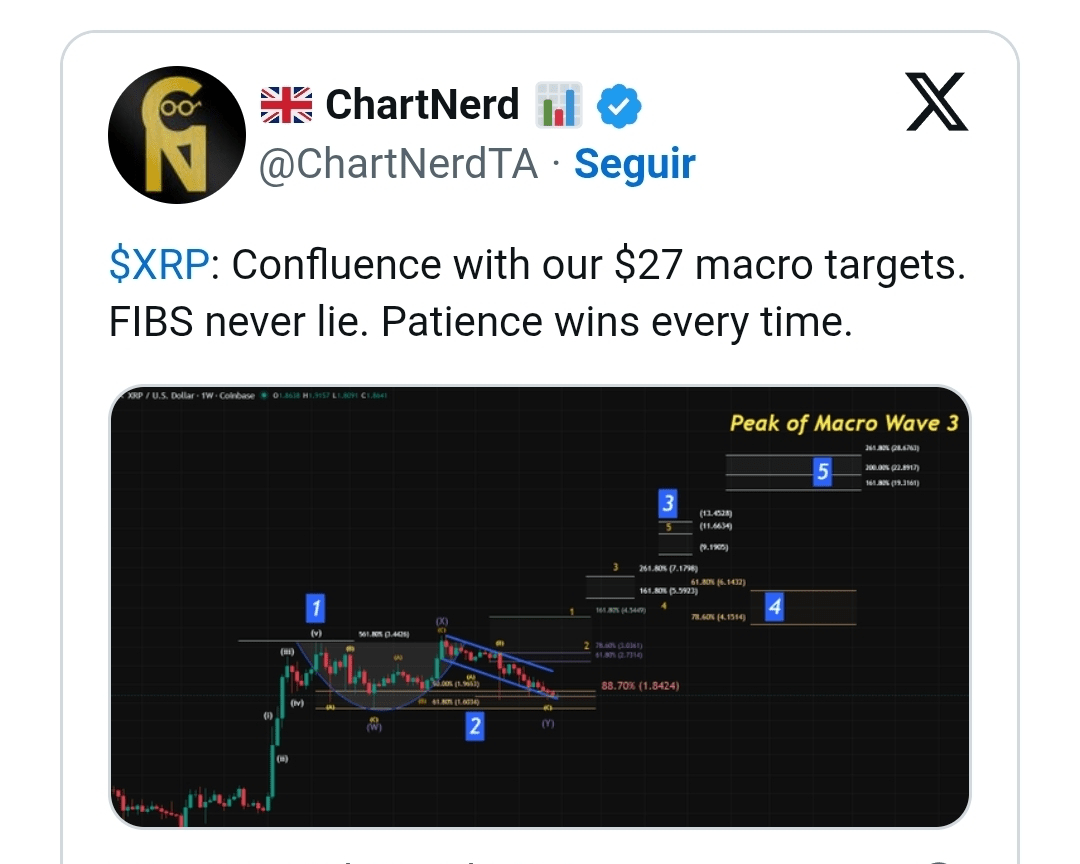

ChartNerd (@ChartNerdTA), a highly respected cryptocurrency analyst, shared a long-term chart of XRP highlighting a confluence between Fibonacci extensions and a developing Elliott Wave structure. The chart focuses on the weekly XRP/USD pair and maps out a structure that could lead XRP to $27.

Instead of reacting to short-term volatility, the chart focuses on a large cup and handle pattern that has developed over an extended period. XRP's rise to its all-time high in July 2025 marked the completion of the cup. What followed was a controlled decline that persisted throughout the remainder of 2025.

This drop formed the handle portion of the pattern. This prolonged consolidation also aligned with the corrective behavior of the waves in the Elliott Wave pattern shown in the chart.

The cup and handle structure is aligned with the conclusion of Wave 2.

According to the caption on the ChartNerd chart, XRP completed a macro high of Wave 1 before entering a prolonged correction of Wave 2. The handle formation phase coincides with this corrective movement. XRP respected several Fibonacci retracement levels during the drop, including the 61.80% and 78.60% zones.

The chart also shows a retracement of 88.70% near $1.84, which acts as an important invalidation level. Despite several drops below this level, XRP quickly recovered and continued within the handle pattern. With XRP close to the end of the cup pattern, a confirmed breakout would signal the transition from Wave 2 to Wave 3.

The targets of Wave 3 point to double-digit levels.

In Elliott Wave theory, Wave 3 is typically the strongest impulse. The ChartNerd chart projects the targets of Wave 3 using Fibonacci extensions from the previous impulse. The first significant extension is at 161.80%, positioning the price near $5.59. Higher extensions cluster around $7.17 and $13.45, based on the projections of 261.80% and intermediate levels marked on the chart.

These levels are aligned with Wave 3, reinforcing the analyst's view that a breakout from the handle would represent a significant movement. The chart does not show intermediate resistance zones between the breakout area and these targets, which supports the idea of a strong expansion phase if the market gains momentum.

Wave 5 and the macro target of $27

In addition to Wave 3, the chart extends projections for Wave 5. The Fibonacci extensions between 161.80% and 261.80% position the final targets in the range of $19 to $28. The upper projection aligns with the macro target of $27 mentioned in the ChartNerd post.

Wave 4 is projected as a consolidation zone between Wave 3 and Wave 5, with retracement levels marked near $4.15 and $6.14. This range suggests volatility but not structural failure, should XRP reach it after a high of Wave 3.

🚀 FOLLOW for early alerts 🙌🏽🚀💰💰💰

Remember folks, that nothing said here represents a recommendation to buy, sell, or maintain assets.

Thank you all!