The trading volume of futures contracts $BTC is significantly decreasing, while the selling side still maintains control over the market and this is something I am closely monitoring in the current context.

Bitcoin futures trading remains the driving force shaping the market structure, even though daily trading volume has decreased by nearly half since November 22. Specifically, the volume has decreased from about 123 billion USD to 63 billion USD.

For me, this drop clearly explains why BTC has been moving sideways, with low volatility and not generating significant price momentum in recent weeks.

However, in the overall market context, 63 billion USD in daily futures volume is still a very large number.

It is nearly 20 times the trading volume of Bitcoin spot ETFs (around 3.4 billion USD) and more than 10 times the volume of traditional spot markets (around 6 billion USD). Therefore, I do not believe that ETFs or spots are leading prices at this moment; futures remain the determining factor for short- and mid-term price behavior.

Many opinions are focused on the outflow of funds from ETFs in recent weeks.

From my perspective, this capital flow does contribute to selling pressure, but it is merely supplementary. The focus remains on the derivatives market, where the scale and speed of trading completely overshadow the remaining segments.

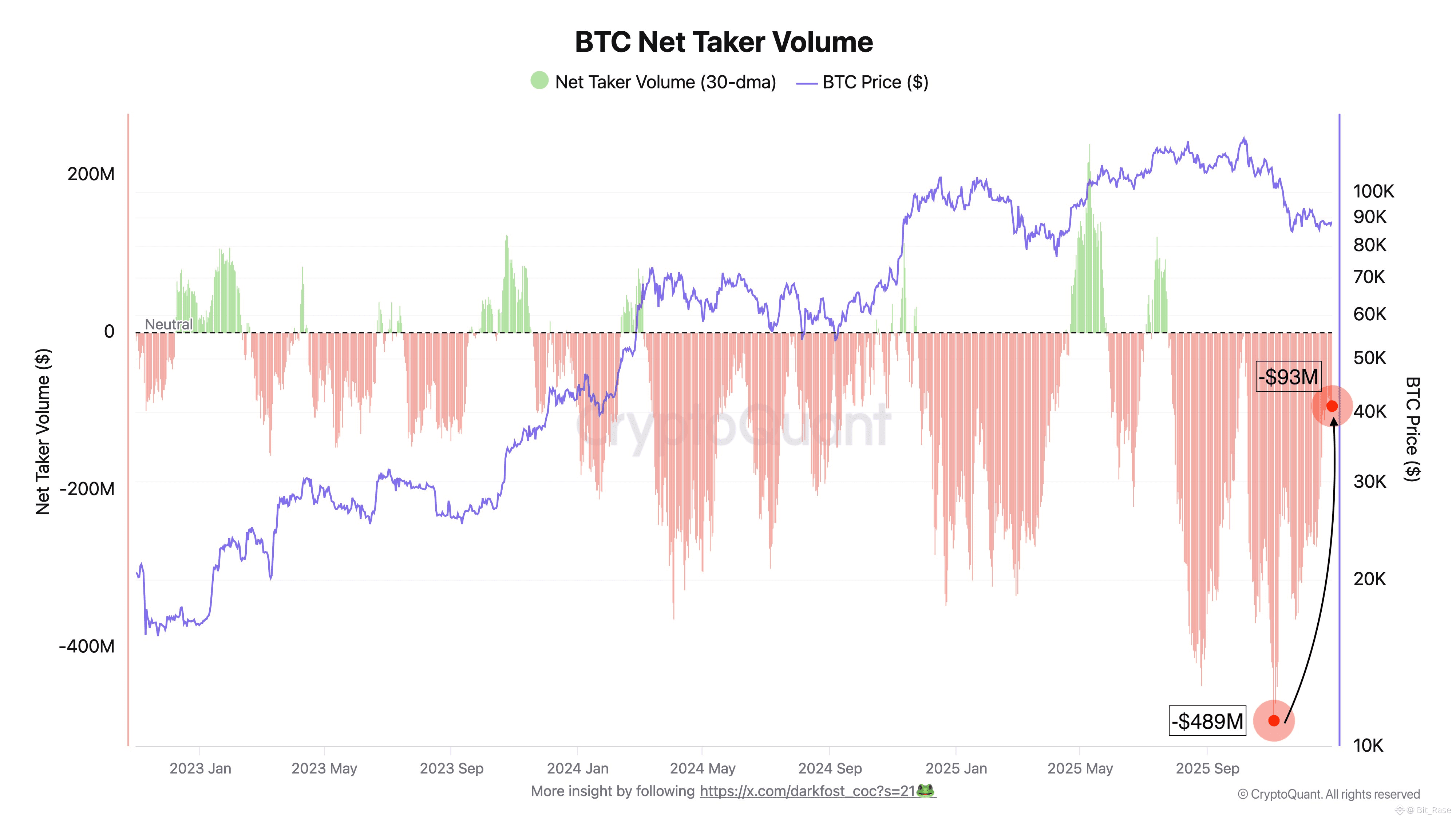

Delving into the net buying volume indicator in the futures market, what I find quite consistent is: each time this indicator shifts to negative territory, Bitcoin enters a phase of correction or prolonged accumulation.

Negative net buying volume means that selling pressure is dominant, and when the negative degree expands rapidly, selling pressure from futures becomes much more apparent.

Since July, net buying volume has mostly remained negative. At the beginning of October, there was a significant decline, creating conditions for BTC to reach a new peak, but then the selling side quickly regained control over the market.

As a result, in the last month, Bitcoin has been 'stuck' in a narrow price range – typical of a market lacking a leader that I often see before strong polarization phases.

The positive point that I highly value is that selling pressure from the futures market has significantly decreased since the beginning of November. Net buying volume has improved from around -489 million USD to around -93 million USD. This indicates that the selling side is weakening, and the derivatives market is entering a more balanced state.

However, in my opinion, the mere reduction in selling pressure is not enough to trigger a new trend. Overall liquidity remains weak, while both ETFs and spot are not large enough to absorb the existing supply on futures.

As long as the market still depends on derivatives without new capital from spot, BTC is likely to continue accumulating.

This is a state that I will closely monitor in the near future. Only when futures truly stop creating selling pressure and the leading role gradually shifts to spot or ETFs, will the market have a basis for an expansion phase and form a clearer trend