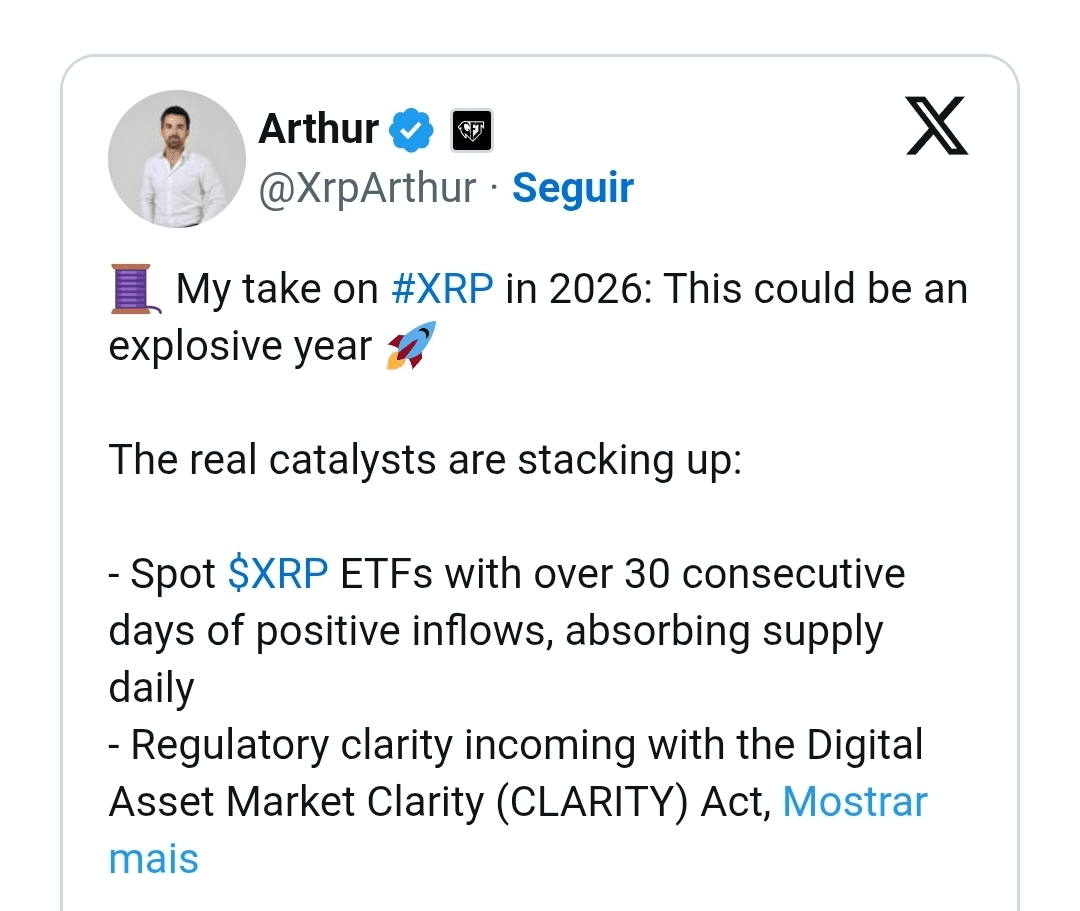

With increasing attention turning to 2026, cryptocurrency commentator Arthur presented a forward-looking assessment of XRP that focuses on structural developments rather than short-term price fluctuations.

Your analysis emphasizes that next year could be defined by institutional participation, regulatory clarity, and infrastructure readiness, factors that converge in favor of XRP. Instead of relying on speculative narratives, Arthur's vision is anchored in developments that are already consolidating in financial markets and political circles.

Momentum and supply dynamics of ETFs

A fundamental element of Arthur's perspective is the performance of XRP spot ETFs. He points to a sustained period of positive inflows extending over more than a month, arguing that this trend has significant implications for supply and demand.

According to his assessment, consistent inflows indicate a steady absorption of available XRP, potentially reducing net supply and signaling growing confidence among institutional allocators. Arthur considers this dynamic one of the most immediate market factors that can influence the trajectory of XRP in 2026.

Regulatory clarity as a structural catalyst

Arthur also highlights the anticipated impact of the Digital Asset Market Clarity Act, which is expected to establish clearer regulatory limits for digital assets in the United States.

He suggests that defined rules could lower entry barriers for large financial institutions that have remained cautious amid regulatory uncertainty. In his view, a clearer compliance framework in 2026 would not only legitimize broader participation but also support the expansion of regulated investment products linked to XRP.

Infrastructure preparation and validation by the industry

In addition to market mechanics and regulation, Arthur highlights the maturity of Ripple's infrastructure. He notes that extensive partnerships, the ongoing expansion of On-Demand Liquidity, and proven efficiency in international payments position the ecosystem for large-scale real-world use.

This assessment is reinforced by comments from key figures in the industry. Roger Bayston from FTI Consulting described the XRP Ledger as a payment-focused blockchain, designed for real-time and low-cost settlement, a characterization that Arthur sees as a validation of the established experience in financial services.

Additional institutional recognition is reflected in statements attributed to Maxwell Stein, director of BlackRock, who stated that trillions of dollars in assets are about to be migrated to blockchain through real-world tokenized assets using the XRP Ledger.

Arthur interprets these statements as signs that major asset managers are actively preparing for infrastructure capable of handling large-scale tokenization.

Price Expectations and Institutional Influence

Arthur's perspective also references projections by Geoffrey Kendrick from Standard Chartered, who set a price target of $8 by the end of 2026, citing demand for ETFs and favorable regulatory factors.

Although Arthur does not present this as a certainty, he agrees with the broader view that institutional adoption can materially influence evaluation. He also mentions comments from Ripple CEO Brad Garlinghouse, who stated that XRP is at the center of Ripple's operations, reinforcing the strategic importance of the asset.

In conclusion, Arthur suggests that if institutional engagement and adoption trends continue to accelerate, higher valuations would not be unexpected. His personal expectation places XRP in a range that could approach double digits by the end of 2026, depending on execution and sustained market participation.

🚀 FOLLOW for early alerts 🙌🏽🚀💰💰💰

Remember folks, that nothing said here represents a recommendation to buy, sell, or hold assets.

Thank you all!