On one side, Bitcoin is in a tug-of-war around the $90,000 mark, while on the other side, gold and silver are both hitting historic highs in a frenzy. Wall Street analysts are unanimously bullish on U.S. stocks, as the forces of bulls and bears in the market are being redefined.

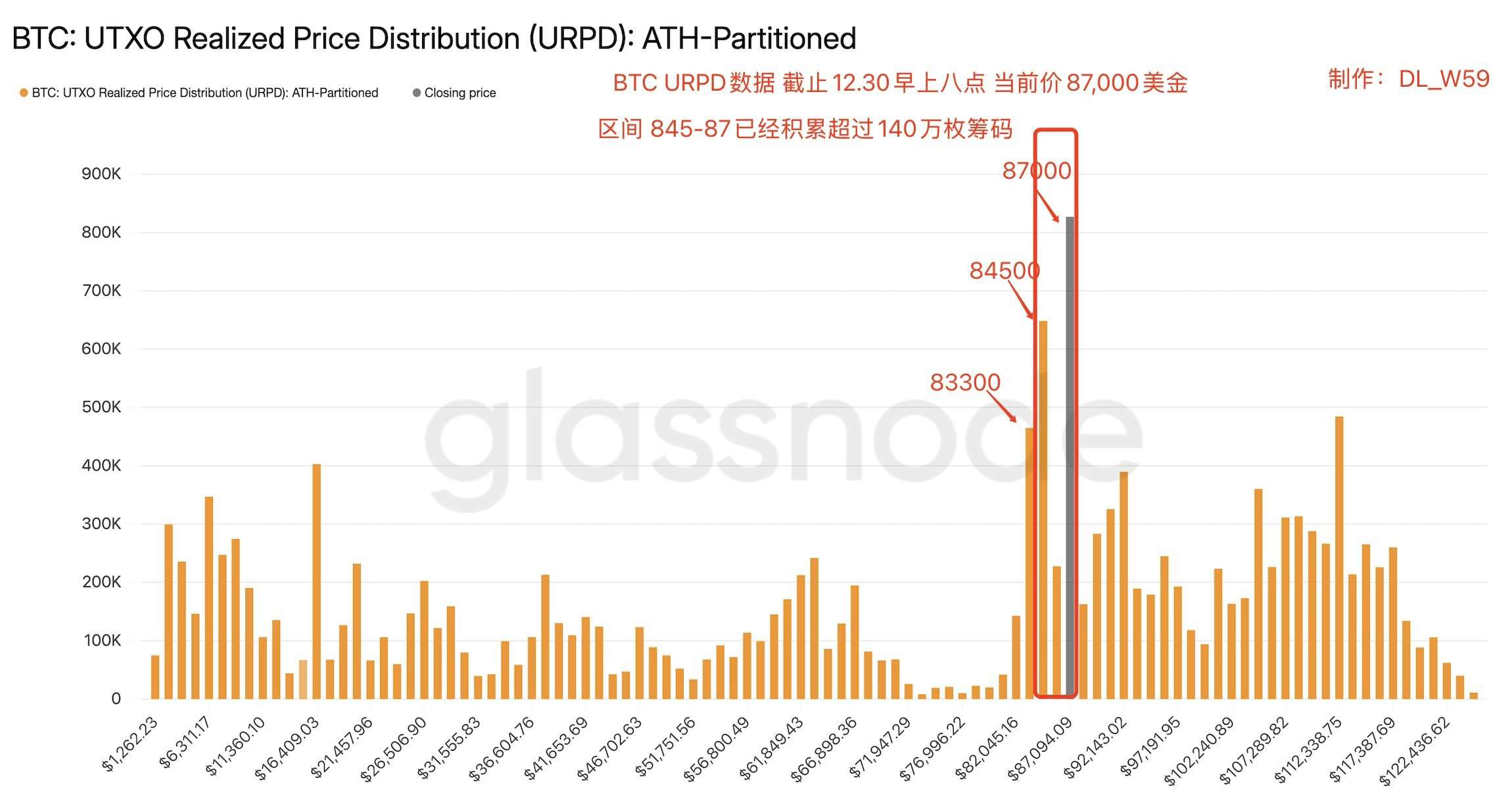

"The $90,000 curse has been talked about for a long time," wrote a cryptocurrency market observer on the trading day after Christmas. On that day, Bitcoin's price briefly touched $90,230 but quickly retreated to the $87,000 range in thin holiday trading.

At the same time, the precious metals market is experiencing a historic surge. On December 26, spot gold briefly reached $4549.96 per ounce, marking an astonishing increase of 72% year-to-date. Silver also surged over 10% in a single day, breaking the $79 per ounce mark.

01 Market Puzzle

At the end of 2025, the global financial markets presented a seemingly contradictory picture of conflicting long and short positions. Low holiday liquidity intensified market volatility, making price movements across various assets more unpredictable.

Any rally in the Bitcoin market unsupported by substantial trading volume faces the risk of a rapid reversal. Meanwhile, structural changes in the Bitcoin options market are quietly influencing price movements.

After record-breaking options expirations, open interest dropped nearly 50%, indicating many traders have temporarily stepped back to观望. Market makers' long gamma positions before options expiry have now turned into short gamma, meaning price increases will force these institutions to hedge by buying spot assets or short-term call options.

02 The $90,000 Battle for Bitcoin

According to market data, Bitcoin rose about 2.6% during low-liquidity trading periods but failed to maintain its $90,000 level during Monday's Asian session. Analysts remain cautious about Bitcoin's short-term outlook.

QCP Capital noted that this move lacks the necessary participation to decisively push prices higher. In fact, Bitcoin has been oscillating between $86,000 and $90,000 recently, forming a gradually expanding wedge pattern.

From a technical perspective, the Bitcoin market is still resisting lower levels, indicating that the downward momentum is weakening. Bulls need to break above $91,400 and, more critically, the $94,000 resistance level to regain control.

Market observers note that once Bitcoin breaks above $94,000, it could open a path toward $101,000 and even $108,000, though it will face significant resistance along the way. However, analysts emphasize that any breakout requires sustained spot demand; otherwise, the upward momentum may gradually fade.

03 The Super Cycle Logic of Precious Metals

While Bitcoin struggled around the $90,000 mark, the precious metals market experienced a historic rally. As of December 26, spot gold had posted a year-to-date gain of 72%, on track to record its largest annual increase since 1979.

Silver performed even more strongly, surging over 10% in a single day with a year-to-date gain of 174%. Platinum also showed strong performance, rising 10.39% in one day and 172% year-to-date.

Xia Yingying, analyst at Nanhua Futures, pointed out that the surge in the precious metals market stems from deep resonance among multiple factors. Core drivers include a decline of about 10% in the US dollar index, the Federal Reserve restarting rate cuts and technically expanding its balance sheet, and escalating trade tariffs accelerating de-dollarization.

The deeper driver lies in the ongoing crisis of US fiscal sustainability, which is undermining the credibility of the US dollar. A market analyst described it as 'the collapse of sovereign trust' and 'accelerated de-dollarization'.

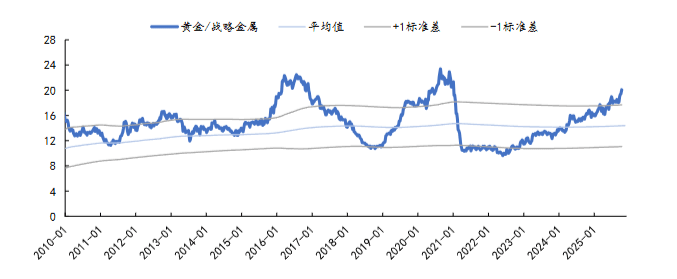

The precious metal ratio offers an interesting perspective on market valuation. According to historical data, the gold-silver ratio was approximately 12:1 in ancient Rome, around 15:1 in 19th-century America, and averaged between 40-60:1 throughout the 20th century.

In 2025, this ratio hovered around 80-85:1. A high ratio typically indicates that silver is relatively cheap compared to gold, potentially offering investment opportunities.

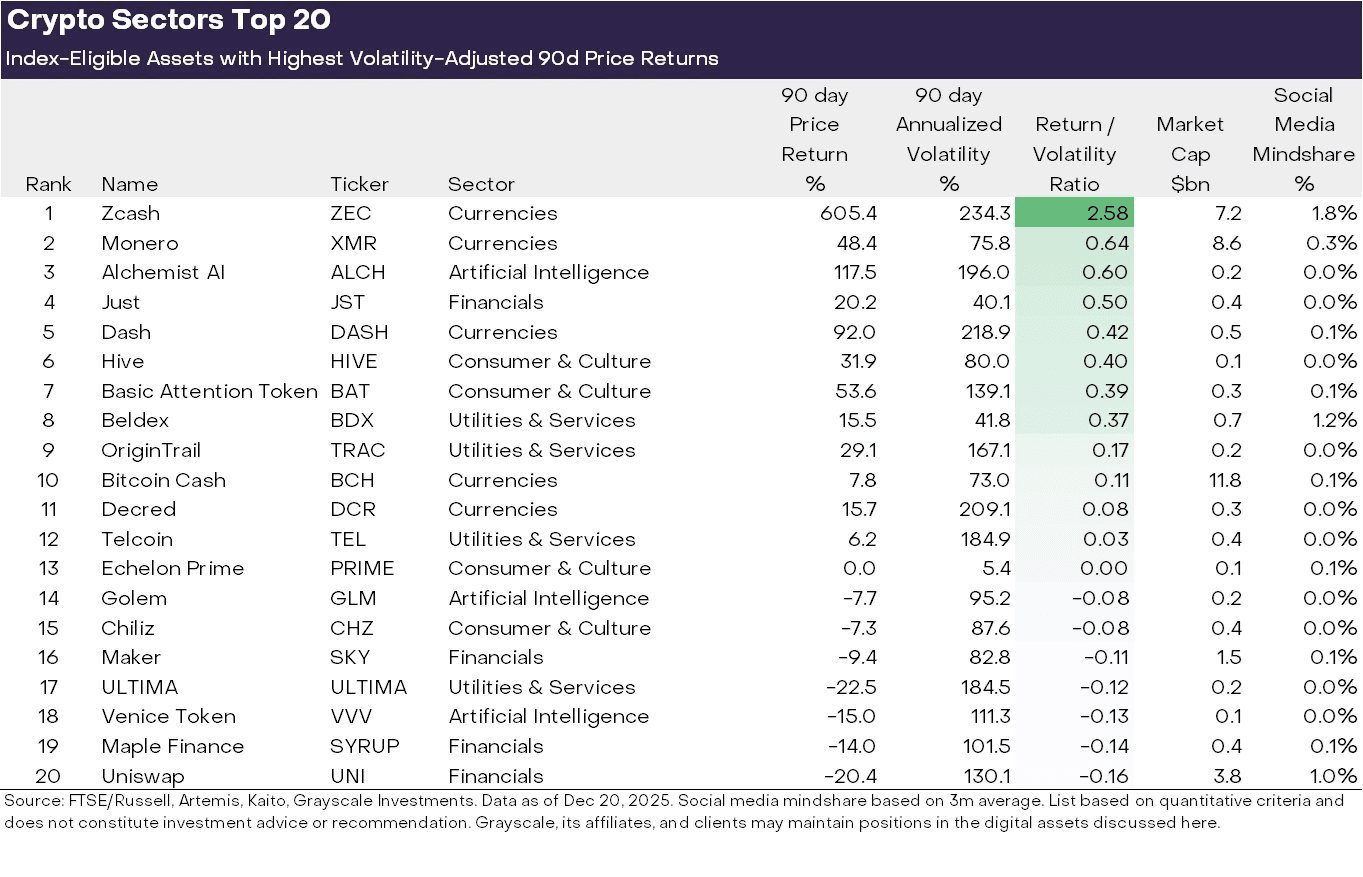

04 The Countercyclical Value of Privacy Coins

An interesting phenomenon in the 2025 crypto market is the counter-cyclical performance of privacy coins. During the overall market consolidation phase, privacy coins led by Zcash (ZEC) saw significant gains, with prices rising as high as 950% from their September lows—far outpacing the overall market.

This phenomenon has sparked market reflection. Privacy coins are not typical bull market assets; their underlying logic lies in a revaluation of value after the market began to distrust that 'rules will always be friendly'.

With Zcash's shielded pool (tokens held in private addresses) recently reaching a historical high of over 4.5 million tokens, it reflects growing user demand for true financial autonomy. The market is not just speculating—it is functionally demanding a system that offers accountability without sacrificing confidentiality.

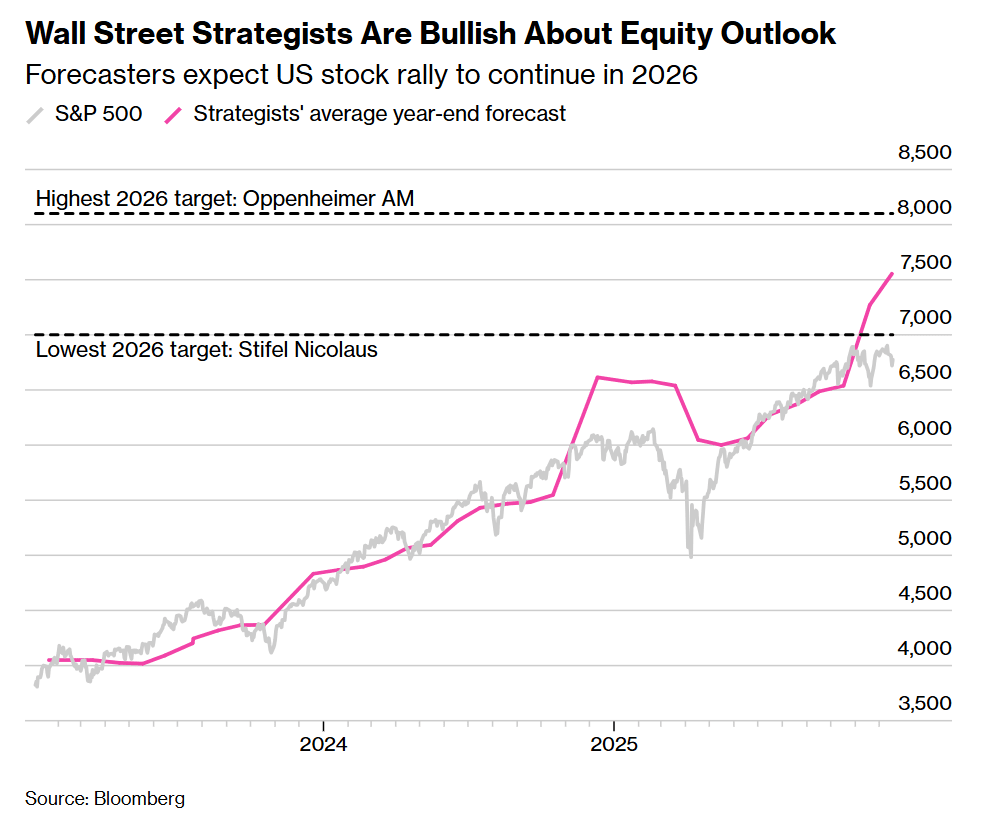

05 Consensus and Concerns in US Stocks

Despite the high volatility in both cryptocurrency and precious metals markets, Wall Street has shown an unusually optimistic consensus on US stocks. According to a Bloomberg survey of 21 analysts, none predicted a stock market decline in 2026, with an average forecast suggesting the S&P 500 will rise another 9%.

Senior market strategist Ed Yardeni stated: 'Pessimists have been wrong for so long that people are starting to tire of their narrative.' He forecasts the S&P 500 will close at 7,700 points next year, a rise of 11% from Friday's closing price.

Structural divergence is unfolding within US stocks. Since January 2009, the 12-month rolling returns of global tech stocks have surged by about 700%, while global equities excluding tech stocks have grown by only about 75%.

This 'great divergence' is underpinned by Nvidia maintaining a net profit margin above 55% in 2025, and tech giants like TSMC, Microsoft, and Meta achieving net profit margins exceeding 35%. This level of efficiency is difficult for traditional manufacturing and retail sectors to match.

06 2026 Asset Allocation: A Logical Framework to Cut Through the Noise

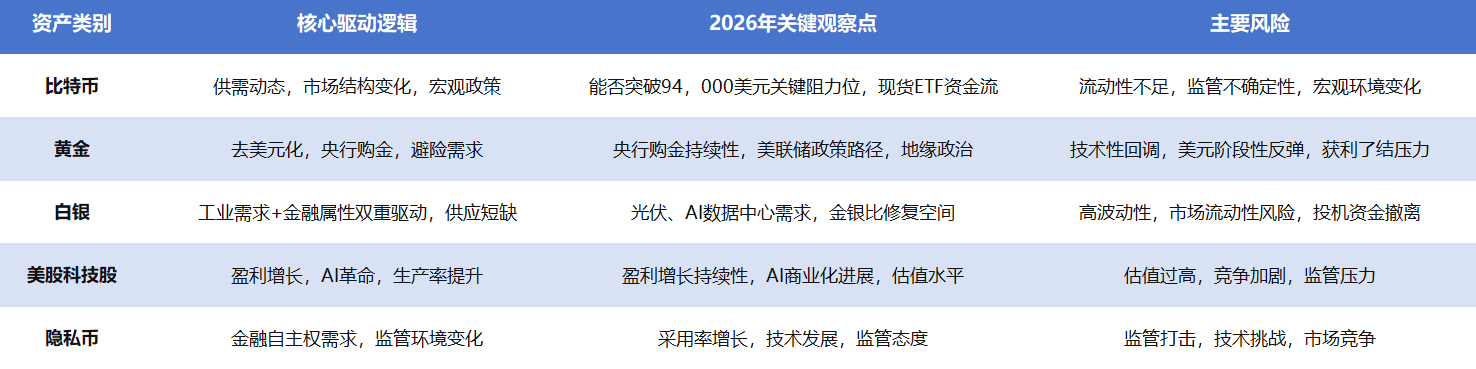

Faced with the complex performance across multiple asset classes, investors need to establish a clear logical framework to navigate the 2026 market environment. Different asset classes are driven by distinct underlying logics and factors.

Although gold and silver are both precious metals, their driving logics differ. Gold is primarily driven by its monetary and financial attributes, while silver's rise relies simultaneously on industrial and financial factors.

Professor Li Huihui from Lyon School of Management refers to gold as 'a thermometer of monetary credibility,' believing its recent rise is primarily driven by 'the collapse of sovereign trust' and 'accelerated de-dollarization'.

For investors, understanding the underlying logic of different assets is crucial. Bitcoin remains primarily driven by supply-demand dynamics, market sentiment, and macroeconomic conditions; precious metals are influenced by monetary attributes, industrial demand, and safe-haven sentiment; US stocks, especially tech stocks, are more driven by earnings growth and innovation.

To better illustrate this divergence, the following table compares the core logic of different asset classes:

07 The Chemical Foundation of Precious Metals as Natural Money

When discussing precious metals, a fundamental question arises: why were gold, silver, and platinum chosen as monetary forms throughout history? This is directly related to their chemical properties.

Those familiar with chemistry know the activity series of metals: 'Potassium, Calcium, Sodium, Magnesium, Aluminum, Zinc, Iron, Tin, Lead, Hydrogen, Copper, Mercury, Silver, Platinum, Gold.' Gold sits at the very end of this sequence, meaning it is one of the least chemically reactive metals.

Gold does not readily form stable compounds and tends to exist in its elemental form, a characteristic that has allowed it to preserve value across millennia. Silver and platinum also exhibit similar stability, although platinum historically did not become a mainstream currency due to limitations in mining technology.

In modern financial markets, the price relationship between gold and silver has become a key tool for professional traders to assess relative value. The historical range of the gold-silver ratio is vast—from 12:1 in ancient Rome to 120:1 during the 2020 pandemic. In 2025, this ratio hovered between 80-85:1, still at historically high levels.

Beyond ratios between precious metals, professional investors also monitor broader metrics such as the Dow-to-gold ratio (measuring relative value between equities and gold) and the real estate-to-gold ratio. These tools help investors identify cross-market relative value opportunities, rather than focusing solely on the absolute price of a single asset.

In contrast to the stable chemical nature of precious metals, the value foundation of cryptocurrencies like Bitcoin and risk assets like tech stocks is more built on intangible elements such as technological innovation, network effects, and market consensus.

The investment environment in 2026 will become more complex, with ongoing geopolitical tensions, US debt issues, technological advancements, and global monetary policy uncertainty continuing to intertwine and impact asset performance. Investors need to build diversified portfolios based on a deep understanding of the underlying logic of different asset classes, rather than simply chasing short-term trends.

Disclaimer: The content of this article is for market information interpretation and opinion sharing only, and does not constitute any investment advice. Markets involve risks; investment decisions should be made with caution. Readers are encouraged to make independent judgments and decisions, and assume full responsibility for all risks.