*I do not use this, but I noted it down for understanding.

**Theoretical cheat sheet but without practical understanding: market movement, % of deposit position, leverage ↓ USE WITH CAUTION

(this is for informational purposes and alternative cautious trading attempts)

***Be careful with every piece of information that comes your way, as the responsibility lies solely with the one who takes action.

🧭 1. 14 Laws without which the market does not work

№ Law Essence

1 Trend Law Always trade in the direction of the trend

2 Wave Law Enter only after a correction, not in the middle of an impulse

3 Level Law Levels are places where the price stops, reverses, or accelerates

4 Candle Law Candle = psychology: enter only with a clear pattern

5 Volume Law Volume confirms movement. Without volume — the signal is weak

6 Time Law It is important where and when the signal appeared (at the level? after the trend?)

7 Confirmation Law Entry = at least 2 out of 3: trend + level + pattern

8 Asymmetry Law Risk:profit must be at least 1:2

9 Simplicity Law A simple system > complex. Without overloading with indicators

10 Expectation Law The best trade is the one you did not make without confirmation

11 Psychology Law Reevaluation = reversal. Panic = opportunity

12 Majority Law Most are wrong at peaks/troughs

13 Filter Law Not every movement is a signal. Filter the noise

14 Self-discipline Law The strategy works only if you do not violate it

---

⚙️ 2. Universal ENTRY SYSTEM (LONG/SHORT)

🔍 When to enter?

📌 Only if ALL 3 conditions are met:

№ Condition Example

1 Trend Price above/below EMA 20–50

2 Level Rebound or breakout of the support/resistance level

3 Candle signal Hammer, Engulfing, Pin Bar, Shooting Star

👉 + Bonus: Confirmation with volume (volume increases during the signal)

---

🔼 LONG (buy)

Component Condition

Trend EMA 20 and price are directed upwards

Level Rebound from support or breakout of resistance

Signal Hammer / Bullish Engulfing at the level

Volume Volume increases during the appearance of the pattern

Stop Slightly below the minimum of the pattern (entry candle)

Target Nearest resistance or ratio 1:2

---

🔽 SHORT (sell)

Component Condition

Trend EMA 20 and price are directed downwards

Level Rebound from resistance or breakout of support

Signal Shooting Star / Bearish Engulfing

Volume Volume increases during the appearance of the bearish pattern

Stop Slightly above the maximum of the pattern

Target Nearest support or ratio 1:2

---

💼 3. Minimum set of tools

Category Tool Comment

Orientation EMA 20, EMA 50 Trend direction

Levels Support/resistance lines Drawn manually, the basis of the signal

Candles Price Action 8 basic patterns are enough

Volume Volume or OBV Confirmation of signal strength

Oscillator (optional) RSI (14) For divergences or overbought

Stop/target Fixed ratio Always 1:2 or better

---

🧠 4. Action algorithm before each trade

✅ Go through this checklist:

1. 📊 Clear trend?

2. 📉 Is there a support/resistance level nearby?

3. 🕯️ Has a candle pattern appeared?

4. 📈 Is there volume at the moment of the signal?

5. 🎯 Is a realistic stop and target set?

6. ✋ If at least one answer is NO → do not enter.

---

🗂️ Format for trader's journal (recommended to keep)

№ Date Trend Pattern Level Volume Stop/Target Result Comment

and the most important rule that I learn to use (although unfortunately it is not working yet) ↓

→ Being without a position is also a position!)))

p.s. be wise))

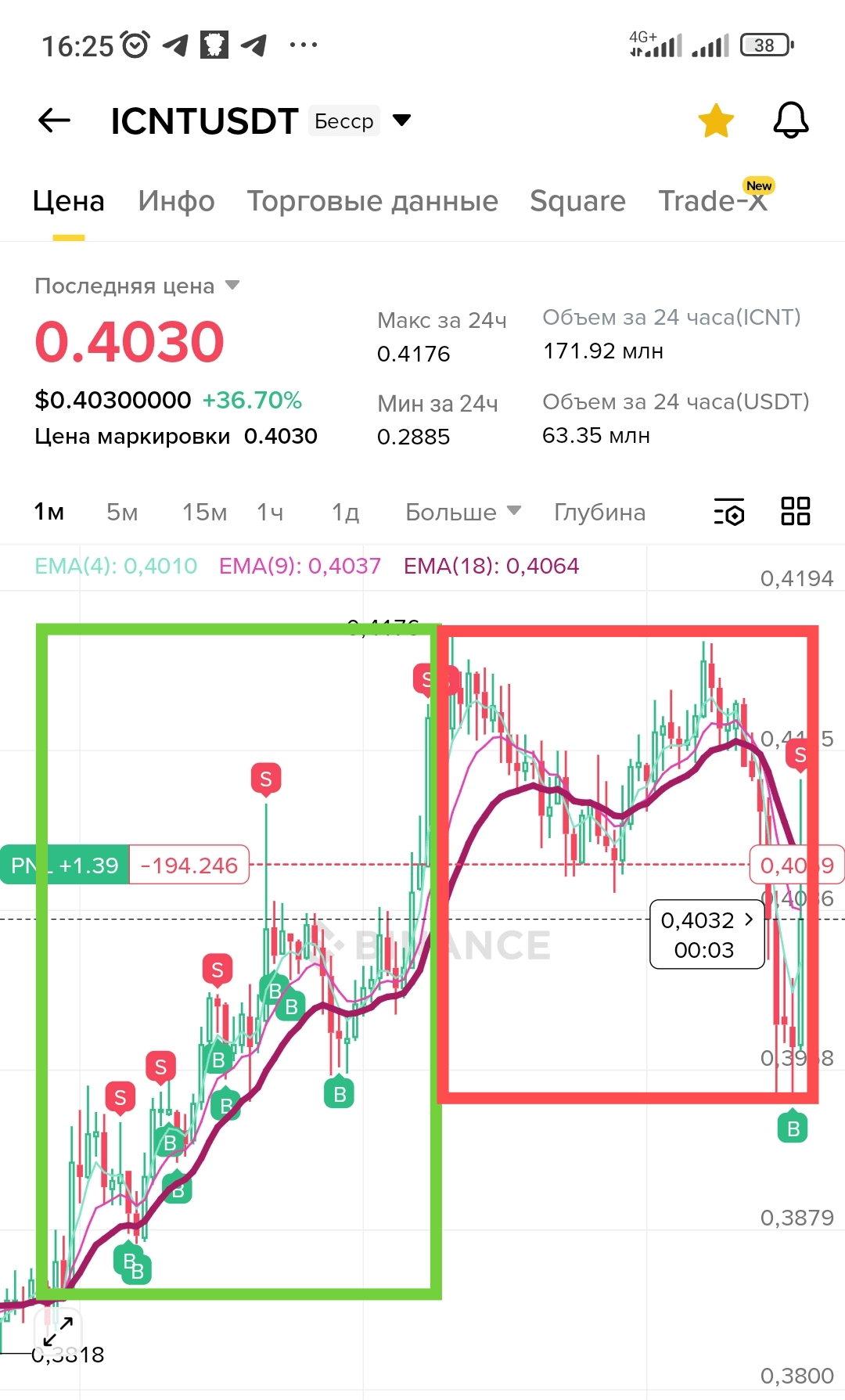

$ICNT Old long and after short (scalping position)