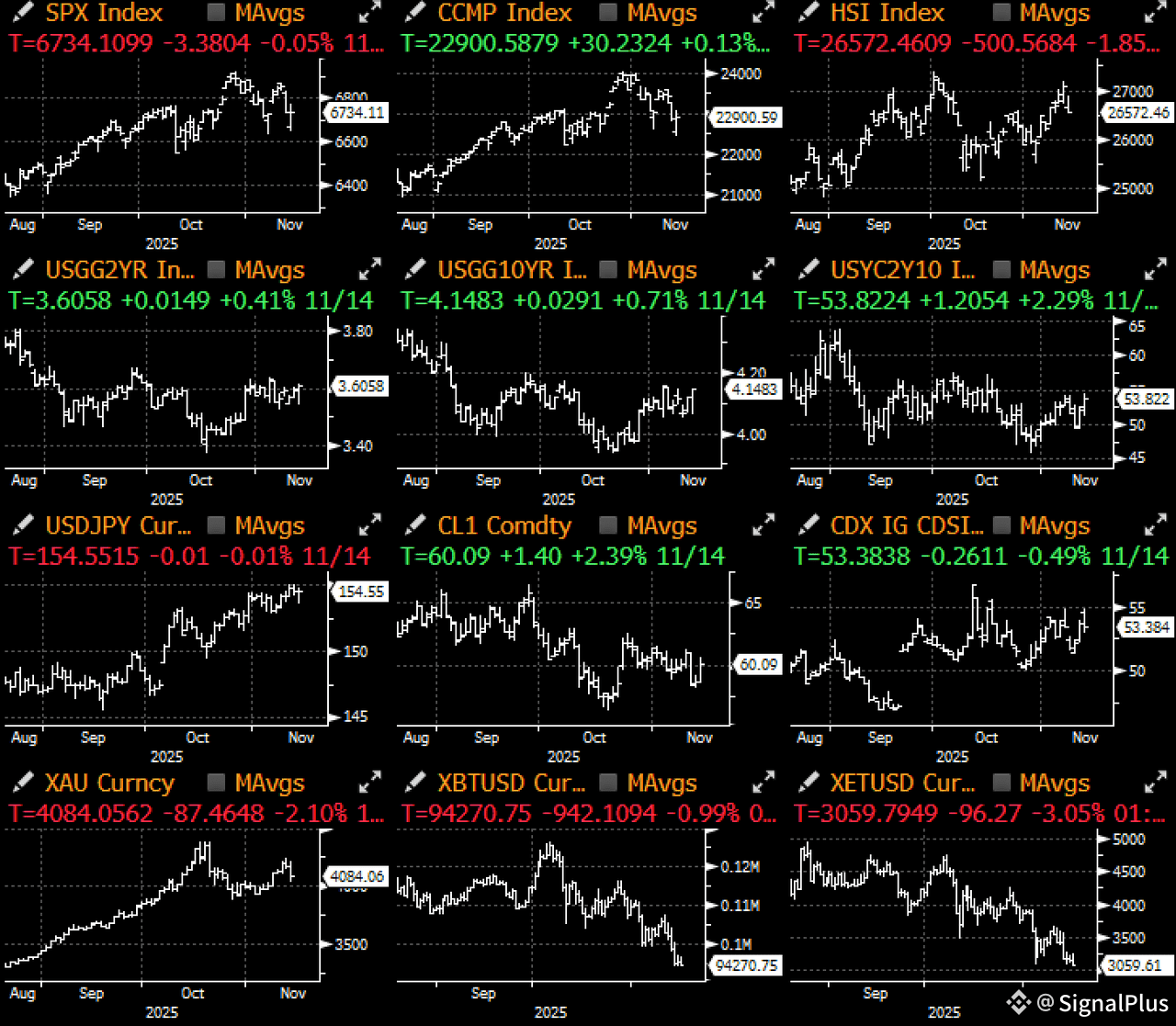

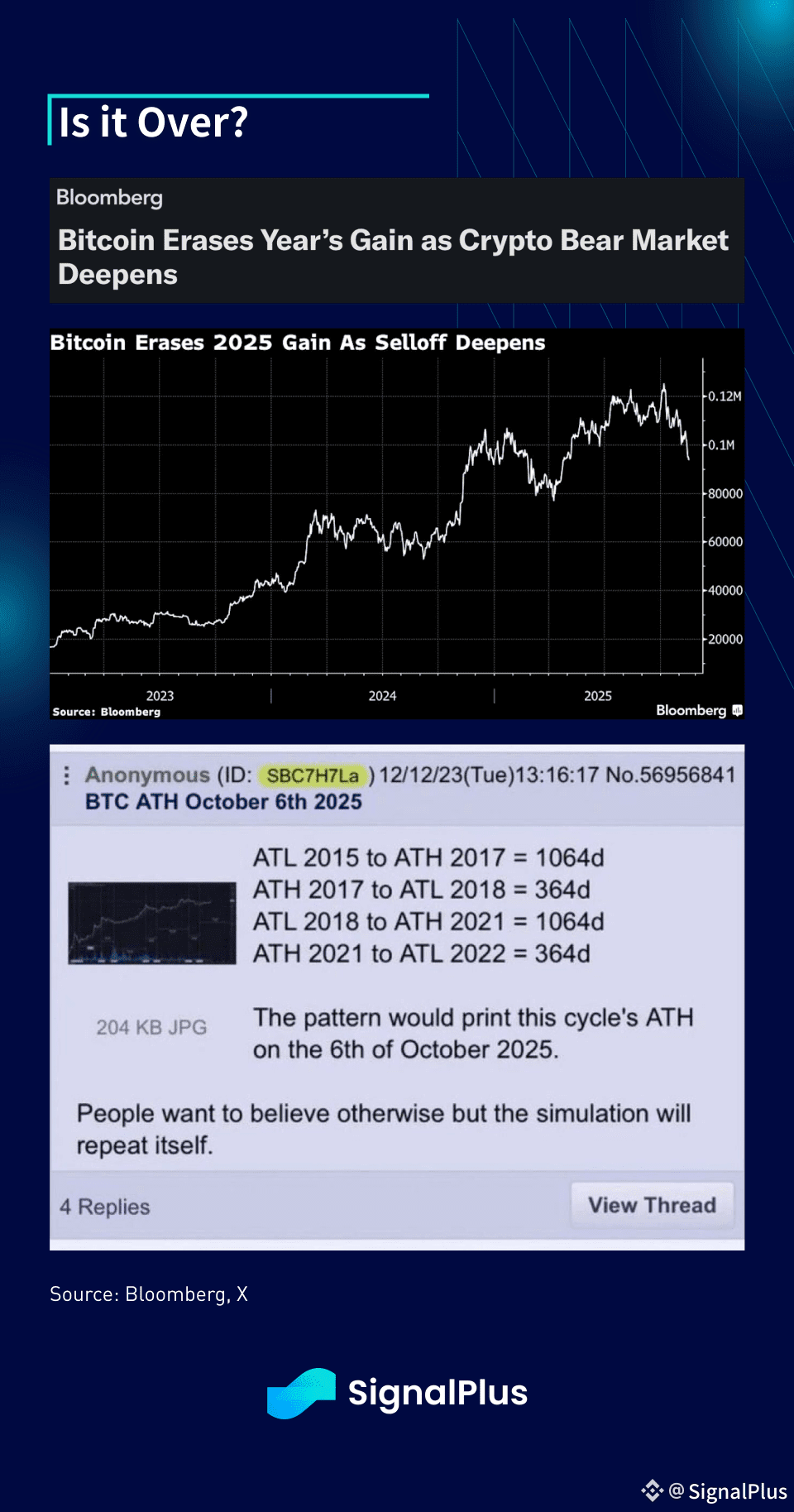

Crypto prices faltered again the past week with BTC touching $94k on the back of a thin Monday selloff, with the majors selling off another 10–20% on a week-on-week basis, and native sentiment as pessimistic as it’s ever been, including the prior bear markets. While macro headwinds could be excused for driving part of the sell-off, crypto has legitimately underperformed most other asset classes, including levered tech stocks, which they have been most tightly correlated with.

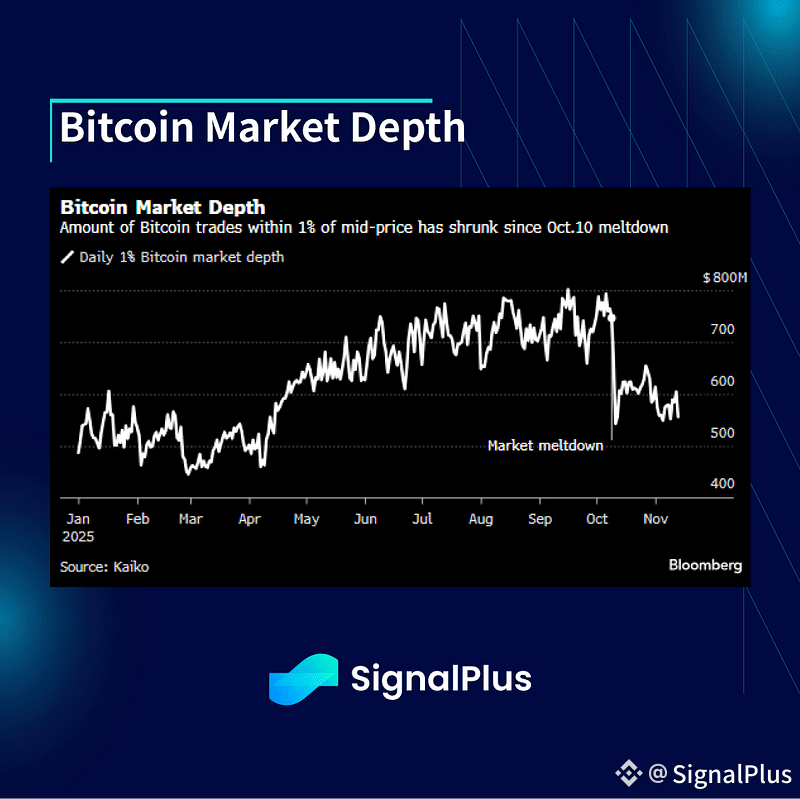

Furthermore, post the October meltdown, persistent rumors of significant market maker losses have led to a significant drop in order book liquidity, exacerbating market moves and particularly to the downside.

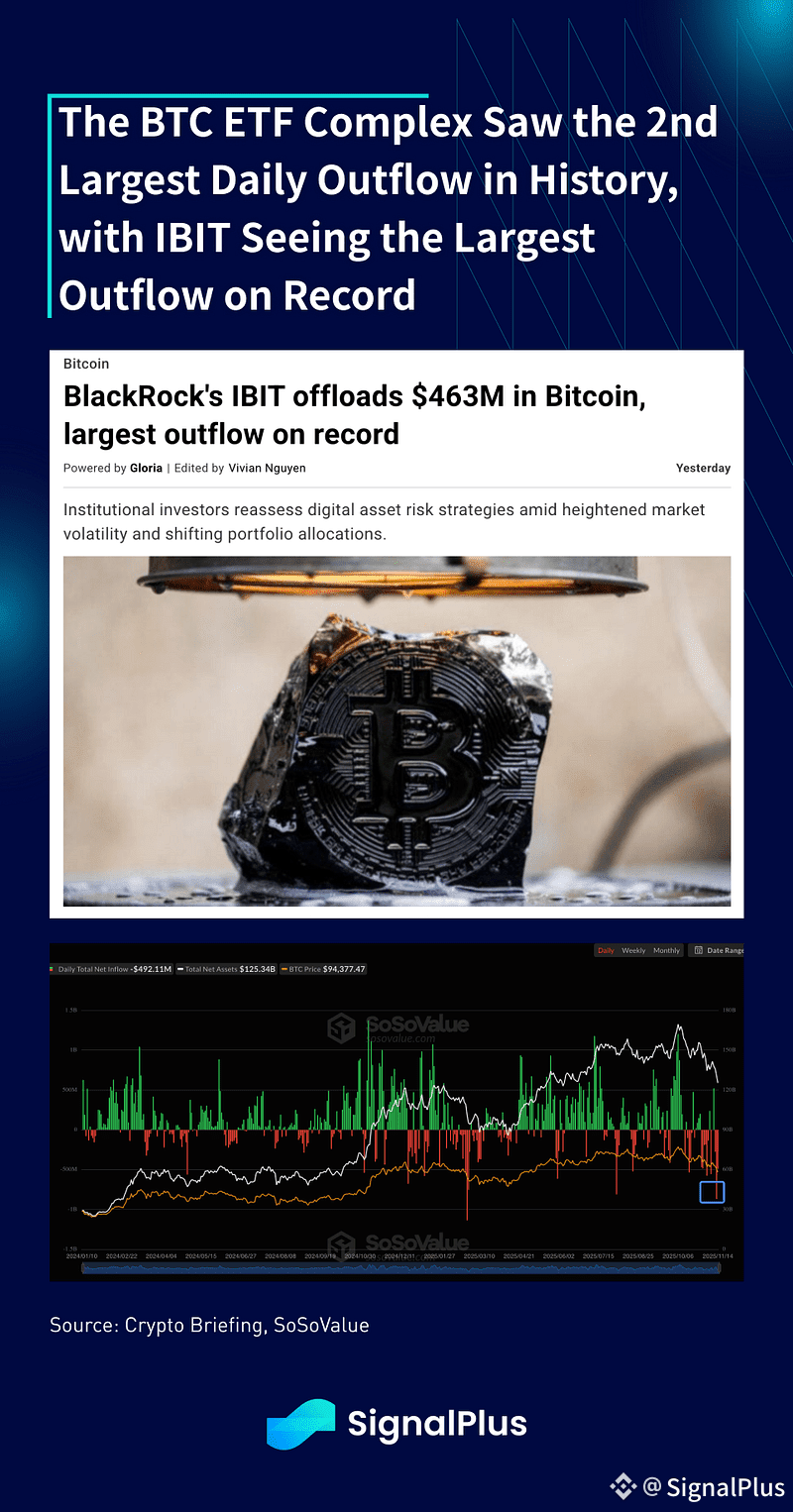

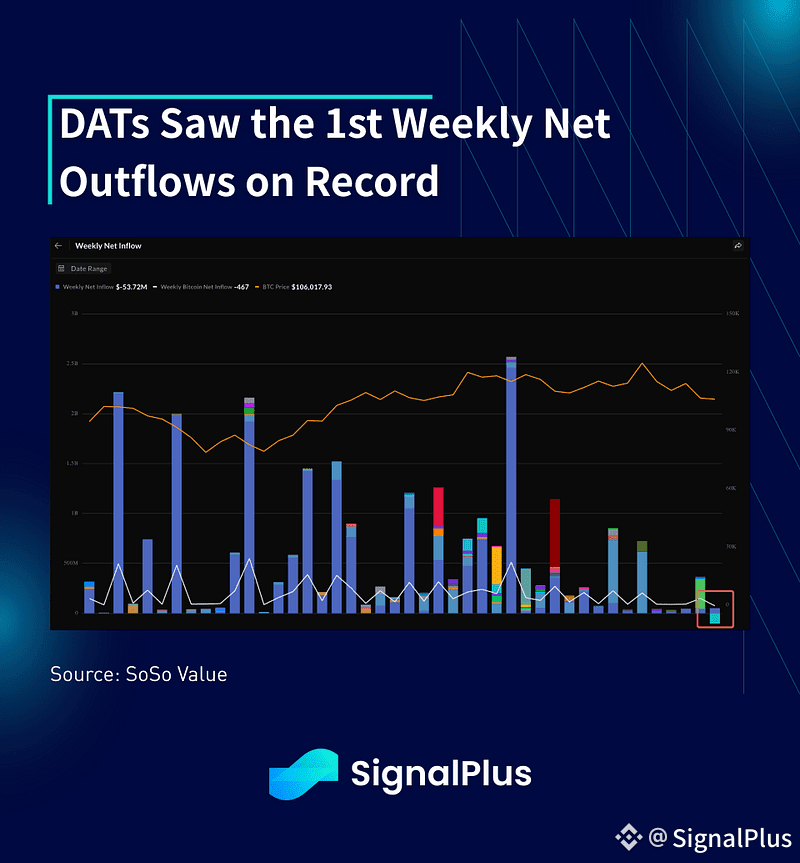

Unsurprisingly, we’ve seen rapid deleveraging and real money outflows across the entire crypto complex. Significant CEX futures liquidations are followed by YTD highs in ETF outflows and DAT sales, with Blackrock’s IBIT seeing a single day record of -$463M in sales and DATs also seeing the first weekly outflows since inception.

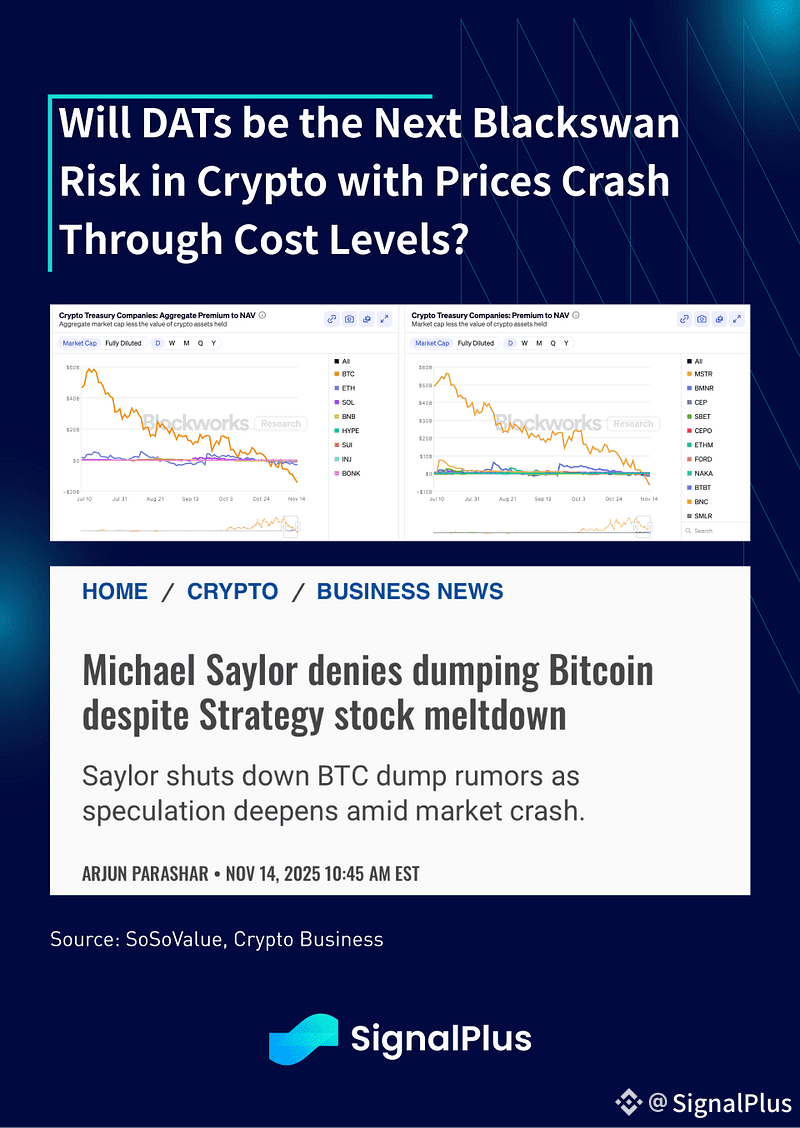

The persistent sales have led to a collapse in DAT premium to negative territory, sparking concerns of treasury sales as companies dispose of assets to support the falling equity market cap. MSTR is obviously the elephant in the room, though Saylor was quick to publicly deny any sale shennigans, but the final verdict might be yet to be seen.

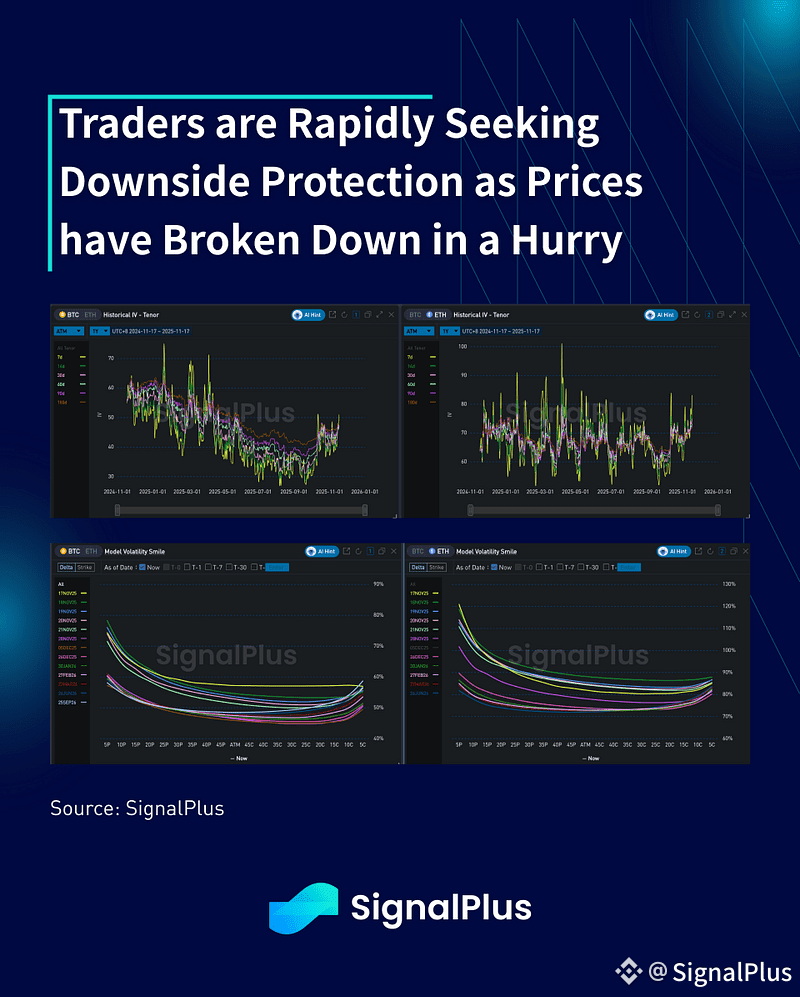

After a long period of doldrum, both realized and implied volatility have perked up as prices crashed through bull cycle ranges. In particular, put skews remain bid especially for ETH, where real money support less supportive than BTC, opening concerns for sharper downsides.

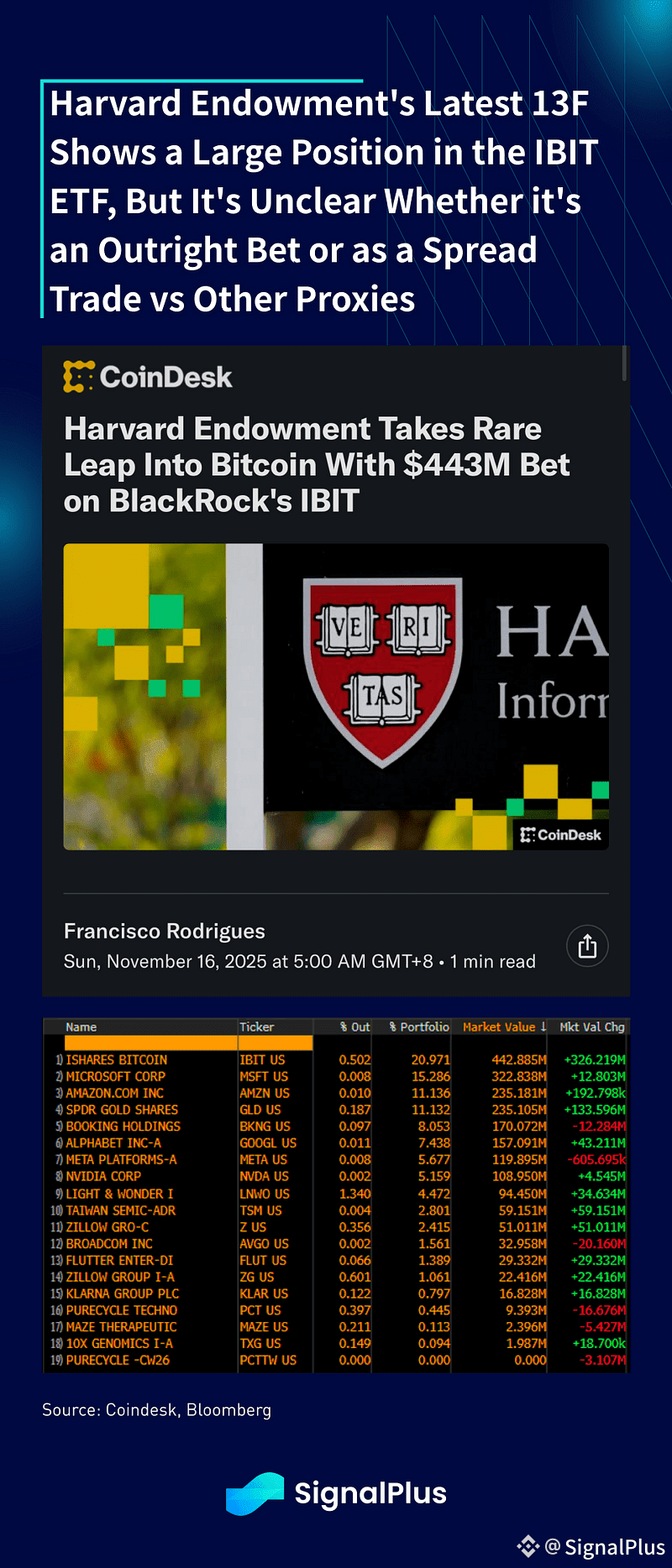

Amidst all the doom and gloom, have there been any good news out of the space as of late? Outside of the recent Square announcement that they have recently started to accept Bitcoin payments for their merchants, the latest 13F filings have also shown that the Harvard Endowment ($57B AUM) now has a $443M position in IBIT, their largest single equity holding in the portfolio. But before everyone gets too excited, it is unclear that if the position is an outright long or as a spread/arbitrage trade vs DATs or other crypto proxy. We lean towards the latter, but it’s still good to see that TradFi real money accounts are at least becoming more active participants in this space, even if it’s not just a pure long exposure.

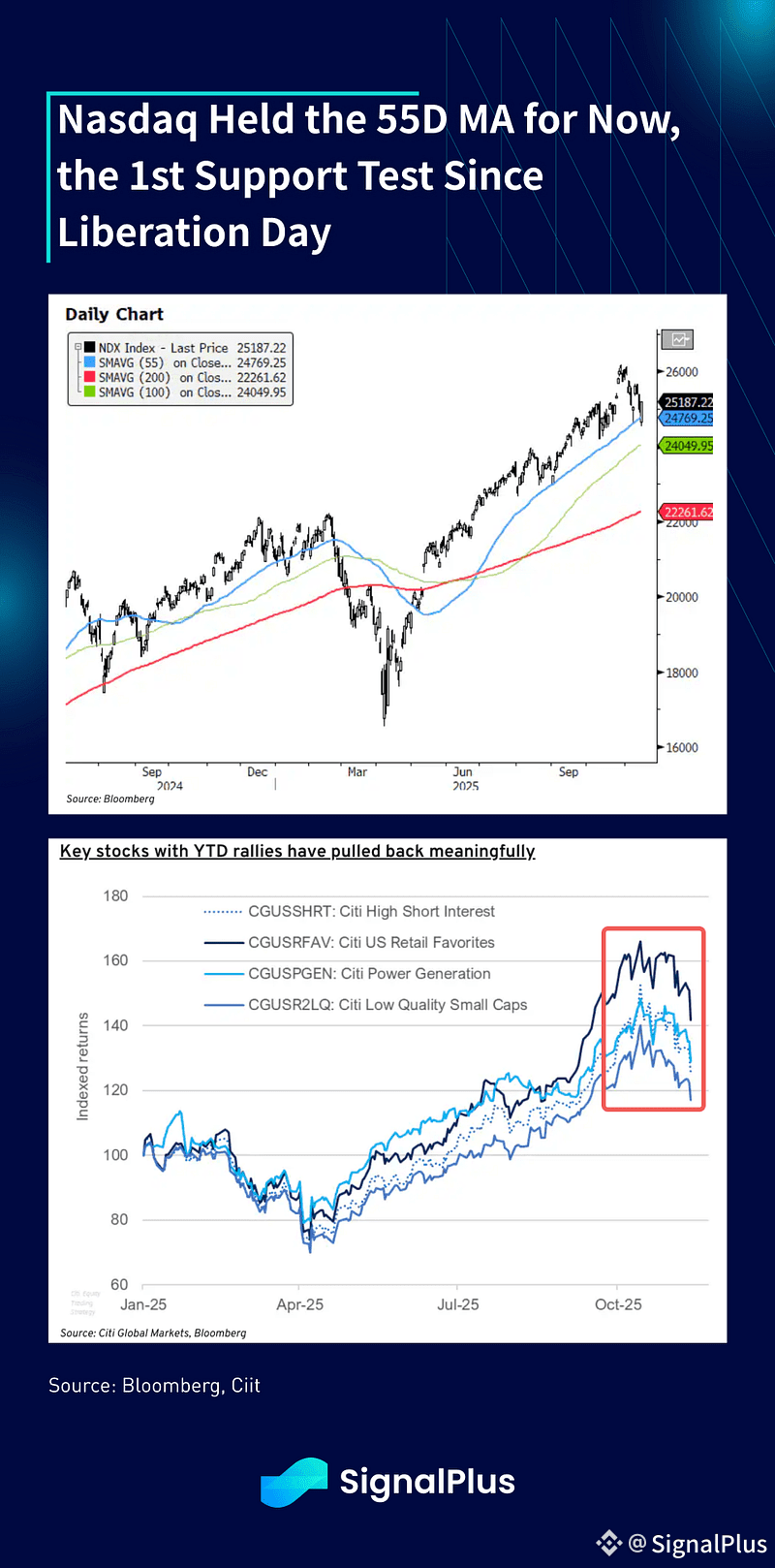

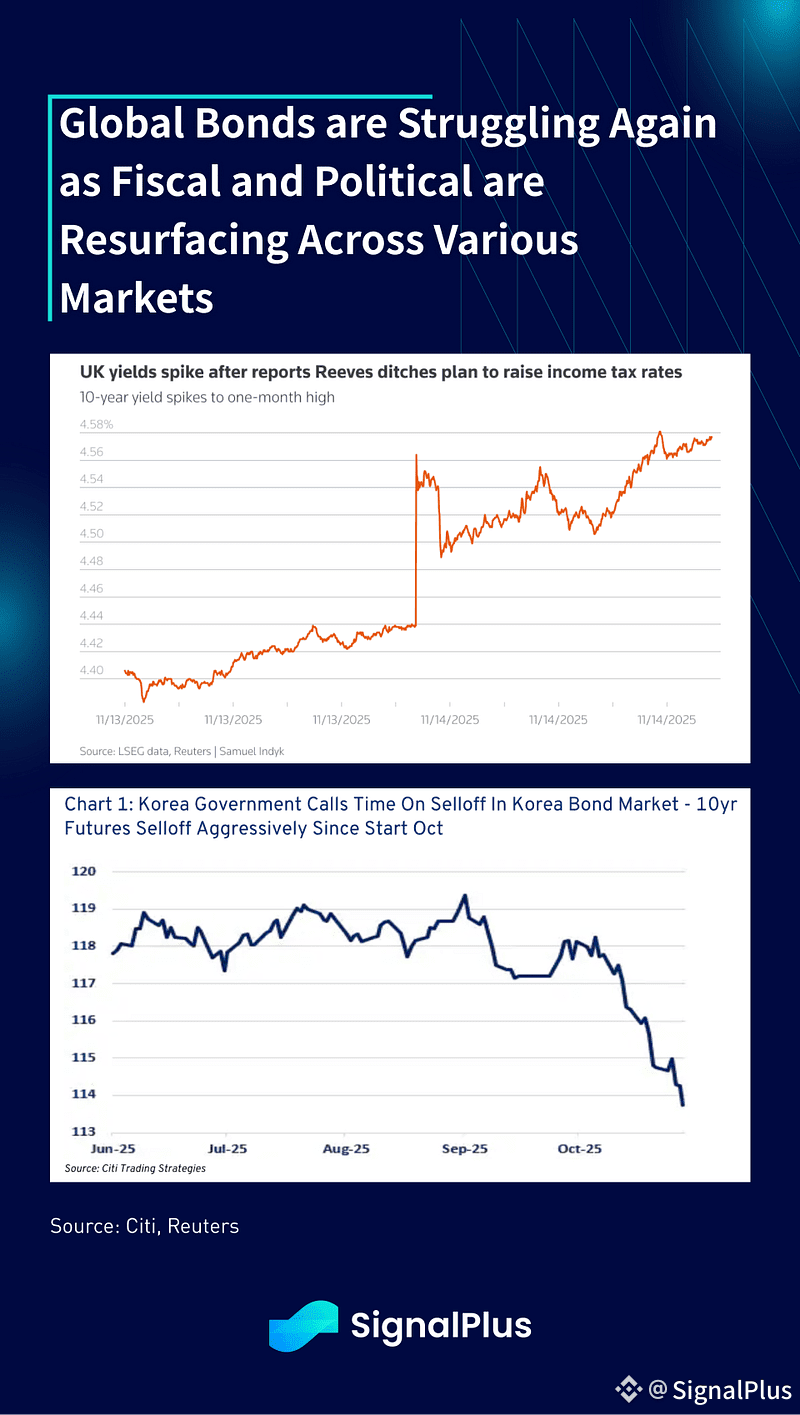

Back on macro, US stocks shook off a shaky start despite a -3.8% sell off in the KOSPI and an early -2% swoon in the Nasdaq to close positive on the session while holding its 55d moving average support. Fixed income has also been under stress with Japan, Korea, and UK bonds all under pressure due to brewing fiscal / political concerns, with US treasuries facing similar headwinds as yields have reversed higher.

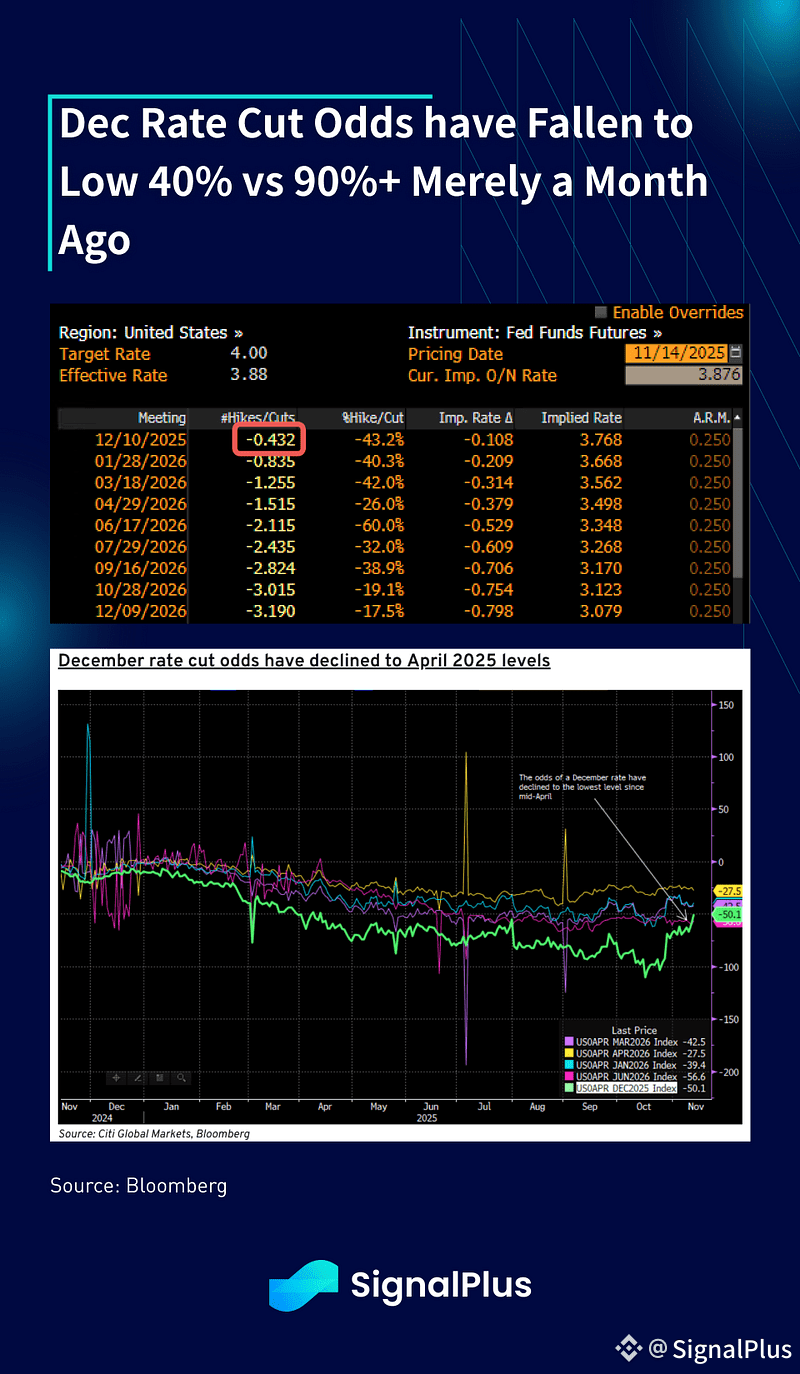

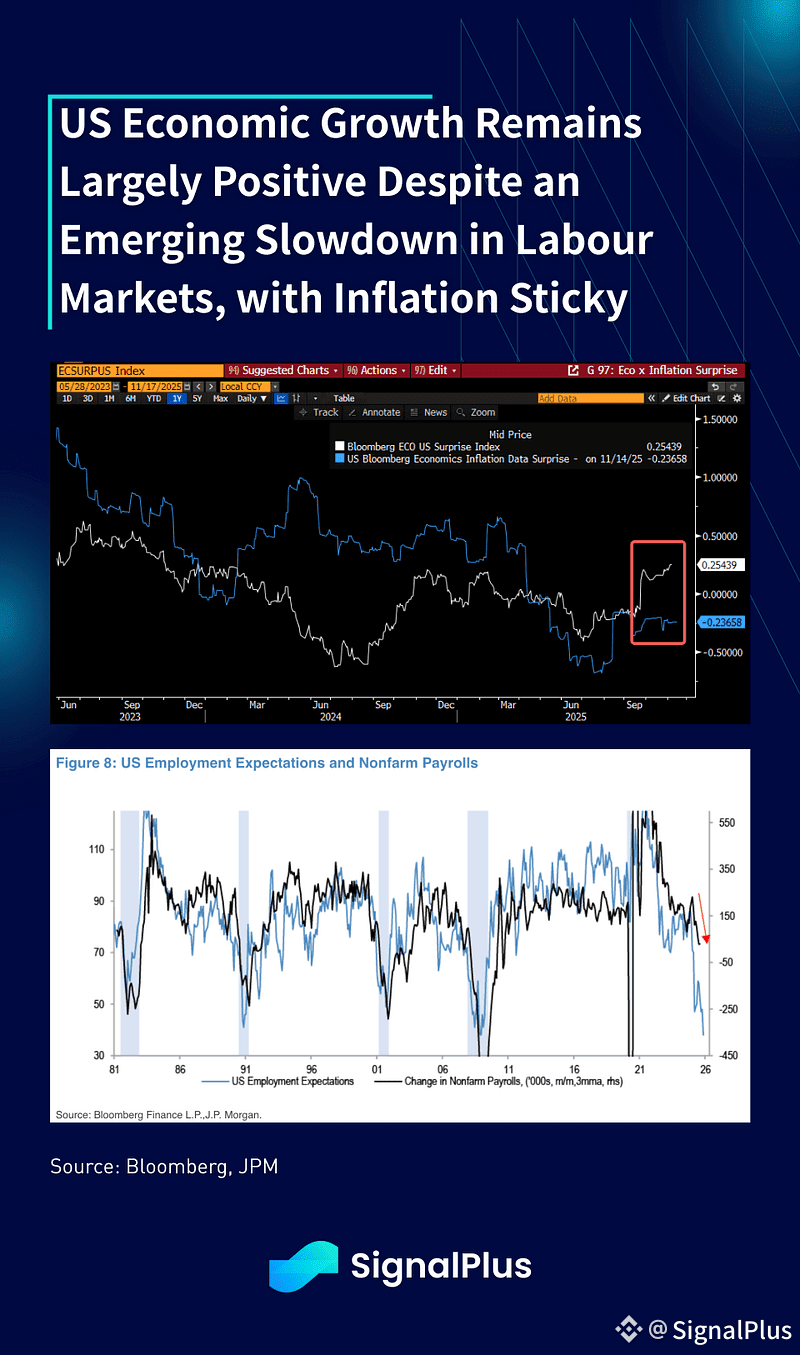

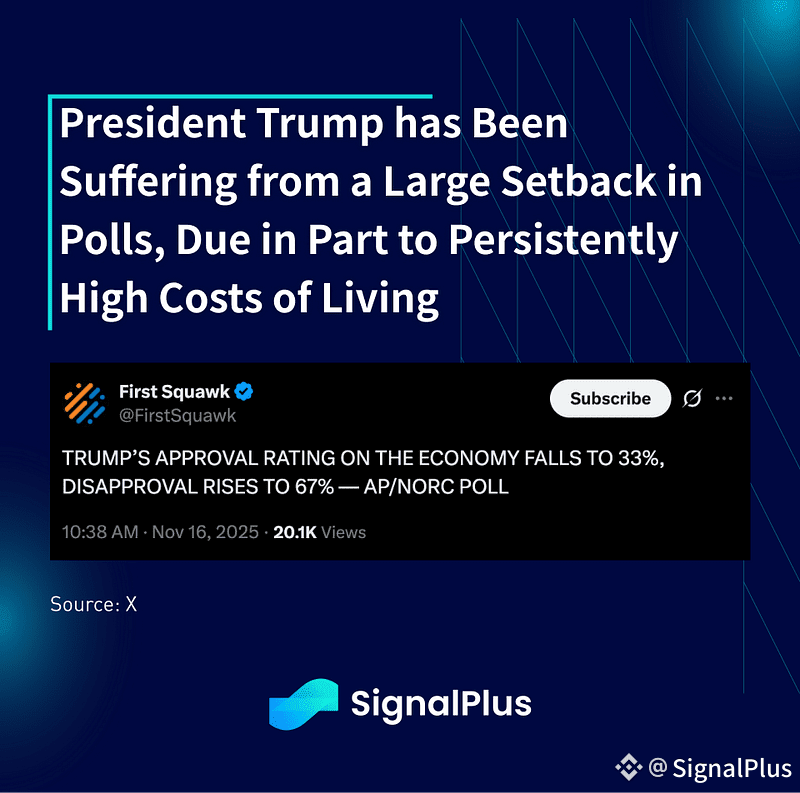

Over in the US, December rate cut odds have fallen towards 40% as Fed officials have been coming out in force to manage down easing spectations, with the US economy still largely holding in despite some concerns over the labour market. The biggest worry remains with inflation, where President Trump has recently suffered a significant setback in polls given high inflation and rising cost of living concerns, with former Treasury Secretary and Fed Chair Yellen declaring that the US is “in danger of becoming a banana republic”.

Fed Officials have Been Explicit in Managing Down Easing Expectations, with Former Chair Yellen Proclaiming the US Being in Danger of Being a “Banana Republic”

“It’s not obvious that monetary policy should be doing more right now,” — Cleveland Fed President Hammack

“As I look to the December meeting, I think it would be hard to support another rate cut unless we were to get convincing evidence that inflation is really coming down faster than my expectations or that we were seeing more than the gradual cooling that we’ve been seeing in the labor market.” — Dallas Fed President Logan

“I do not think further cuts in interest rates will do much to patch over any cracks in the labor market — stresses that more likely than not arise from structural changes in technology and immigration policy,” — Kanas City Fed President Schmid

Looking ahead, we’ll be keeping an eye out on a few things.

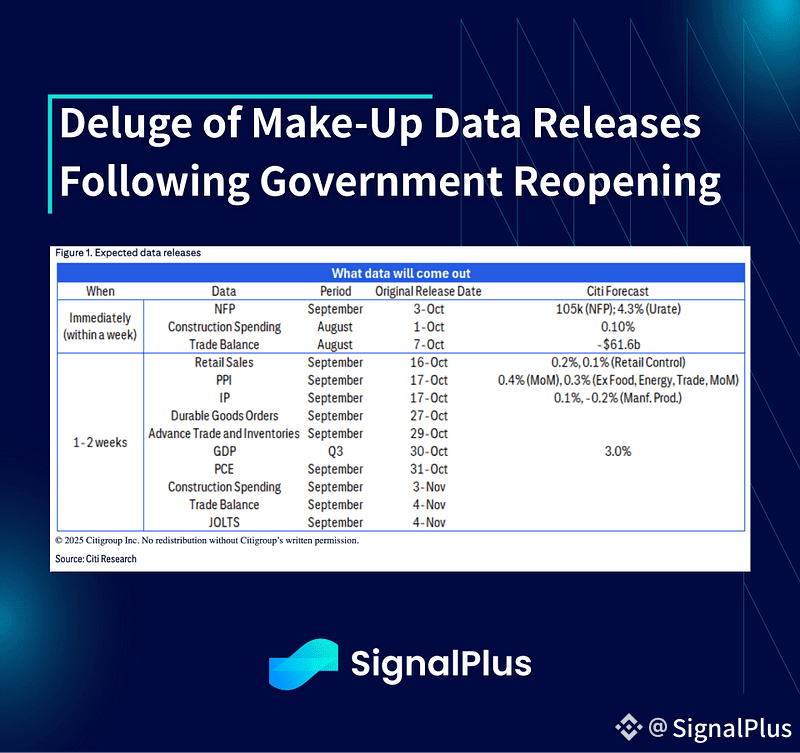

1.Deluge of Make-Up Data Releases Following Government Reopening

We expect rate cut expectations to be volatile over the next couple of weeks analysts begin to sift through a backlogged economic dataset

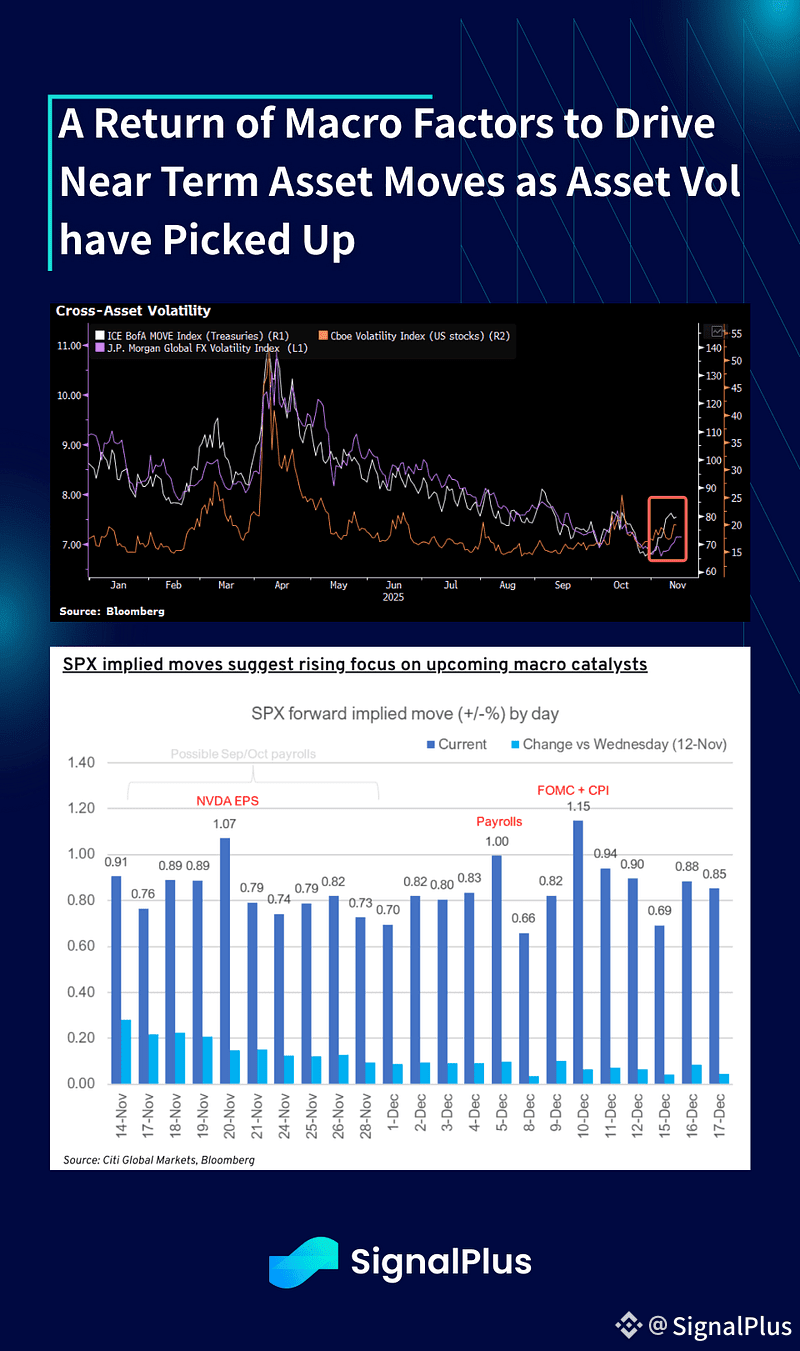

2. A Return of Macro Factors to Drive Near Term Asset Moves as Asset Vol have Picked Up

Cross-asset volatility has picked up as investors are focusing back economic growth with early stages of a labour slowdown against stubborn inflation

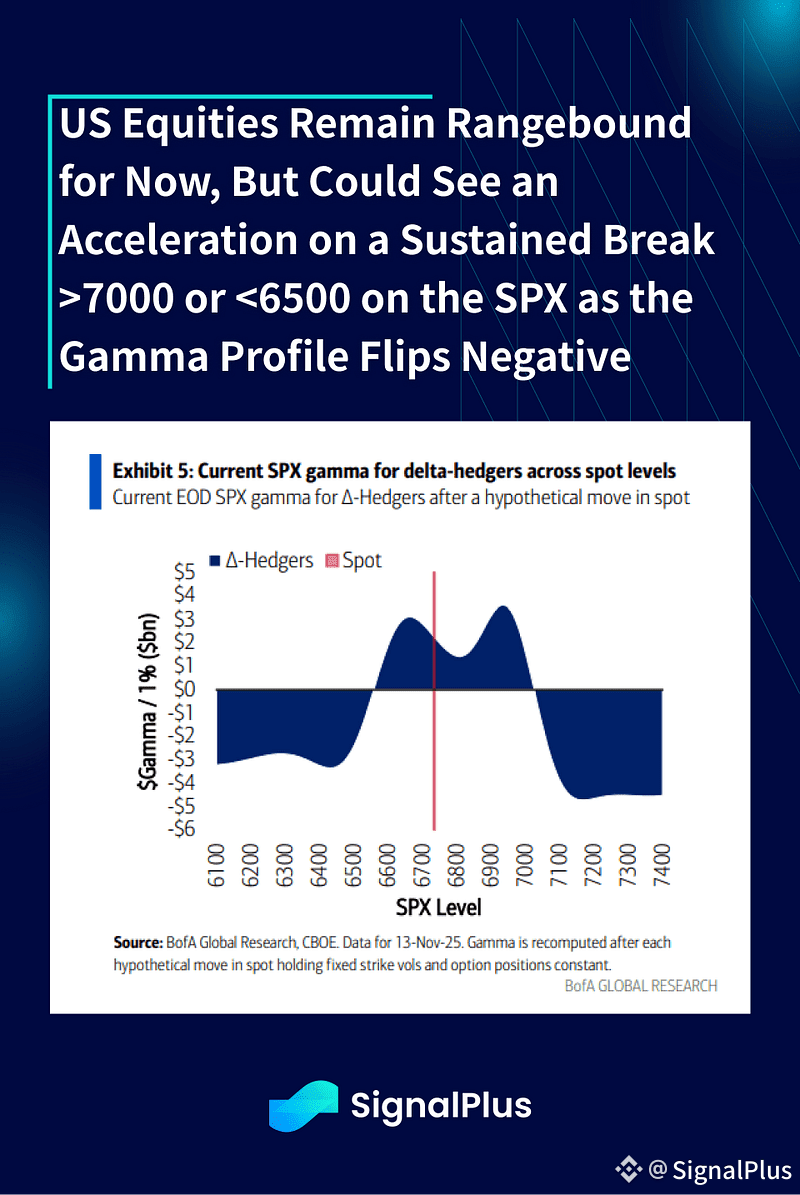

3. US Equities Remain Rangebound for Now, But Could See an Acceleration on a Sustained Break >7000 or <6500 on the SPX as the Gamma Profile Flips Negative

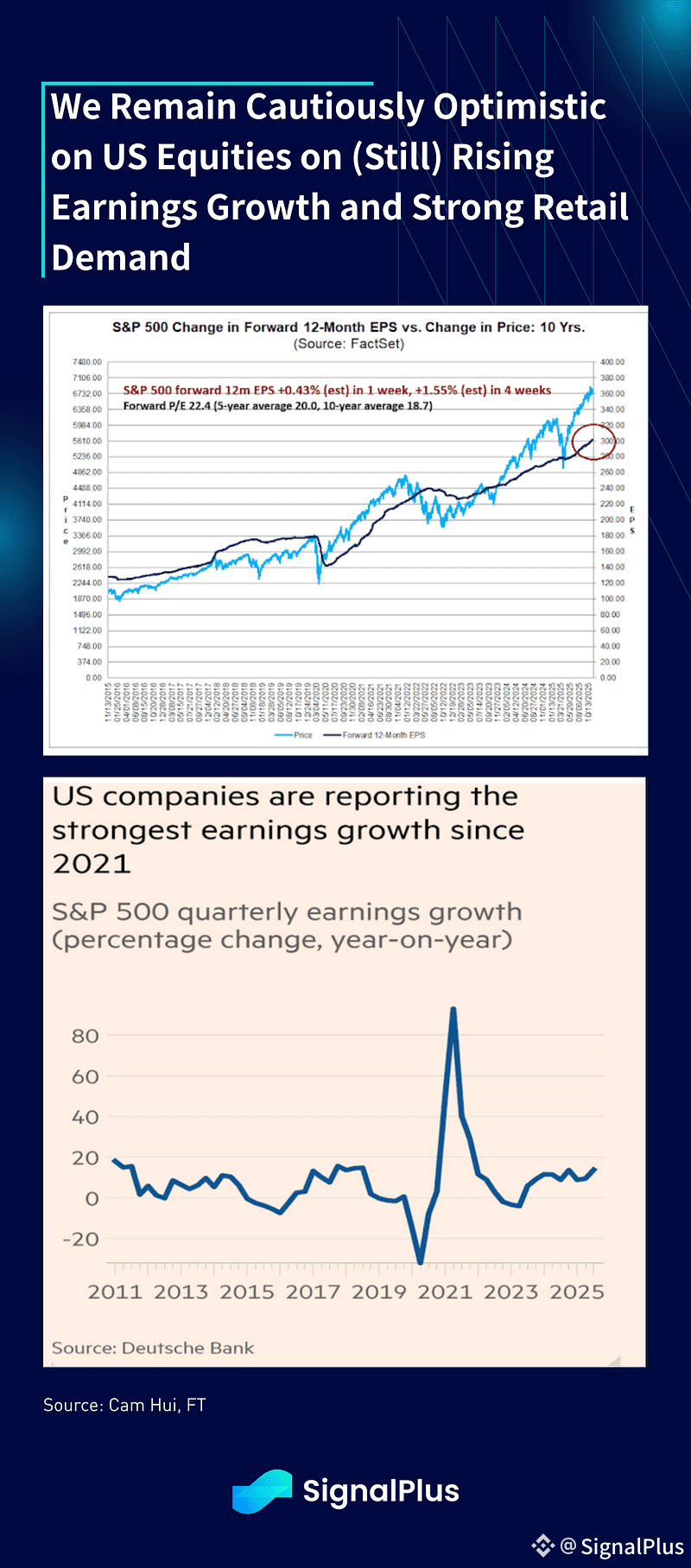

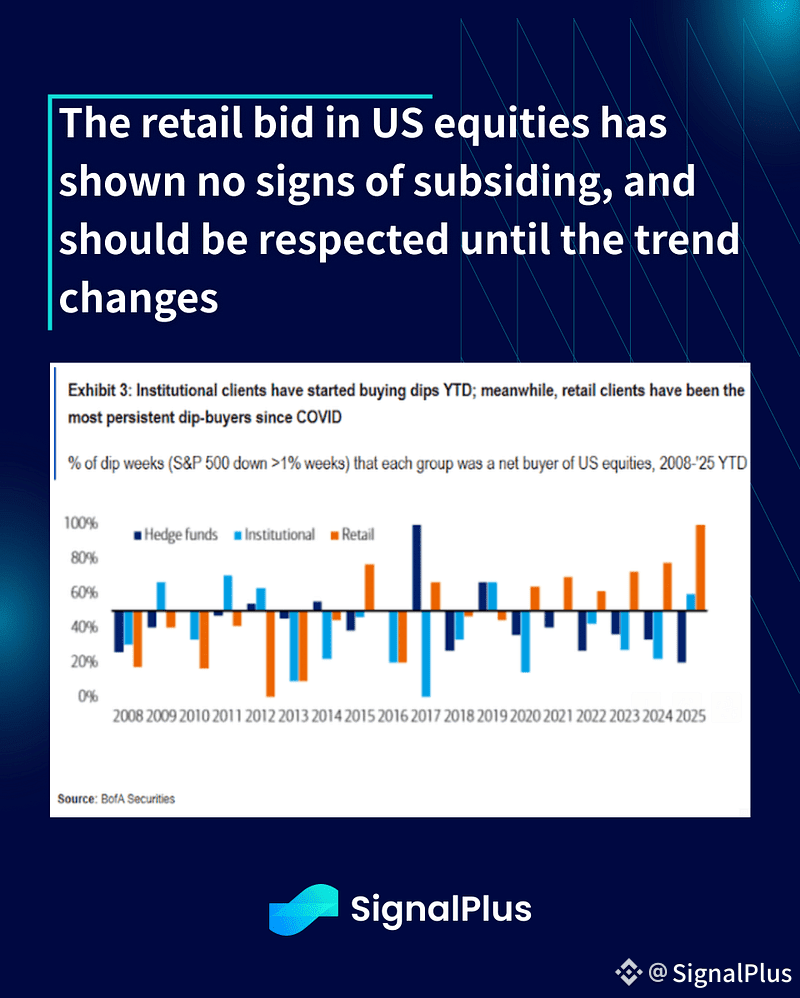

4. We Remain Cautiously Optimistic on US Equities on (Still) Rising Earnings Growth and Strong Retail Demand

While valuations are expensive, US corporate earnings growth remain at some of the highest levels in recent years

The retail bid in US equities has shown no signs of subsiding, and should be respected until the trend changes

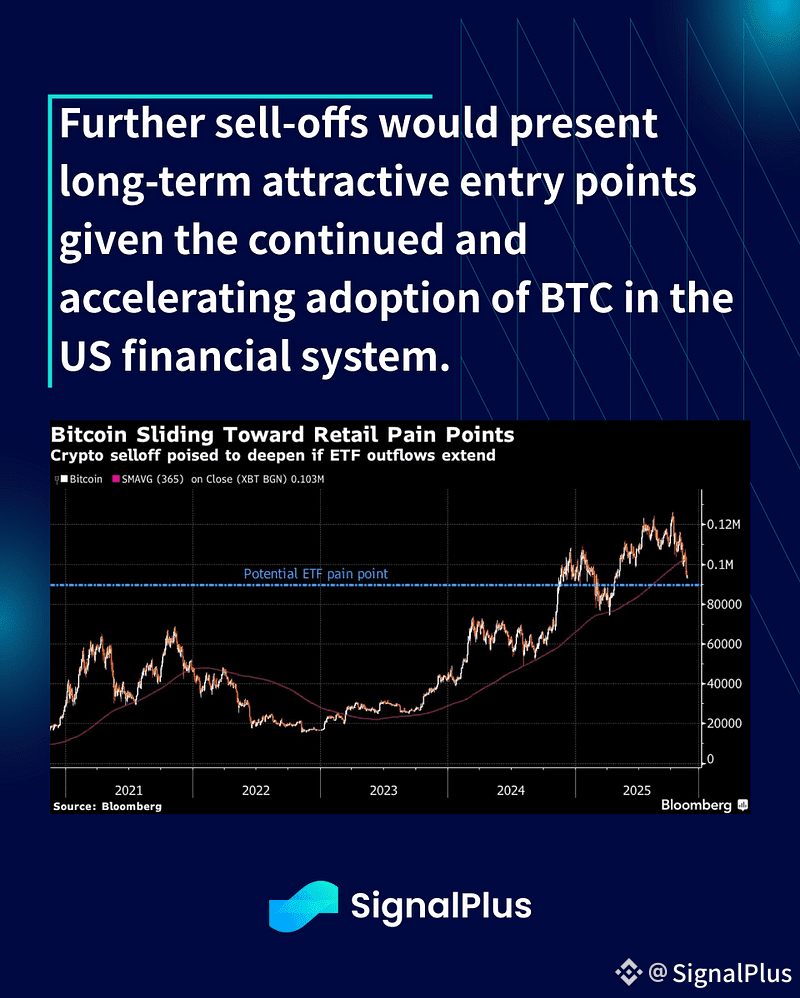

5. Technical Picture on Crypto is Less Supportive, But Could Offer Decent Long-Term Entry Points

We continue to expect the fallout from the October collapse to drag-on as more victims surface, and more protocols to shut as more native participants exit on further dillusionment

DAT sales are a real risk and present a significant overhang on sentiment until further notice.

Further sell-offs would present long-term attractive entry points given the continued and accelerating adoption of BTC in the US financial system.