🫵 UPDATE ON-CHAIN $LINK – WHAT DOES THE SPOT MONEY WANT TO SAY?

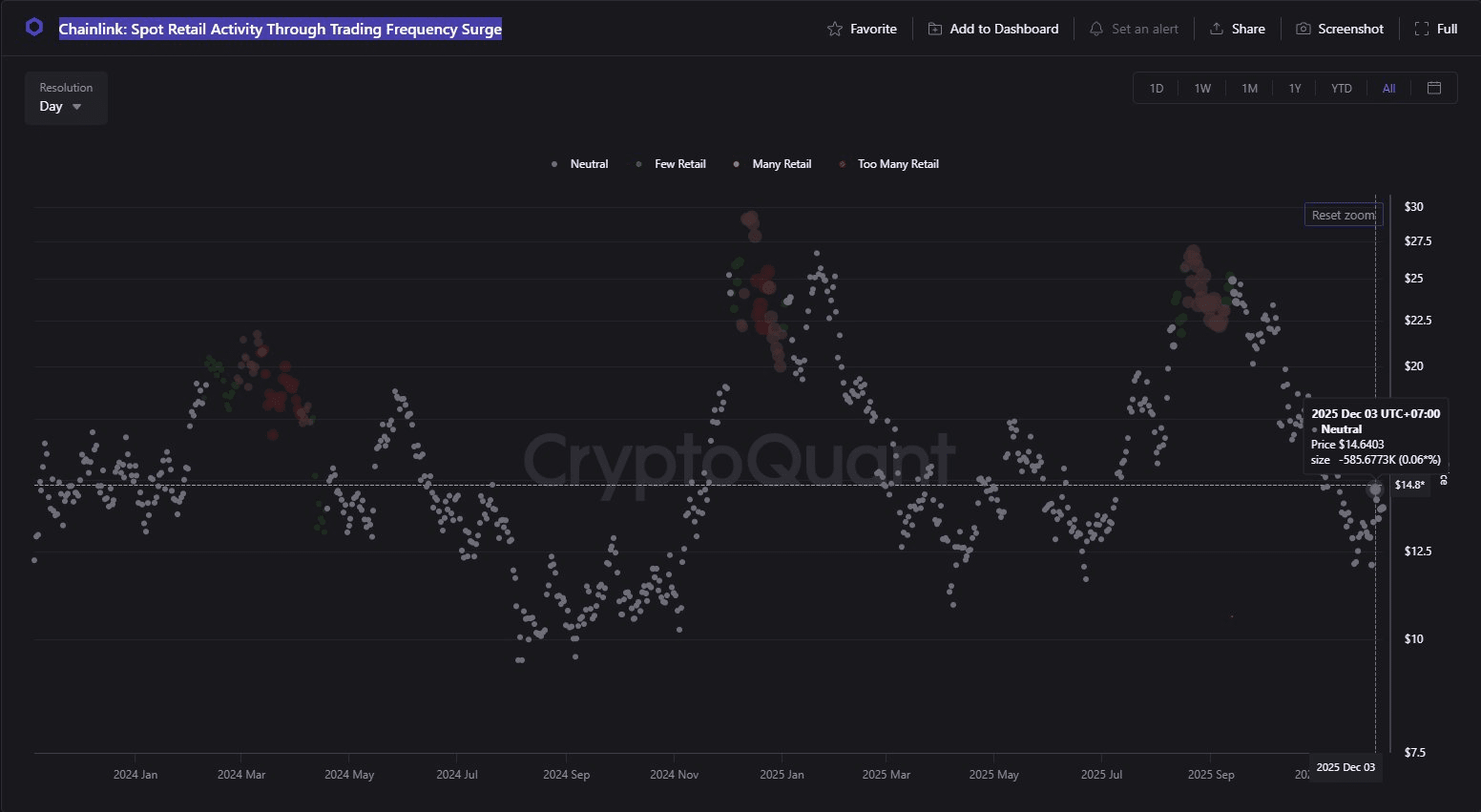

1️⃣ Retail: Retailers are staying out → The market is cleaner.

In previous rallies, LINK was often strongly affected by retail FOMO: a multitude of Many Retail and Too Many Retail points appeared.

But now it's different:

The Retail Activity indicator is at Neutral level

Fewer small retail transactions

No longer is there a crowd of retailers scrambling to chase prices

👉 The market is in a state of frustration → This is the environment for big players to accumulate assets.

Retail that stands outside usually marks the beginning of a new trend.

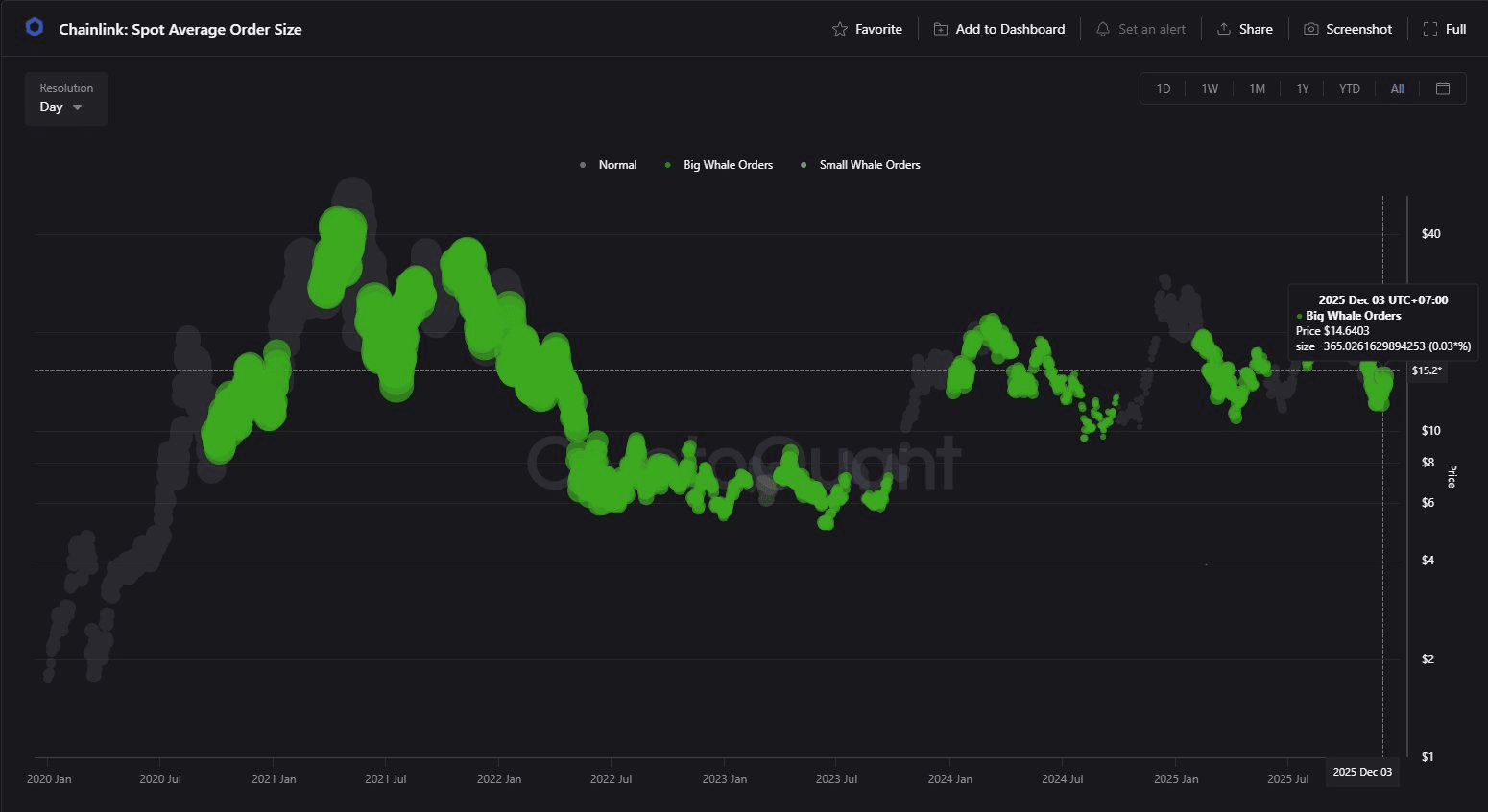

2️⃣ Average Order Size: Large orders are back – Whales are in action.

The biggest highlight of LINK right now:

The size of spot orders has significantly increased.

The indicator has shifted to the Big Whale Orders zone.

This means:

👉 Those trading LINK right now are mainly large wallets – not retail.

👉 The price has dropped to a local bottom, but whales are not pulling back; on the contrary, they are actively buying.

Whales returning to the market are often an 'early' signal before the price experiences strong fluctuations.

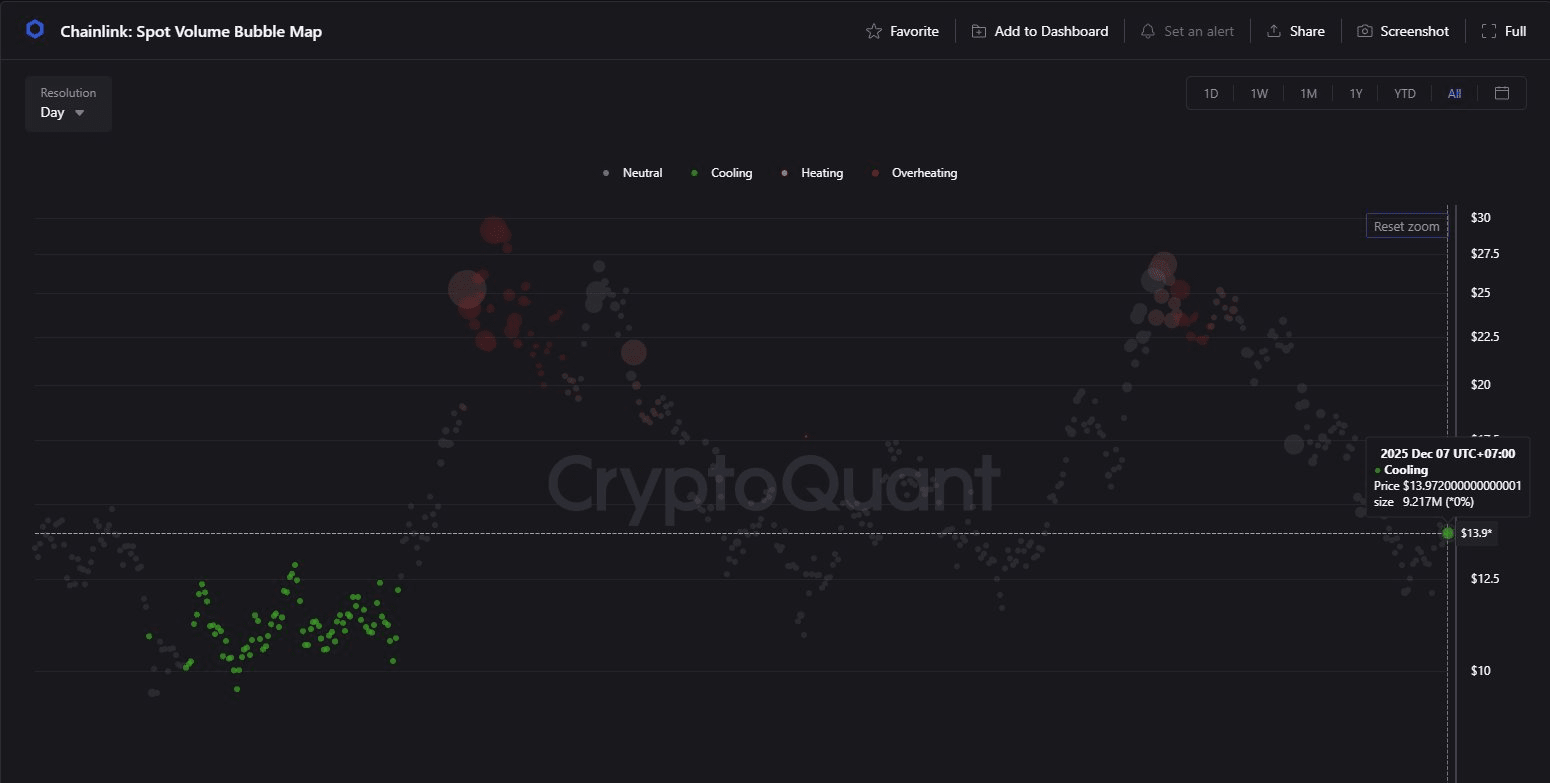

3️⃣ Volume Bubble Map: Volume 'Cooling' – Money flow is accumulating, not pushing.

At the current price level, the Bubble Map shows:

Low volume

Cooling green bubble

No overheating like previous strong pump phases.

Combined with large order size →

👉 Whales are accumulating quietly, not wanting to drive the price up.

👉 This is a typical accumulation pattern of LINK over the years.

When volume decreases + retail stands outside = an opportunity for large players to accumulate before pushing the trend.

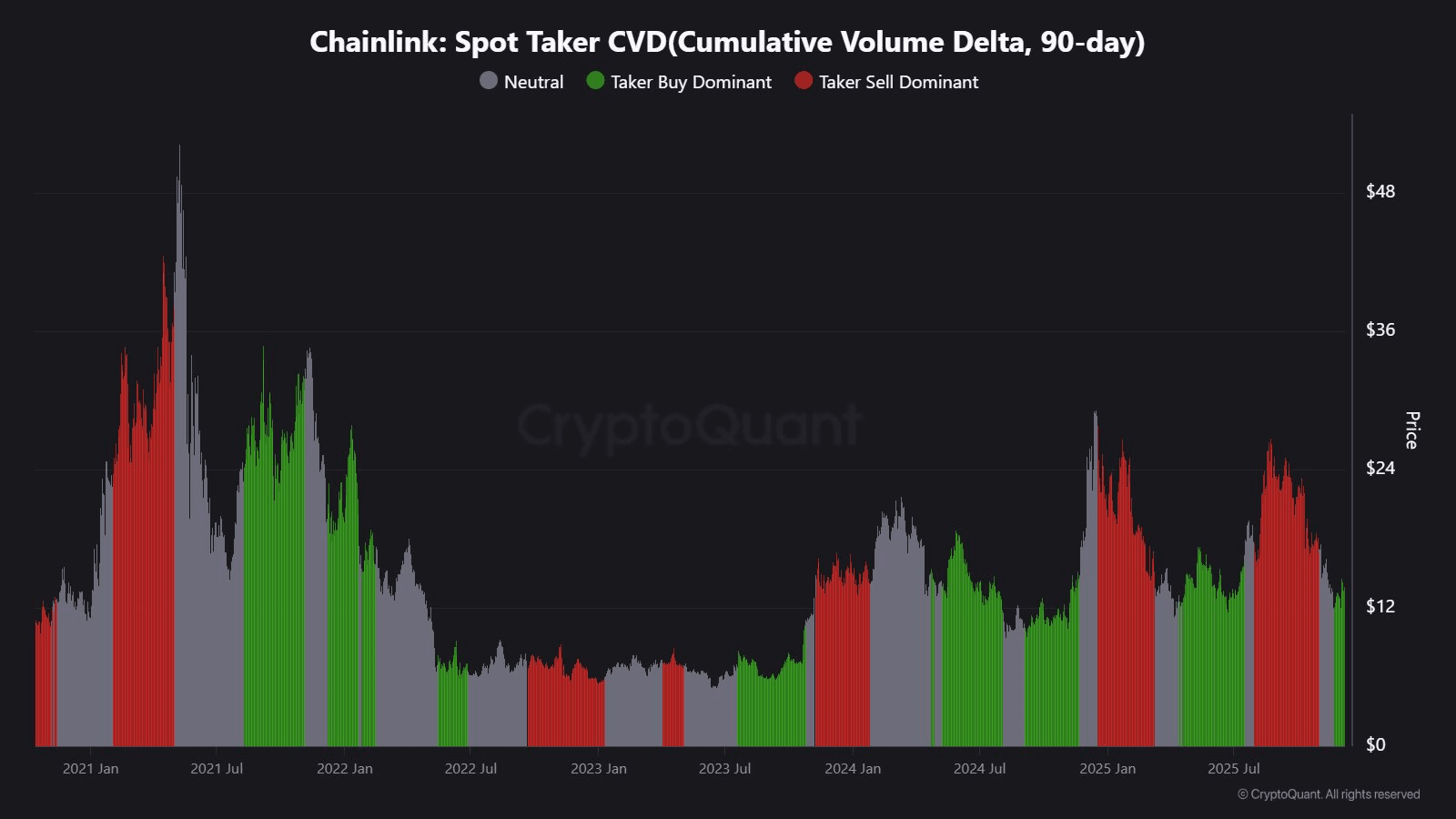

4️⃣ Spot Taker CVD (90d): The buying force has appeared again.

CVD shows:

Taker Buy Dominant has returned.

The active buying force is stronger than the active selling force.

LINK is supported each time the price adjusts deeply.

Historically, each time CVD turns green and remains stable → it usually marks the beginning of a 20–40% increase.

👉 Real money flow is leaning towards the buying side.

🎯 In summary

$LINK is currently in a frustrating phase for Retail, but Whale is accumulating.

If history repeats itself, the possibility of LINK returning to the $17–$20 range in the next phase is entirely reasonable.