Spending on crypto cards linked to Visa surged in 2025, highlighting the growing use of digital assets and stablecoins for everyday payments.

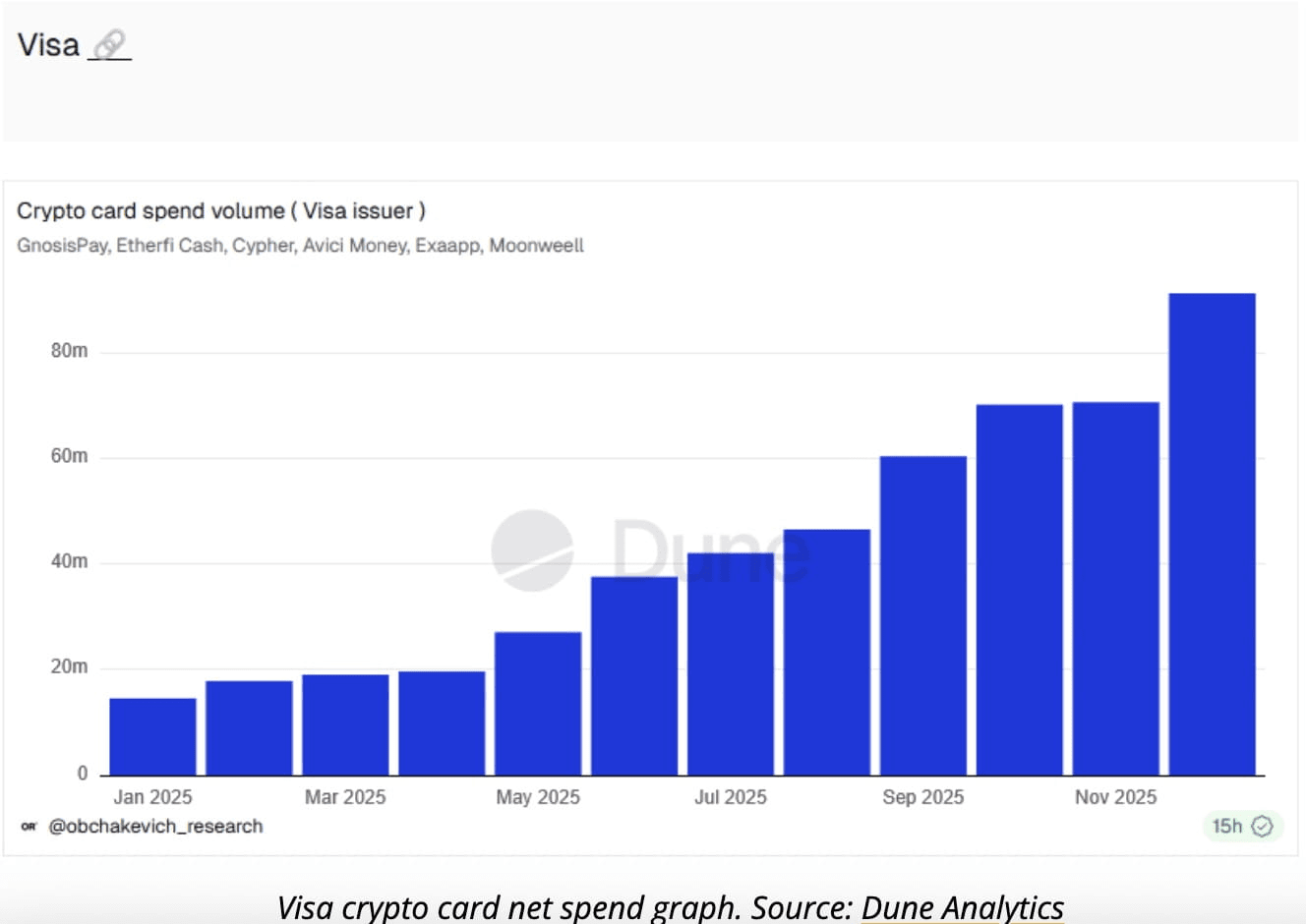

Liquid spending on a group of crypto cards issued by Visa increased by 525% over the year, rising from $14.6 million in January to $91.3 million by the end of December, according to data from Dune Analytics.

The data tracks six crypto cards issued by blockchain projects in partnership with Visa, providing insight into how native crypto payment tools are gaining traction among users.

EtherFi leads in cryptocurrency card spending

Among the six cards analyzed, EtherFi's Visa-backed card dominated spending activity, recording $55.4 million in total net spending during 2025.

This figure placed EtherFi well ahead of its competitors, with Cypher in second place at $20.5 million. Other cards included in the dataset came from GnosisPay, Avici Money, Exa App, and Moonwell, each contributing to the broader rise in cryptocurrency card usage.

Growing role of cryptocurrencies and stablecoins in payments

Market participants said the increase reflects more than short-term experimentation.

"These numbers demonstrate not only the rapid adoption of cryptocurrency cards among users, but also the strategic importance of cryptocurrencies and stablecoins for Visa's global payments ecosystem," said a researcher from Polygon, posting under the name @obchakevich_ on X.

"The rise in spending volume confirms that cryptocurrency is no longer just an experimental technology, but a fully developed tool for everyday financial transactions," added the researcher.

Visa strengthens stablecoin infrastructure

The growth in cryptocurrency card spending is occurring as Visa continues to expand its initiatives related to stablecoins and blockchain.

In recent months, the payments giant has expanded stablecoin support across four blockchains, while forming new partnerships and updating its infrastructure to make digital assets more accessible to both retail and institutional clients.

In mid-December, Visa accelerated its momentum even further by launching a stablecoin consulting team, aiming to help banks, merchants, and fintech companies design, launch, and manage stablecoin-based products.

Momentum heading toward 2026

With transaction volumes increasing dramatically and Visa deepening its commitment to stablecoin infrastructure, analysts expect cryptocurrency card usage to remain a key growth area in 2026, particularly as more users adopt stablecoins for cross-border payments and everyday spending.

The data suggests that crypto-linked cards are increasingly moving beyond niche use cases—and becoming a significant extension of traditional payment networks.