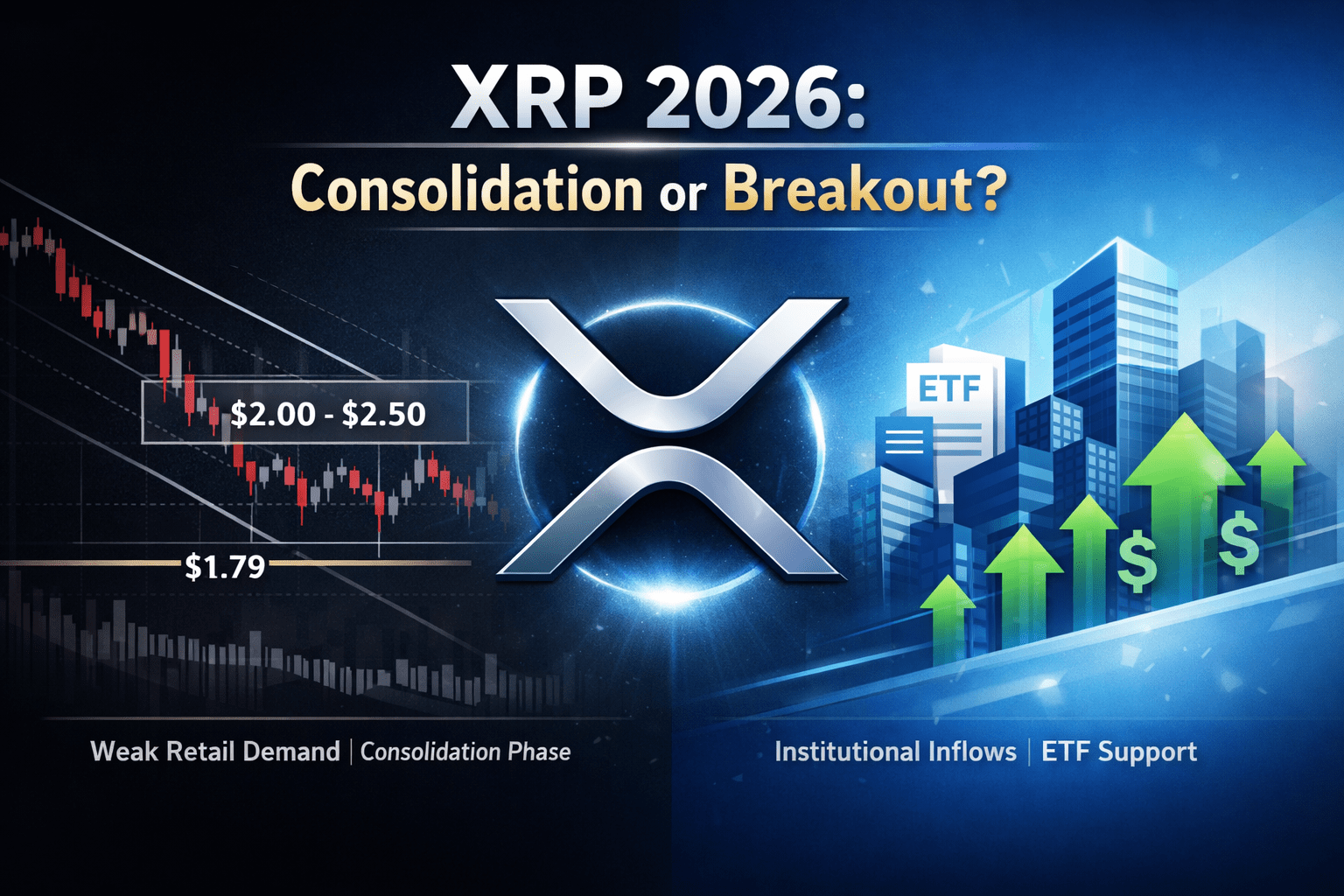

$XRP The price has been under pressure for the last few weeks and despite recovery attempts, it has not been able to confirm a clear breakout. XRP continued to trade within a broader downtrend by the end of 2025, while performance lagged behind market expectations. Weak spot demand and cautious sentiment from retail investors continued to limit the upside.

Despite this, institutional investors provided strong support for XRP. According to CoinShares, XRP saw inflows of approximately $70 million in the last week of December, while total monthly inflows reached $424 million. Throughout the year, XRP attracted $3.3 billion in inflows, indicating that institutions are positioning for the long term rather than reacting to short-term noise.

XRP ETFs have also reinforced institutional confidence. Since the launch, there has been no net outflow recorded in XRP ETFs, indicating sustained demand. Market experts suggest that institutions often accumulate before ETFs, with price reactions coming later.

Long-term holders saw both accumulation and distribution phases during 2025. Distribution was more evident in Q4, highlighting uncertainty. If this trend continues into 2026, XRP may face extended consolidation or correction.

Currently, XRP is trading at around $1.87. The outlook for early 2026 is cautious. Unless a strong macro catalyst emerges, XRP may move within the $2.00–$2.50 range. A sustained breakout above $3.00 could bring back a broader bullish trend, while moving below $1.79 would increase downside risks.

Final Thought: Institutional support and ETFs strengthen the long-term structure, but in the short term, XRP may face volatility and consolidation.