The cryptocurrency market experienced strong volatility on Thursday, April 18, as the price of BTC surged towards $89.5 thousand before quickly retreating to around $84.5 thousand ⚠️. This turmoil directly affected LTC, which suffered a sharp decline of about 7.5% within a few hours, touching a low of $72.64, and then attempting to stabilize later near $75.89.

🔻 Breaking historical support… and declining confidence

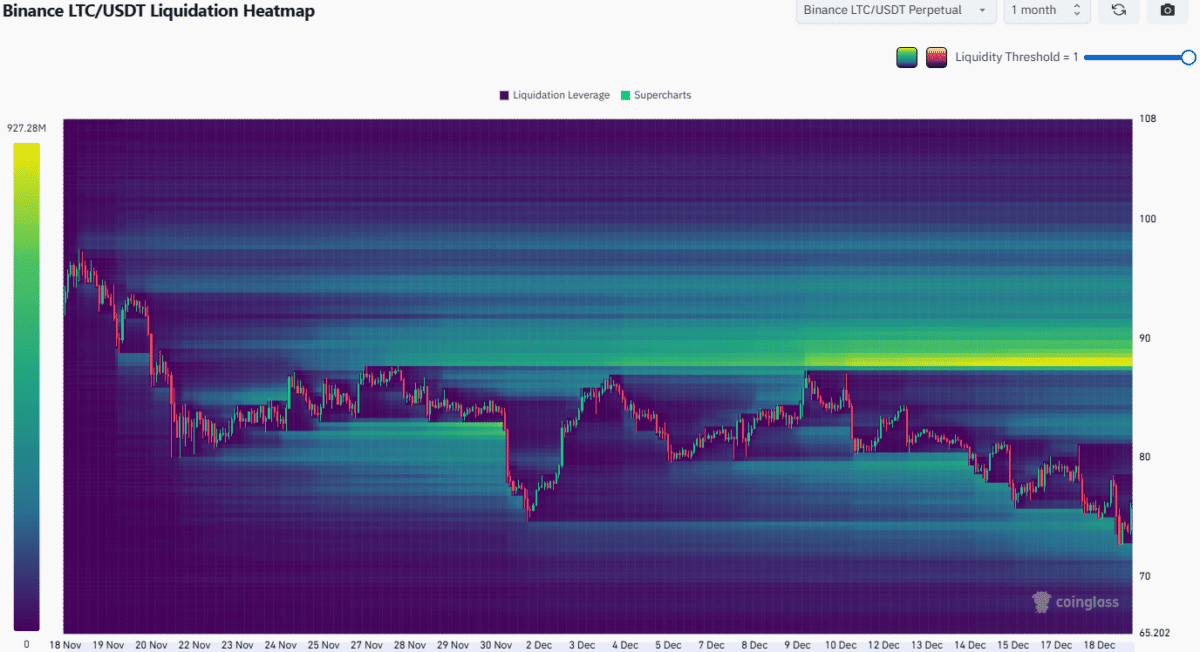

Over the past two weeks, LTC lost a pivotal support area that had extended for a long time between $80 and $84 ⛔. This break revealed the weakness of the upward momentum, as attempts to defend this range seemed limited and insufficient to stop the downward path, despite some positive news that did not actually reflect on the price movement.

📊 Technical reading of the downward trend

Price action and trading volume analysis for 2025 shows that the annual value area extended approximately between $83 and $120. After surpassing the upper limit in early October, a sharp reversal occurred that brought the price back to a negative trajectory 🔄.

Volume indicators also showed that the balance shifted strongly towards sellers, with a clear decline in demand strength. Despite attempts to hold during November at the $80 level, this support later collapsed, confirming the continuation of the downward trend.

🧱 Upcoming support levels

With the loss of the $80 level, the focus has shifted towards long-term support stations, notably:

🟡 $73.4

🟠 $66.5

🔴 $59.6

Liquidity data has shown that the area around $73 has been fully consumed, allowing for a short-term technical rebound.

🔁 Are we witnessing a temporary rebound?

The current rebound may extend towards the $82–$83 area, which is a potential price attraction zone 🧲. In a less likely scenario, an overall improvement in market sentiment could push the price towards $88, where strong selling pressure is concentrated. If liquidations accelerate, LTC may attempt to test the $90 level and regain a new upward trajectory 🚀.

⚠️ A cautious look for followers

Despite any potential rebounds, the overall picture still leans negative. The price structure is downward, and there are no strong signals of sustained buying pressure on longer time frames.

If the price returns to test the $80–$84 range, it may create a tough resistance to break through 🔒. Therefore, the $66 and $59 areas remain potential targets if weakness continues.

✦ Summary of the scene:

Litecoin is going through a sensitive phase after breaking a historical support level, and while a rebound is possible, the overall trend remains tilted downwards unless market conditions change drastically.