Short Correction in a Long Bullish Trend?

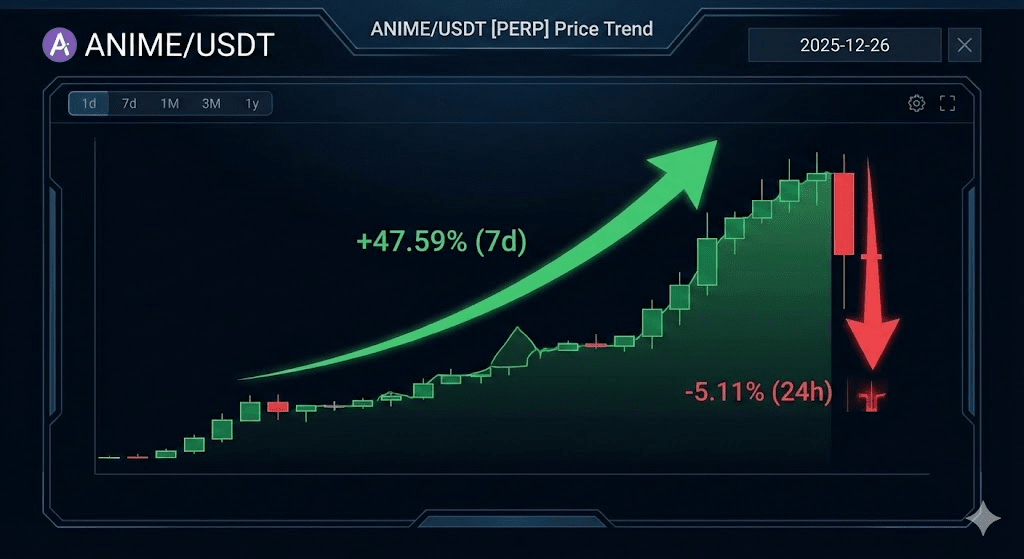

Illustrative chart showing the price trend of ANIME/USDT, highlighting the rise of 47.59% in 7 days and the recent drop of -5.11% in 24 hours.

A recent analysis by Alphanexus Institutional on the asset ANIME/USDT [PERP] reveals a mixed outlook. Although the asset shows weakness in the short term with a change of -5.11% in the last 24 hours, it maintains a strong bullish trend in the longer term, recording an increase of 47.59% in the last 7 days.

The current technical structure is rated as neutral, presenting an RSI of 59.58 and a bearish EMA trend. However, attention should be paid to an important risk factor: a net negative flow of $-40,097,857, which could affect the stability of the asset.

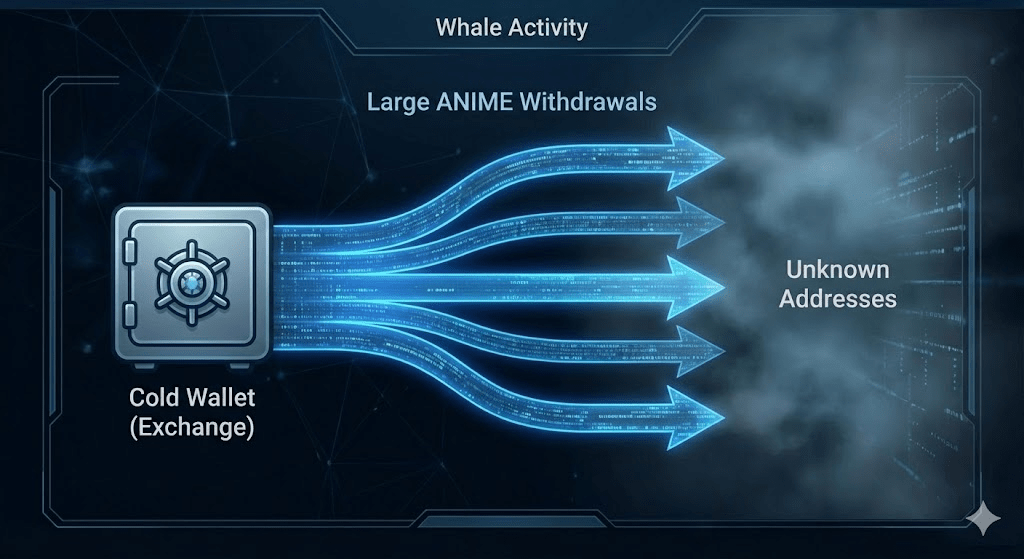

Infographic representing "Whale Activity," showing arrows indicating large withdrawals from "Cold Wallets (Exchange)" to "Unknown Addresses."

Context and Whale Activity

The external narrative has focused on the recent price increase of ANIME, driven by 30% rises in Arbitrum, which has captured the interest of the crypto community. It is mentioned that ANIME could be an asset with long-term growth potential, although currently there are no specific catalytic news indicating a significant change in the market.

Regarding the flow analysis, the large movements observed suggest a distribution of the asset. Several withdrawals of large amounts of ANIME have been detected from cold exchange wallets to unknown addresses.

Technical analysis chart marking key levels: Support at $0.005, Resistance at $0.0105, and intermediate interest zones at $0.0080, $0.0090, and $0.0100.

Probable Scenarios (Theoretical Plan)

The analysis presents two main theoretical scenarios based on key technical levels:

Bullish Scenario: If $ANIME manages to break the resistance level of $0.0105, the next logical target would be $0.0120, considering the overall bullish trend and interest in the asset.

Bearish Scenario: If the asset loses the support level of $0.005, the risk increases towards $0.0030, considering the short-term weakness and the net negative flow.

Traders should pay attention to the technical interest areas at $0.0080, $0.0090, and $0.0100, which could serve as reaction zones.

This analysis is based on a confidential report from Alphanexus Institutional dated December 26, 2025.

#ANİMECOİN #CryptoAnalysis #BinanceSquareFamily #TradingTrends