The long-term technical structure of XRP has once again become the focus of attention, as cryptocurrency analyst Egrag Crypto examines the recent developments in the monthly Relative Strength Index.

Your analysis focuses on the historical behavior of momentum and how similar conditions of the RSI preceded notable changes in trend structure. The current setup, according to the analyst, closely resembles previous cases where XRP shifted from prolonged corrective phases to periods of renewed strength.

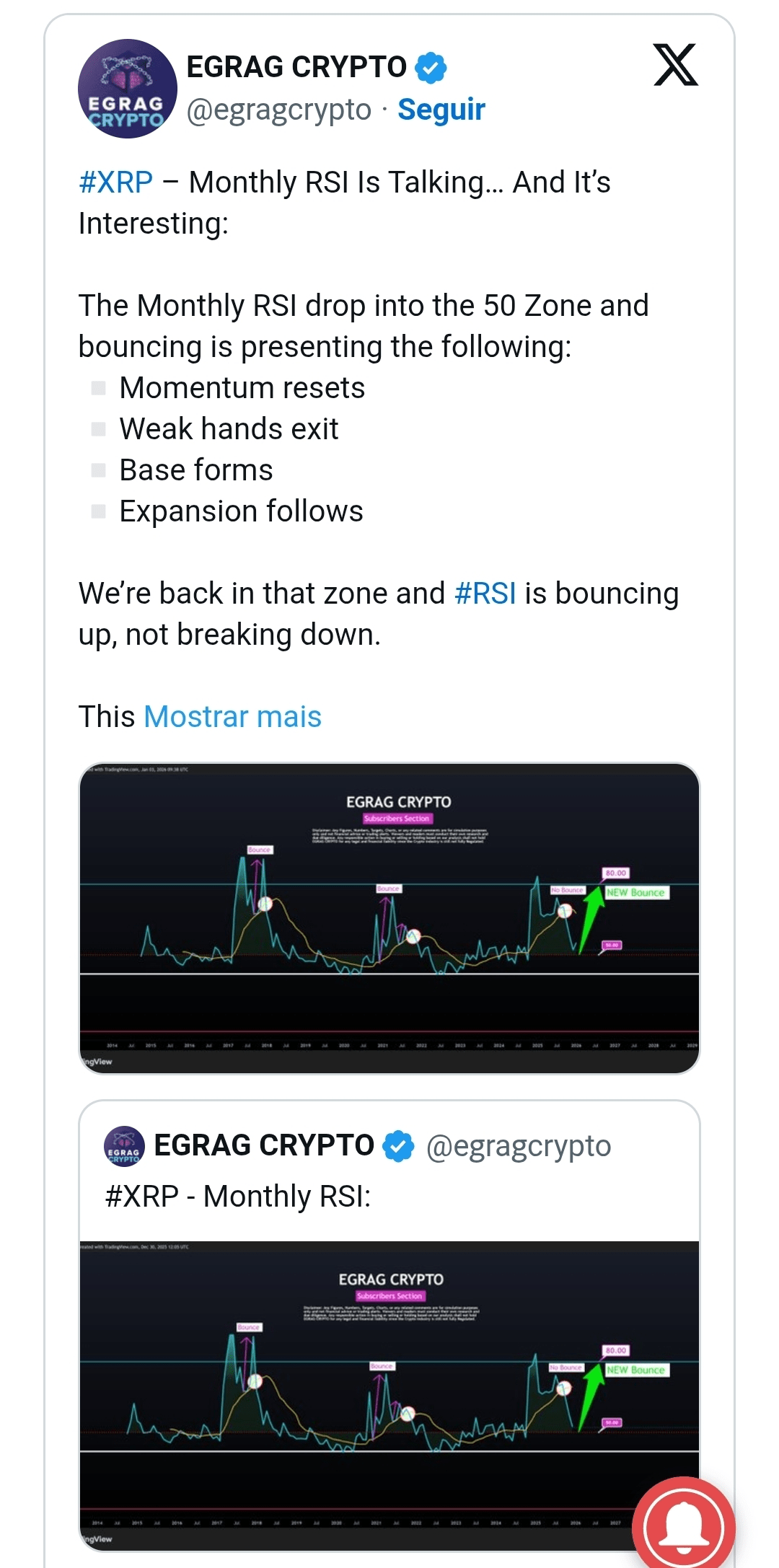

The monthly RSI returned to the 50 zone, an area that historically acts as a momentum reset point rather than a sustained weakness signal. Egrag Crypto emphasizes that this level often marks the point where selling pressure diminishes, speculative excess is eliminated, and a structural base begins to form.

It is important to highlight that the RSI is described as rising from this zone rather than falling, a distinction that separates constructive resets from failed recoveries.

Historical context and the importance of the RSI reflection

The chart shows previous market cycles with a recurring pattern. When the monthly RSI fell to the 50 region and successfully recovered, XRP subsequently experienced a gradual strengthening of the trend, followed by expansion phases.

These previous rebounds contrast with a single historical case of failure, where the RSI did not hold within the zone and overall conditions deteriorated. Egrag Crypto notes that the current setup aligns more closely with successful rebound scenarios than with the exception.

The analysis suggests that this phase represents a maturing accumulation period, not a conducive environment for an immediate breakout. The RSI still does not indicate extreme momentum conditions, which supports the view that the market is still in a phase of structural rebuilding. According to the analyst, this absence of overheating reduces the likelihood of an abrupt reversal and keeps long-term bullish scenarios technically viable.

Probability Perspectives and Structural Expectations

Egrag Crypto assigns weighted probabilities to potential future paths based on the current behavior of the RSI. The most likely outcome, in their view, is a gradual strengthening of the trend from current levels, reflecting an improvement in momentum without excessive volatility.

A secondary scenario involves prolonged sideways consolidation, allowing price action to stabilize further while maintaining structural support. The least likely outcome is a collapse scenario, which the analyst specifically associates with a failure in broader macroeconomic support, and not just the internal structure of XRP.

The analysis reinforces the importance of confirmation. Although the recovery of the RSI suggests that the reset phase may be complete, further validation is expected through structural support and ongoing momentum development. Expansion, according to Egrag Crypto, would become more likely if the monthly RSI advanced towards the 70 to 80 range, a zone historically associated with stronger trend phases for XRP.

XRP: Structure before the Moment

The main conclusion of the analysis is that XRP's market structure is overlapping with short-term euphoria. Egrag Crypto interprets the current behavior of the RSI as evidence that accumulation is progressing and that the market is transitioning to a more constructive phase.

However, the analyst emphasizes that the structure must lead, confirmation should follow, and momentum should be the final signal, reinforcing a disciplined technical perspective and long-term outlook rather than premature expectations of rapid price acceleration.

🚀 FOLLOW for early alerts 🙌🏽🚀💰💰💰

Remember folks, that nothing said here represents a recommendation to buy, sell, or maintain assets.

Thank you all!