You’re probably scrolling Binance Square thinking, “Another oracle project… do I really need to care?” Fair question. Most traders ignore oracles until something breaks. But APRO is one of those projects that quietly sits under the hood, doing work that actually decides whether a DeFi app lives or dies. And once you see how it works, you’ll understand why seasoned traders pay attention to it early.

You can have the best cryptocurrency strategy in the world, but if the data feeding your dApp is wrong, everything collapses. Oracles are the bridges that bring real world data on-chain. Prices, randomness, game outcomes, even real estate data. A weak oracle means bad liquidations, manipulated trades, and broken protocols. This is exactly the problem APRO is trying to fix.

What APRO actually does, in simple words

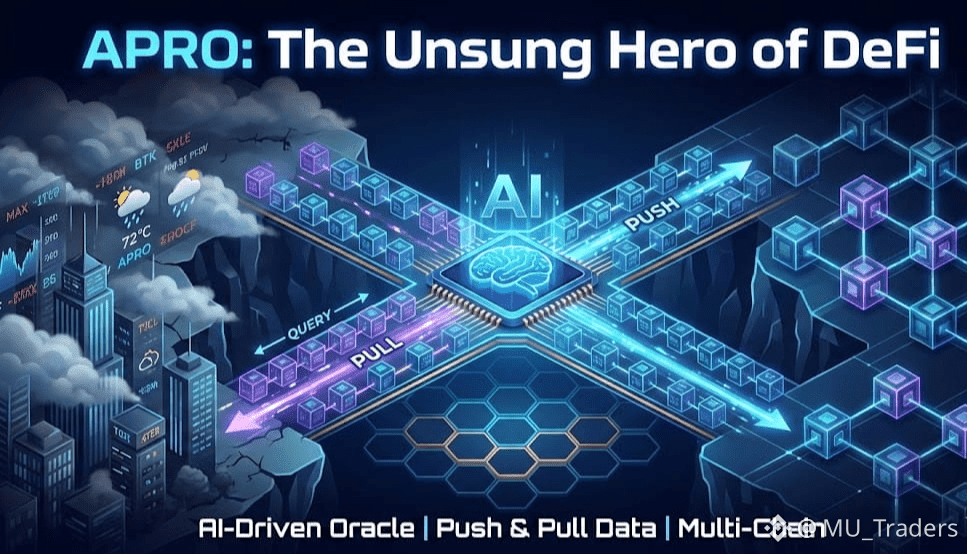

APRO is a decentralized oracle designed to deliver reliable, real-time data to blockchain applications. It uses both off-chain and on-chain processes to balance speed, cost, and security. Instead of forcing developers into a single data model, APRO offers two flexible methods.

Data Push and Data Pull explained like a trader

Data Push is simple. APRO actively sends updated data to smart contracts. This is useful for fast-moving markets like cryptocurrency prices, where delays can mean losses.

Data Pull works differently. The smart contract requests data only when it needs it. This helps reduce costs and avoids unnecessary updates. As a trader, think of it like checking price only when you place an order instead of refreshing every second.

This dual approach makes APRO efficient without sacrificing performance.

AI-driven verification is the real edge

Here’s where APRO starts to feel next level. It uses AI-driven verification to check data accuracy before it hits the blockchain. Most oracles rely heavily on manual or static validation rules. APRO adds an adaptive layer that can detect anomalies and inconsistencies.

From a trader’s mindset, this reduces the risk of flash crashes caused by bad feeds. You might never see this feature directly, but you’ll feel it when platforms behave more smoothly during volatility.

Verifiable randomness for real use cases

Randomness sounds boring until you realize how many applications depend on it. Gaming, NFTs, lotteries, and even certain DeFi mechanisms require randomness that cannot be manipulated.

APRO provides verifiable randomness, meaning anyone can verify that outcomes were fair and not influenced by validators or insiders. This is critical for trust, especially as crypto adoption expands beyond hardcore traders into mainstream users.

Two-layer network for security and scalability

APRO uses a two-layer network architecture. One layer focuses on data collection and validation, while the other handles on-chain delivery. This separation improves security and allows the system to scale without becoming expensive.

As someone who’s traded through congested networks, I appreciate this design. It helps keep gas costs lower and performance stable, even when markets heat up.

Multi-asset and multi-chain support

APRO doesn’t limit itself to just cryptocurrency prices. It supports stocks, real estate data, gaming metrics, and more. On top of that, it works across more than 40 blockchain networks.

This matters because serious adoption does not happen on one chain alone. Developers want flexibility. Traders want access to more products. APRO is positioning itself where both needs meet.

Easy integration and lower costs

One underrated advantage is how closely APRO works with blockchain infrastructures. This makes integration easier for developers and cheaper for users. Lower oracle costs often translate into better yields, fewer fees, and more sustainable DeFi platforms.

From a trader’s perspective, that’s a silent win.

My honest take as a seasoned trader

I’ve seen many oracle projects promise reliability and disappear after one bad exploit. APRO feels different because it focuses on fundamentals: data quality, verification, and scalability. It’s not hype-driven. It’s infrastructure-driven.

If crypto is going to onboard the next wave of users, projects like APRO will matter more than flashy tokens. You don’t trade oracles directly every day, but you trade on platforms that depend on them.

Final thoughts

You don’t need to be a developer to understand why APRO matters. If you use DeFi, GameFi, or any on-chain application, you’re already trusting an oracle somewhere. APRO is building that trust layer with smarter verification, flexible data delivery, and wide network support.

Sometimes the best crypto opportunities are not the loudest ones, but the ones holding everything together.

Sources and further reading:

APRO official documentation: https://apro.com

General oracle overview by Chainlink: https://chain.link/education/blockchain-oracles

Decentralized oracle risks and design explained by Ethereum Foundation: https://ethereum.org/en/developers/docs/oracles/