While Bitcoin is the "King" and Cardano is the "Dragon," Starknet (STRK) represents the "Architect"—a high-conviction, venture-style bet on the future of Layer-2 scaling. After a brutal capitulation event in December, the technicals confirm that the selling is exhausted, and a violent mean-reversion rally has begun.

Here is the analysis for the most volatile asset in our portfolio.

The Trade: Catching the Knife

Starknet didn't just correct; it capitulated. From the November 20th high of $0.28, it shed nearly 73% of its value in a straight line, bottoming at $0.0756 on December 23rd.

Our Entry: We identified the Major Long Signal on December 20th at approximately $0.0824. This was a contrarian entry when fear was at its peak.

Current Status: We are up ~11.2% from the signal close.

Recovery from Lows: Price is up +21.16% from the absolute bottom.

We have successfully "caught the knife" and are now building a base. Unlike the majors which are structurally sound, STRK is a Deep Value play—we bought it for pennies on the dollar, and the risk-reward ratio here is mathematically skewed in our favour (10:1).

Wyckoff Analysis: The Selling Climax

The drop to $0.075 on December 23rd bears all the hallmarks of a Wyckoff Selling Climax (SC).

The Flush: The speed of the drop (Nov-Dec) flushed out every weak hand. There is no leverage left.

Automatic Rally (AR): The current bounce to $0.091 is the first sign of life. We are essentially in Phase A/B of the accumulation structure.

The Lag: STRK is lagging the rest of the market by about 2-3 weeks. This is good. It means the "L2 Rotation" hasn't happened yet. When profits rotate from ETH to L2s, STRK is priced to move the fastest.

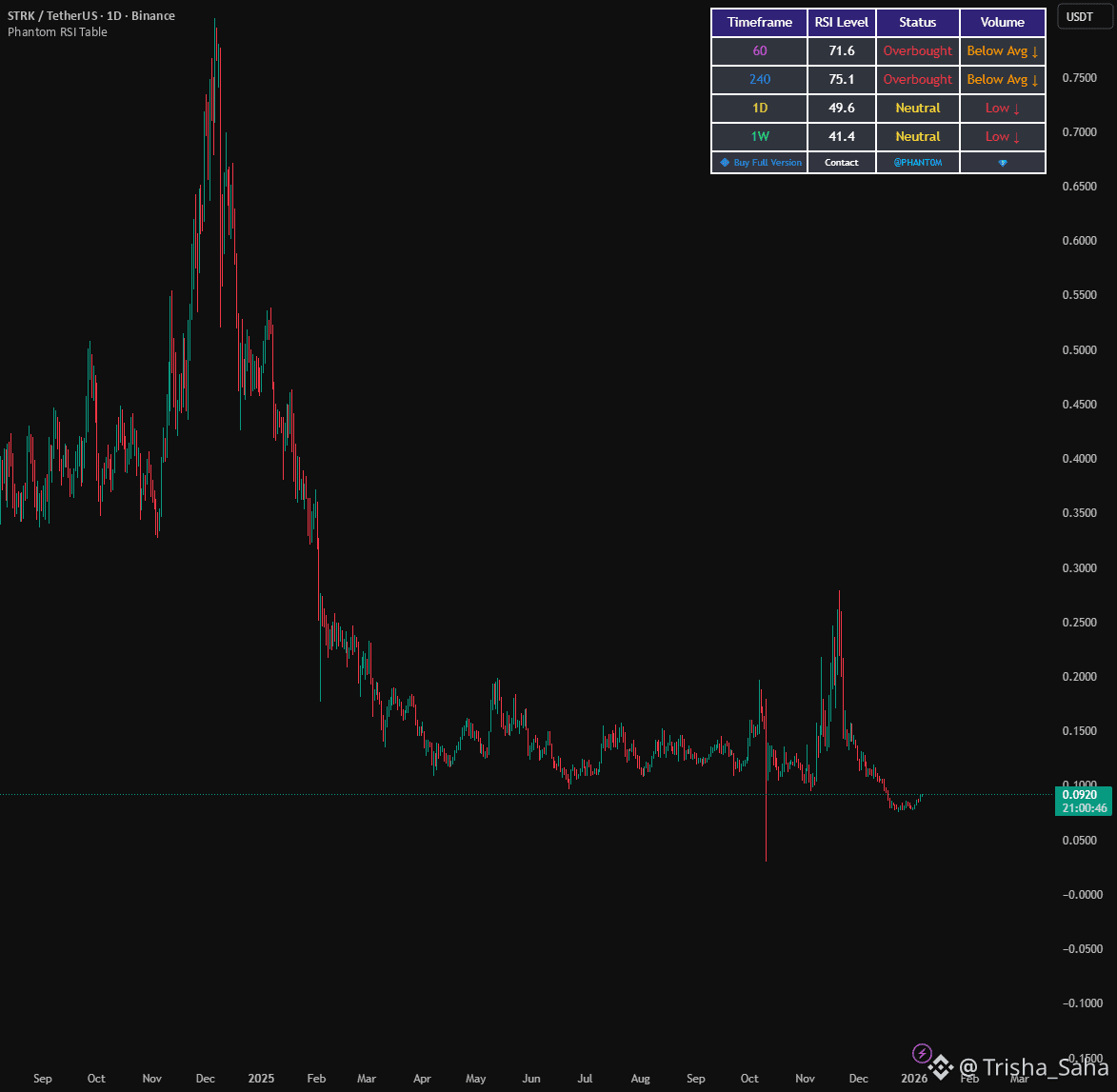

RSI & Momentum: The Sleeping Giant

The Daily RSI is sitting at 49.2. This is the "coiled spring" zone.

Under the Radar: While BTC and ETH are heating up (RSI 60+), STRK is dead neutral. It hasn't even started its run yet.

The Cross: A crossover above 50 (which is happening now) usually precedes the most explosive leg of a recovery rally.

Strategic Price Targets & Roadmap

Because STRK fell so hard, the Fibonacci retracement levels are massive percentage jumps away. We are trading so far below fair value that even a "dead cat bounce" yields 50% returns.

1. Immediate Resistance: $0.123 (High Probability)

The Level: The 0.236 Fibonacci Retracement.

The Play: This is our first milestone. A move to $0.12 would represent a 35% gain from current levels. This is where the first "bag holders" from November might look to exit, so expect resistance.

2. The "Fair Value" Target: $0.153 (Medium Probability)

The Level: The 0.382 Fib Retracement.

The Logic: Once the $0.12 resistance clears, there is very little volume history (air pocket) until $0.15. Price should glide through this zone quickly.

3. The "Golden" Target: $0.201 (Target for Q1)

The Level: The 0.618 Golden Pocket.

The Logic: A full recovery to the 0.618 level would be a ~120% gain from our entry. This is the power of the "Deep Value" play. We don't need a new All-Time High to double our money; we just need a standard market recovery.

The Verdict

Starknet is the "wildcard." The December 20th Signal got us in near the generational bottom. While BTC offers safety and ETH offers structure, STRK offers Torque.

We are positioned 11% in the green on an asset that is down 70% from its highs. The downside risk is negligible (we are near zero), but the upside is a 2x-3x multiple just to return to the mean.

Strategy: Hold firmly. This is not a trade to micro-manage. We wait for the $0.12 breach to confirm the L2 season has begun.