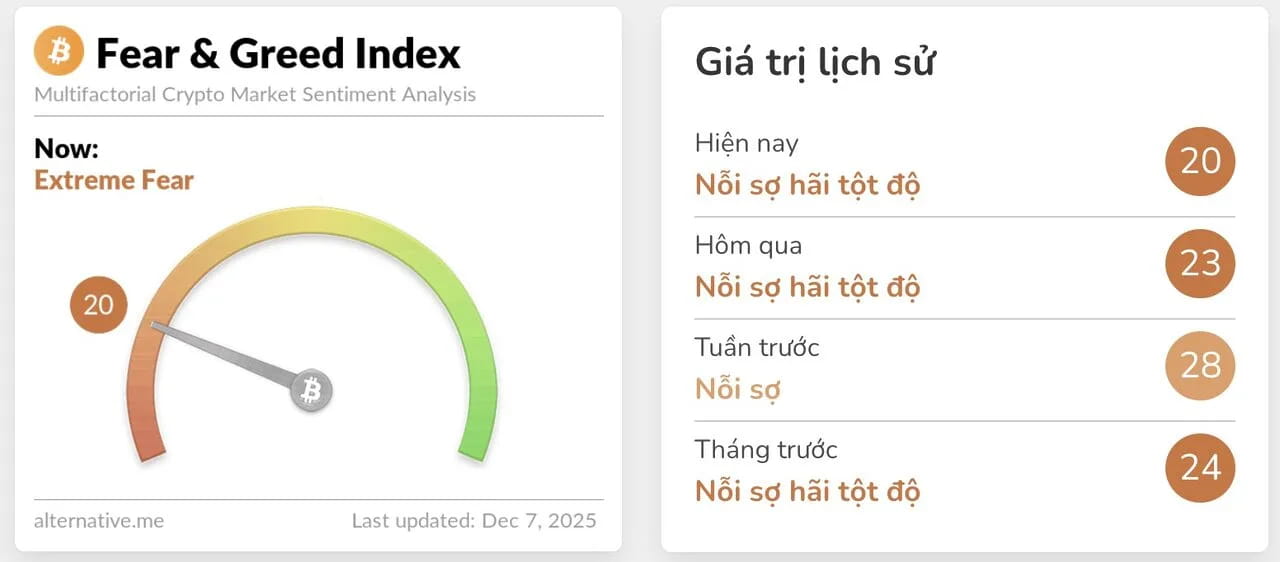

The cryptocurrency market is currently very fearful. The Fear and Greed Index is at 20, and previously it was even lower, at 10. Fewer people are searching for Bitcoin on Google, and many investors have become more cautious after the major crash on October 10.

When interest rates fall and ETF capital flows reverse, everyone is wondering if this is just a correction or the beginning of a real bear market?

The cryptocurrency market index reached extreme fear.

According to recent market data, the incident on October 10 was the main reason for the market sentiment dropping to a record low of 10, due to unexpected news about the trade war between the US and China.

After the Bitcoin price was announced to drop from $126,000 to $98,000, over $19 billion in leveraged trading was wiped out. Meanwhile, major altcoins like SOL, XRP, etc., dropped more than 40% in just a few hours.

Due to this collapse, the cryptocurrency order book became very thin. Market makers withdrew liquidity to avoid further losses, ETF inflows turned into outflows, and global demand for digital assets weakened.

While most investors remain cautious, fear has dominated the market for weeks.

Investors are losing interest as search volume on Google declines.

Although the market stabilized somewhat as the cryptocurrency fear and greed index slightly rose to 21, it still remained deep in the fear zone.

Meanwhile, retail interest in cryptocurrency, tracked through global Google Trends for 'cryptocurrency,' 'Bitcoin,' and related searches, has returned to levels seen during previous mid-cycle corrections.

According to market traders, such periods when interest rates are low and fear is high often mark accumulation zones, times when smart investors quietly build positions while the crowd remains pessimistic.

Is this a bear market or a reset between cycles?

Even as panic increases, analysts remain divided. Cryptocurrency trader KillaXBT stated that Bitcoin is repeating a similar pattern as after each recent FOMC meeting. This time, Bitcoin slightly increased above $95,000, then dropped about 5% and is currently near $90,000.

He expects the next significant move to occur around December 10-11 based on the latest FOMC data.

Although the Nasdaq, silver, and S&P 500 all rose, Bitcoin went in the opposite direction, falling 3% today, marking the first time since 2014 that the market fell while traditional assets rose.