The emergence of Crypto Superapps (crypto apps that combine everything in one place)

Why do today's apps that we use most frequently, like Grab / Facebook / banking apps / WeChat or Line, need to be able to perform multiple transactions beyond just one function?

#Now we are entering an era where everything comes together in one app, like the iron rule of the digital world: when products become easily distributed and cheaper, their value will fall to those who can control the users the most. In the crypto world (digital currency), this idea was once known as the 'Fat Wallet thesis' (the theory of the big wallet that combines everything). But now it's different because the infrastructure (the backend system) has developed far enough to create real Crypto Superapps, not limited to just the wallet format.

#CryptoSuperapp What is it?

In this report, Crypto Superapp is not a giant app that does everything on its own but an app that selects the best protocols in the market to combine in one place.

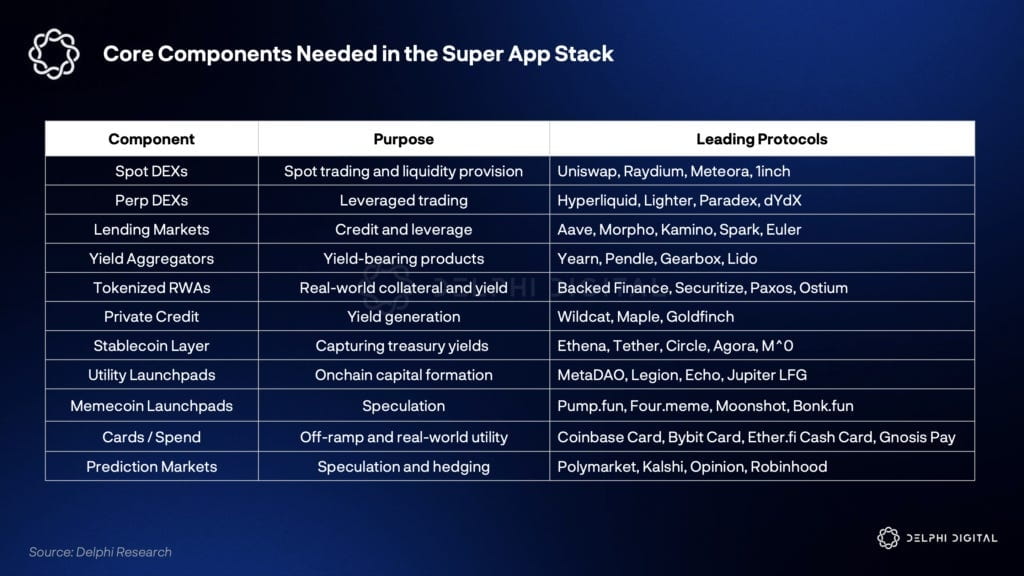

The main function is to compress users' financial life and on-chain activities into a single screen, with the following main components:

- One identity: through wallet or account.

- One balance: for major coins, stablecoins, and other assets.

- One feed: A single screen for transactions on-chain.

Why does having everything in one place solve the problem?

Aggregation is the most profitable business model on the Internet because these companies do not own products but win by controlling discovery, operations, and product distribution. We will see this repeated, such as:

- Internet data aggregators: Amazon / Shopee / Lazada (including shopping markets), Meta / X (Twitter) (including social and content).

- Mobile Superapps: Mini-program systems like WeChat or Grab that expand from ride-hailing to multiple platforms.

- Fintech: Nubank, Revolut, Cash App, or various colored bank apps - combining services to compete with traditional banks by making life easier.

Regardless of the industry, the result is the same: people are willing to pay more for convenience, such as using fewer apps, logging in less, and experiencing smooth data flow. Looking at wallets and trading platforms that earn millions from fees proves that crypto users are also willing to pay for comfort.

***

Integrate vs. Acquire.

In Fintech, centralization succeeded but faced cost limitations due to legacy structures. Adding new businesses requires a slow and expensive path: building (years to get licenses and research), acquiring companies (like Block acquiring Afterpay), or applying for licenses.

But crypto changes the game: Superapps in crypto can only add functions by integrating protocols without needing to acquire companies. The advantage over Fintech is:

- Global liquidity, open 24/7: no market closing time or waiting for T+1/T+2 payments. Asset tokenization allows the market to remain open. Once people try it, they won't go back to the old way.

- Composability: Protocols share a common backend system, allowing users to easily connect transactions, such as borrowing money secured by US Treasury bonds converted to tokens, then trading derivatives with USDC.

- Distribution through Mini-apps: Crypto Superapps can serve as distribution channels by allowing external developers to create mini-apps within the system, similar to WeChat but applied to finance. For smaller apps, embedding in a Superapp is a smart approach.

#Why now?

Crypto Superapp can arise from three main factors:

1. Technology readiness: Smart accounts, secure connections, and reduced blockspace costs from L1/L2 solve user experience (UX) and legacy cost issues.

2. Increased regulatory clarity: From enforcement to clear frameworks (like FIT21, MiCA, AGDM) reduces risks and attracts institutional money.

3. Expanded Utility: The system is not just for speculation, but has complete services, such as real-world assets (RWAs), yields, consumer loans, and prediction markets.

The best part is that no team has to build everything from scratch; these services are already available. The current job is to integrate them smoothly.

***

#Expected developments in 2026

Subsequent updates will continue. What to watch in 2026:

- The spread of Prop AMMs (Automated Market Makers that manage liquidity proactively), such as HumidFi, Tessera V.

- Liquidity infrastructure, such as 1inch, Aqua.

- Orderbook lending (buy order system), such as Avon.

- Low-cost securities lending and consumer loans, such as 3Jane.

- Stablecoins not pegged to USD increase FX volumes on-chain.

- Non-custodial crypto cards embedding DeFi rewards for idle funds.

- Fairer Launchpad auction mechanism, such as Uniswap’s Continuous Clearing Auction.

***

#The evolution of user experience (UX) makes crypto more accessible to the general public:

The design principles focusing on easy understanding and step-by-step learning have become a new standard in the industry, emphasizing the concept of “learning while using.” There are step-by-step guides with illustrations that make it easy to remember, gradually increasing complex content as users are ready. A clear example is the setup process of MetaMask, which has a detailed user navigation system.

1. Visible and understandable security.

Modern security systems communicate risk clearly to users through various features:

* Security status lights: Clearly indicate security levels.

* Real-time alerts: Immediately notify whether a transaction is secure.

* Alerts: Notify when encountering suspicious wallet addresses.

* Transaction Simulation: Shows upfront how the wallet balance will change if confirmed (preventing being scammed out of money).

* Contract ABI decoding: Converts complicated computer code into human language so that users clearly understand what they are approving.

2. Key turning points: Apple Pay and Digital ID.

Connecting Apple Pay with the Base app is a major turning point that reduces the friction of starting to use the service.

* Users can top up their wallets directly without going through the cumbersome crypto wallet setup process.

* One tap to buy Stablecoin (USDC), trade, or pay instantly.

* Portable Digital Identity: Create a single ID on the blockchain that can be used to log in to all services (similar to logging in with Facebook or Google but in a decentralized way). Data and contact lists travel with us everywhere, eliminating the need to log in multiple times. This may evolve into the use of government documents in the future.

3. Turning usage into fun (Gamification).

Game-like mechanics help attract users to stay on the app five times longer than regular crypto platforms.

* Coinbase Earn: A pioneer in the “learn and earn” model by rewarding real crypto coins when completing short lessons on mobile.

* Binance Academy: Develop further with more engaging quizzes, clickable answers, and a reward system.

* Reward systems: Currently, there are tier levels (e.g., bronze, silver, gold), platform coin distributions, cashback programs (such as Base Pay returning 1% in USDC), interest from staking coins, and bonuses for referring friends.

***

#Case study: Coinbase - Everything Exchange.

The third-quarter shareholder letter from Coinbase clearly states its desire to be the Everything Exchange. They are making progress by adding trading assets (covering 90% of crypto market value), expanding derivatives, payments (USDC), Launchpad (Echo), and new products through #Base. This is a sign that the market is consolidating at the application layer.

Coinbase plays two sides: on one side, it is a partner that Wall Street trusts, and on the other side, it drives the on-chain economy through $Base and creates a social network specifically for crypto.

Revenue diversification to reduce risk.

Coinbase wants to shift from relying on volatile transaction income to being a platform that earns money when users trade, hold, spend, and create.

1. Revenue diversification: In 2020, transaction income was 96%, but by the end of 2025, it is expected to drop to 60%, while subscription and service income rises to 40%.

2. USDC: The most important, income from Stablecoin (from USDC reserve yields) in Q3 2025 skyrocketing to 354.7 million (+44% YoY). Stablecoin balances tend to remain stable in bear markets. If USDC becomes the primary currency in Coinbase Base and payment channels, it will create a stable revenue base without waiting for market booms.

3. Coinbase One: A subscription plan (monthly, multiple tiers) reducing fees and offering special rewards, creating a “sunk-cost effect” that encourages users to consolidate activities here for maximum value, making it hard for competitors to match trading volumes.

4. Derivative markets (Future & Option Trading): Expanding to Coinbase International Exchange and acquiring Deribit in the global market. Spot is a small part; derivatives account for 80%. Deribit brings deep liquidity and institutional option markets.

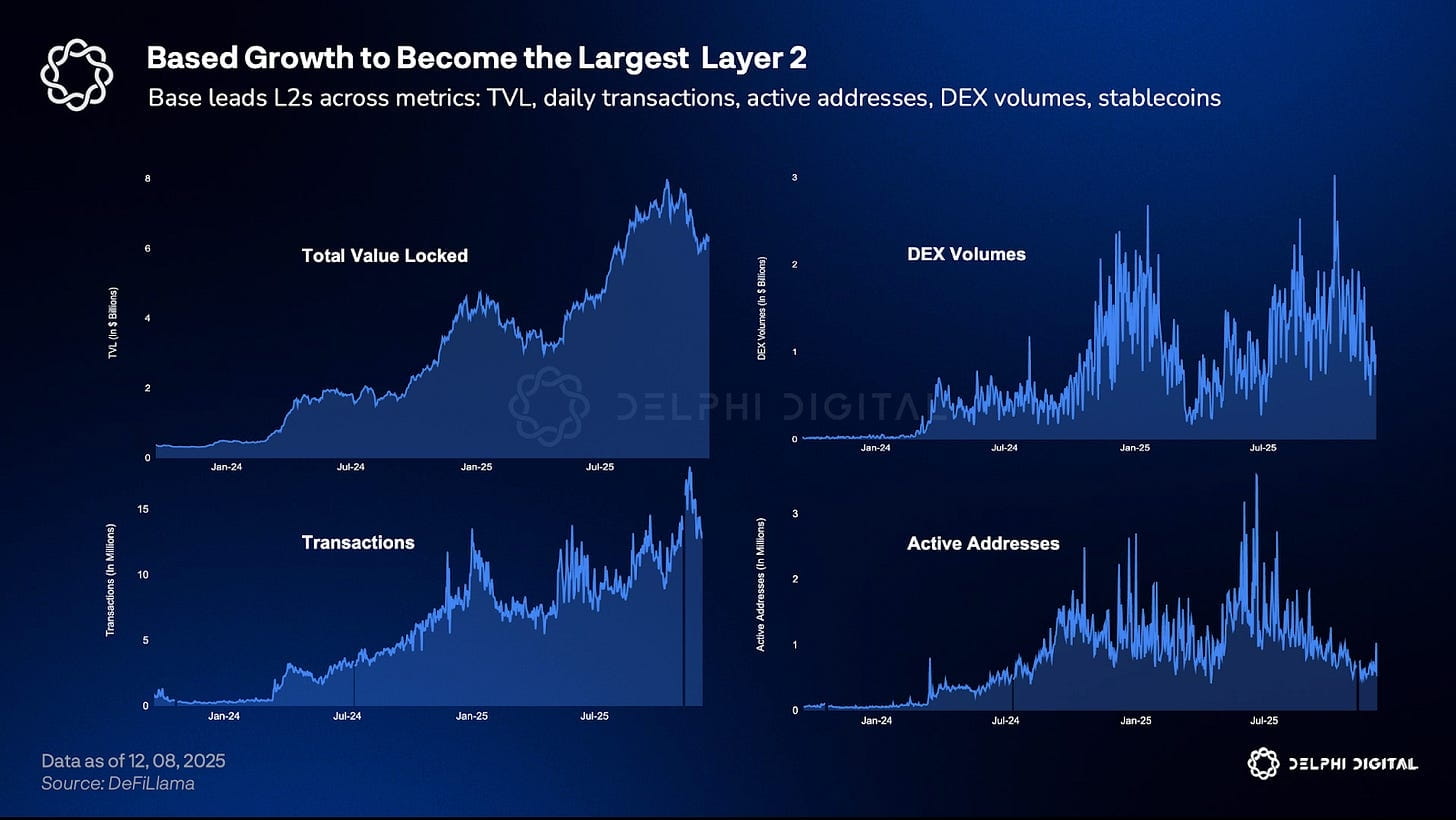

Create Superapp: Base L2 (OS) + The Base App (Interface).

Coinbase knows that having every feature is not as important as being an app that people use every day.

- The Base App: Designed as a daily interface, focusing more on social feeds than financial tools, and made easier with Passkeys (recover with biometrics instead of seed phrases). Sponsored transactions (paying gas fees for users). Magic Spend (transacting on-chain with balances in the Exchange). The goal is to draw people from centralized Exchanges into Base.

- Base L2: If the Base App is the screen, Base L2 is the operating system, creating a Rollup that integrates with Ethereum instead of a closed chain, benefiting from developers and communities while still profiting from owning the distribution channel.

Strategic acquisitions:

- Deribit (May 2025 $2.9B): Providing derivative liquidity.

- Echo (Oct 2025 $375M): Bringing fundraising and asset issuance.

Coinbase bets that the winner will be the one who seamlessly combines decentralization and centralization. If successful, it will upgrade from an Exchange to financial infrastructure.

#EarthDeFIRE Report 16/12/2025