The m cryptocurrency market is falling broadly due to a combination of macroeconomic and technical factors, not due to a specific project collapse.

cryptocurrency market is falling broadly due to a combination of macroeconomic and technical factors, not due to a specific project collapse.

First, there is global macroeconomic uncertainty. Traditional markets are showing caution due to expectations of high interest rates for a longer period, which reduces the appetite for risk assets like cryptocurrencies. When Wall Street is uncertain, money tends to leave crypto first.

Second, there is institutional profit-taking. Large investors (“whales”) are selling after previous increases, especially in Bitcoin and Ethereum, creating bearish pressure across the market. These sales drag down altcoins more strongly.

Third, from a technical standpoint, many assets broke through key support levels, triggering automatic liquidations in futures and leveraged positions. This accelerates cascading falls and causes the 'bleeding' effect.

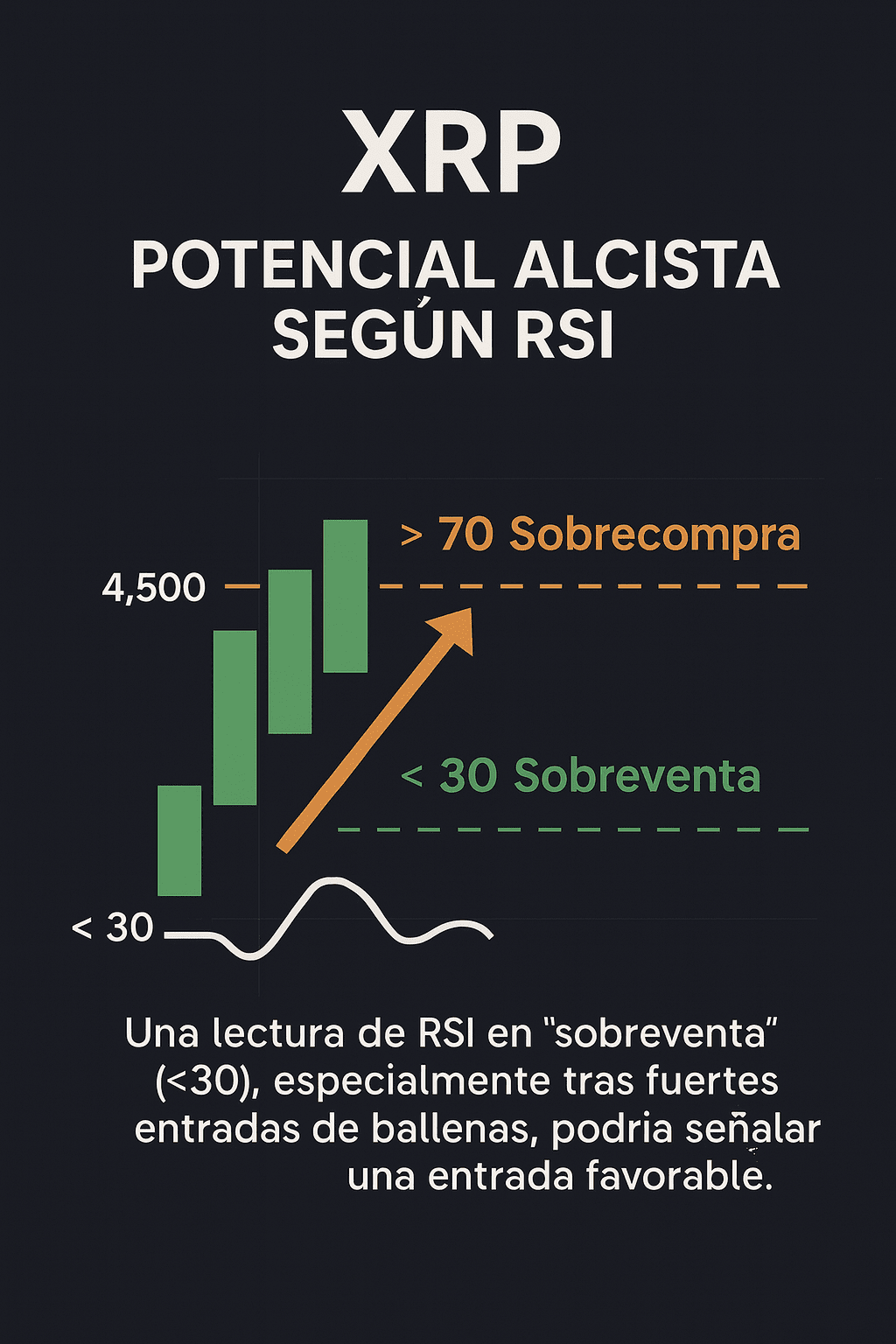

Fourth, the low RSI in several cryptos indicates weakness in buying momentum. Although it is not extreme panic, it does reflect a lack of strength to bounce back quickly.

In summary: it is not the end of the market, but a correction driven by fear, profit-taking, and technical liquidations. Historically, these periods often precede phases of consolidation or selective bounces, but they require patience and confirmations before entering.

If you want, I can tell you what signals to look for to know when it stops bleeding or which cryptos tend to recover first.