The Web3 landscape has fundamentally shifted beyond the hype cycle; we are witnessing an increasingly mature industry attracting unprecedented institutional attention. As the CEO and one of the founders of Altius Labs, I have witnessed this transformation from the front lines, bridging my experience from traditional finance at Deutsche Bank to CeFi at Amber Group, with the ongoing crypto-based innovations.

New Reality: Institutional Blockchain Adoption Becomes a Main Focus

The future of Web3 looks very different compared to two years ago. We have shifted from retail experimentation to enterprise-grade infrastructure demands. The global Web3 market, valued at $2.25 billion in 2023, is projected to reach $33.53 billion by 2030 — a staggering CAGR of 49.3%, reflecting institutional confidence beyond just retail speculation.

What I am seeing from my position at Altius Labs is unprecedented: giants like Stripe and Robinhood are no longer just 'experimenting' with crypto or blockchain. They are actively exploring building or integrating their own chains. This represents a fundamental shift in how we view blockchain industry trends — from public utility to private infrastructure.

Recent milestones indicate many things: Layer 1 and Layer 2 growth has surged, multi-chain adoption has become the standard, and mainstream brands like Nike, Reddit, and Starbucks have moved from pilot programs to full integration. However, the real story lies behind these apparent victories.

Key Trend #1: Enterprise-Level User Experience (UX) and Compliance-First Orientation

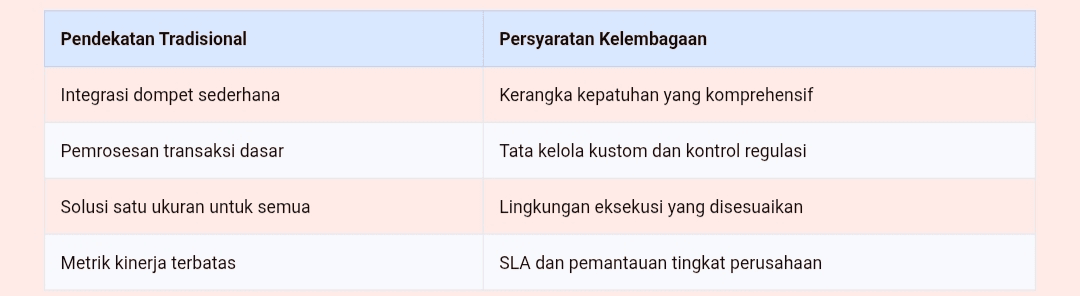

The narrative around user experience has evolved significantly. While retail UX remains important, institutional onboarding presents entirely different challenges. This is not just about simplifying wallets — it is about building enterprise-class systems that are ready to comply with regulations and capable of handling the regulatory requirements of trillion-dollar organizations.

At Altius Labs, we see many institutions needing an execution stack capable of handling compliance, performance, and tailored governance requirements. The traditional ecosystem that only supports EVM cannot meet these needs. This drives the transition to multi-VM architecture, application chains, and sovereign rollups that we have integrated into our modular execution stack.

Core Trend #2: The Multi-VM Revolution and Modular Architecture

One of the most significant trends in the crypto market that I am monitoring is the evolution of the EVM-specific ecosystem into multi-VM, application chains, and modular designs. This is not just about technical sophistication — it is a business necessity.

When I founded Altius Labs with CTO Anit Chakraborty, we realized that VM-agnostic design is not just maturity; it is a prerequisite for building chains at the scale needed by Stripe or Robinhood. Our approach separates execution from consensus layers and data availability, enabling institutions to integrate our high-performance execution stack into any L1, L2, or application chain.

These numbers speak for themselves. Our testing shows performance improvements in gigabytes per second — far better than traditional implementations. However, more importantly, this modular approach allows institutions to maintain existing infrastructure while still gaining blockchain capabilities.

Why Modularity is Important for Institutions

Traditional monolithic blockchain approaches create several issues for institutional adoption:

Vendor lock-in: Organizations cannot easily replace or upgrade components

Performance barriers: All functionalities must run through a single execution environment

Compliance challenges: Difficult to implement specific regulatory requirements

Integration complexity: Existing systems require total overhauls

Our modular execution layer addresses these challenges by providing seamless plug-and-play integration without the need for specialized hardware. This maintains decentralization and accessibility — crucial factors for institutional adoption.

Core Trend #3: Real-World Assets and Tokenized Finance

The Web3 prediction I am most confident in centers around the tokenization of real-world assets (RWA). This is no longer speculation — it is happening at scale.

The expansion of USDC Circle, BlackRock's tokenization fund, and deeper crypto integration at Robinhood are just the beginning. What is lacking in the current ecosystem is the flexible, high-performance execution engine needed for purpose-built institutional chains. This is what we are building at Altius Labs.

Institutional demand for RWA tokenization drives several key requirements:

Regulatory compliance: Integrated KYC/AML controls and jurisdictions

Performance scalability: The ability to handle traditional financial transaction volumes

Interoperability: Seamless integration with existing financial infrastructure

Privacy controls: Selective disclosure and optional compliance layers

Our modular architecture supports public chains with private modules and optional compliance layers, allowing institutions to balance permissionless innovation with regulatory requirements.

Core Trend #4: Institutional Infrastructure that Maintains Privacy

Perhaps the most complex challenge facing institutional blockchain adoption is balancing permissionless innovation with compliance requirements. Institutions cannot join without a clear framework for KYC, AML, and jurisdiction alignment, yet they are also aware of the value of permissionless decentralized systems.

This creates what I call the 'compliance paradox' — institutions need the benefits of blockchain but within traditional regulatory frameworks. Our solution at Altius Labs involves a modular architecture that can support public chains with private modules and optional compliance layers.

Altius Vision: Enabling the Next Phase of Web3

Looking ahead, the most significant trend I see is the shift from blockchain as an asset class to blockchain as an execution layer for global financial and tech giants. This is not just about trading cryptocurrencies — this is about fundamentally reshaping how digital infrastructure operates.

At Altius Labs, we are building an execution engine that enables any chain — including those from Stripe, Circle, or Robinhood — to scale instantly. Our modular execution stack, agnostic to VM, provides:

Instant performance enhancement: Increased throughput in gigabytes per second

Universal compatibility: Support for EVM, SVM, MoveVM, WASM, and future VMs

Seamless integration: Plug-and-play deployment without migration hassle

Future-proof architecture: Modular designs that adapt to evolving compliance, privacy, and other institutional-level requirements

Feedback from various institutions has been very positive. They are not questioning whether they should adopt blockchain technology — they are questioning how quickly they can implement it with the performance and compliance features they need.

What This Means for Developers and Builders

For the Web3 community, this trend presents unprecedented opportunities. This institutional wave does not replace crypto-based innovation — rather, it strengthens it. As financial institutions and large tech companies build their own chains, they will need the tools, protocols, and talent developed by the Web3 community.

This creates a virtuous cycle: institutional adoption provides legitimacy and funding, while crypto-native innovation provides the technical foundation and creativity that institutions lack. The result is a more mature, scalable, and sustainable Web3 ecosystem.

Looking Ahead: A Future Focused on Infrastructure

The blockchain innovation we are witnessing today is fundamentally focused on infrastructure. Unlike previous cycles driven by speculative tokens or consumer applications, this phase focuses on building the foundation for the next generation of digital infrastructure.

From my perspective as a leader at Altius Labs, the next 18 months will be crucial. Various institutions are transitioning from evaluation to implementation, and infrastructure providers capable of delivering enterprise-grade performance, compliance, and interoperability will capture much of this enormous market opportunity.

The Web3 industry is moving toward a future where blockchain technology is invisible to end users but powers the financial and digital infrastructure they use every day. This represents the highest success of our technology — when this technology becomes so fundamental to how the system operates that users do not have to think about it.

As we continue to build at Altius Labs, our focus remains on realizing this future through high-performance modular execution infrastructure that meets the demands of both crypto-native applications and institutional requirements. The convergence of these two worlds is not just the future of Web3 — it is the future of digital infrastructure itself.