#Plasma Reviewing a particularly foolish operation from yesterday.

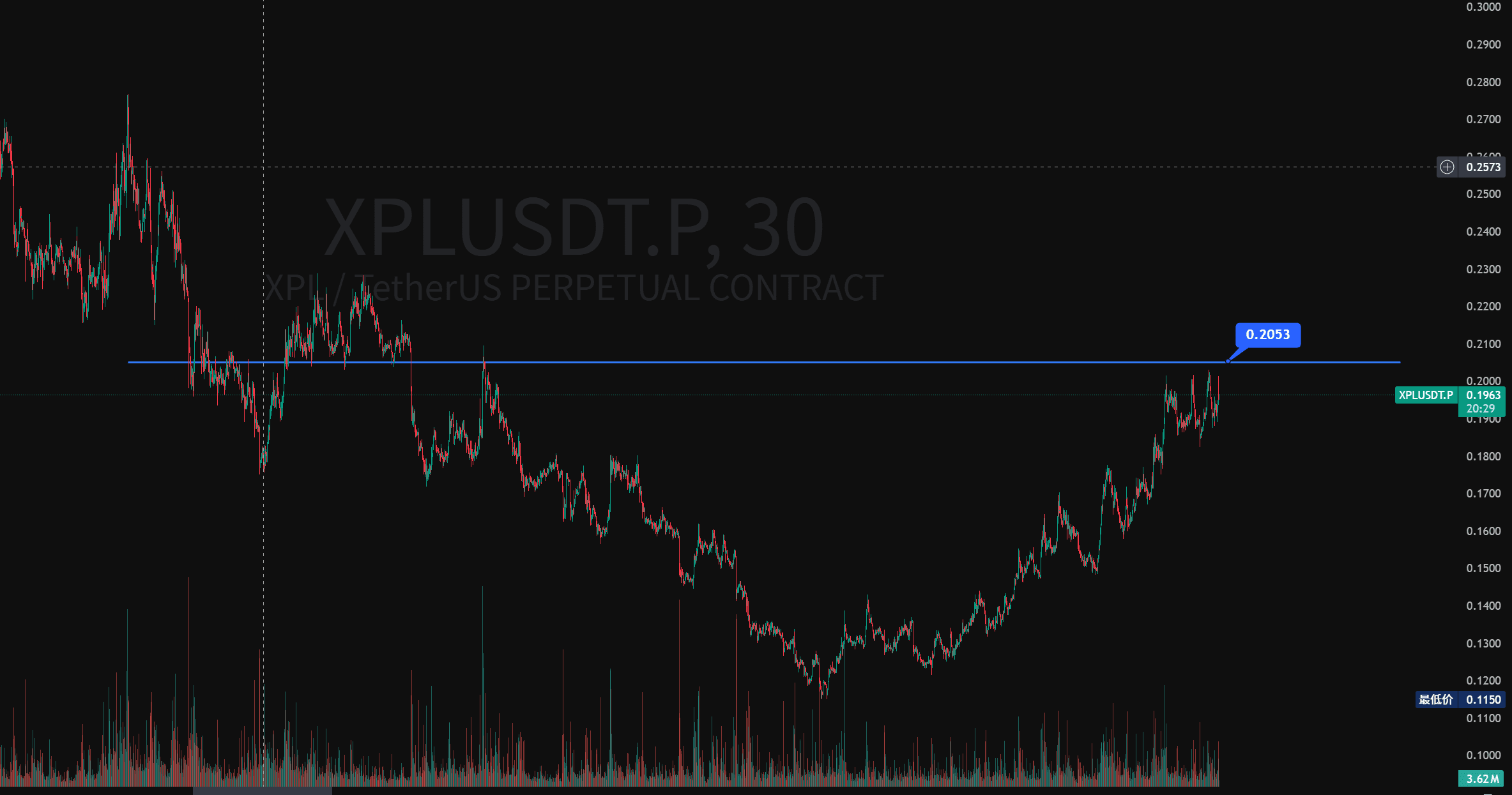

Yesterday I was a bit reckless, seeing that the counterfeit was rising so much, I wondered if I could short it for a while. After looking at a few, I found that XPL had a downward trend in the small time frame, so I thought about catching a swing, and since there was selling pressure at the resistance, I opened a short position at 0.1911. Originally, there was no major issue at this position, but I don't know if it was because I was really reckless or what, I set the stop-loss position particularly close at 0.2021. As expected, I was eventually stopped out, losing over 200 U.

Since it's a review, let's analyze the mistakes made in this trade.

Opening positions against the trend. Under the premise that the entire market is generally rising, opening a short position against the trend is a major taboo; especially opening a short position on a counterfeit.

Market trends seem self-evident and overly subjective, lacking objective analysis. First, under the premise of an upward trend, if one wants to open a short position against the trend, there must be conditions to do so, such as a strong resistance level or a significant drop breaking a natural lower point. The idea that a lot of increase means a correction is due is a significant reason for losses.

The stop-loss settings are unreasonable. The area around 0.202 is a resistance level, and since the previous two attempts to break through it have failed, one should give themselves some flexibility, at least at this resistance level, allowing for some space to increase positions.

Knowing that the area around 0.202 is a resistance level, yet not entering again. A good trader, if they understand the nature of a coin and have corresponding trading opportunities, should have enough courage to enter again.

If mistakes are not painful enough, it may foster a habit of making mistakes. Remember this!

(By the way, can't transaction records be added in article mode?)