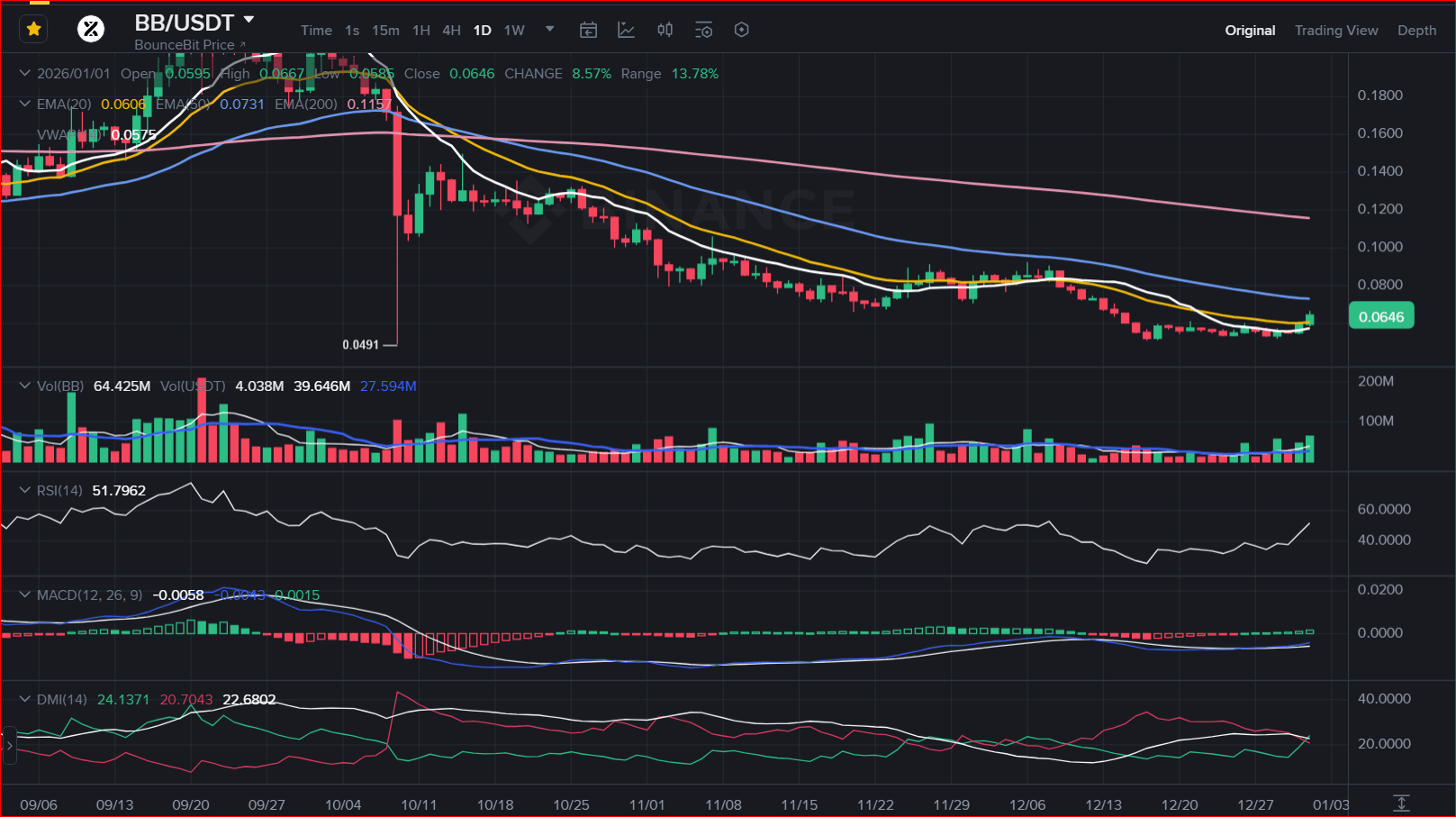

$BB has had volatile behavior recently. We analyze whether this rise is a simple "dead cat bounce" or the start of a V recovery.

1️⃣ The Fundamental Context

BounceBit moves significantly based on BTCFi narratives (Bitcoin DeFi). If Bitcoin is strong or ranging, capital rotates to its ecosystem. This rise suggests smart capital rotation seeking Bitcoin "betas."

2️⃣ Technical Analysis (4H and 1D)

Resistance Break: Check if the price has managed to break the 50 EMA (Light Blue Line). That is the "Berlin Wall" for BB. Breaking it changes the bearish structure to neutral.

Volume (The Snitch): Look at the volume bars below. Do you see increasing green bars accompanying the rise? Without volume, the rise is suspicious.

3️⃣ The DMI Traffic Light

In the DMI indicator: Did the Green line (+DI) violently cross above the Fuchsia line (-DI)?

If the ADX (White) is still low (below 20), it means the trend is just beginning and could have a lot of room to grow.

Conclusion:

If the RSI (White Line) is not above 70 (extreme overbought), there is still room to rise. BB is an explosive asset; protect your gains by adjusting the Stop Loss to the 20 EMA (Yellow).

👇 Are you staking BB or just speculating on the price?

#bouncebit #CeDeFi #BitcoinEcosystem #CryptoAnalysis #BinanceSquare

🇬🇧 English Summary:

BounceBit ($BB) Awakening? Potential trend reversal driven by BTCFi rotation. Key levels: Price needs to hold above the 50 EMA (Light Blue). Watch the DMI: If +DI (Green) crosses -DI (Fuchsia) with increasing Volume, the rally is sustainable. If Volume is low, beware of a fakeout.

⚠️ Disclaimer: This content is for educational and informational purposes only. It does not constitute financial advice. Do your own research (DYOR).