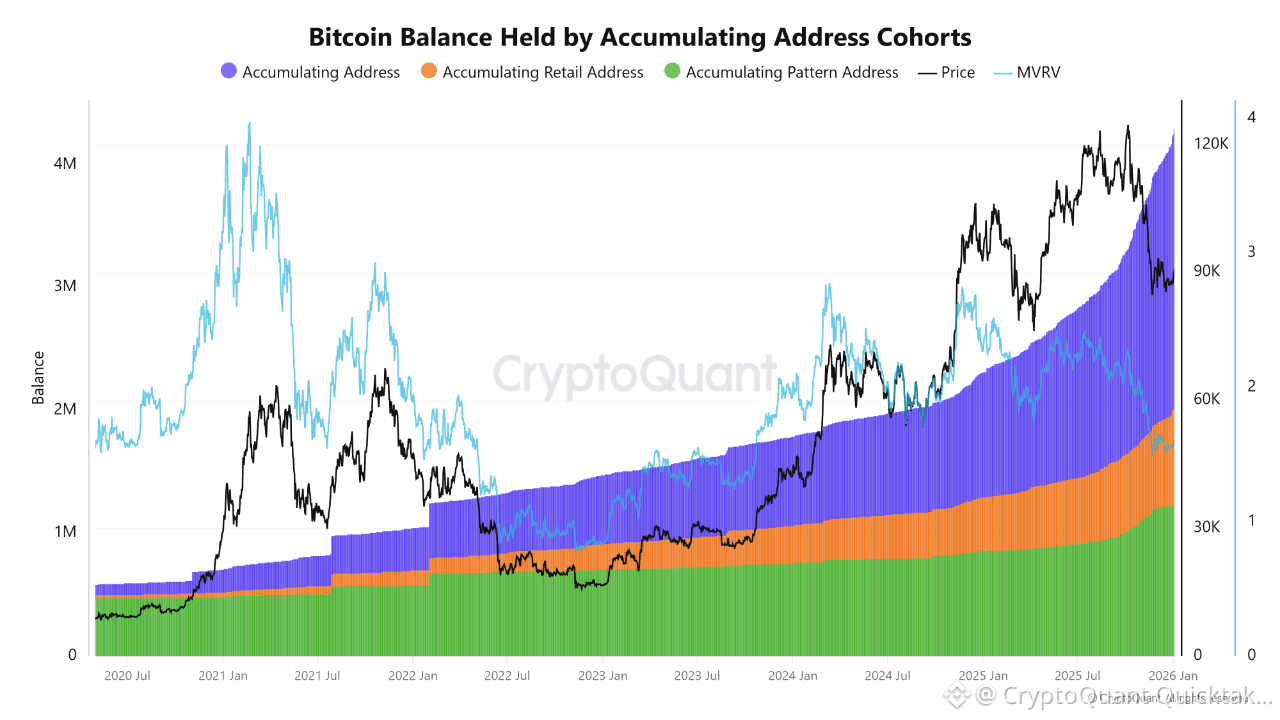

The latest data on Bitcoin Balance Held by Accumulating Address Cohorts continues to highlight a strong structural accumulation trend beneath recent price volatility. Across all major cohorts, long-term capital is steadily absorbing supply, reinforcing the broader bullish market structure.

Accumulating addresses (blue) have reached new all-time highs in BTC balance, accelerating notably throughout 2024–2025. This behavior is historically consistent with phases where long-term conviction outweighs short-term price fluctuations, often acting as a stabilizing force during periods of elevated volatility. Importantly, this accumulation has persisted even as price retraced from local highs, suggesting reduced sensitivity to short-term drawdowns.

Retail accumulating addresses (orange) are also trending higher, though at a more measured pace. This indicates growing participation from smaller holders without the signs of euphoric inflows typically observed near cycle tops. Meanwhile, accumulating pattern addresses (green) continue their steady expansion, reinforcing the view that systematic and strategic accumulation remains dominant across market participants.

From a macro on-chain perspective, the MVRV ratio has cooled from overheated levels while remaining well above long-term mean values. Historically, such resets within an uptrend tend to extend cycle longevity rather than signal structural tops. This normalization suggests the market is digesting gains rather than distributing aggressively.

Taken together, the divergence between rising accumulation balances and short-term price weakness points to a market still driven by conviction rather than speculation. As long as accumulation cohorts continue to absorb supply at this pace, downside risk appears structurally limited, with the broader trend remaining constructive for BTC in the medium to long term.

Written by CryptoZeno