Only when everyone is panic-selling do the true investors just enter the market.

This statement has once again been proven true in the crypto market.

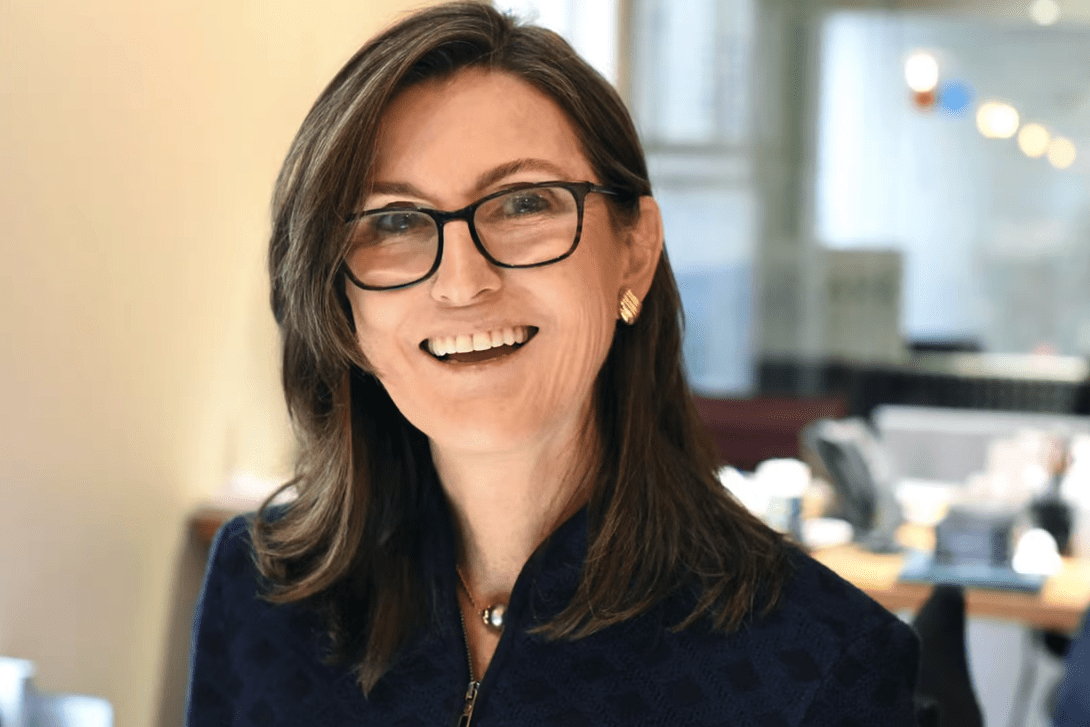

Cathie Wood, known as 'Wood Lady', leads ARK Invest, which is buying crypto concept stocks against the trend while lowering the long-term target price for Bitcoin — it seems contradictory, but in fact, it follows a very clear logic of 'institutionalized second half'.

The price of the currency is no longer driven by fantasies.

However, the financial infrastructure built around Bitcoin is ushering in a new round of revaluation.

1. Why is ARK still buying when 'blood is flowing like a river'?

For retail investors, 'the market' is price;

For institutions, 'the market' is structure and chips.

ARK's counter-cyclical investment is mainly based on three judgments:

The technology and legality have not been disproven

Blockchain and Bitcoin have not been denied by mainstream regulation; instead, they are accelerating their integration into the existing financial system, and Bitcoin's role as an 'alternative reserve asset' is becoming increasingly clear.

Slow variables remain healthy

The hash rate is oscillating at a high level, and the proportion of institutional and national wallets holding coins is increasing, Bitcoin is evolving from a 'speculative product' to a 'reserve asset'.

Emotions have stepped on point

Collective liquidation, emotional collapse, quality assets being mispriced—disastrous for short-term, but a discounted pool of chips for the long-term.

ARK is taking typical institutional actions:

Using a long-term perspective, absorbing the mispriced chips of short-term emotions,

Acquiring assets that originally required high valuations at 'panic discount prices'.

Please click to enter a description for the image (up to 18 characters)

2. Why lower the Bitcoin target price while buying 'crypto stocks' at the bottom?

Seemingly contradictory actions are backed by three layers of logic:

1. Bitcoin returning from 'myth pricing' to 'asset pricing'

After ETFization and institutionalization, Bitcoin increasingly resembles a financial asset that can be quantified and constrained:

Need to talk about risk-reward ratios,

It needs to be compared with stocks, bonds, and gold,

Need to accept the constraints of regulation and asset allocation rules.

Lowering the target price does not mean being bearish on Bitcoin, but rather acknowledging:

It is no longer something that rises based on myths, but rather needs to find its place within the framework of reality finance.

2. What is truly being revalued is the 'infrastructure surrounding Bitcoin'

When Bitcoin is viewed as 'long-term existing digital gold' rather than an endlessly rising chip:

Trading platforms, custodians, clearing networks, compliance technology

Companies that can continuously generate cash flow and service fees are more likely to receive high valuations.

In other words:

Bitcoin doesn't need to rise to absurd heights,

'Selling water' can also earn long-term money.

3. Shifting from a single point All in to a track portfolio

Directly betting on BTC: high volatility, difficult to explain, cash flow is blank;

Betting on track companies: able to explain business models, have income, have regulatory frameworks, making it easier to enter institutional portfolios.

Publicly 'lowering expectations' actually makes the Bitcoin story more sustainable:

Regarding regulation: We are rational investors,

For investors: Don't treat it as faith, just regard it as a high-risk asset class,

For the market: Reduce dream premiums, increase realization probabilities.

Three, what does this set of 'bearish expectations + bullish layout' indicate?

For ordinary investors, there are three realistic insights:

1) In the next phase, what's more important than 'betting on a coin' is 'choosing the right track'

What institutions focus on is no longer just the rise and fall of BTC/ETH, but the entire industrial chain:

Trading end

Custody and clearing

Stablecoins and payments

Compliance and risk control

Coin prices can fluctuate greatly, but as long as these infrastructures continue to be used, the ceiling will be clearer and more stable.

2) The more extreme the emotions, the closer it is to 'the buying range of institutions'

When:

The media is filled with collapse theories,

Everyone in the circle is recognizing losses and clearing positions,

Quality assets are falling harder than junk,

Often indicates:

'Retail time' is ending, 'institutional time' is taking over.

Does not mean an immediate bottom, but indicates that clearing positions here is often a textbook example of a reverse demonstration.

3) Accepting reality: the 'myth era' of crypto is coming to an end

After regulation, ETFs, and sovereign funds enter the market, this market will:

See volatility converge,

Macroeconomic correlation is stronger,

The narrative's imaginative space is shrinking.

But this is not a bad thing—

It means:

From 'a few people betting on a wealthy story',

Transition to 'most people earning reasonable returns through rational allocation'.

Four, three small things ordinary investors can do

Don't make decisions in extreme emotions

In days of extreme greed and extreme fear, it's suitable to pause and observe, rather than heavily express opinions.

Shifting from 'betting on a price' to 'understanding a chain link'

The question has shifted from 'how high can it rise?'

To 'who is on this chain, making stable money?'

Lower expectations for getting rich quickly, enhance cycle patience

The ceiling for Bitcoin has been lowered,

more like a reminder:

Lower expectations for 'getting rich quickly',

Raise the requirements for 'living long, holding on, and distributing widely'.

What really deserves attention in Wood's latest actions is not how much she lowered the Bitcoin target price, but rather:

When everyone is cursing 'crypto is over', what exactly did she buy,

On the road from frenzy to maturity, which side did she stand on in advance.

Prices will change, target prices will be revised,

But maintaining rationality in panic and being patient in cycles

Will only become scarcer and increasingly important for more and more participants.