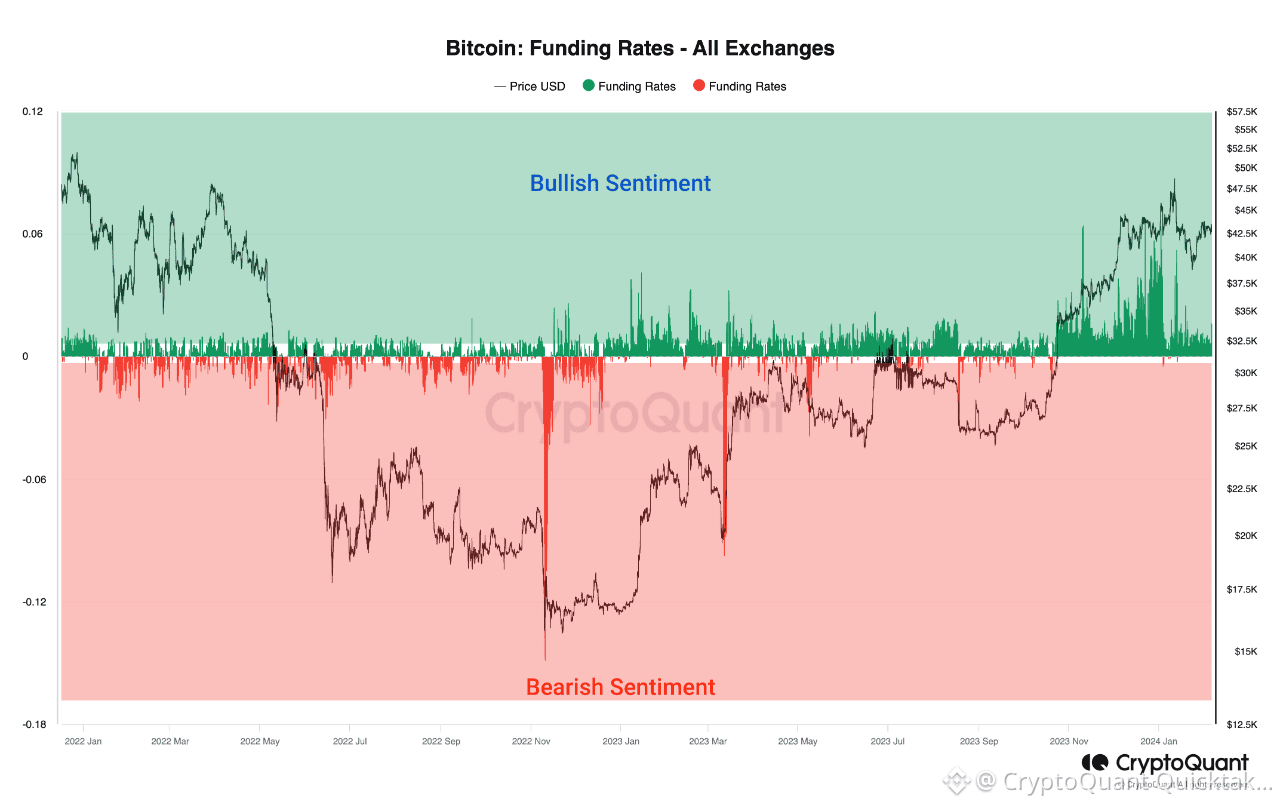

BTC funding rates across major exchanges have been hovering around neutral to positive levels for an extended period, signaling a clear shift in derivatives market behavior compared to previous bearish phases. Historically, prolonged negative funding aligned with deep drawdowns and forced deleveraging, particularly during mid to late 2022. The current structure, however, looks materially different.

While funding rates remain mostly positive, they are not excessively elevated. This indicates that long positioning exists, but leverage has not reached euphoric or overcrowded conditions. From a macro on-chain perspective, this balance is important, as sustainable uptrends tend to form when optimism builds gradually rather than through aggressive leverage expansion.

Past cycles show that deeply negative funding often marks local or macro bottoms, as shorts become overextended and vulnerable to squeeze-driven reversals. In contrast, the present funding environment suggests the market has already absorbed prior deleveraging and is transitioning into a more stable risk-on regime.

Notably, positive funding has persisted even during periods of price consolidation. This implies traders are increasingly willing to maintain long exposure despite short-term stagnation, a behavior typically associated with strengthening conviction rather than speculative excess.

From a macro standpoint, this aligns with a broader shift away from survival-mode positioning toward capital reallocation back into Bitcoin. As long as funding rates remain moderately positive without spiking into extreme territory, the derivatives market is reinforcing trend stability rather than signaling overheating.

Overall, Bitcoin funding rates suggest structurally improved sentiment and support a constructive medium-term outlook. However, continued monitoring remains essential, as sharp funding expansions would indicate rising leverage risk and a potential change in market dynamics.

Written by CryptoZeno