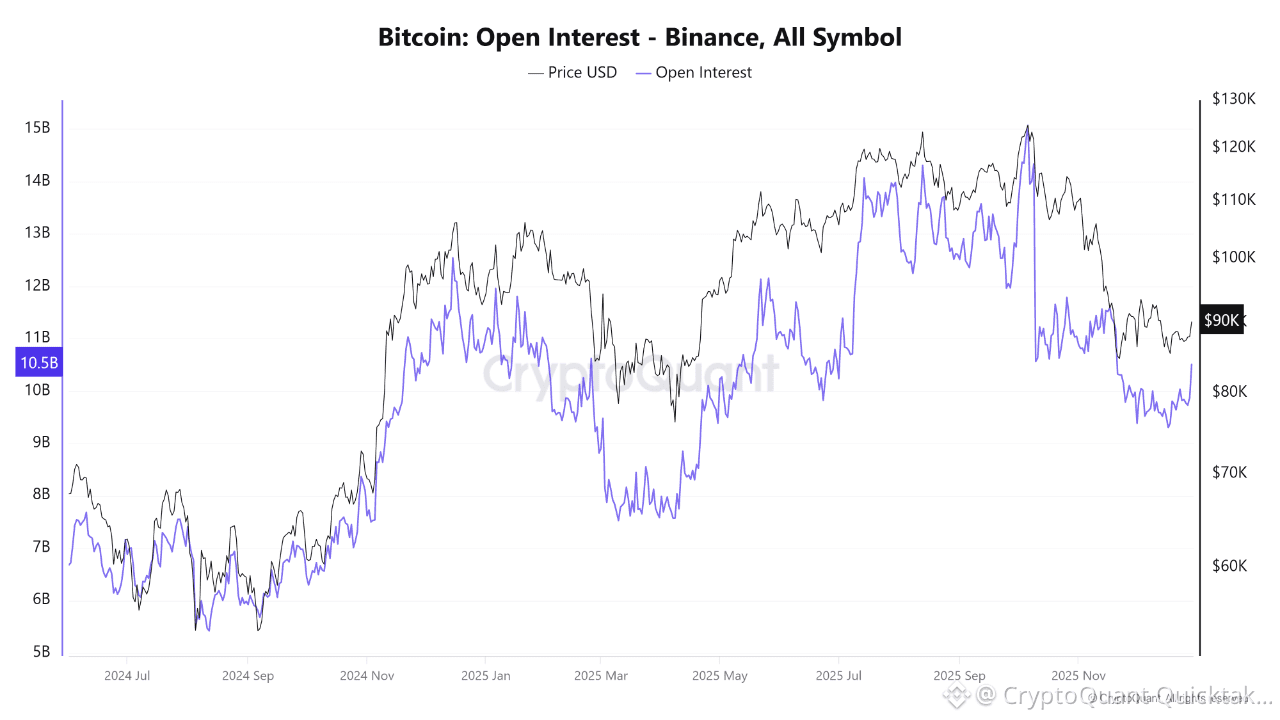

Bitcoin data on the Binance platform indicate that open interest has risen to its highest level in nearly a month, after hitting a low of around $9.3 billion. This shift is significant, as it suggests a gradual return of activity to the derivatives market following a period of contraction and heightened risk aversion.

When open interest reached $9.3 billion, the market was extremely cautious. This low coincided with a widespread sell-off and a notable exit by highly leveraged traders. This phase is often described as a “market clean-up,” during which weak positions are eliminated, reducing leverage-driven pressure and paving the way for more balanced price movements later on.

open interest began a gradual climb, currently reaching around $10.5 billion, its highest level in nearly a month. This rise does not appear to be random, but rather reflects a deliberate return to position-building. It suggests that traders are beginning to re-enter the market, albeit at a more conservative pace compared to previous periods that saw peaks exceeding $14 billion and $15 billion.

Most importantly, the increase in open interest coincided with a relative stabilization in Bitcoin’s price near $90,000, reducing the likelihood that this rise was driven by excessive short-term speculation. On the contrary, this alignment suggests that the market may be entering a repositioning phase, where new positions are being opened based on clearer forward-looking expectations.

Written by Arab Chain