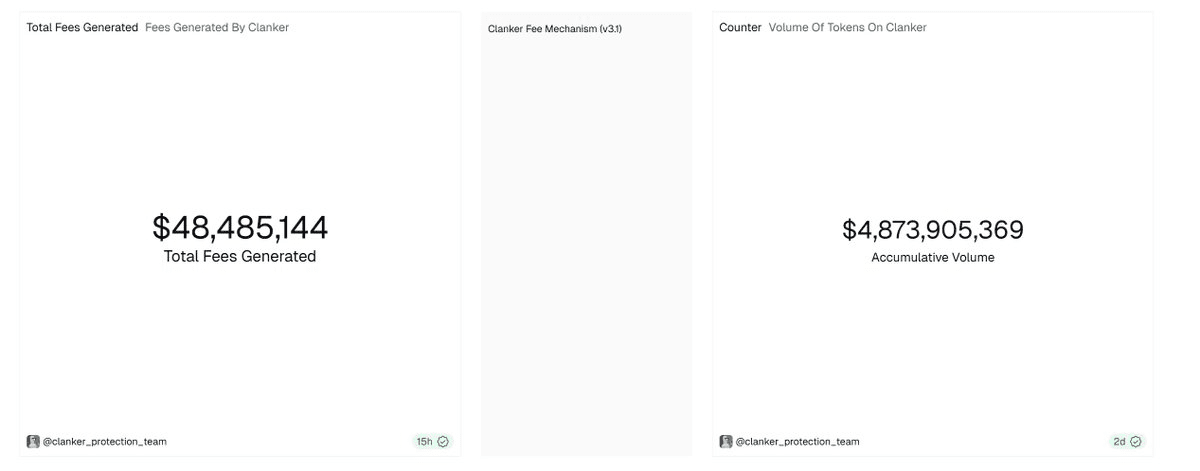

In the year following its release, Clanker recorded a total trading volume of 4,873,905,369 U and collected 48,485,144 U in protocol fees (note that part of the fees were collected in project tokens, and about 40% of it was creator revenue).

Due to Clanker's historical upgrades and fee adjustments, it is currently difficult to estimate its actual revenue from the past year. However, since Farcaster acquired Clanker, we have a new data source:

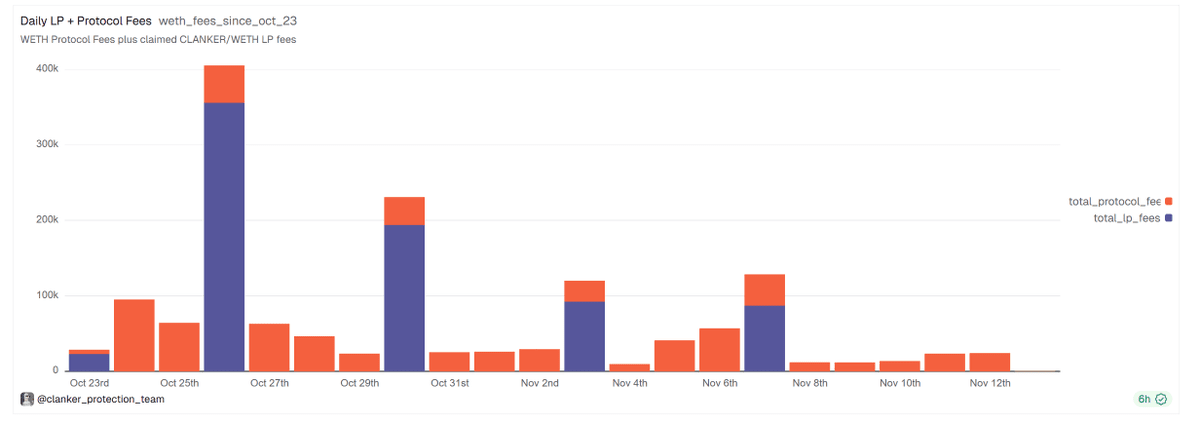

Between October 23 and November 13, over 20 days, Clanker's protocol revenue was approximately 1.58 million. The annualized revenue is about 28.8 million. Of this, 2/3 will be directly used for buybacks of Clanker, leading to an estimated annual buyback amount of 19.22 million.

And it should be noted that over the past 20 days we have almost experienced one of the most dismal times this year in Crypto, only second to April. Overall, the on-chain activity has been quite dull. Using the data from the past 20 days to estimate Clanker's revenue for the entire upcoming year is actually relatively underestimated.

My view on Clanker

Not just buybacks

Many people focus only on the changes in revenue buybacks regarding Farcaster's acquisition of Clanker, but more importantly, it is Farcaster itself.

Never underestimate Farcaster, as it once gave birth to a project valued at over 1 billion — Degen

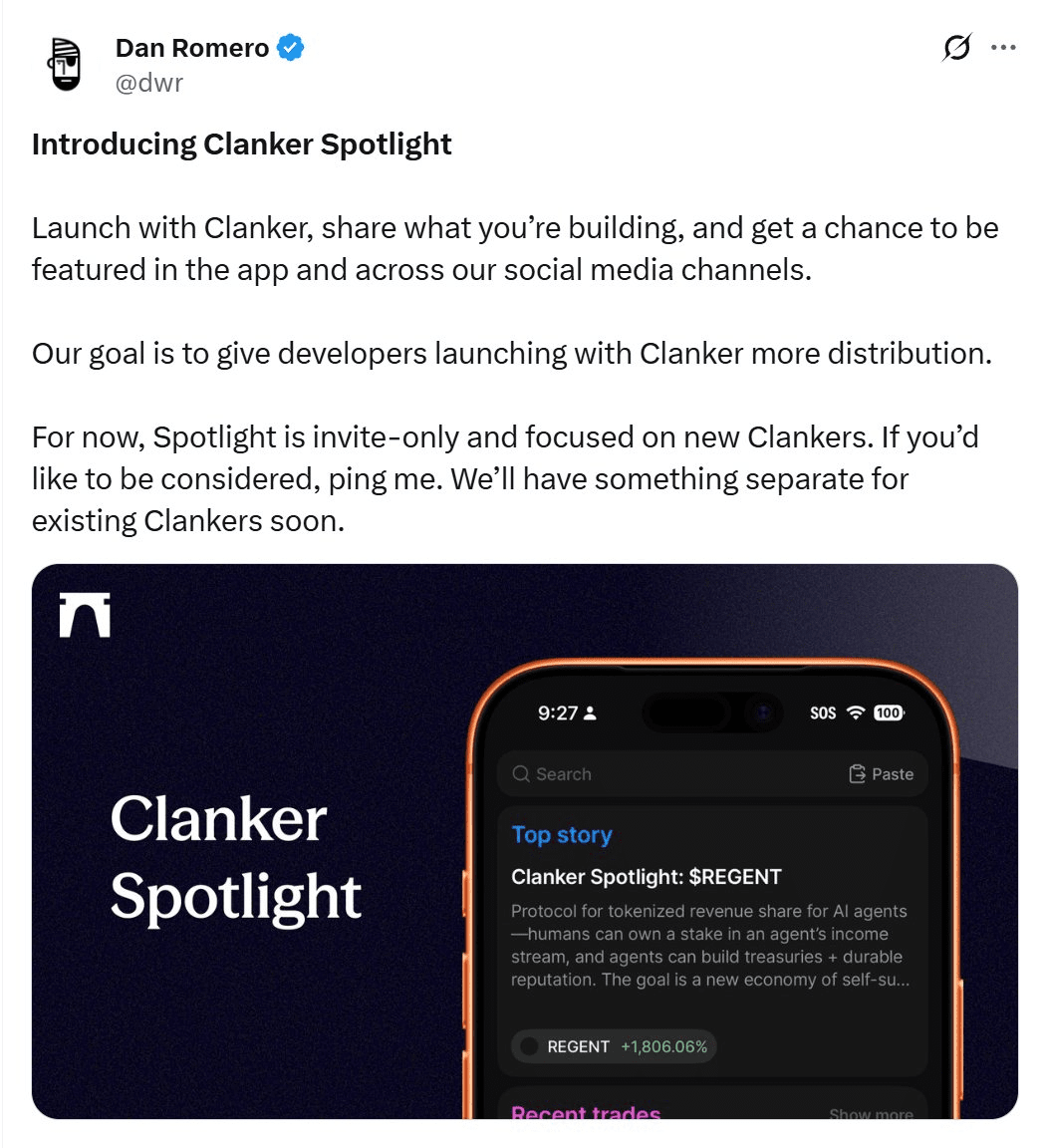

Farcaster has brought Clanker far more than just changes in token economics. Within a week of Clanker's acquisition, Farcaster launched the Clanker spotlight feature to provide a high-exposure advertising space within the app for quality projects launched on Clanker.

There are too many projects that allow one-click token issuance, and Launchpad has become completely non-scarce today. All platforms need to ask themselves one question, WHY YOU? Why would good DEV choose your platform to issue tokens? Clanker and Farcaster provide the best answers.

No exposure? Farcaster gives you the best advertising space

Disappointed that you can't make money? The highest fees give you 80%, and you don't take a dime from the fees of your own project token, Clanker.

Finally, many people may not have noticed that the recent official updates from Clanker have been personally updated by @dwr. You can understand that the current developer of Clanker is @dwr

The best Proxy in the Base ecosystem

As someone who has long been deeply involved in the Base ecosystem but uses the UTC+8 biological clock, the biggest pain point is actually missing out on the earliest projects on Base, because projects on Base often do not emerge from Twitter, but from the early hours on Farcaster, and sometimes project information is very chaotic. For example, early tokens like $noice and $fair are very difficult to position early unless you are full-time on Base.

But now, with the introduction of the buyback mechanism, Clanker has become the best target to capture these early opportunities. Because the fees contributed by these tokens will ultimately be returned to Clanker holders.

If previously 80% of the tokens on Farcaster were issued by Clanker, today after Clanker was acquired, that probability has almost risen to 99%. If you don't want to mix in the Base community and don't want to stay up all night to monitor the market, Clanker can be said to be the best β.

Extreme safety margin

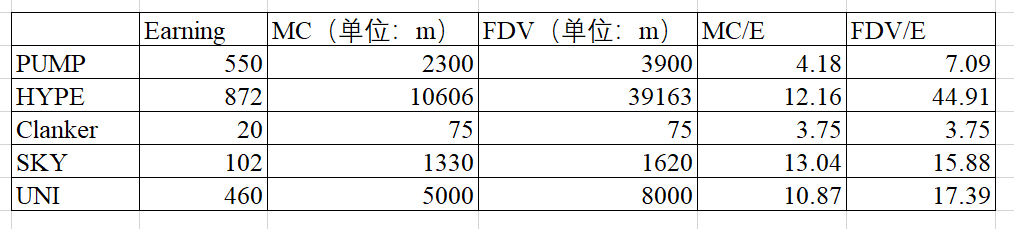

As mentioned earlier, Clanker is expected to buy back about 20 million tokens in a year, while the current fully circulating valuation of Clanker is only 75 million. The corresponding PE is 3.75. 7% of the tokens held by the project team have already been permanently locked in the LP.

Let's take a look at the valuations of projects that currently have revenue and buybacks:

Clanker is the lowest valued target among them, and it is fully circulating, with no project team dumping, and no situation where the project team buys and sells at the same time.

Of course, buybacks and low valuations only guarantee Clanker's lower limit; we still have many future catalysts for Clanker to look forward to:

Farcaster token issuance

Base token issuance

Clanker listed on Binance spot

The on-chain ecosystem is thriving again

Conclusion

Perhaps months later when we look back, we will be grateful for this darkest moment in the crypto space, as the lack of liquidity and low sentiment gave us the perfect opportunity to buy the dip $CLANKER .

If you are optimistic about the BASE ecosystem, then you can buy Clanker

If you are optimistic about the Farcaster ecosystem, then you can buy Clanker

If you still believe in fundamentals, then you can buy Clanker

If you think the number of tokens issued in the future will continue to increase, then you can buy Clanker

Of course, there are many risks, the competition for Launchpad is fierce, and just look at this year's pump and bonk to know whether it will directly enter a bear market cycle of four years, I'm not sure, but I have already made my biggest bet in the second half of this year. Once you buy, hold. DYOR